It seems like the world has long forgotten the regional banking crisis, is shaking off CRE doom, and barring a recession actually believes cyclicals and small caps should rally further. And this rightfully so is music to bank investors ears. While top tier franchises have rallied and carry full valuations, there are still a lot of cigarette butts left on the ground with a puff or two in them.

Especially a puff or two if rates on the short end come down boosting NIM and rates on the 5 year plus part of the curve stay low helping refinancings in the CRE space.

Given the change in pricing AND the change in estimates coming out of the Street I wanted to refresh this heading into the long weekend.

Contrarian investors, sharpen your focus.

Unveiled here: The 40 most undervalued banks amongst all banks with 2025 estimates for EPS & TBV. A treasure trove of potential if you will. These institutions stand as the market's current pariahs, shunned for reasons both valid and perhaps overblown.

Make no mistake - these banks bear the weight of legitimate concerns. The market's hate isn't baseless, but therein lies a potential opportunity.

Current prices tell a stark tale: the market is betting on their failure to achieve 2025 results. It's pricing these institutions as if their 2025 ROTCE is smoke and mirrors. Yet, history teaches us that markets often overshoot, both in euphoria and despair.

Some of these could be bad estimates too so keep that in mind.

But consider this: if even a fraction of these banks delivers on their projected figures, the upside could be monumental. We're not talking about modest gains, but potentially transformative returns. The risk-reward ratio, for those with the stomach and the insight, appears compellingly skewed.

However, a word of caution: this is not a call to blindly buy. Far from it. Each of these banks demands rigorous scrutiny. Their challenges are real, their paths to redemption uncertain. What we offer here is not a guarantee, but a starting point for your own deep dive.

In the coming weeks, I'll be dissecting a select few from this list. Please feel free to ping me with requests. These analyses will peel back the layers, examining the good, the bad, and the ugly. And try to separate the phoenixes-in-waiting from those that deserve to be left in the ashes. Or at the very least pick the factors that should outperform going forward.

For our paid subscribers, this list is your head start. It's a map to potential buried treasure, but like any good map, it doesn't eliminate the need for the journey. Use it as your compass, not your crutch. And know that my inbox is always open.

Remember, banking is a sector where perception often lags reality. By the time the market fully recognizes a turnaround, much of the upside may have evaporated. Our task is to spot these inflection points before the crowd, to see value where others see only risk.

As you peruse this list, keep in mind:

Past performance doesn't dictate future results, but it often leaves clues.

Management quality can be the difference between resurgence and ruin.

Regulatory environment remains a wild card - stay informed.

Liquidity is king - scrutinize balance sheets with a magnifying glass.

Market sentiment can change rapidly - be prepared for volatility.

CRE concerns are not dead - they may come back.

This opportunity set reminds us why we're in this game. It's not just about numbers; it's about seeing beyond them. It's about having the courage to zig when others zag, always grounded in thorough analysis.

The road ahead for these banks is undoubtedly rocky. But for the discerning investor, it might just be paved with opportunity.

For more about the Growth Rank refer back to this article:

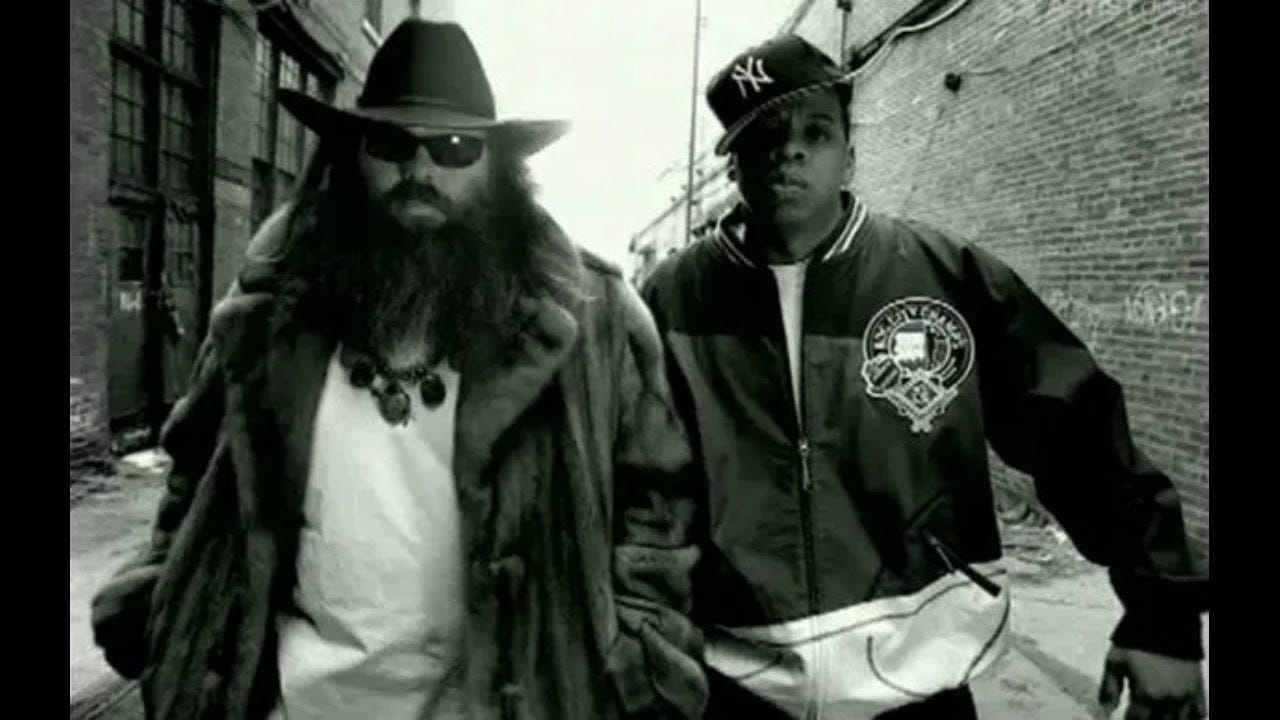

And so, in the words of Jay Z, I am crazy for this one Rick.

And now without further ado, the cheapest trend implied banks by 2025 ROTCE. “Trend Implied” should be obvious, but it’s nothing more than looking at what a theoretical ROTCE is worth in TBV terms relative to where they are today.

Enjoy and let me know if you find anything interesting. Cheapest at top. Then cheapest greater than $500mm market cap.

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.