Happy Labor Day

It’s crazy how far the collective “we” have come in such a short time. Just think about Labor Day’s origins.

Labor Day, celebrated annually on the first Monday in September in the United States, emerged from the era of rapid industrialization in the late 19th century. This period saw exponential economic growth, with U.S. GDP surging from $7 billion in 1850 ($252 billion in 2023 dollars) to $38 billion by 1900 ($1.3 trillion in 2023 dollars). By 1890, the U.S. manufactured one-third of the world's industrial output, cementing its position as a global industrial powerhouse. The manufacturing sector's contribution to GDP grew from 15% in 1850 to 24% by 1900, driven by new industries like steel, oil, electricity, and chemicals. This surge helped John D. Rockefeller to a net worth of around $150 million ($4 billion in 2023 dollars) in 1882 on his way to $900 million in 1913.

PS - despite him being a bit of a tyrant his book is 10/10 (38 Letters From J.D Rockefeller to his son)

Anyways, this massive U.S. prosperity came at a severe and almost mind-boggling human cost. Workers faced grueling 12–14-hour workdays, often 6-7 days a week. Children as young as 5 toiled in dangerous factories and mines, with an estimated 1.7 million children under 15 working in 1900. Think about that again, almost 2 million kids under 15 were being put through the dangerous meat grinder of the industrial revolution (although one could argue the mind rot of TikTok and social media is more dangerous today). Unsafe working environments, coupled with a lack of regulations, led to frequent injuries and deaths. In 1913, there were about 23,000 industrial deaths among a workforce of 38 million and countless injuries. Workers earned meager wages, barely enough to survive, while enduring poor sanitation and no job security. The average annual wage for manufacturing workers in 1900 was just $435, equivalent to about $13,700 in 2023 dollars.

The first unofficial Labor Day occurred on September 5, 1882, in New York City. About 10,000 workers, sacrificing a day's pay, marched from City Hall to Union Square, advocating for basic labor rights. As strikes intensified, with over 1,000 strikes occurring in 1886 alone, tensions escalated. The deadly Pullman Strike of 1894, which involved about 250,000 workers in 27 states, marked a turning point. The Pullman strike originated in a town outside of Chicago and began with factory workers for a company that produced luxury railroad cars. This quickly spread to involvement of the Railway Union also based out of Chicago and caused massive disruptions to rail traffic nationwide.

In its aftermath, President Grover Cleveland signed an act making Labor Day a federal holiday that same year, a conciliatory gesture towards the labor movement. This act was passed just six days after the end of the Pullman Strike, highlighting the government's urgency to address labor unrest. And that was only 140 years ago or so. Kind of insane to think about.

And thank you to the Chicagoans for your part in Labor Day

August for Banks

Back to banks. It was a fairly eventful month for markets overall. August was a story of an air pocket as the great Yen trade unwind led to the Nikkei dropping 12% and cyclicals getting pummeled across the globe as recession fears kicked in. The air pocket gave way to a slow and methodical rally higher as people “bought the dip”.

The S&P 500 led the pack with a 2.28% price change and 2.43% total return. The KBW Bank Index (big banks) also performed well, up 1.19%. The Nasdaq-100 showed solid gains too. However, the KBW Regional Banking Index and Russell 2000 (RTY Index) underperformed, with the latter declining 1.63% over the period.

