It’s funny how at this age your memory changes. You forget some things. You remember some things. And they are random (trust me my memories are random).

One memory that has always stuck with me and that I thought about randomly, is from growing up and playing catch with my grandpa in my front yard. My grandpa was a HUGE Cincinatti Reds fan of the “Big Red Machine” era. We’re talking Bench, Joe Morgan, and of course Charlie Hustle himself, Pete Rose. PS remind me to tell you a story about the jar of “beans” one day.

Part of those memories I have of my grandpa is watching This Week in Baseball. This Week in Baseball"(TWIB) was a landmark sports program that aired from 1977 to 2011, leaving a big dent on baseball broadcasting. Debuting on March 26, 1977, and running almost continuously for over three decades. Narrated by the legendary Mel Allen, TWIB became a cultural touchstone, providing unparalleled access to Major League Baseball in an era before widespread cable sports networks and internet highlights. Its longevity and influence underscore its crucial role in promoting the sport and connecting fans to the game they loved.

Mel Allen, known as the "Voice of the New York Yankees" from 1939 to 1964, was a legend. His voice and style, characterized by catchphrases like "How about that!" and "Going, going, gone!", became part of baseball's cultural lexicon. I’ll always remember those phrases and my grandpa with a smile.

Note to self: keep those good memories alive in life.

And that’s where my inspiration for this post is. So, without further ado, here is This Week in Banks.

The Macro Week That Was:

As we entered last week, bank stocks were rallying hard. The catalyst? A potential Trump victory and the promise of rate cuts, coupled with a steeper yield curve. These factors painted a rosy picture for the banking sector. But the tides of Wall Street are ever-changing. We had started seeing banks soften as Kamala Harris's odds improved, bringing with it the specter of higher taxes and rates. Then came Thursday & Friday's gut punch: weak economic data, including soft ISM and jobs numbers. This data, ironically, implied lower rates ahead - the very thing that had boosted banks earlier. The result? Bank stocks "puked hard," as traders say. Almost a 180-sentiment check. Just days ago, lower rates were a boon for banks. Now, they're suddenly toxic. Welcome to the paradoxical world of finance, where today's medicine can quickly become tomorrow's poison.

Bank Indexes:

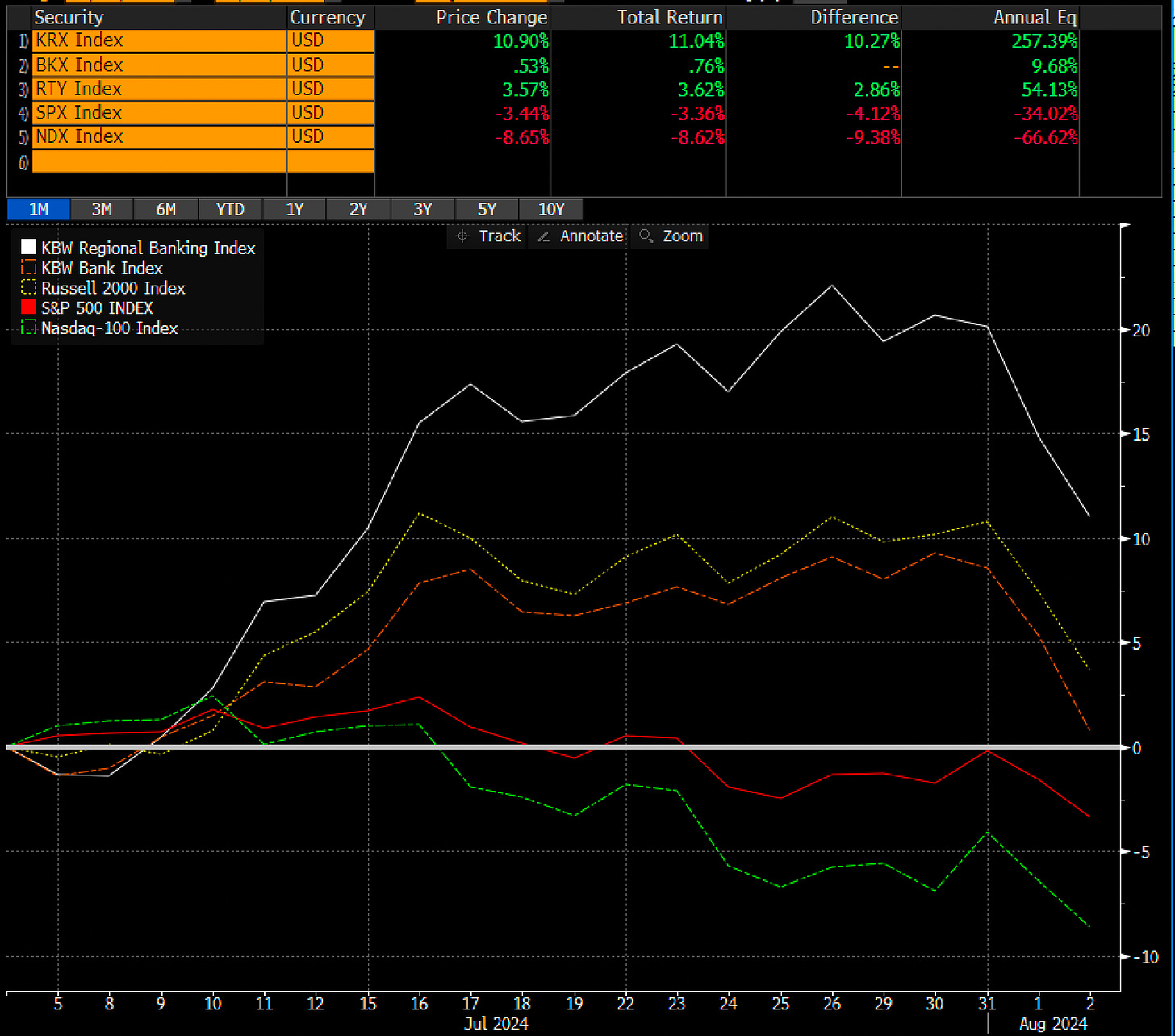

Over the past week, the financial markets experienced a decent downturn across various indices. KRX (regionals) saw the steepest decline, dropping 7.02%, while BKX (big banks) wasn't far behind with a 6.85% fall. RTY (Russell) also took a significant hit, decreasing by 5.64%. NDX (Nasdaq) faced challenges as well, sliding 3.25%, while the SPX showed more resilience but still dipped 2.14%. A reminder that sell-offs do happen in the face of a market that has just wanted to keep going up and up.

Looking at the month-long perspective, however, presents a mixed picture. KRX demonstrated impressive strength, surging 10.90% over the past month. RTY performed well, climbing 3.62%, while the BKX hung in for a 0.53% gain.

In contrast, the SPX showed a slight decline of 3.44% for the last month. And the NDX faced more significant headwinds, retreating 8.65% over the same period. And they said that banks couldn’t outperform.

