What's A Cult-ish Bank Stock Worth?

$0.02 on Hingham Institution for Savings

Hingham Institution for Savings (HIFS):

Maybe it’s not cult-ish but it definitely has outspoken investors on both the long and the short side, especially on the run up during 2021 and the sell-off in 2022-2023. In fact, merely uttering the name on X turns people into Brennan & Dale on the front lawn in Step Brothers.

Truth be told, it’s never been on my radar as an investment, but after seeing their most recent 8-K, I figured I’d put some thoughts onto paper.

This is where it’s at from a valuation standpoint right now:

Current Approx. Market Cap: $360mm & Current Price: $165.16

Current Approx P/TBV: 87% & Current P/LTM Earnings: 14.64

Q1 2024 Net Income Annualized Run Rate: $27.5mm or $12.68 a share

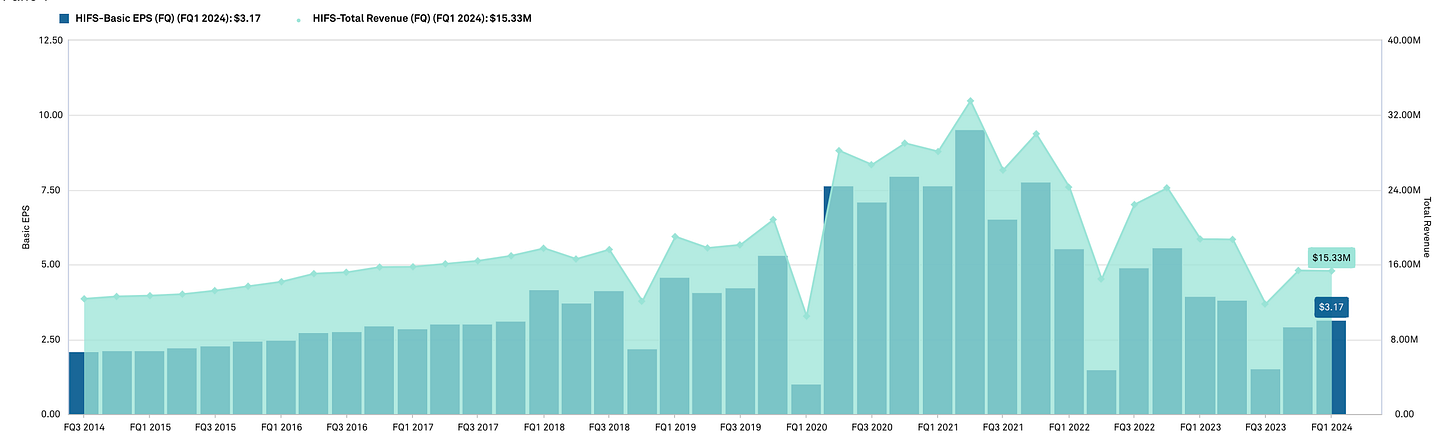

But a lot of the reason why this bank stock has become a battleground of sorts is because for years and years it was a grower of top line & bottom line with a thoughtful and non-traditional exec team that grew vocal supporters in the bank space. The run up into the post Covid peak was impressive and even more so looking back to about 2009. But the trend is not your friend today.

Holding Opposing Beliefs?

This is my attempt to have some of you not swing a bicycle at me, but if you still want to, swing away. Can I believe a person, or a management team are fundamentally good humans and not like their stock or their capital allocation skills? Yes. In fact, personal feelings and expected future financial returns often do not correlate. Think about all those baseball players that were the casualty of Moneyball, great people all of them, but to the woodshed went their careers when the time came. And maybe more importantly, can you admire what a bank did the past 10-15 years and also not like their prospects for the next few? The answer to that is also yes.

With HIFS is I’m sure they are good humans (a look at their annual report shows they do a phenomenal job in their communities), but it’s hard to justify paying $165.16 unless you told me Fed Funds was certain to go down 200 plus basis points fast & that you could promise me there would be no CRE losses coming down the pike. I don’t have a crystal ball & the environment has changed drastically and so the bank’s ability to pump out mid-teens ROEs & command a premium valuation is contingent on two things I have little control over.

