Stocks Go Up.

The S&P 500 jumped 3.9%. Dow up 2.9%. Nasdaq up 5.43%.

What sparked this rally? A barrage of surprisingly good economic news. Inflation cooling. Retail sales strong. Jobless claims down. Crops are saved.

Just two weeks ago, a weak jobs report sent stocks plummeting. Now … Those losses are ancient history. And the markets on a hair trigger, reacting violently to every scrap of data. Vol can be fun. Traders are scaling back bets on aggressive Fed rate cuts. Bond yields are a mixed bag. Short-term up, long-term down.

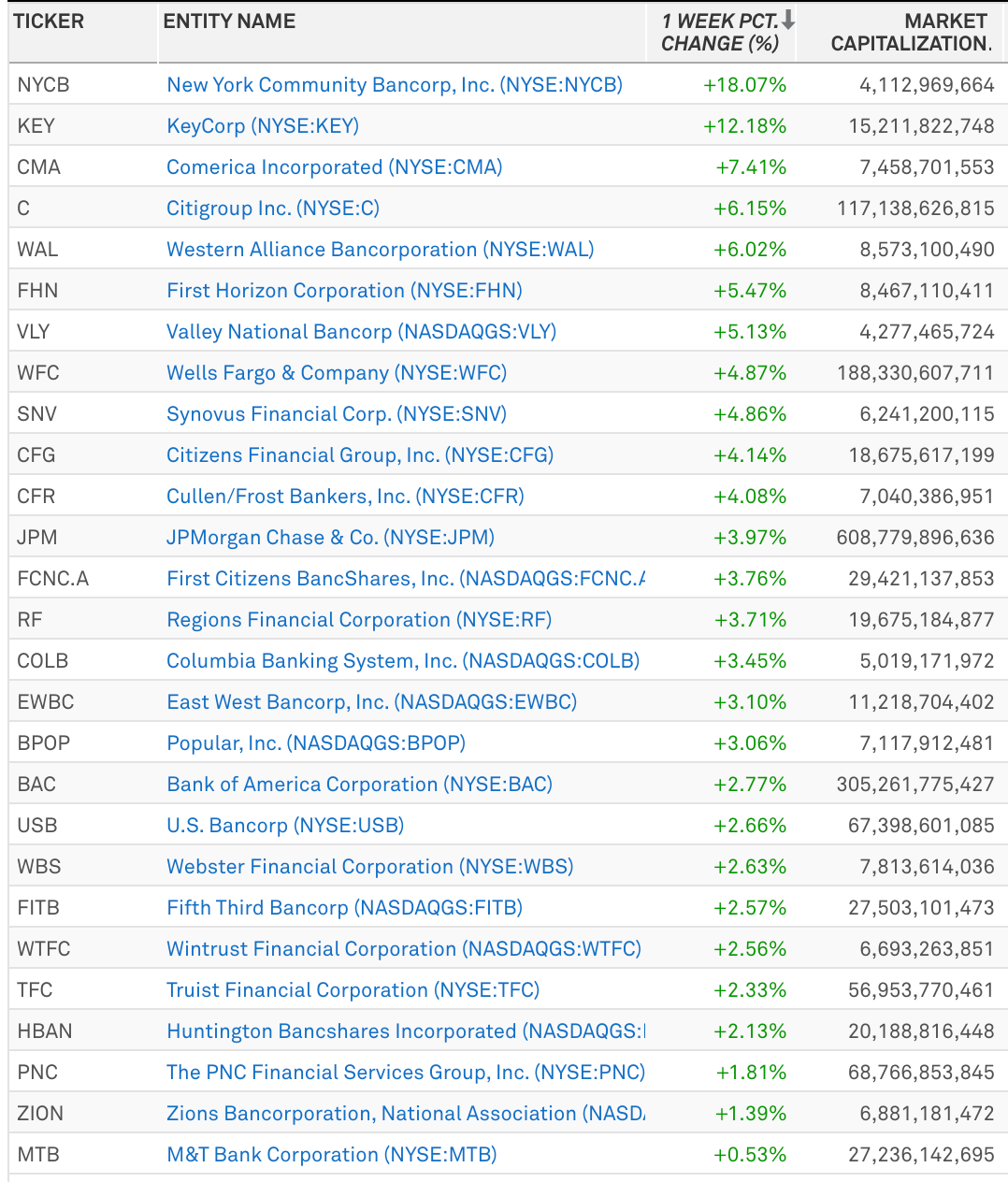

Bottom line: Wall Street's gone from gloom to boom in the blink of an eye. Banks participated, but not as much as the rest of the world. And going into an election cycle that’s 80 days away from resolution, buckle up for more turbulence ahead. Banks are following the cyclical tides for now.