Bank Winners & Losers this Week:

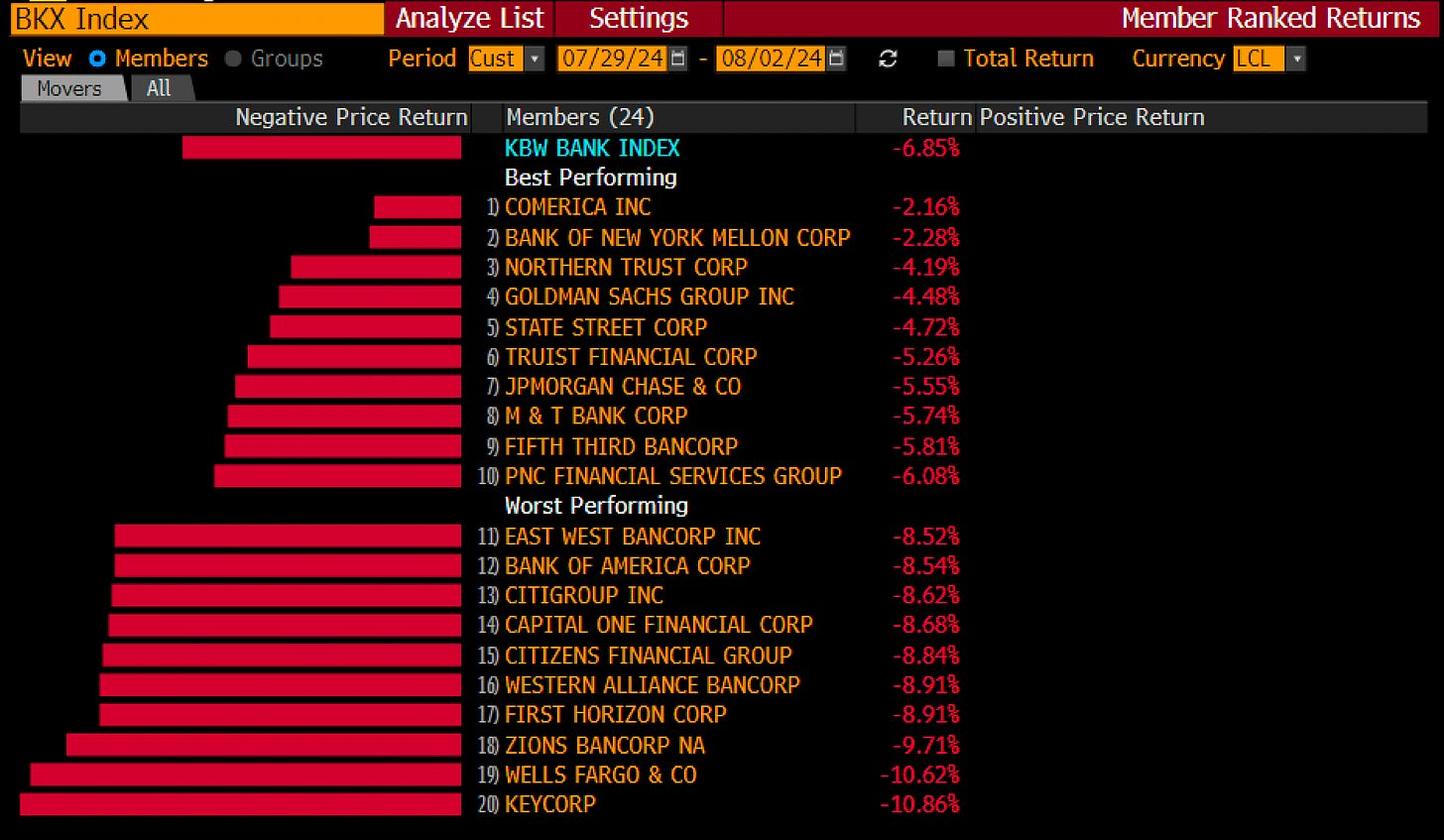

Comerica emerged as a relative winner, though still down 2.16%. BNY Mellon followed closely, declining 2.28%. Northern Trust fared worse, dropping 4.19%. Not a great week when “winning” is losing the least. But maybe Rosie Perez had it right in White Men Can’t Jump, “sometimes when you win you really lose and somethings when you lose you really win”. The banks that were just plain losers this week were: KeyCorp who fell 10.86%, Wells Fargo tumbled 10.62%, and Zions Bancorporation fell 9.71%.

In Regional land, a few stocks managed to hold their ground amidst a sea of red. Aka. “Flat is the new up”. ABCB (Ameris), AUB (Atlantic Union), and GCBI (Glacier) all remained flat, emerging as the relative winners in a challenging environment.

On the downside, SNV (Synovus) took a decent hit, falling 10.38% and leading the pack of decliners. Hot on its heels was HWC (Hancock Whitney), which saw its value erode by 9.99%. CADE (Cadence) rounded out the top three losers, shedding 9.75% of its value.