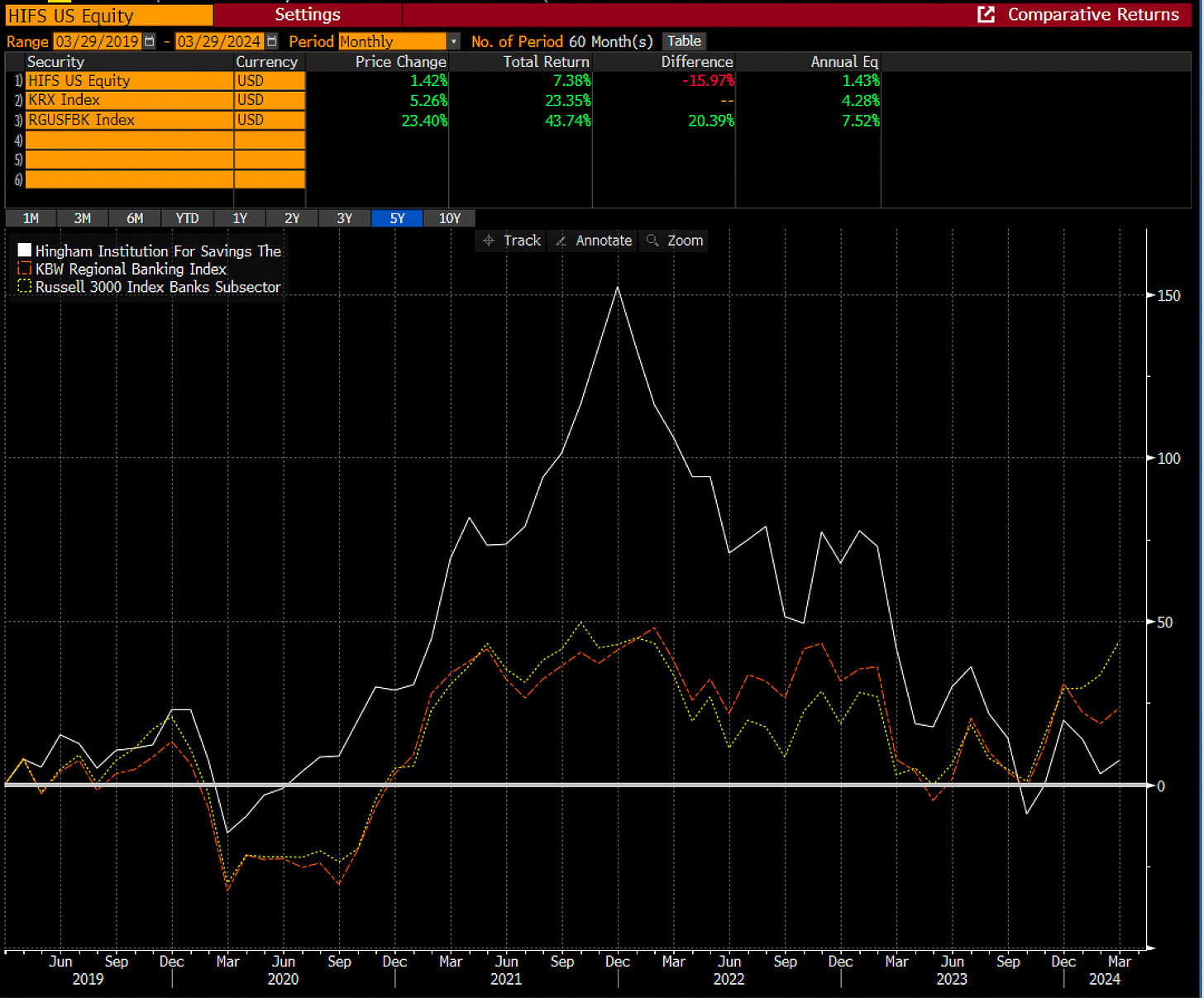

To prove this out, if you’ve owned HIFS for the last 10 years you’ve outperformed KRX & the Russell 3000 Bank Index annually by 428bps and 234bps, respectively. Pretty good if you ask me, actually really good in bank land.

But if you’ve owned them over the last 5 years you’ve actually underperformed KRX & the Russell 3000 Bank Index annually by 285bps and 609bps, respectively.

And over the past year (a tough one for a liability sensitive CRE lender like HIFS), they’ve underperformed KRX by 32.57% and the Russell 3000 bank index by 49.43%. So if you’re an owner of HIFS, depending on your time horizon, your return experience would’ve been vastly different depending on when you got in. And I’m sure as you’ll see later (when talking about insider buys/sells) people that bought 20 years ago with a much lower cost basis probably don’t care about the short-term swings even though they should. For as the Buddhists say, the past doesn’t exist there is only the present.