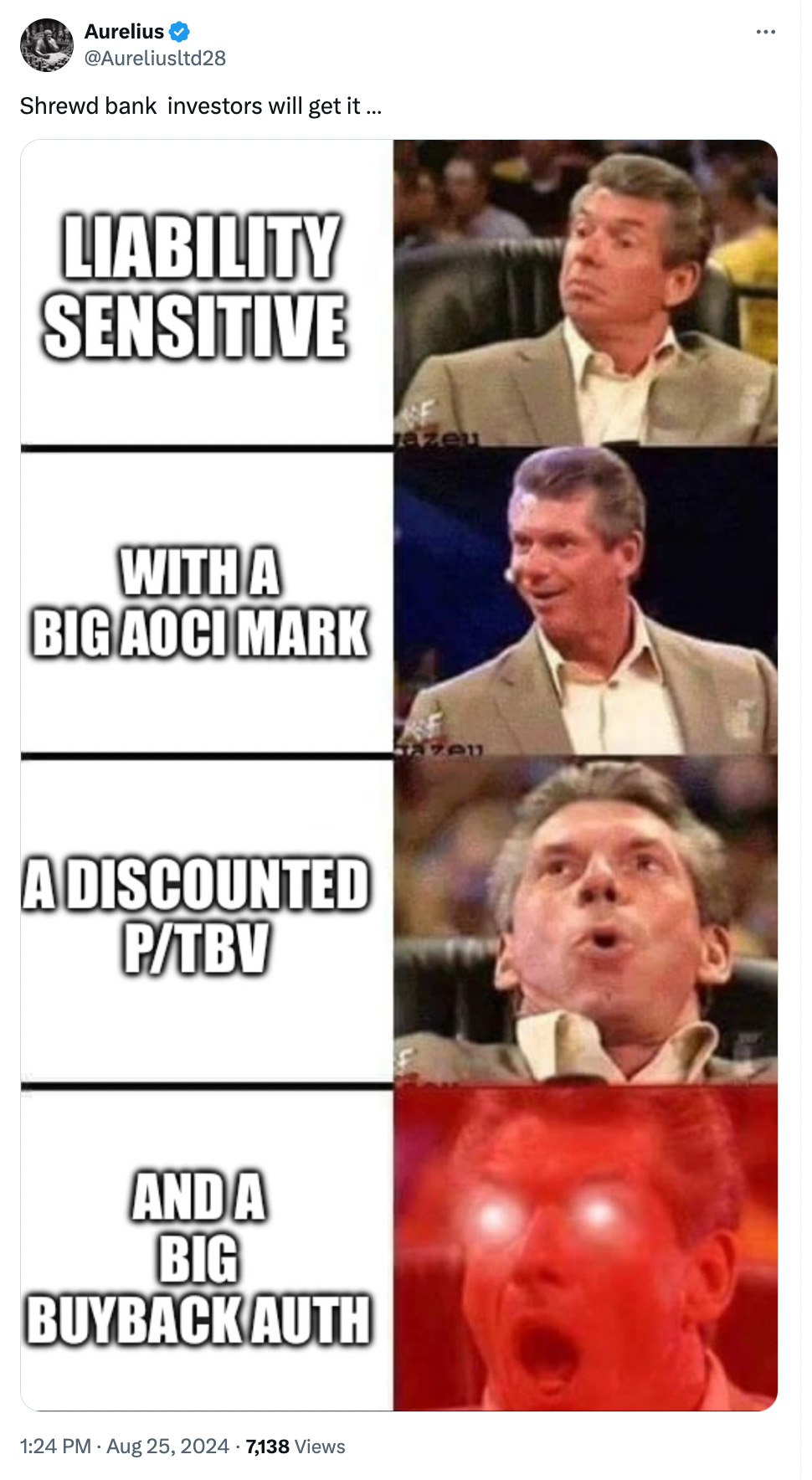

In regional banks only a few banks were green and to me the trend is obvious. This was a rally in some severely beaten down names with unbelievably low expectations and all kinds of CRE issues. These are some of the names that I’d be long if I had to play larger cap names and wanted to express a view on a less bearish CRE environment than everyone else. NYCB will be a huge winner (high % wholesale funding) so long as their loan book behaves. WAFD is one of the bigger liability sensitive names out there after digesting Luther Burbank (not to be confused with Luther Vandross). EBC is also interesting because they’re similarly liability sensitive, but with less credit risk and lots of capital after a conversion in October of 2020.

In big bank land YTD (crazy to think we’re 245 days through the year) JPM and GS have taken the lead from C which was leading up until mid-July. Much has been made of Uncle Warren punting BAC. BAC is hardly expensive at 161% of TBV and it’s hard to fathom Buffett thinking they’re a bad position when he’s made so much money off them. He still owns over a billion shares and potential reasons he’s selling could be: he wants to manage regulatory scrutiny with being over 10%, he wants to build cash although he’s already got $277 billion as is, he thinks the market overall is expensive, he’s worried about corporate tax rates going up, or he’s doing some “succession planning” type moves since this was a mega position for him and he doesn’t want to burden his heir apparents with it. I think we can definitively say he still like BAC, given the outright size but it’s anyone’s guess why he’s paring back.

And closing this section up, I am not doing this “but it’d be the funniest thing” if the valuation convergence trade worked.

