Top 26 Banks Updated P/TBV & Forward ROTCE Scatter

What's a given ROTCE worth after the Trump election?

It’s done. The Biden-to-Trump transition is behind us, and now we’ve entered what I’ll call the “Trump Normal.” Forget traditional normalcy—this is a new era defined by pro-USA policies, slashed regulations, M&A fever, attention-grabbing tariffs, plenty of volatility, and no shortage of headline-worthy antics. Including BARRON, MELANIA, and all the other coins your heart desires. Whether you love it or hate it, one thing is clear: the market is moving, and the action is happening fast with volatility here to stay.

But here’s what most people are missing: while the noise of crypto, meme stocks, and speculative plays has distracted investors, the foundation for a big bank resurgence has already been laid. And now, with earnings season underway, that resurgence isn’t just coming—it’s here.

The Calm Before the Surge

Back in November, financials rallied 15% after Trump’s election win, riding a wave of optimism around deregulation and pro-growth policies. Flows rushed into banks and financials with reckless abandon. But December and early January? That was the exhale. Speculative assets like crypto and unprofitable growth plays captured the market’s attention, leaving big banks in the shadows.

And here’s where it gets interesting: that lull wasn’t a setback—it was the perfect setup.

While the market obsessed over speculative noise, banks quietly strengthened their foundations. Deposits having long shaken off the SVB turmoil in 2023, started climbing. Banks started cutting deposit rates to widen margins. M&A discussions ramped up. Capital plans were created for growth. And now that earnings are here, the full picture is coming into view.

Big banks have already reported their numbers, and the results speak for themselves. Citibank, JPMorgan, Wells Fargo, and Bank of America led the charge, delivering strong earnings that highlight the strength of the banking system.

Deposits? Up. Margins? Expanding. Reserves? Solid. M&A pipelines? Warming up. And too much capital? Yes, too much capital.

And the tone on those earnings calls? Pure confidence. CEOs like Jamie Dimon, Brian Moynihan, and Charlie Scharf didn’t just share good news—they leaned into it, talking about higher buybacks, growth in lending, and even optimistic outlooks on capital markets activity. The message was clear: big banks are ready to dominate in a pro-growth, pro-Trump policy environment. The narrative rhymes with the mid to late 90s golden bull market of banking which even saw a tech bubble pop.

While the market has been distracted by speculative plays and the latest crypto buzz, the real story has been unfolding in plain sight. Big banks are executing, yet their valuations don’t fully reflect their potential. People are still wanting to apply the “old school” multiples to banks, when in reality they should readjust to the “Trump Normal”.

Consider the setup:

Deposits are growing.

Costs are falling.

Margins are expanding.

Earnings momentum is building.

And price momentum is building too.

And yet, many of these stocks remain undervalued relative to their historical norms. This is the kind of disconnect that creates opportunity—an opportunity for savvy investors to get ahead of the herd.

Orienting to the Bank World Ahead

But enough of the bull case and pumping bank stocks. Now it’s time to focus on one of the most critical metrics for bank investors: the relationship between Price-to-Tangible Book Value (P/TBV) and Forward Return on Tangible Common Equity (ROTCE). If you’re serious about understanding which banks are worth your money, this correlation isn’t just important—it’s essential. Here’s why.

First, P/TBV tells us how much the market is willing to pay for the tangible assets of a bank, stripped of goodwill and other intangibles. Dimon says TBV is the truest version of a banks “worth”. And the Price in relation to TBV is a direct measure of investor sentiment about future value. Combine this with Forward ROTCE—a forecast of how efficiently a bank is expected to generate profits on its tangible equity—and you’ve got a powerful framework for comparing valuation against profitability. High ROTCE banks trading at low P/TBV ratios can be a goldmine of mispriced opportunities.

Second, these metrics reveal how well a bank is positioned to deliver shareholder returns in a changing environment. In a pro-growth economy, banks with expanding ROTCE tend to see P/TBV multiples re-rate higher, rewarding investors who spot the disconnect early. It’s a simple but effective way to identify banks with both operational efficiency and untapped upside.