The Good.

I’ll start on the positive side, which ironically become potential points of future weakness.

Hingham likely runs one of the MOST efficient banks in the country. And while their Q4 non-interest income to average assets was anemic at 3bps (has to be 99th percentile type bad), their non-interest expense to average assets in Q4 was 65bps (99th percentile great). And while the recent decline in income is wreaking havoc with their Efficiency ratio (71.65 as of Q4 2023) their net overhead is one of the best in business. It may even be THE best in the business. But why is this a problem? They literally may have nothing to cut expense wise, it’s literally all muscle at this point and as we all know non-interest income doesn’t grow on trees.

The second big positive is credit performance. Their credit at the moment at least, is sterling & clean as a whistle. Non-performers are basically non-existent as are charge-offs.

And while they have an 87% loan to asset ratio, 320% of capital in Multi Family CRE, and 233% of capital in Non-Owner Occupied CRE this won’t be my focus because I don’t have enough transparency into LTVs, DSCRs, Geographic Breakdowns, and so on so I’m not going to make a credit call. And at a Q4 2023 L/D ratio of 163.66% I’ll just say I hope HIFS success continues on the credit side. Worth noting that call report data also doesn’t breakout maturity vs. repricing making the below less useful, but you should realize they grew $547mm of CRE in 2021 and $618mm in CRE in 2022, with most of that termed out 3 years or more. There’s a maturity wall issue down the line, but not today.

And what I can say is that when credit is pristine, there is quite literally only one way to go. Unless all of a sudden, their borrowers are going to start paying back more than they owe.

The Challenging.

And now here’s the rub. So long as credit stays good, your ability to buy this bank and outperform is basically tied to what happens to interest rates. If rates stay higher or go up, it will be unbelievably hard for this bank to command the valuation it has. And even if they go lower, you need more than you think to make returns abundant. Obvious to some, but worth digging into the right side of the balance sheet.

Per the last 8-K their all in Cost of Funds was about 3.90% and their NIM 0.85%. This is what is spitting out $6.9mm of income for the Quarter on a consolidated basis ($27.6mm run rate). Their Q1 of 2023 run rate for consolidated net income was $8.5mm ($34mm run rate) at a 2.76% all in COF (including non-interest bearing in the balance). Excluding non-core type income (which I’ll point out later) makes the picture even less rosy.

Simply put, buying HIFS right now at today’s prices means you as an investor need the short end to go down a little more than 200bps (Fed Funds at 3.25%) fast in order to justify a reasonable earnings stream and current valuation. At today’s $360mm market cap and using last year’s 2023 Q1 run rate of earnings at $32mm you’re still about a 10.5x multiple (not that cheap). At today’s earnings run rate, you’re paying 14x (even though the discount to TBV is 87%). Bulls will call attention to their liability sensitive profile and potential for COF to move fast in rates down but I’m not sure this will be as true as you might think.

First of all, from 2007 to 2009 Fed Funds went from 5.25% to basically zero and HIFS COF went from 4% to 2% (ballpark). 500bps of cuts led to 200bps of HIFS COF release (in industry parlance this is a 40% beta). And eventually it caught down as rates stayed lower (longer term horizon 60% beta) but there is always a lag coming off of high-rate cycles. And we’re not even done with this cycle’s version of higher for longer where any customer with a pulse comes asking “why aren’t my rates higher?”

Second, they extended $785mm of borrowings this go around versus the past easing cycle in 2007-2009 where they had fewer borrowings on the liability side on a percentage basis and fewer extended.

One note, you’ll see these are “structured borrowings”. My sincere hope is that these are either call-able at the bank’s discretion (not the FHLBs) or the FHLB’s market value borrowings (that act a little like interest rate swaps), and not put-able borrowings where the bank sold the option. Put-able borrowings effectively give you a little extra cost saves today but give the FHLB the option to keep you as a long borrowing should rates fall. Bank nerds will remember that these advances had a hand in Hudson City’s ultimate “transformation” into M&T when they found themselves upside down on put-able borrowings and jumbo mortgages.