That would look something like fading JPM at 245% of TBV and buying NYCB at 52% of TBV or VLY at 97% of TBV. If you wanted to express this in regional land, you’d do something like fading CFR at 255% of TBV and buying FCNCA at 147% of TBV. Again, I’m not doing these, but my gut always says sell when I see multiples for banks north of 250%. Overall, I think we can all agree that large caps are on the whole “fairly” valued especially considering everyone is convinced rates are coming down and a recession for now seems like it’s potential, not probable.

The State of The Consumer

I have been tracking a handful of consumer companies in the consumer space as a read into how they’re doing. This is the picture I’m getting.

AXP - continues to expect performance from the high-end customer and people see this as a place to “hide out” in consumer credit. I call it positive.

COF - has cited more consumers making minimum payments which is maybe a harbinger of future stress but otherwise performance is strong. Positive again.

OMF - credit appears to be okay there because they tightened their credit box in 2022 before anyone else. They expect NCOs to have peaked in this 1H of 2024. Neutral to me.

OPRT - this one should not perform well going forward and is guiding towards higher NCO rates, they specialize in providing credit to the lowest of low-income borrowers. Negative tone for sure.

ALLY - still expecting NCOs toward the high end of guidance and recently discussed incremental challenges in the 2020 vintage of their auto loans. Mixed to negative.

NMIH - small mortgage insurer that should stand to benefit from increased mortgage activity, but nothing substantial showing up in the numbers yet. Positive but tepid.

NAVI - private student lenders are kind of at the whim of the government’s actions (or likely lack thereof right now). Negative and uncertain.

Summing it all, the consumer is mixed. Top end is fine. Bottom end is struggling. And students have a September end to the Biden leniency program. I don’t know how this gets resolved, but throw this into an already chaotic election season just for fun.

