Why Are Banks Up 20%?

The impact of potential tax changes, whether short interest matters, & avoiding guessing interest rates

“In this world nothing can be said to be certain, except death & taxes”

Imagine you've got your eye on a particular company (or bank) whose stock is trading at $100 a share. You know they're pulling in $12.75 of pre-tax earnings per share, which seems pretty solid.

Now, take your mind back to 2017 when Trump slashed corporate taxes to 21%. Under that rate (which is our current rate), our company would be pocketing just over $10 per share after taxes. Not too shabby, you think, especially with the stock trading at about 10 times earnings. Fairly valued? Not for a growth company, but for a bank that’s pretty good because we all can’t be NVDA.

Fast forward to today, and not exactly today but call it a couple months ago. Back when the odds of the presidency were a bit more even. Talk then was that Biden planned to hike taxes back up to 28% if he won. You do some quick math and realize that under Biden's plan, your company's earnings would shrink to $9.18 per share. Suddenly, that $100 stock price doesn't look so cheap anymore – it'd be trading at 11 times earnings.

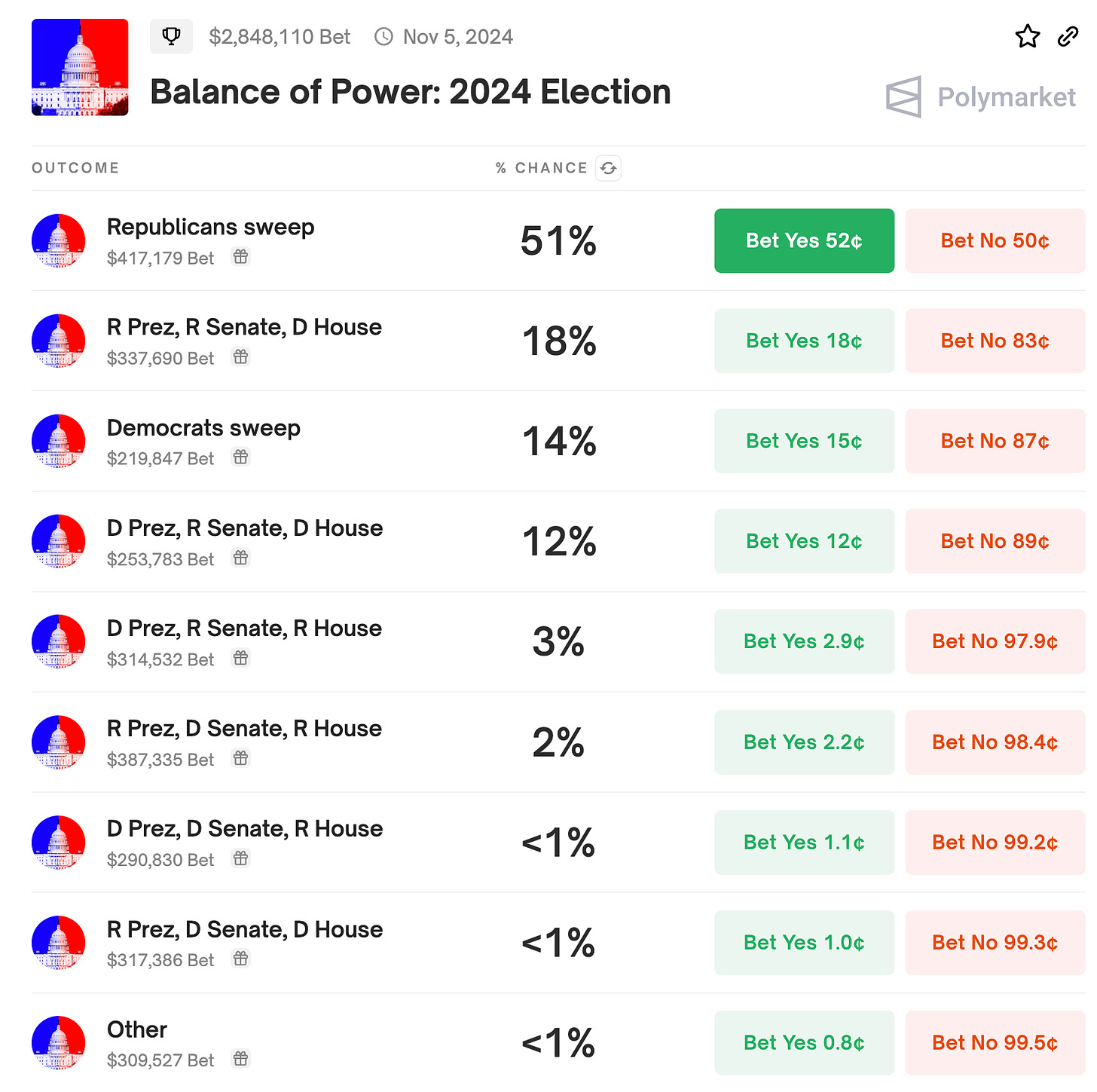

And that’s kind of where the market was for small caps & banks until recently. But then we had the debate & the assassination attempt on Trump. These two events took the odds of him winning the election from less than a coin flip to 66% according to Bloomberg.

And with the odds of Trump winning rising, the idea of slashing corporate taxes even further to 15% start to take hold in the mind of investors. And it’s not like Trump can cut taxes with an executive order, but it’s the Republican sweep that really started shifting sentiment.

Now what happens at the 15% rate? At that rate, your company would be raking in $10.84 per share in after tax earnings – a whopping 18% more than under Biden's plan.

You look at your stock again. At $100 a share, it's now trading at just 9 times earnings. It's starting to look like a real bargain. In fact, you realize that for it to match the valuation it had under the Biden scenario, it would need to jump up by about 18%.

And that's when it hits you – this is why some sectors of the market just snapped back by around 18%. It's not magic, it's not chaos – it's investors reacting to these potential tax changes and their impact on corporate earnings.

And that literally is what an entire universe of investors just did all at once.

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.