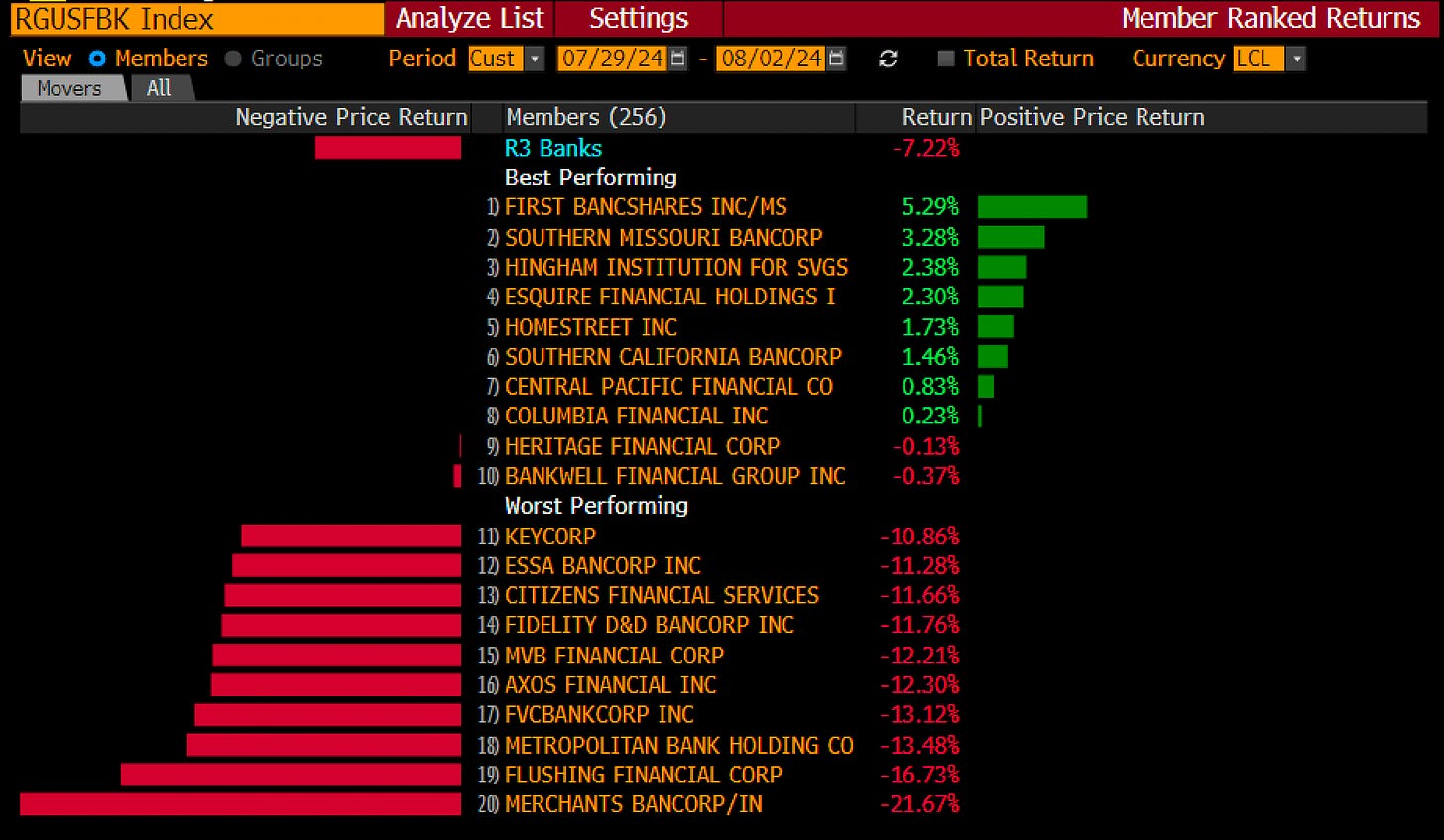

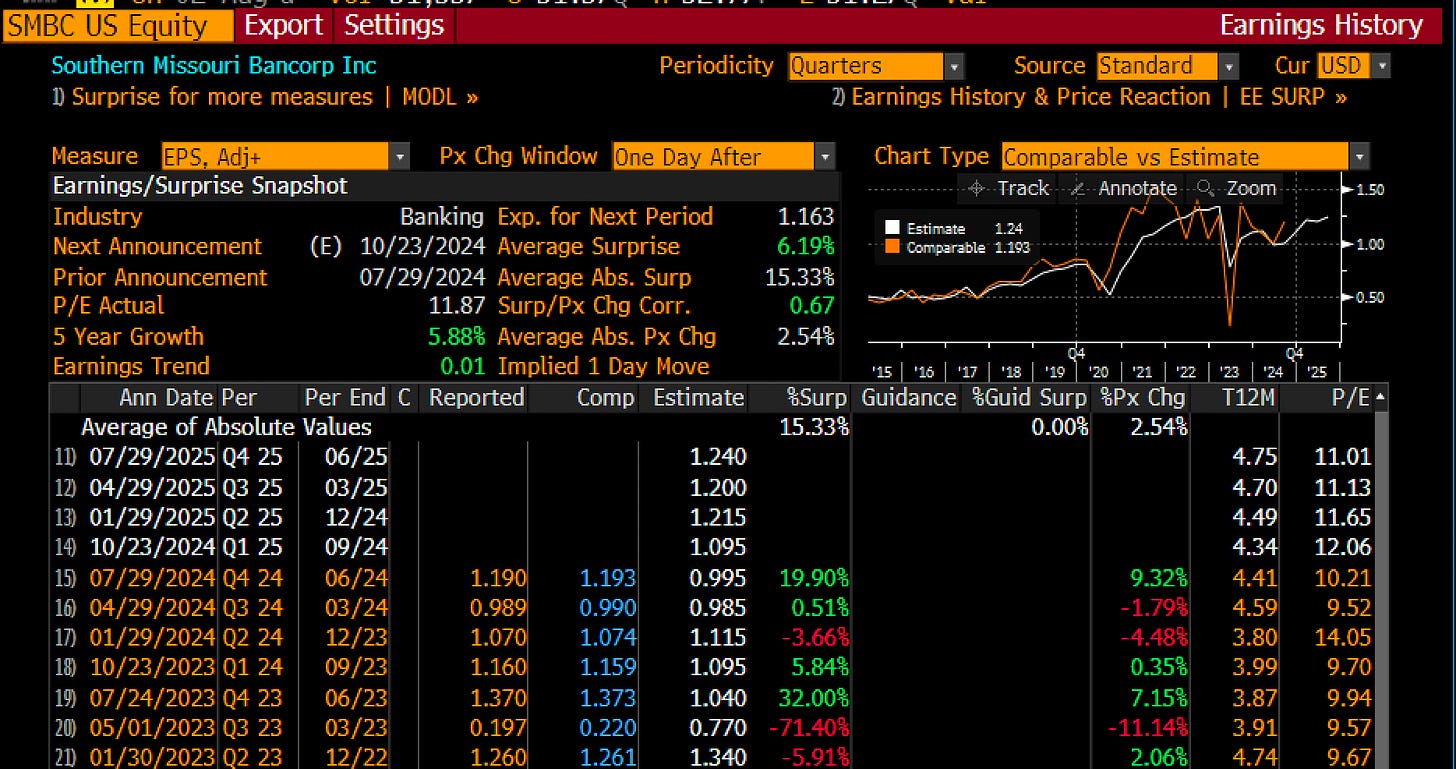

Including some smaller banks in the Russell 3000 Bank Index, a handful of stocks managed to shine brightly against the prevailing downward trend. Leading the charge was FBMS (The First), which surged an impressive 5.29% on its takeout news by RNST. Not far behind, SMBC (Southern Missouri) climbed a respectable 3.28% on a strong to quite strong earnings release (great work). And the cult stock extraordinaire, HIFS (Hingham Institution for Savings) rounded out the top three with a solid 2.38% gain. ESQ (Esquire) and HMST (HomeStreet) also posted positive returns, rising 2.30% and 1.73% respectively.

On the flip side, some smaller stocks faced significant headwinds. MBIN (Merchants Bancorp) bore the brunt of the selloff, going down 21.67%, leaving some shareholders reeling. FFIC (Flushing) wasn't far behind, tumbling 16.73%. MCB (Metropolitan Bank) also felt the heat, dropping 13.48%, while FVCB (FVCBank) and AX (Axos Financial Inc.) saw their values erode by 13.12% and 12.30% respectively.

Highlights for the Week

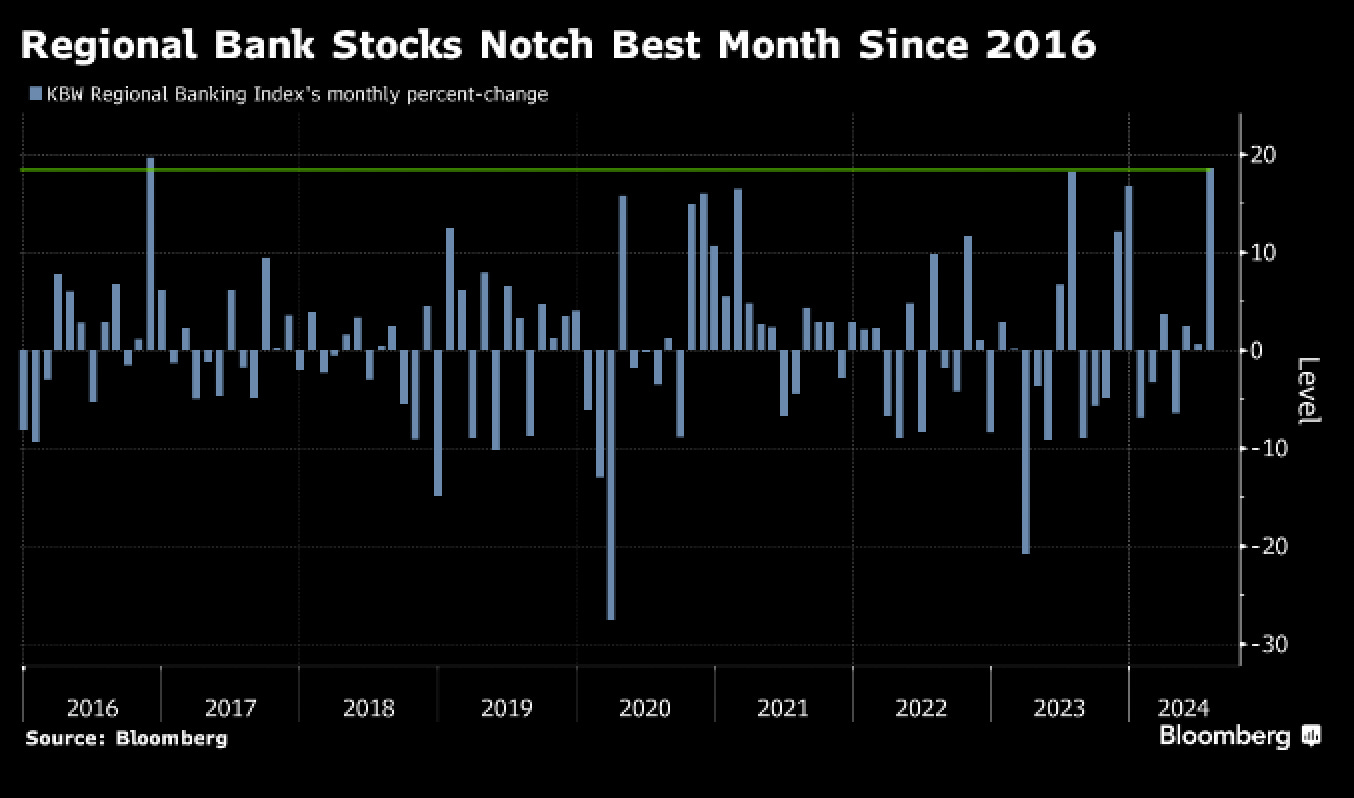

Bloomberg wrote a note highlighting the good month in banks. In fact, it was their best month since 2016. For an industry that has been sucking wind for 18-24 months, this is a welcome sentiment shift. This plus the fact that banks have rallied back and have been competitive with the NDX should be helpful going forward. Maybe the generalists will remember that money can be made in banks and rotate some money our way.