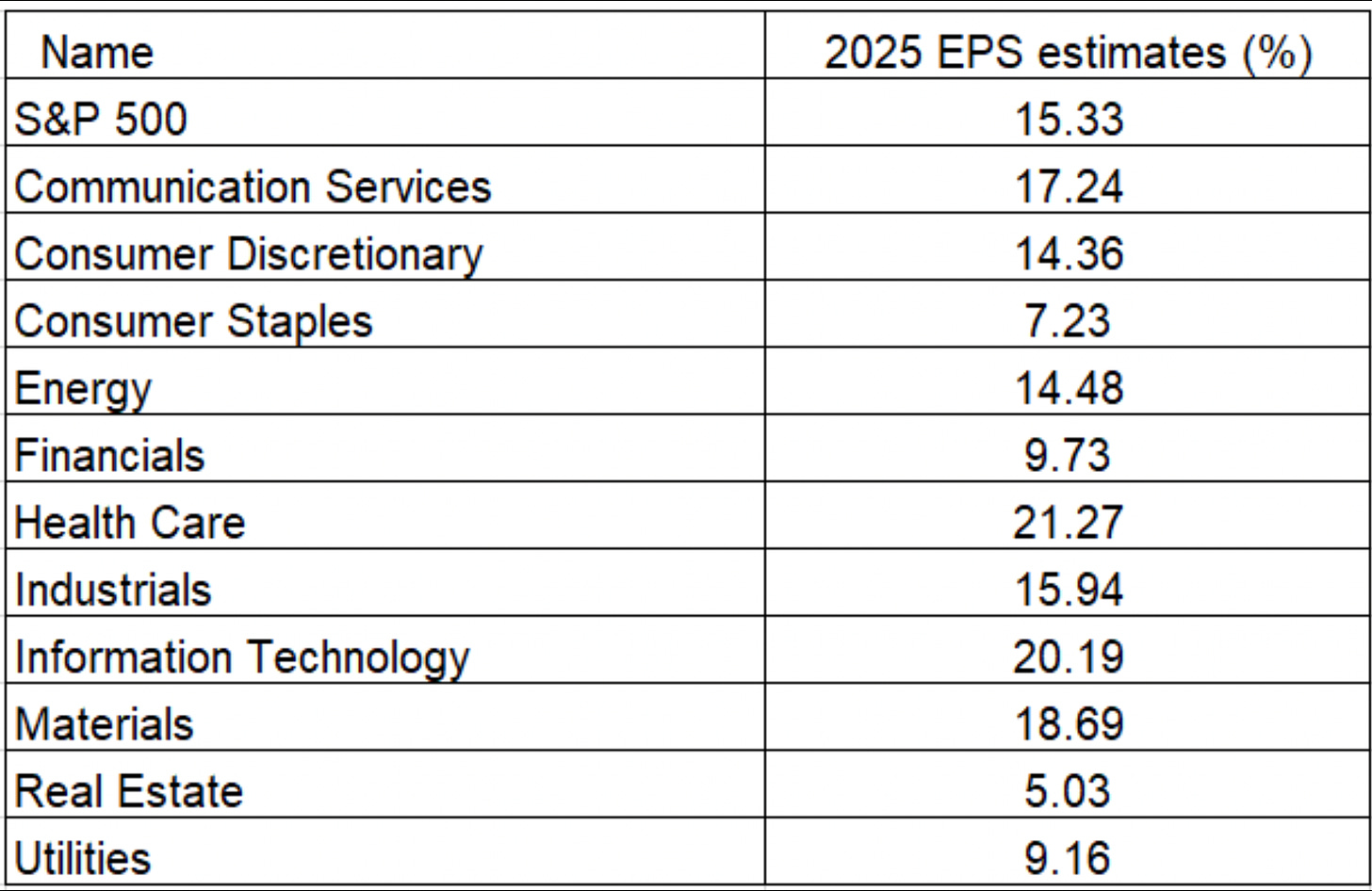

2025 EPS Growth

Back to corporate balance sheets, regular readers know how I feel about longer-term returns being correlated to EPS growth in addition to other metrics. And in looking at next year’s projections, an X friend - Matthew Miskin (Follow Matthew Here) shared some data on 2025 EPS estimates by sector. Mega caps are decelerating down to 15% growth off an impressive base, but still decelerating.

Financials definitely stick out to me as laggards (other than real estate). 9% EPS growth is nothing to write home about especially when tech is set to do 20%.

But here’s a bull case for some banks. When you look at larger more liquid names over $1 billion in market cap, I see 22 banks (estimates I know are fuzzy) that may outgrow the S&P 500 and some of them are even outgrowing tech. And they’re not trading at 30x forwards either.

And before I start getting the snide comments on #1 and #2, there are some names on here that to me start get interesting. Some of these are the darlings of street research. Some of these I’ve written about myself. And others have “hair on them” but still present a compelling risk/reward picture if you’re into banks or even if you’re a generalist. At least for some I can say that single digit P/E multiples do not always mesh with 20% plus EPS growth.

And if you go down cap, you get 24 more names. My friend Sammy the Bull has made his thoughts on CARE known quite well by now. Others are poking around EGBN as a long (afterall you get 2 CFOs for the price of 1). And other names like PGC, DCOM, NFBK, BRKL, and BWB are all poster children for people that went too long CRE into a rates up and got smashed because of it. If the world of CRE does not melt down (and lower long rates and short rates should help) and if there’s no recession, these should have the wind at their backs.

Cheap valuations + earnings growth typically = good returns?

And if you’re looking for some valuation & return based contrarian plays, check out the 40 Cheapest Banks based on 2025 ROTCE. This is a regular view of the world paid subscribers get. They also get access to articles like the TBV/S Growth All Stars Screen which was published a couple weeks ago. Both of them are fantastic places to find discounted names to add.

I think one of two things could happen this coming year for banks. One is there’s a recession and cyclicals (and banks) get dumped. Two there’s no recession and a lot of these banks grind methodically higher. These “contrarian” plays would stand to benefit quite a bit from the latter.

Remember, time heals all wounds and despite what the doomers say, the world does NOT melt down more often than not.

On this list there’s more than a few of these …

Turn Away Bankers

Last one for today. And yes, if you’re a banker, I’m sorry.

A recent Bloomberg (citing Barron’s) article highlighted some amazing numbers.

There are $2.9 trillion in CDs held by retail investors with about $2.5 trillion maturing in the next 12 months and $950 billion maturing in the next 3 months. That is a staggering amount of cash coming due that needs to be re-invested.

But here is the fly in the ointment.