Finally, studying P/TBV and ROTCE correlations helps separate value traps from legitimate opportunities. A low P/TBV may look attractive on paper, but if Forward ROTCE is weak, it’s often a sign of structural challenges the market is rightly pricing in. On the flip side, a seemingly “expensive” bank with strong ROTCE can still be a steal if its profitability justifies the premium.

This push & pull is basically my first “sanity check” when investing in banks.

Understanding these dynamics is what separates smart investors from the rest of the pack. In my next post I’ll be updating my Citibank targets given a changing world, but for now read on to get a lay of the land for the 26 biggest banks.

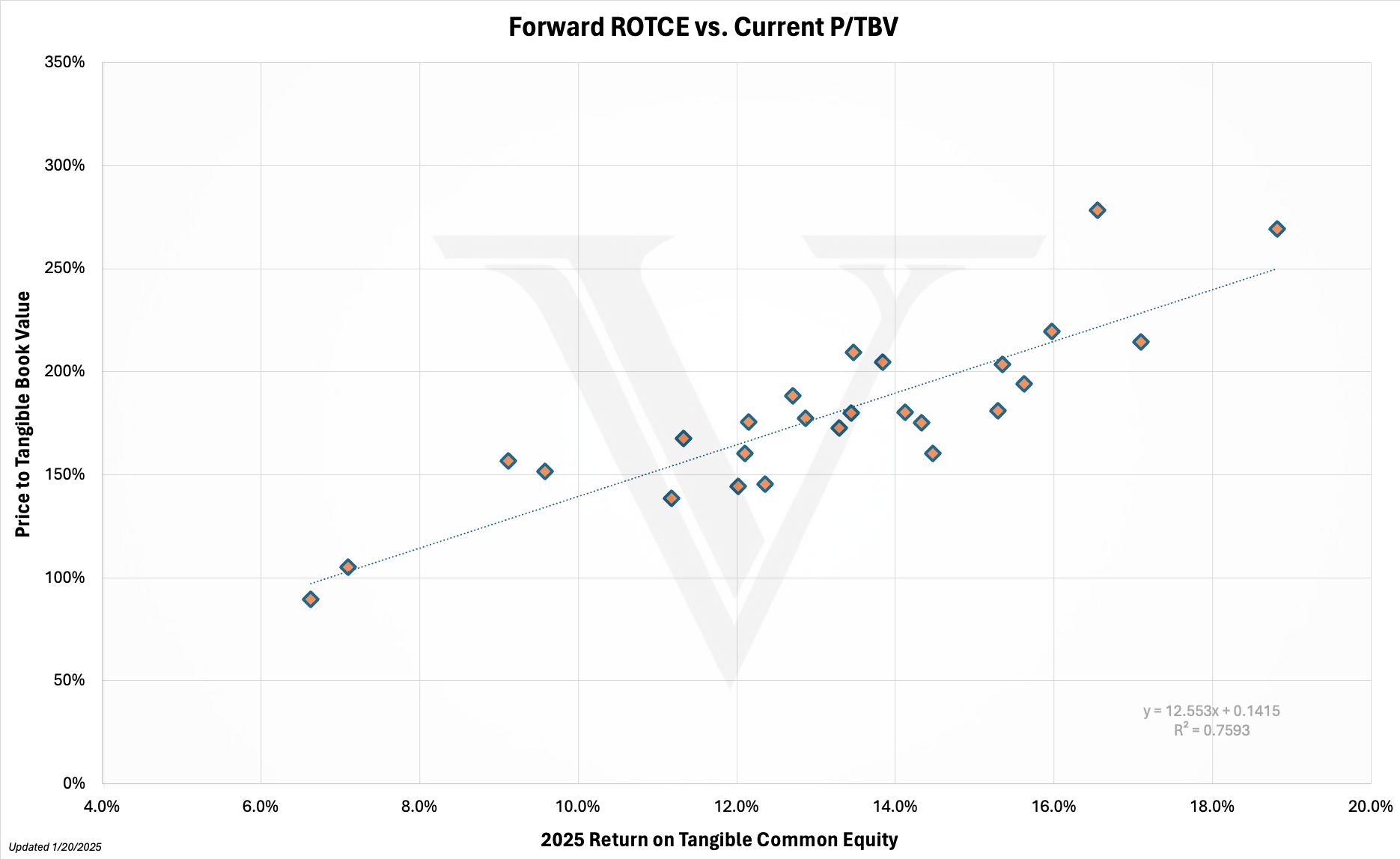

Here is the scatter for those 26 biggest banks (those with assets greater than $50 billion). Editors note: I removed the artist formerly known as NYCB aka FLG because they are slated to post negative ROTCEs next year. Playing with that one is a different animal. And as you sift through this graphic, keep in mind that the value of a bank’s Return on Tangible Common Equity (ROTCE) depends on more than just the number itself—it’s about how the market perceives it. That’s why I use the word “worth” deliberately. Value is in the eye of the beholder, and the market’s collective eye assigns different price-to-tangible book value (P/TBV) multiples based on profitability.

There are all kinds of reasons why banks could be trading above or below the magical R-squared line.

Here’s how it breaks down today:

A 12% ROTCE is typically “worth” around 160% of TBV.