The rally in bonds this month was fast, and it was furious. The 5-year rallied from a 4.07% at the start of the week to 3.61% at the close. That is a 46-basis point move in a single week and while I have no data to back up this claim, I can tell you that this is a historically large move. And what does this mean for banks? Well, the AOCI positions on their bond books just went UP in value, a lot. To quantify this simply, if a bank had a $1 billion investment portfolio with a 5-year duration, it’s market value just went up roughly 2 points or about $23 million. Seems like a lot to non-bond geeks, but the move was large, and bonds are “convex” as they say. And with that TBV went up substantially. And with that bank balance sheets “de-leveraged”. So, the rate move caused their balance sheets to become less levered and saw TBV accretion (just like we knew it would). Anyone want to shoot me a guess at how much BAC’s bond marks went up this past week?

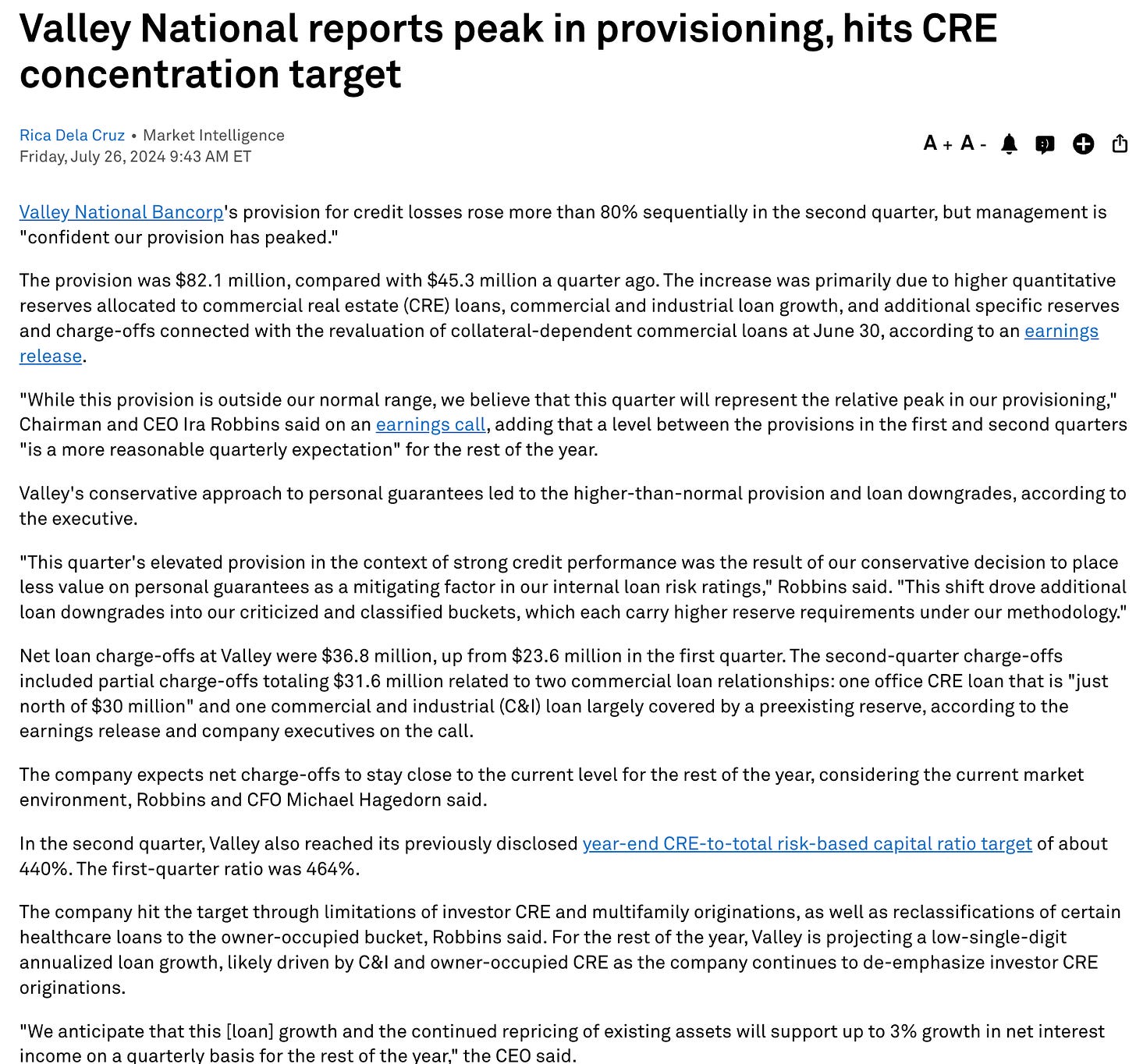

Valley bank said its provision peaked. And I don’t know if I buy it yet, but if true it is a big deal for the CRE doom and gloom out there. VLY has one of the highest percentages of CRE out there and it’s geographically tied to NY and the Northeast. They’re heavily shorted and I don’t think people want them to fail, but they are an easy target for CRE doomers to go after. I’m calling this a positive on the week for sure, because if they are correct then it bodes well for most CRE. As does the rally in rates (refi’s get much easier at lower rates).

SMBC had a nice quarter and good price action. Good small banks do exist. And while I don’t want to bore you with the actual release (check it out), it goes to show that underneath the hood there are banks performing well. Being one of the lone green names on a week like this is also impressive. I haven’t dug in a ton, but they’re trading around 11x forwards and 150% of TBV and I think are projecting an 11% or 12% ROTCE in 2025.