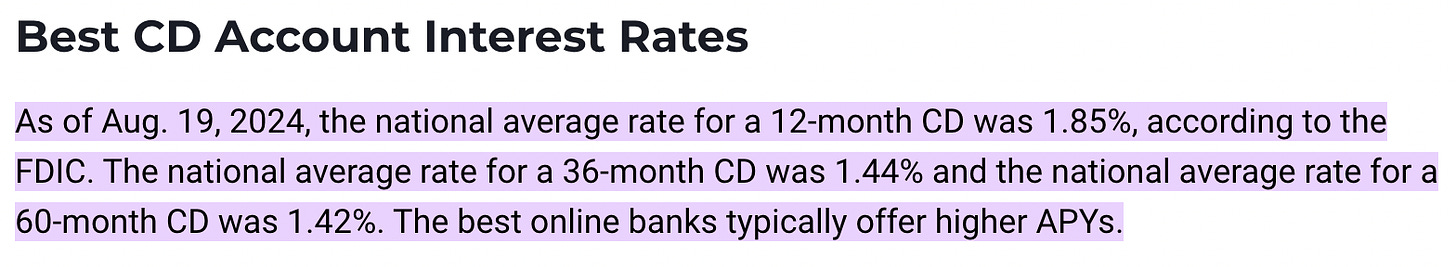

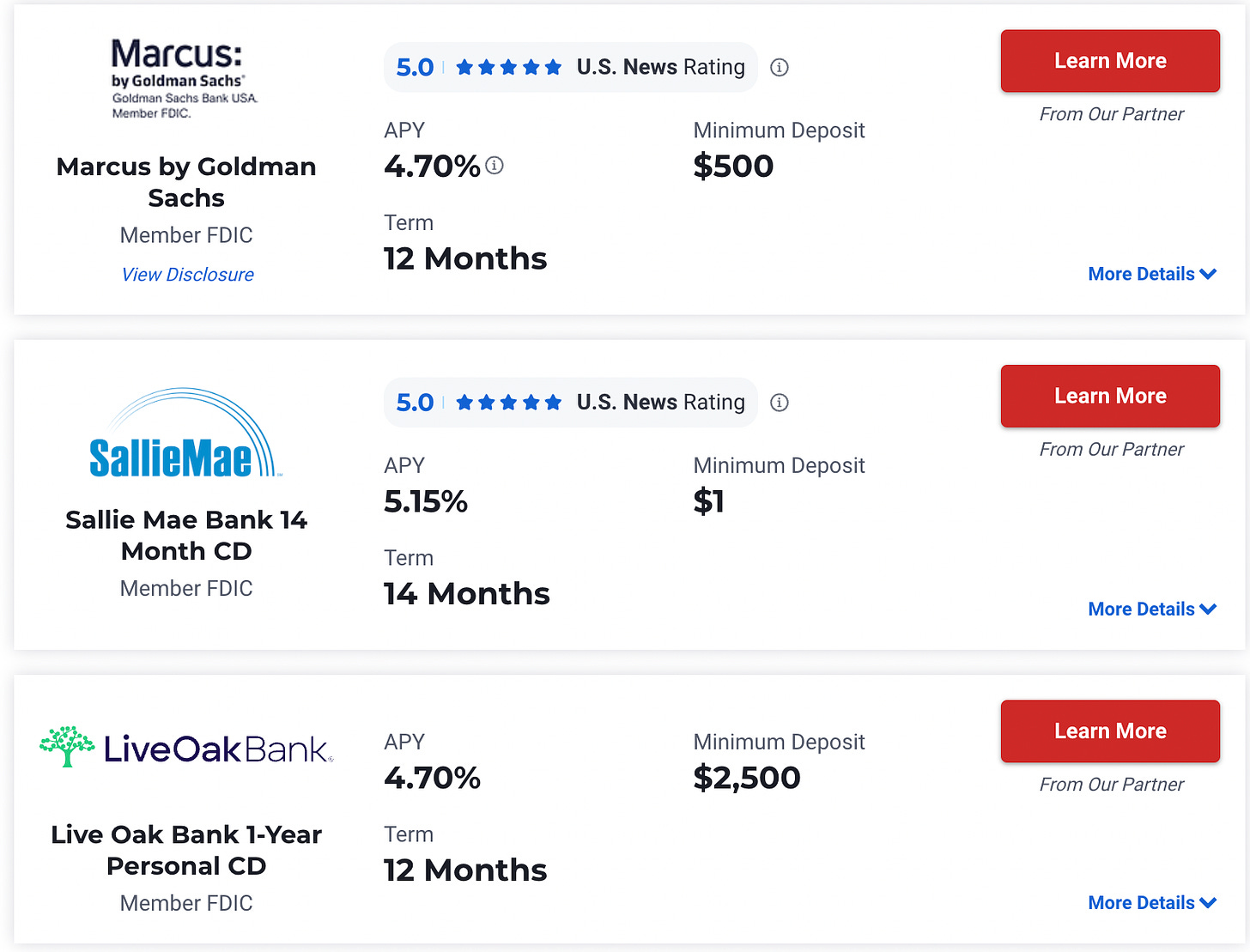

We all know that current “teaser” or new money rates are often north of 5%, but with the Fed telling the world that rates are coming down the national average new CD rate today for 12 months is … drumroll please …. 1.85%.