A 15% ROTCE earns a premium, pushing “worth” closer to 200% of TBV.

And an 18% ROTCE? That’s the gold standard, commanding valuations around 240% of TBV.

These numbers are markedly higher than even a few months ago. I can remember back in July when a 15% ROTCE was only worth book and a half.

Simple enough, right? Well, not so fast.

Before you run off thinking these multiples universally apply, remember that valuation is nuanced—especially for smaller banks. Here are a few key factors that can drag your valuation down, even with strong ROTCE:

Market Cap Matters: Smaller banks often trade at a discount simply because of their size. Institutional investors demand liquidity, and smaller caps come with less market depth.

Loan-to-Deposit Ratios (L/D): A high L/D ratio signals tighter balance sheets and greater risk. The higher the ratio, the more likely investors are to apply a haircut to valuation.

Share Liquidity: Thinly traded stocks are inherently riskier for investors to hold. The less liquid your shares, the lower the multiple you’re likely to get.

Shaky ROTCE: Consistency is king. Even a high ROTCE number will fail to earn a premium valuation if it looks unsustainable or volatile. If you haven’t proven your track record, you’ll likely trade lower than you’d think.

So while ROTCE gives you a baseline for valuation, the real story lies in the context. Banks with smaller market caps, less liquidity, or riskier balance sheets will always struggle to match the multiples of their larger, more stable peers. And that’s why knowing these nuances—before the market prices them in—can give you a serious edge.