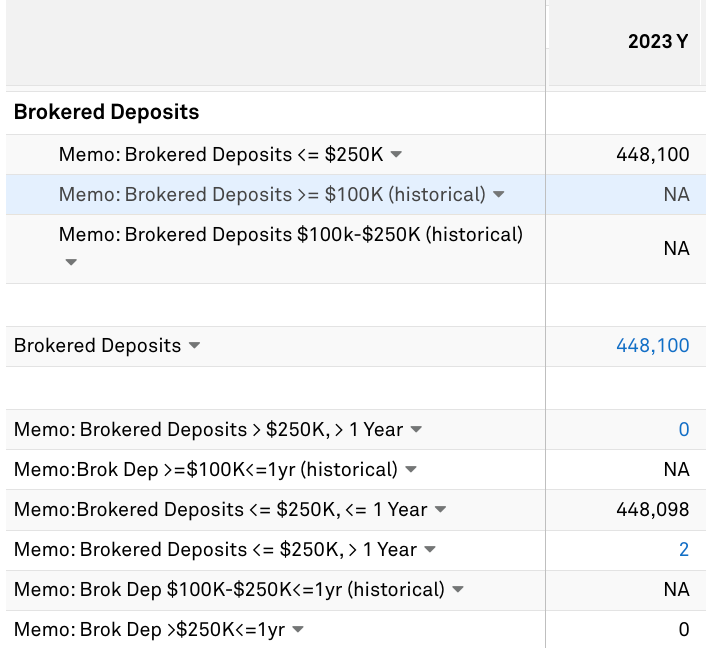

Third and most unfair. I would’ve liked to see the bank hedge this margin squeeze either by doing interest rate swaps or extending borrowings in Q1 of 2022, Q2 of 2022, Q3 of 2022, or Q4 of 2022. It looks like they started extending borrowings early in 2023 and for someone that’s been so great at long term capital allocation, this does feel like a miss. I also would like to see them do longer callable brokered CDs since they’re only rolling over short ones. JPM does this (issue long maturity where you retain the call option) and it gives them a long liability that can be converted into a short one for minimal extra cost. At current, all of HIFS brokered CD’s are short, and so must perpetually be rolled over. And as the late fall of 2023 showed us, if you are trying to refinance these when times are tough, you can’t. This is a little thing, but kind of a big thing at the same time. Just like not hedging or extending borrowings a year ago.

And tying a bow on it all with the topic of non-interest-bearing deposits, the bank had $378mm a year ago and $346mm today. This shift alone from 0% to a 5.5% borrowing rate equates to $1.76mm in extra interest expense. The good news is there are very few non-interest-bearing deposits that could shift overall, but for a bank slated to make $27mm for the year, that is not nothing. As Forest Gump said about shift, it happens.

One More Thing.