And while we all know banks operate with the best intentions, some banks do have “auto-renew” policies in their documents that will roll your wonderful 5.25% CD into a 1.85% CD free of charge for you!

So, if you have some CD’s do yourself a favor and check your maturity schedules, and make sure you’re finding the banks really desperate for liquidity that are still offering 5%. Okay, maybe not 5% but at least a high 4% handle.

Maybe rates down will even cause a flood of cash to come into stocks?

And before you think I’m being mean to banks, I’m not. They all know this is hot money and they can find plenty of cheaper sources elsewhere.

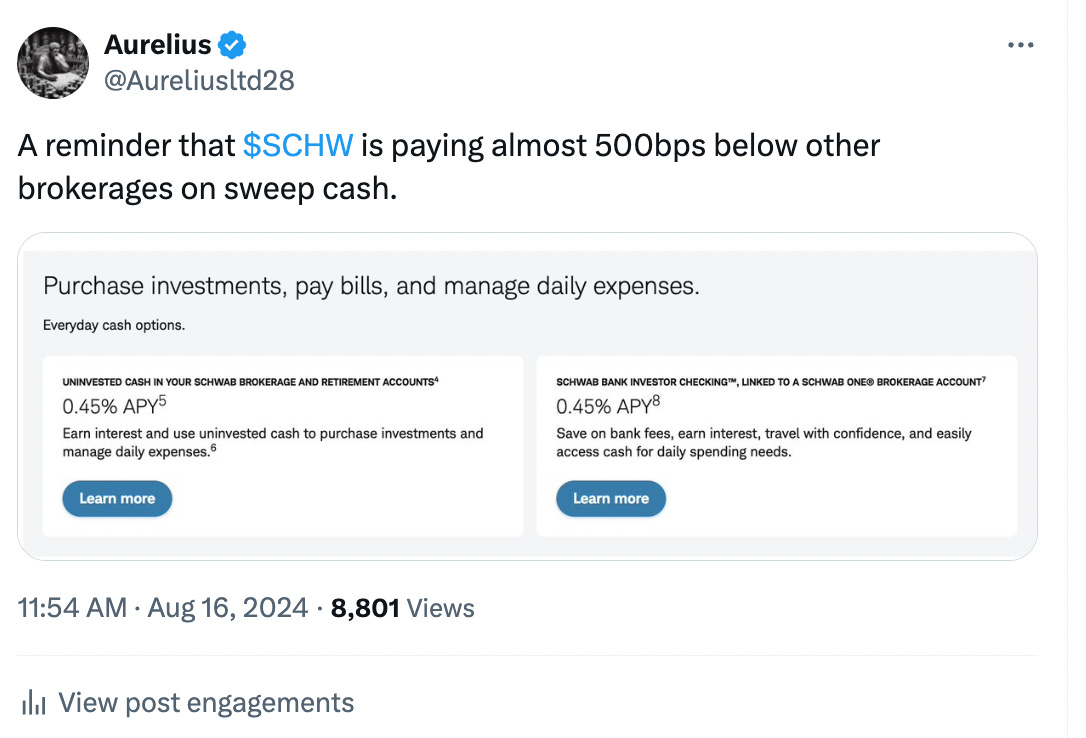

At least they’re not like Schwab …

The Journey Is the Destination

Kirby Smart (hate it or love it) is a modern day buddha wrapped in a sometimes profane, always intense, visor wearing force of nature.

Read the quote below.

I hope you all have a great Labor Day with friends & family. I hope you have a great rest of the year. And I hope that you embrace the grind, enjoy the journey, and succeed beyond your wildest dreams.

The Best Is Ahead,

Victaurs

PS - if you liked this, give a full paid subscription a 14 day run. It will be worth it.