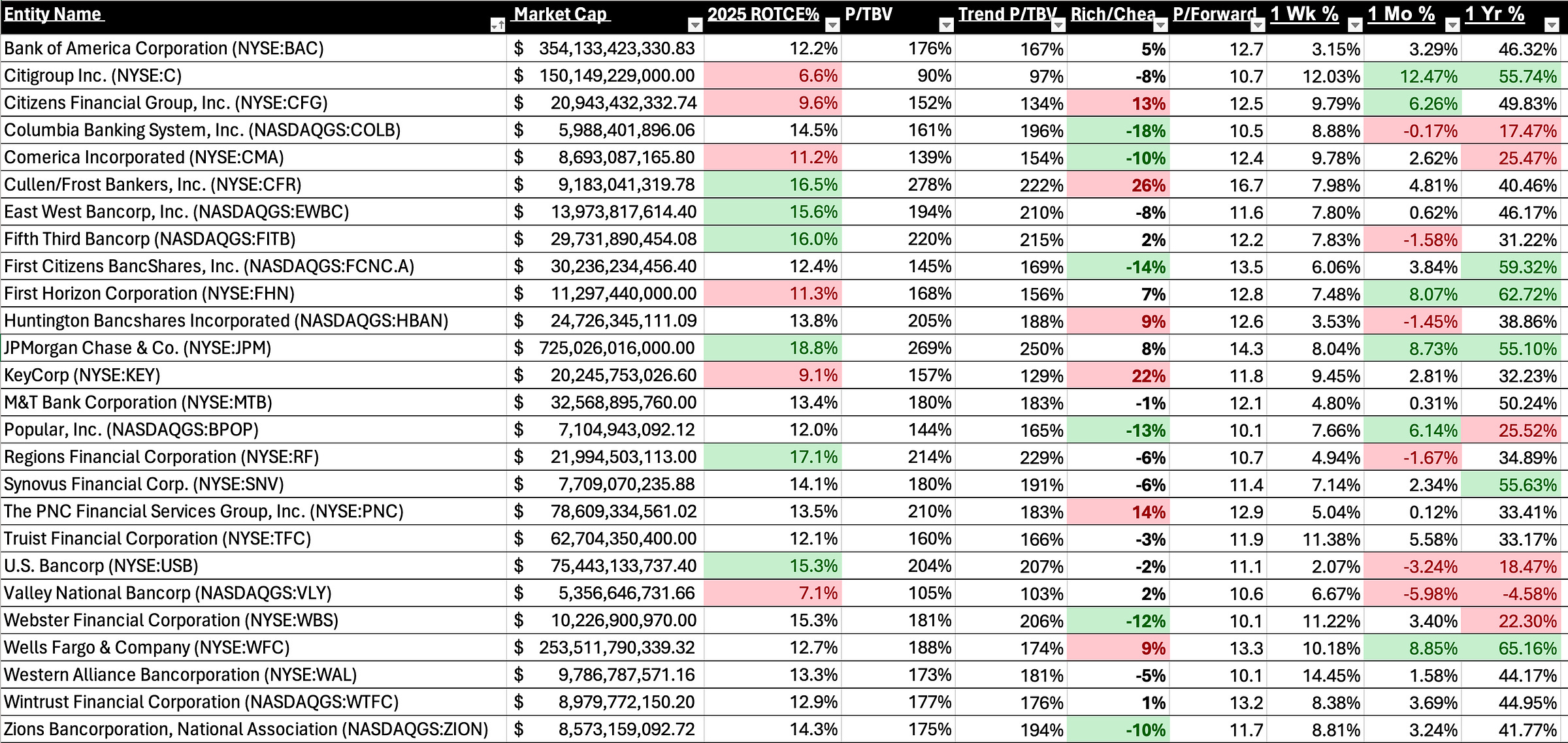

And finally the dig under the hood. I understand fully that not everyone has reported and while I’m sure there will be surprises, these shouldn’t change too much.

Take a look below at the biggest banks in the U.S., what do you notice?

Well first of all if you’re a premium member, you can always message me for individual name commentary. I don’t post all my thoughts here, but the premium members can attest (like recently with the big bank rally call) that the real juice is access to real time info.

At a glance here’s a few things I’m noticing for the biggest banks.

Top 1-Year Price Momentum Names:

Price momentum reflects the bloodless verdict of the market. Does the market like the stock or not. Metrics and analysis be darned. Strong momentum often signals confidence in the bank’s operations, profitability, and growth potential. Also worth noting that it can feed on itself and can also lead to factor based models & funds buying them purely because “stock go up”.

Momentum Leaders:

Citigroup (C): A big turnaround story gaining steam after years of underperformance. This will be Thursday’s updated writeup.

Wells Fargo (WFC): Recovering from regulatory overhangs, with renewed focus on growth and efficiency. I was long them into earnings with call spreads and the common.

First Horizon (FHN): Steady performance with a regional advantage, benefiting from niche market strength and a rally post TD deal break.

First Citizens BancShares (FCNCA): A major growth story, riding high on successful acquisitions and integration strategies. A long time holding of mine, they’re “asset sensitive” but have a capital warchest and just plain win.