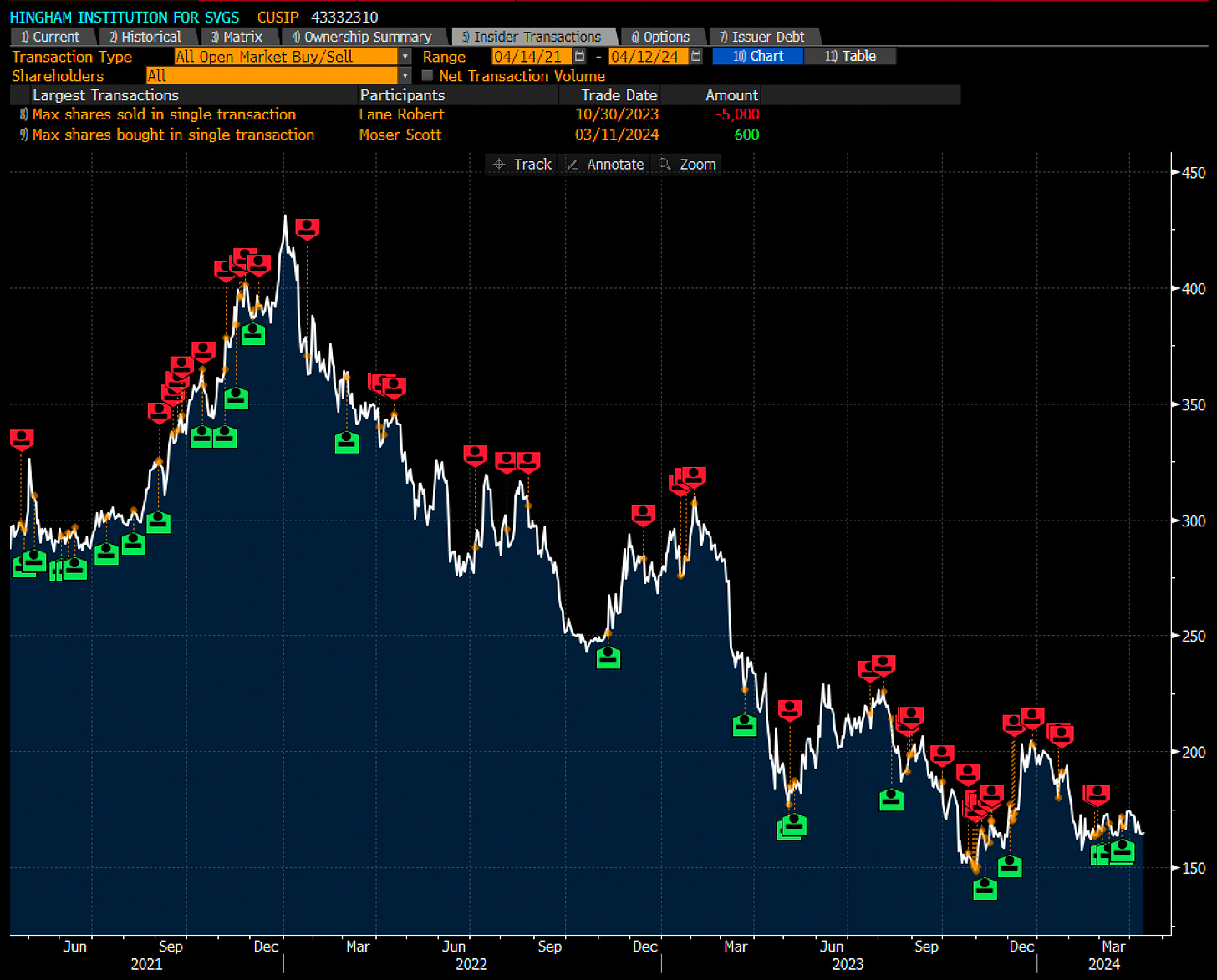

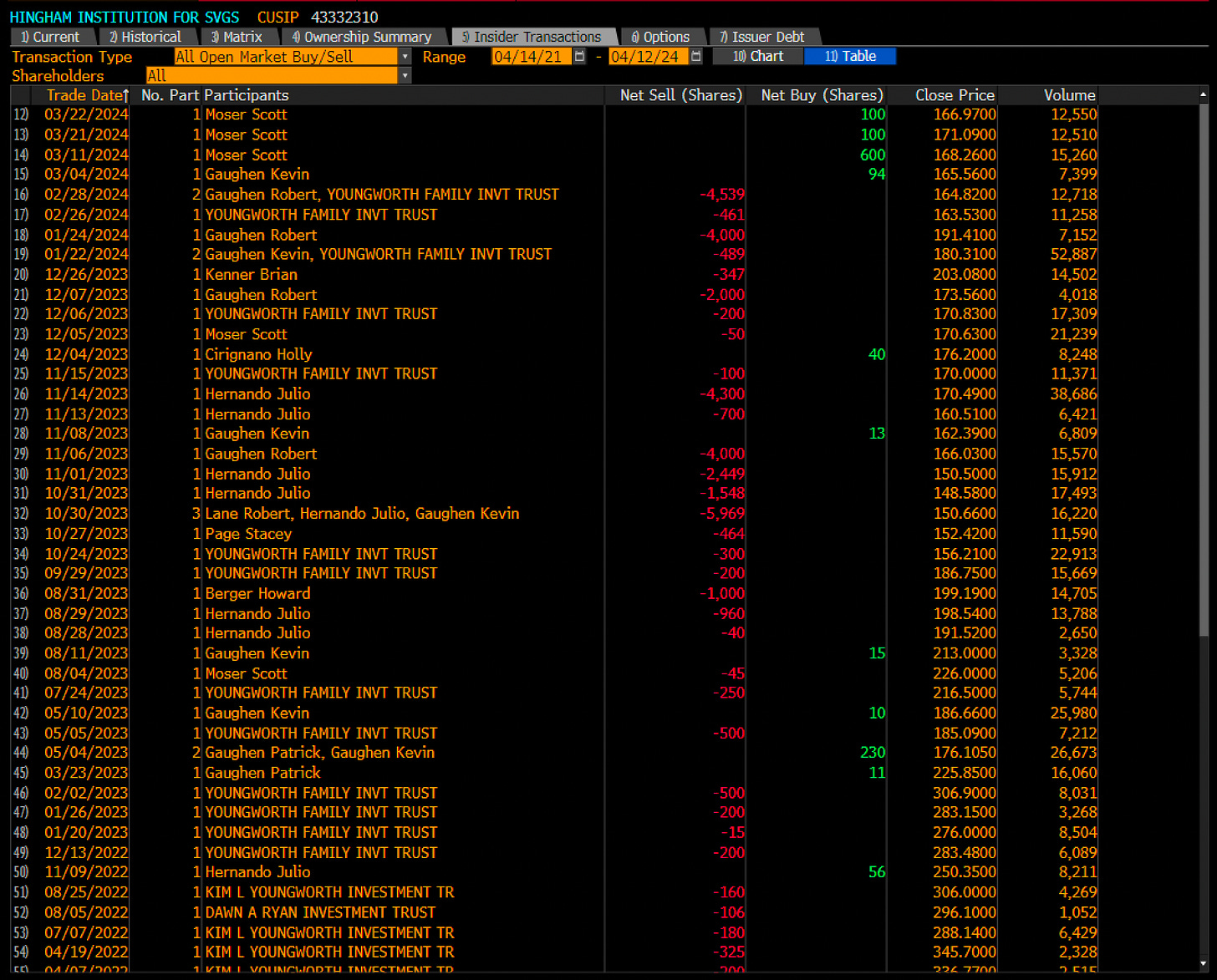

Worth noting, I do not see a lot of insiders buying. I will never fault people for this. From experience, personal financial situations can impact the decision to buy or sell beyond the fundamentals of the Company, but if someone is telling me this is a screaming buy, I always want to make sure the insiders are sharing that feeling with buys. Looking at open market buys/sells, can you look at the below and say, “wow this team thinks their stock is really cheap?” At least Scott Moser does.

What’s It Worth?

Putting this all together, HIFS has been an absolute beast over the longest term (10-15 years) but to me people are paying up for memories of the returns it created before this interest rate world changed and went up 525bps. Looking back from 2014 to 2022 when rates were lower HIFS could pump out mid-teens ROEs with ease, but that was a low-rate and low volatility world. It probably was worth a premium valuation back in the day, but I’m not so sure today.

In this world a long investor in HIFS needs Fed Funds to come down to 3.25% or lower just to get back to March of 2023’s NI run rate of $34mm to be fairly compensated from a valuation standpoint (around 10x earnings). And that’s before even considering any change in CRE credit conditions including the refi window HIFS will have when their 4% & 5% loans made in 2021 and 2022 start to turn over. And that’s before this whole non-core peculiarity of HIFS.