Lowlights of the Week

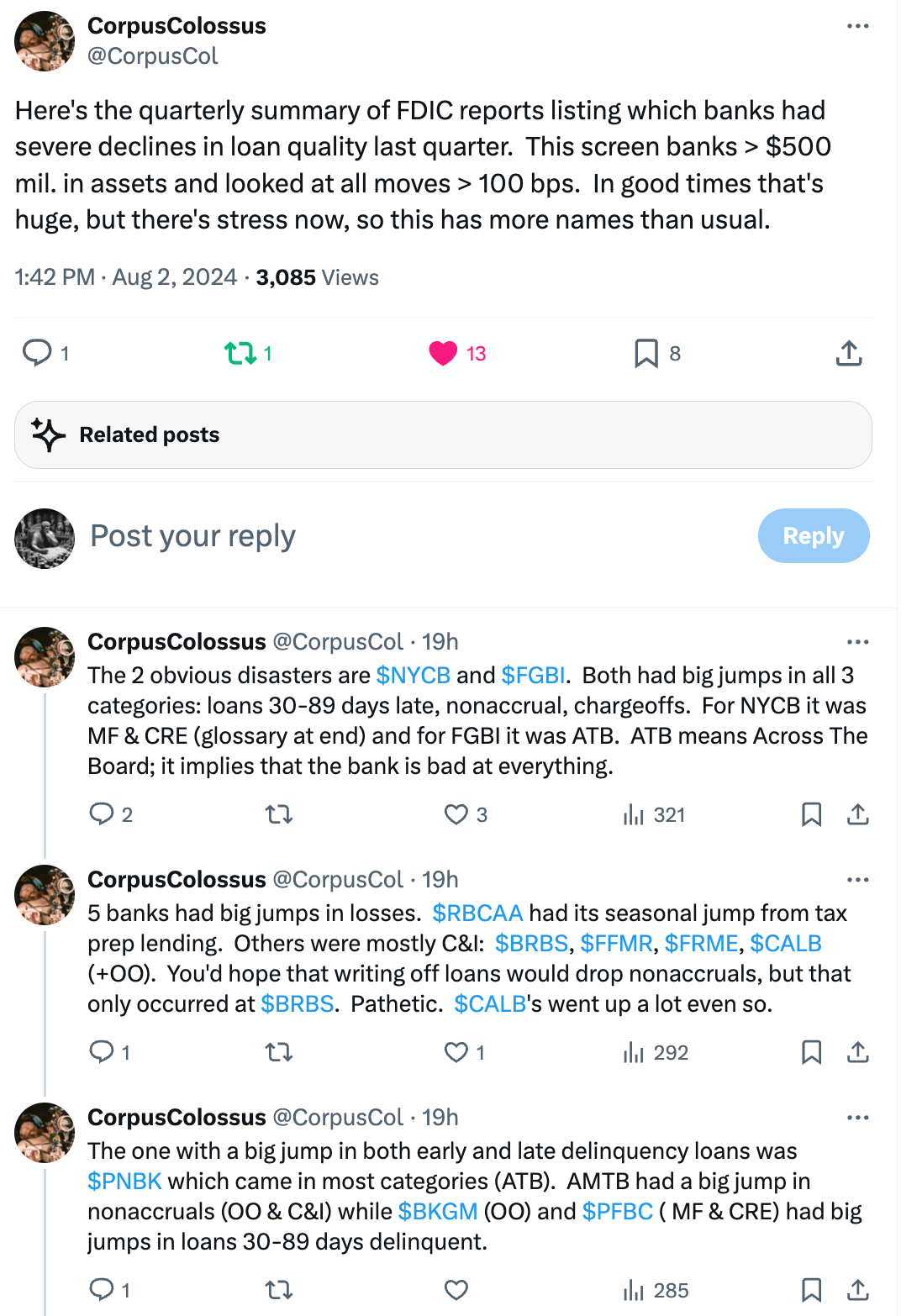

Bad bank credit did happen, just not at large scale. Universally AMRT and BMRC were notables with credit deterioration. Otherwise, there were some names that struggled. And one thing I personally love is when someone infinitely smarter than me does ALL of the work to summarize what’s happened. That human is an X friend of mine, and you should follow him: @CorpusCol

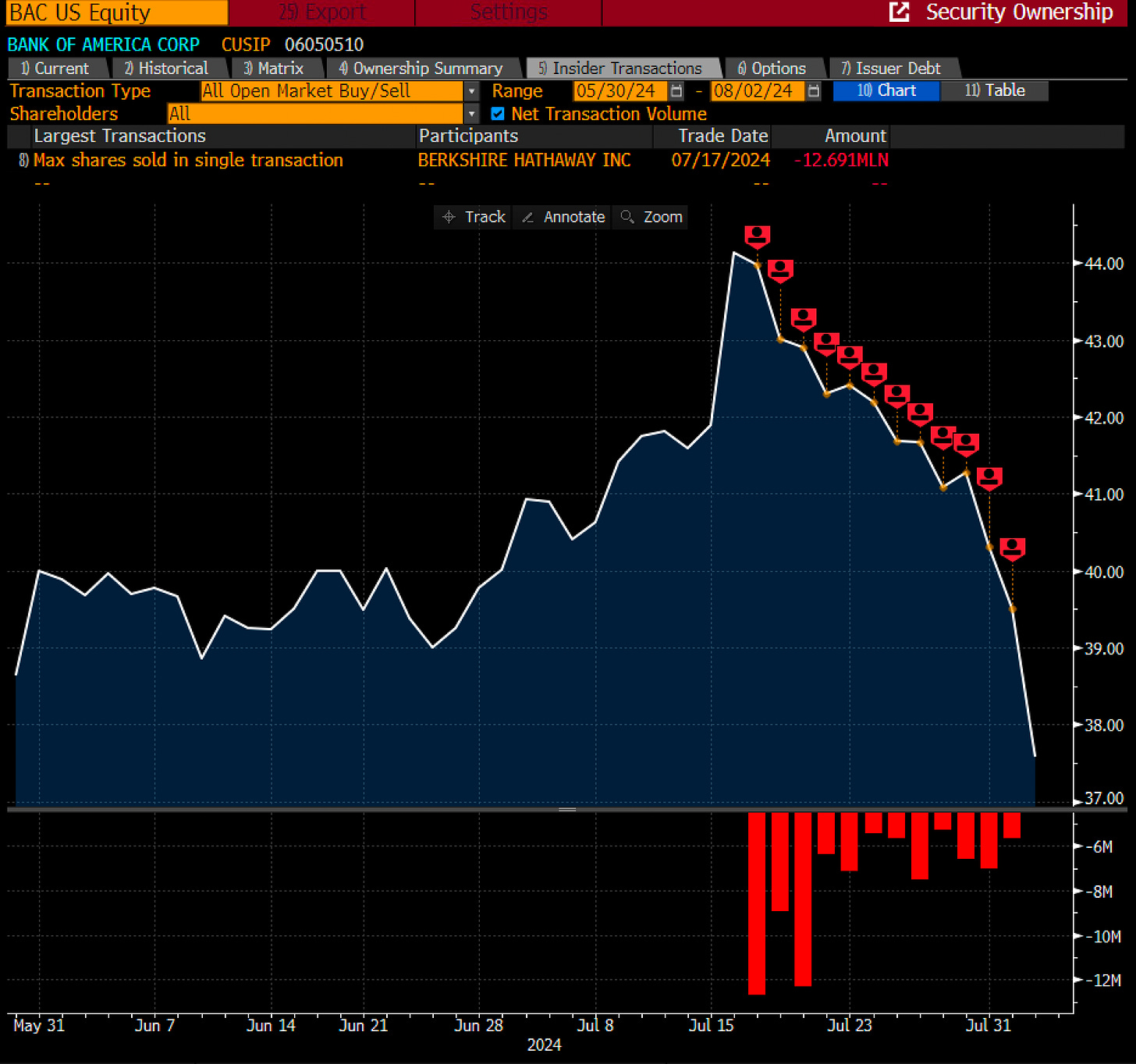

Warren Buffett sold $3 billion of BAC shares. I’m putting this in the negative category, even though he still holds $39.5 billion. Suffice to say this is likely a “trimming the position” move taking advantage of high prices. Maybe he doesn’t want to have to report what he does and get the position to 9.9% or maybe he wants to buy more discounted names & bolster cash. It is worth noting that his cost basis is $14 on this, which is funny. But remember, the dude has stones. This position started in the aftermath of the 2008 financial crisis when the world was like, full on melted down not just fake melted down like now. In August 2011, Berkshire Hathaway invested $5 billion in the bank, receiving preferred stock with a 6% annual dividend and warrants to purchase 700 million shares at $7.14 each. This move was seen as a vote of confidence in the bank, helping to stabilize its position. Six years later, Buffett exercised the warrants, converting his investment to common stock and making Berkshire the largest shareholder in Bank of America. I guess the dude practices the whole “be greedy when others are fearful”. And just remember, AAPL rallied hard once Buffett was done selling.

The Federal Deposit Insurance Corp. board voted in its July 30 meeting to propose a measure that strengthens the regulation of banks' brokered deposits.

The proposed rule would simplify the definition of "deposit broker," eliminate the exclusive deposit placement arrangement exception and limit the primary purpose exception so that only insured depository institutions could apply for it. The rule would remove the enabling transactions designated business exception and clarify how an insured depository institution that has lost its agent institution status can regain it for the limited exception for reciprocal deposits.

Lame duck FDIC boss Martin Gruenberg has expressed concerns about the liquidity risk associated with them. "The proposed rule would change the notice and application requirements for the primary purpose exception to apply only to banks, which, among other things, would help address the underreporting of brokered deposits," Gruenberg said. "All of these changes would significantly enhance the protections of the brokered deposit rule." This will have an impact on Fintech deposits.

Are Banks a Good Value Going Forward?