NYCB Won Harder Than Any Other Bank This Week.

New York Community Bancorp shares surged after exchanging preferred stock for common stock with Liberty 77 Capital, Hudson Bay Capital, and Reverence Capital Partners. Part of a $1.05 billion capital raise, the move converts Series B preferred shares to common stock, ensuring no investor exceeds 9.99% ownership post-exchange. This is one of the most levered risk rewards out there in big bank land. If you believe that rates down is net good for CRE & will benefit high L/D ratio banks, this may be for you. Plus, you get to ride along Mnuchin & Trump. It’s not for me right now (Ockham’s Razor), but it is a fun one.

The Biggest Winners in the Big Boy Space.

Keybank did win this week. And haters will correctly point out that even though they’re just an average performer over the longer term, they did at least “do something”. What did they do? KeyCorp secured a $2.8 billion strategic investment from Scotiabank. This deal, priced at $17.17 per share (around 125% of TBV) for approximately 14.9% ownership, offers three benefits.

Capital Strength and Flexibility: The investment significantly bolsters KeyCorp's capital position, increasing its CET1 capital ratio by 195 basis points to an impressive 12.4%. The improved capital ratio, with a pro forma range of 11.3% to 11.6% post securities portfolio repositioning, does give them some “strategic flexibility”. Regulators want more CET1. Basel III will too.

Accelerated Growth and Profitability: With this capital boost, KeyCorp “in theory” gains the firepower to invest in high-growth areas such as investment banking, payments, and wealth management. The deal is expected to be low single-digit accretive to 2025 earnings per share and slightly accretive to 2026 earnings per share with the bond portfolio restructure baked in. The transaction also increases tangible book value per share by more than 10%.

Strategic Partnership Opportunities: Beyond the immediate financial benefits, the deal opens doors for future collaboration between KeyCorp and Scotiabank. This partnership potential could lead to expanded product offerings, shared expertise, and new market opportunities, ultimately benefiting both institutions and their clients. The capital will come in two tranches ($0.8 billion for 4.9% ownership, followed by $2.0 billion for 14.9% total ownership).

Big Banks Aren’t Really Cheap Anymore.

Tell me who on this list looks cheap? Or rather, how many of these looks cheap today? Not very many in my opinion. It’s a far cry from buying these names in the 7-9x range 12 months ago. A simpler time, when bank doomers were dooming and Investment Bankers were trying to convince the world NIM would be zero.

And where am I at today … do I want to buy Citibank at 10x forwards when I could own someone like FCNC.A who has a war chest of capital, a management team that executes, and a business that should boom in an easier money environment at the same forward multiple? No.

Do I really want to pay 13x or 2.5x TBV for CFR? I know there are no recessions in Texas, and everyone is moving to “Y’all Street”, but you are messing around with valuation gravity buying banks at these multiples.

And then piggybacking on Keybank from above. Would I rather own them with a track record of average returns at 15x forwards (of which that EPS should be adjusted higher in coming weeks) or would I rather buy someone like WAL who has a track record of growing value (and EPS, RPS, & TBVPS) with a huge potential mortgage non-interest income tailwind coming? No, I wouldn’t want to own Keybank over Western Alliance.

Dreams of Rolexes Dance in Refi Brokers Heads

On the mortgage tailwind, one niche has been absolutely flying over the past month as long rates have come down, mortgage refinancing companies. Look at Rocket up a cool 25% in a month.

And while some of this optimism is warranted, Rocket has gotten ahead of itself (like it always does).

Right now, they’re trading at around a $37 billion market cap on just over $4.5b of revenue. And what people are trying to remember is 2020 and 2021 (and to some extent 2022) when they were doing $15 billion and $12.5 billion in revenue on the greatest mortgage banking environment known to humankind. Note: this time period also represented the PEAK in Rolex valuations. Not saying we can’t get there but it will be hard anytime soon.

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.