On the non-core peculiarity, I have one final point on HIFS current earnings. If you look below, you’ll notice one line item that most banks don’t consider core. “Gain on equity securities” is a non-recurring line item and non-core business to banks. It’s a quirk of some Mass. banks because not many other state banks are even allowed to own equities but extracting this (since I’m assuming HIFS is not a changing its business to include being a Hedge Fund) you get a net income number for Q1 of 2024 of … $2.2mm or roughly $1.00 per share. This would be a run rate of $4.00 per share and at a price of $165.16, a multiple of 41x.

When The Facts Change.

One set of facts that I believe hasn’t changed is that the team at HIFS is probably still doing everything it can to deliver for their communities and generally be good humans. But the earnings facts have changed, returns for this bank are going to be tougher moving forward (absent Fed Funds ticking 3%). And don’t forget those equity gains are also a source of recent “alpha”. Thankfully for HIFS they still have vocal supporters and long-term retail type holders that still think it’s a good buy all the time, there’s something to be said for that.

For me, John Maynard Keynes said it far better than I could, “The inactive investor who takes up an obstinate attitude about his holdings and refuses to change his opinion merely because facts and circumstances have changed is the one who in the long run comes to grievous loss.”

PS - If anyone can prove to me that HIFS management long’d LLY and NVDA this past year and that’s where the equity gains came from, I’ll retract this whole thing.

Until next time,

Victaurs