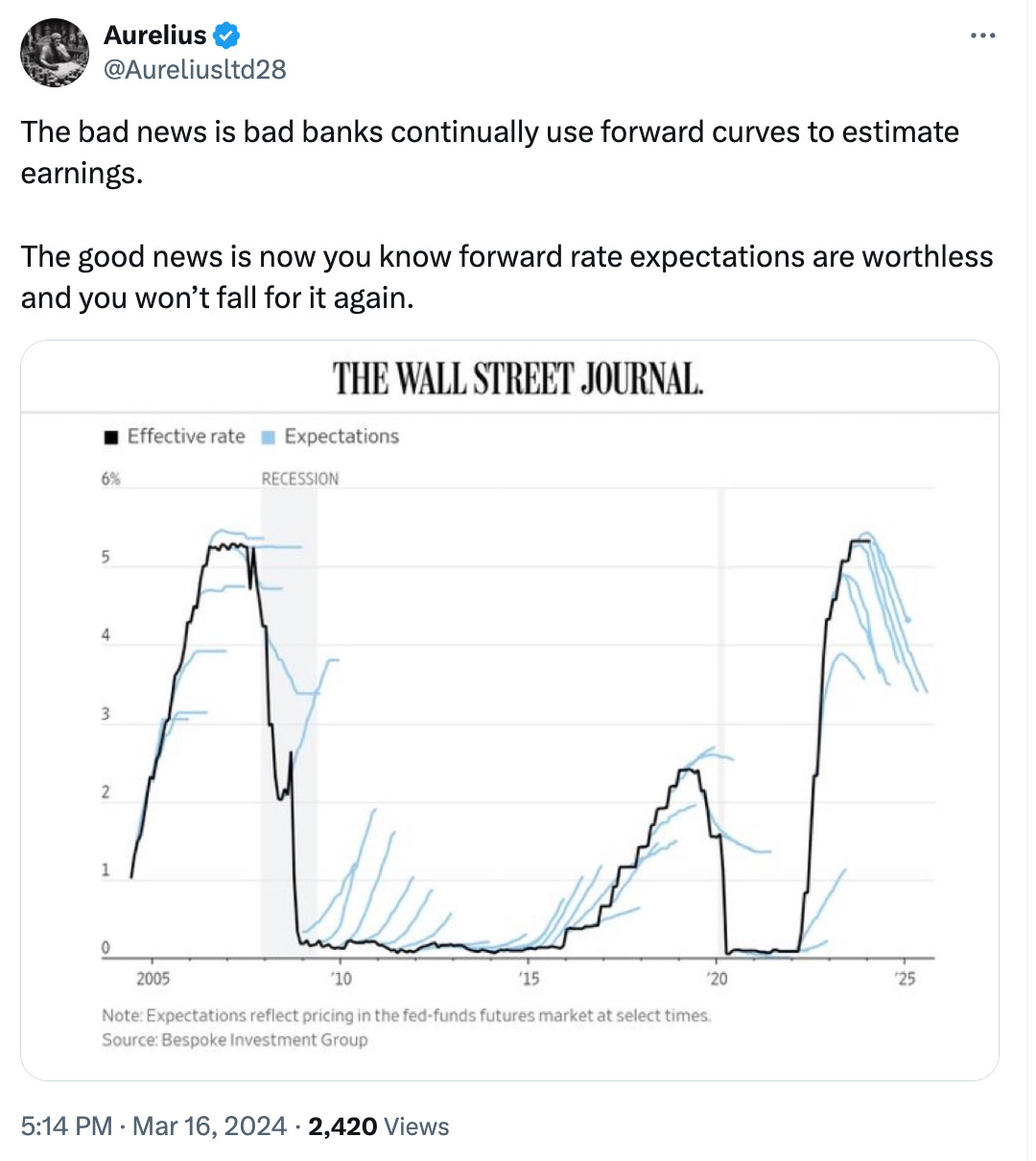

This really depends on a few key factors. Number one will there be a recession. I can’t predict this, sorry. I promise if I did know, I would tell you all right after I bet every penny I had on the outcome. You have my word. Number two what happens with rates. Speaking to number two, I just want to remind all of you that you do not know where rates are going beyond a handful of weeks/months. The Fed is notoriously bad at getting it right 12 months out, and they literally are the ones voting on it. The Economy is a complex adaptive system that cannot be predicted over a long horizon. Those betting on futures see below. You never get it right, so stop deluding yourself into thinking that you can this time.

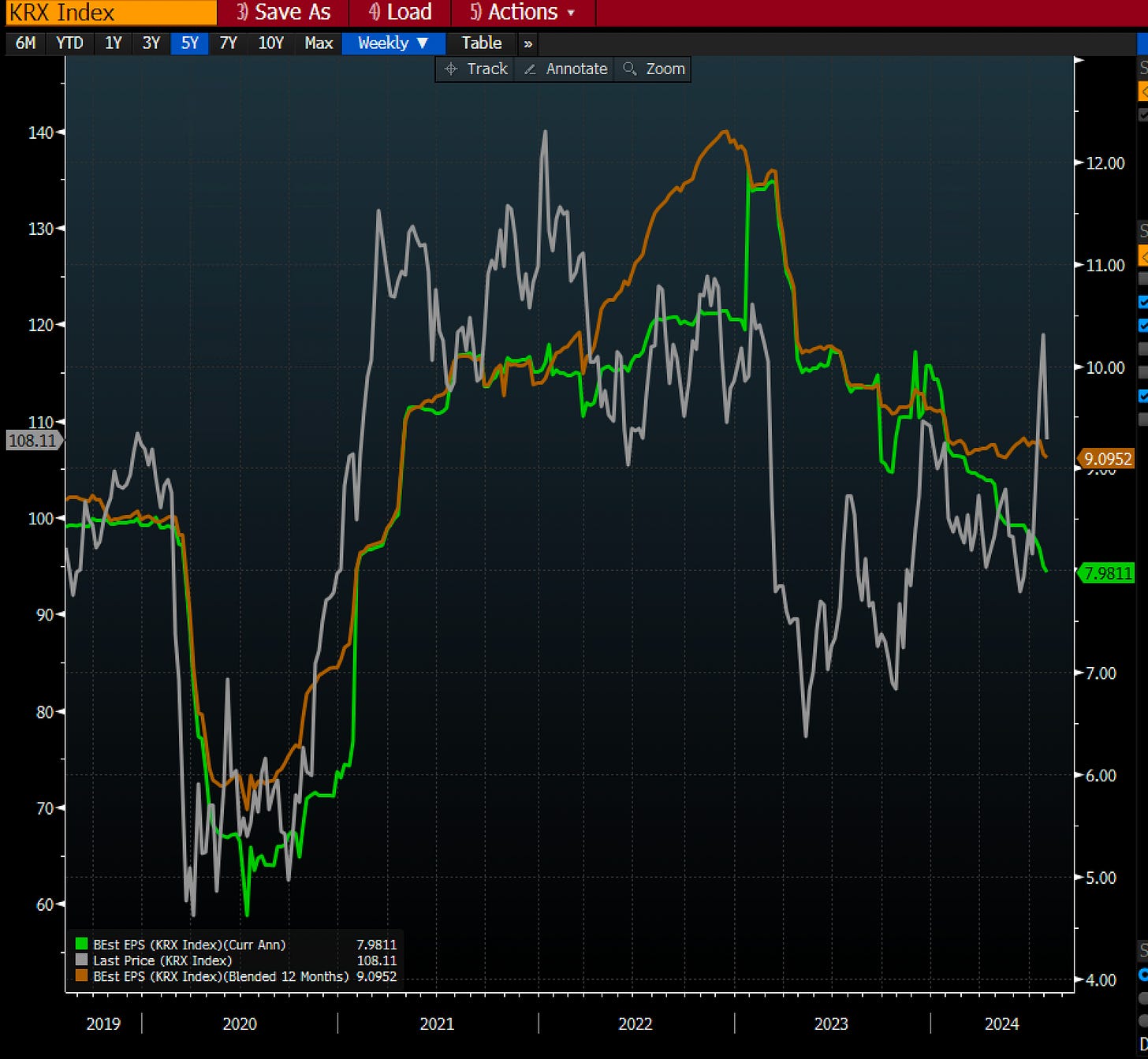

Are we fairly valued or not? This mini pullback has actually helped a bit. And I have to say yes, we’re fairly if not slightly cheap on certain names. At the KRX index level, you can pretty clearly see that the price of the index “overshot” fundamental current (green line) and future estimated (red) earnings. How I’m thinking about it at an index level is this, banks are solid on liquidity, solid on credit (knock on wood) and rates being lower is a tailwind for CRE refi’s and the like, have high capital levels and have just de-levered their balance sheets with the rate move. From an earnings standpoint I do “buy” the projections for 10% to 15% EPS growth into next year. KRX is trading around 12x forwards, which again is fair. Individual names like FCNC.A which I added recently are at 10.5x or so, which doesn’t feel expensive for someone with a track record of growth and a competent if not great management team. I think JPM and the boys are saying your alpha should be bad banks catching up price wise, but for me when things have violent snap backs like recently, I tend to find ways to buy up in quality cheaper. Great businesses at fair prices.