Price Laggards: Undervalued or Stuck in the Mud?

Price laggards often reflect investor skepticism, weak fundamentals, or poor sentiment. I’m usually one for playing the turn in banks (just for kicks), but lagging price movement can mean deep value that’s cheap or just plain value traps being pulled down by price gravity. For me I think the envrionment lends itself to positive momentum, rather than catching a flip in names like this. These are technically the weakest names from a trading standpoint.

Momentum Laggards:

Valley National (VLY): Struggling with weak momentum and a discounted valuation while fresh off a capital raise to plug capital gaps.

Columbia Banking (COLB): Price underperformance despite operational stability suggests mispricing but they have a lot to work through still.

U.S. Bancorp (USB): Sluggish performance compared to peers, weighed down by macro concerns but also just a more upside down balance sheet than most.

Webster Financial (WBS): Weak price momentum suggests low investor confidence and high CRE, but potential lies in its improving ROTCE metrics. If there was one to “catch the turn on” it would be WBS.

Richest to Forward ROTCE: The Premium Players

Banks trading at high P/TBV multiples relative to forward ROTCE reflect market optimism—but they may also be priced for perfection. This category typically includes banks with strong market positions or perceived safety. Some of this comes form long years of performance too. I almost never like buying rich banks, but man some of these like CFR have defied the odds for a long time.

Premium Valuations:

Cullen/Frost Bankers (CFR): A regional standout, trading at a premium for its stability and ROTCE strength. I’m told there are no recessions in Texas and they have some favorable TBV accretion via bond pay downs coming.

KeyCorp (KEY): Valuation remains high relative to profitability, requiring sustained improvement to justify its multiple. Lots of people getting bulled up with their capital raise and “offense” mentality.

PNC Financial (PNC): A blue-chip bank benefiting from scale and consistent earnings, but valuation is stretched. Demchak wants to do some M&A and I can almost promise you it won’t be a juicy failure deal.

Citizens Financial Group (CFG): Trading rich to ROTCE, I don’t really ever look at CFG but maybe it’s getting ahead of itself given it’s “meh” 2025 estimated ROTCE & EPS outlook.

Cheapest to Forward ROTCE: The Value Plays

Banks trading at low P/TBV multiples relative to their forward ROTCE offer potential upside, assuming their earnings outlook remains stable. These are often the hidden gems where fundamentals outshine sentiment. I do like trafficking in these (my general momentum comments notwithstanding) but you do have to realize things are often cheap for a reason. Two of these are heavy in CRE

Undervalued Picks:

Columbia Banking (COLB): Despite lagging price performance, COLB’s ROTCE suggests undervaluation. High CRE and a liability sensitive profile are hanging on perceptions.

First Citizens BancShares (FCNCA): Strong profitability paired with a reasonable valuation makes FCNCA a standout. It’s kind of wonky because it’s not covered quite as much as the rest, but has all kinds of bullish upside potential. Haters will say it was all failure deal accretion.

Popular, Inc. (BPOP): A consistent performer trading below its intrinsic value. I’m long the name in the low 90s and think with a lot of CET1 they should be pumping the buyback machine soon. Over the past 7 years they’ve CAGR’d EPS at 18% plus, despite some near term challenges. Full Write Up On BPOP From Victaurs

Webster Financial (WBS): Weak price momentum but significant undervaluation relative to forward ROTCE signals upside potential. Said it before, some CRE concerns and digesting the merger so thinner capital than most would want.

What’s Next

Momentum leaders like Citigroup (C) and First Citizens (FCNCA) are grabbing the hearts and minds of investors, while deep-value plays like Popular, Inc. (BPOP) offer compelling upside for patient investors. In anything bank, you want to think portfolio wise. Part growth, part value. Part rates up, part rates down.

On Thursday, I’ll release my full update on Citibank (C), including a fresh price target and detailed analysis. Mayo and I seem to agree, and have since 2023. If you’re watching the banking sector, now’s the time to pay attention. Stay tuned!

Until next time,

Victaurs