A good example of a bank I think would & should do well going forward is FMBL. Without going too much in depth, they have a strong funding base (sub 2% all in COF), a low L/D ratio and little credit risk with high resi (73%), a big AOCI tailwind in the bond book, a buyback in place, and trade at less than 50% of TBV. They’re not terribly liquid, and I can’t buy them, but the fact remains they should perform well given the macro backdrop. These factors should perform well should the world play out as it is now. Short rates down, credit benign, TBV accretion via bond losses alleviating.

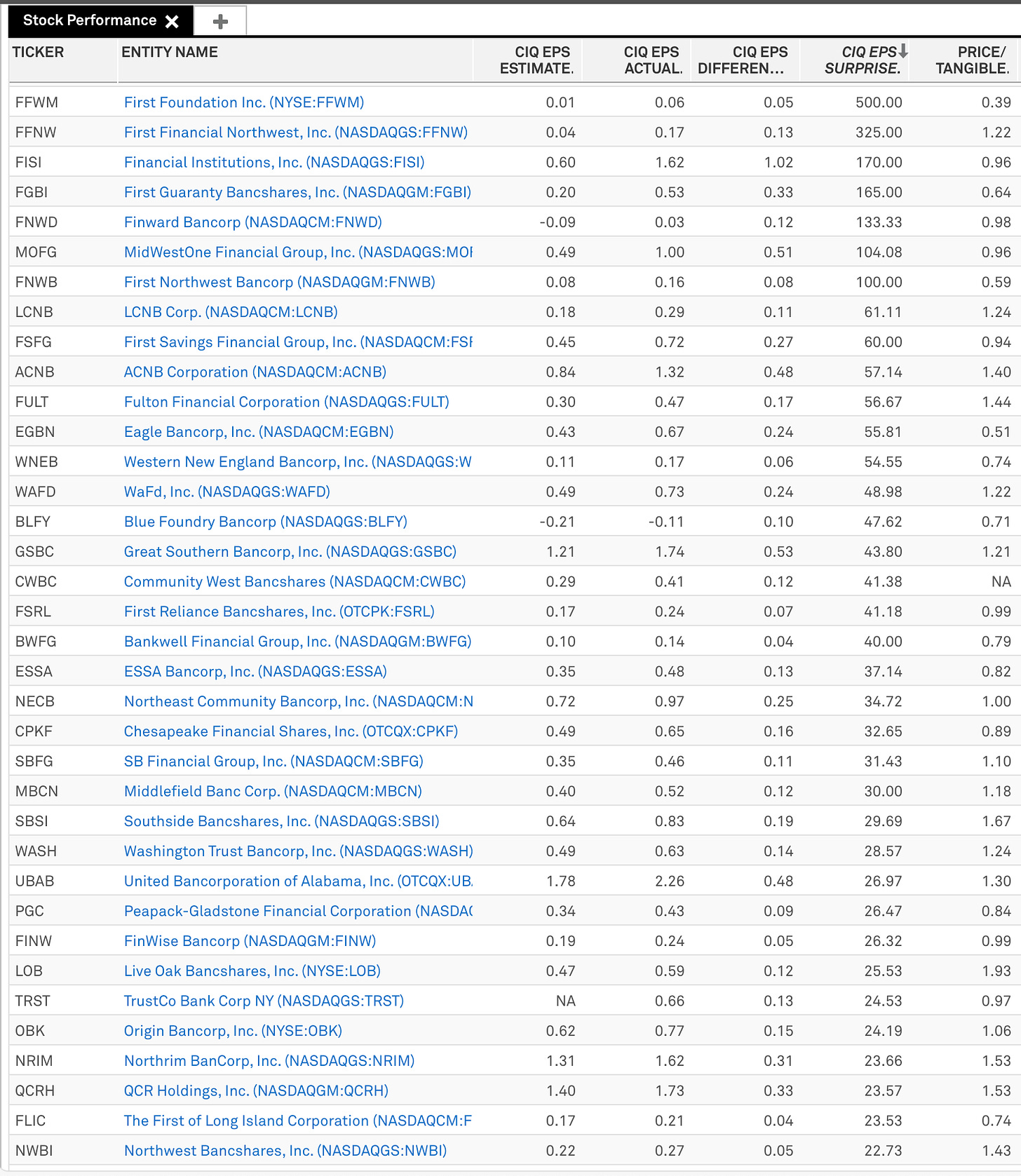

Beats by banks? Worth noting that sometimes S&P estimates are off so take these with a grain of salt, but for all the doom and gloom some people (gasps) outperformed in a tough environment. Of course, some or most in some cases of this would be due to low expectations, but the fact remains there were some nice beats like WAFD, NECB, and UBAB. As always, find the consistent performing banks at good valuations that are putting up good numbers.

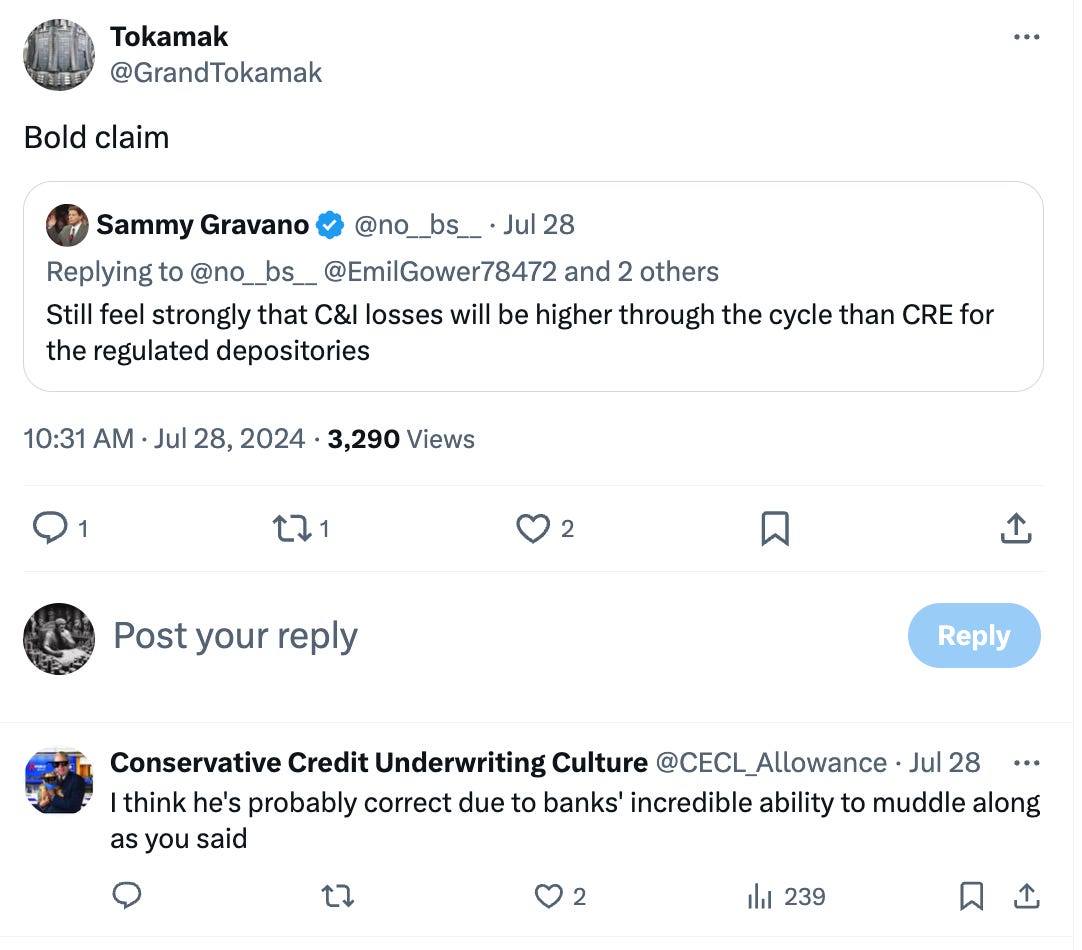

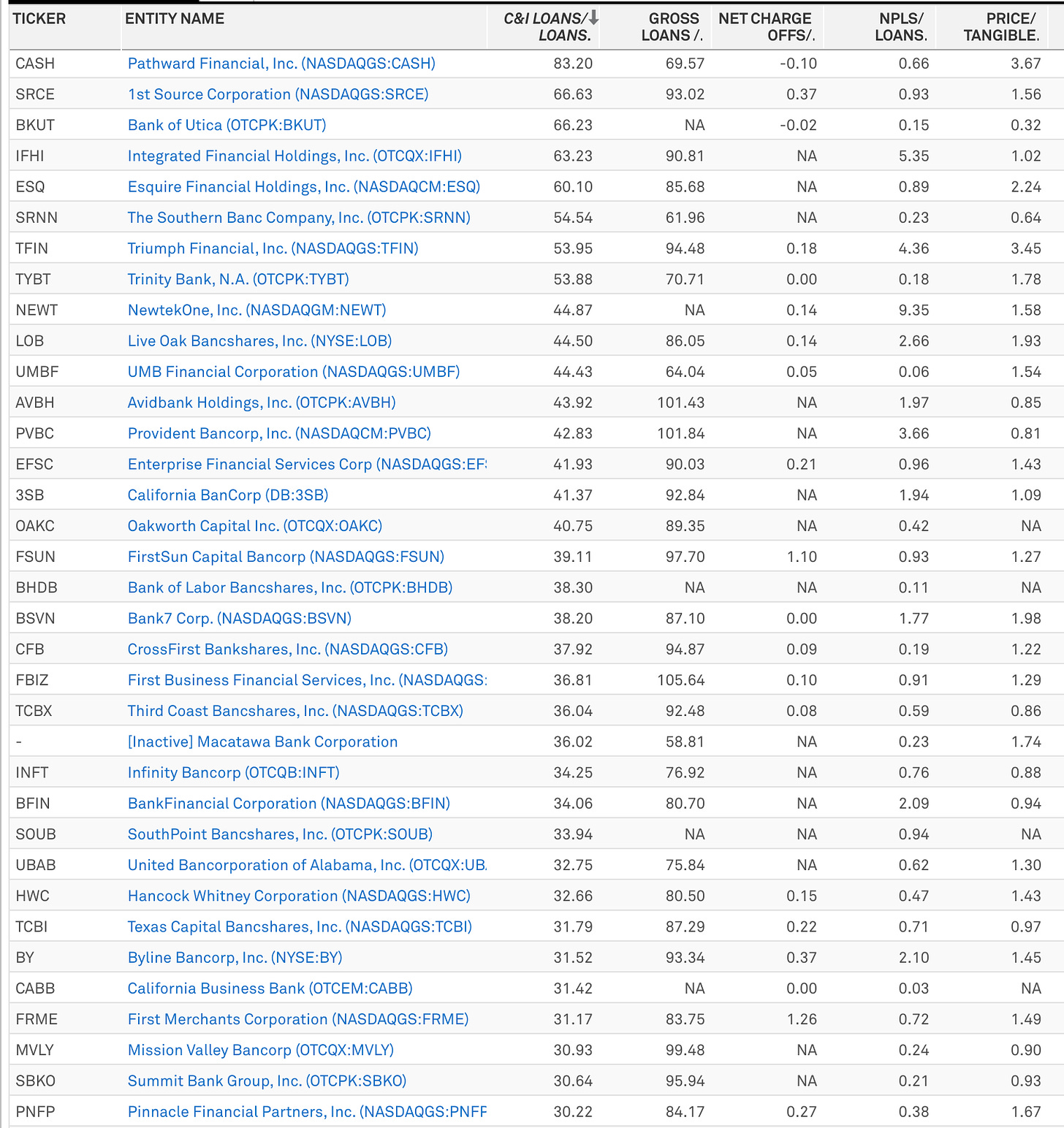

Rates down may have been a death knell for CRE doom. But maybe the real problems will poke their heads in C&I? Another human smarter than myself and someone you should follow @no__bs__ I think may be right that C&I would have a tougher time credit wise in the new yield curve and new “recession yes” world.

In honor of him here’s your screen for high C&I banks and note, not all C&I is created alike. I tried to share NCO and NPL data to orient to current factors as well as overall credit leverage via L/D ratio. FYI, to my knowledge Sammy the Bull Gravano as he goes by on X is not really a mob boss so you can follow him without fear.

Life After the First Cut

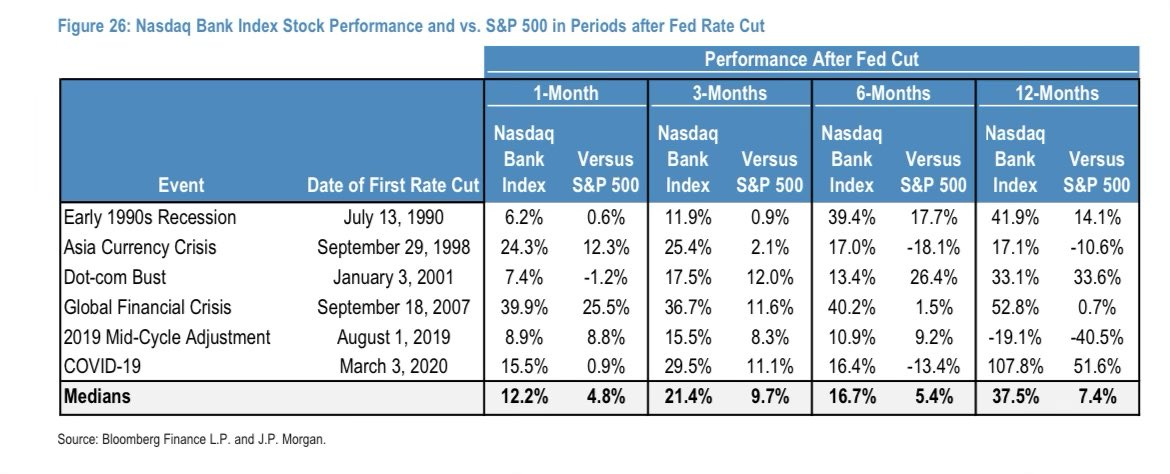

I would be remiss if I didn’t mention at least acknowledge the historic “first cut” we have coming. Call me an optimist, but I think banks can actually outperform going forward and make sure to send this to your favorite generalist.

Consider these facts:

In most cases, the Nasdaq Bank Index outperformed the S&P 500, especially in the short term (1-3 months) after rate cuts.

The most dramatic outperformance was during the COVID-19 period, where the Nasdaq Bank Index gained 107.8% over 12 months compared to the S&P 500's 51.6% gain.

The Global Financial Crisis in 2007 also saw significant outperformance by bank stocks, particularly in the short term. Which really feels wrong, but the data is what the data is.

The 2019 Mid-Cycle Adjustment was an exception, where bank stocks underperformed the S&P 500 over 12 months. Funny that time also included a Trump factor.

The median performance shows that bank stocks tend to outperform the broader market across all time periods after Fed rate cuts, with the gap being largest in the 12-month timeframe (37.5% vs 7.4%).

So you’re telling me there’s a chance?

The best is ahead,

Victaurs