This Week in Banks

Keeping it short and sweet this week. I hope that all of the new subscribers have found the time to read up on Western Alliance (recently unlocked to all) because I do believe that it should continue outperforming going forward. The AmeriHome optionality in a lower mortgage rate (higher gain on sale) world is a big deal. Also read up on Rocket from last week, there was some actionable data on the total amount of mortgage volume able to refinance at 7% mortgage rates and 6.5% mortgage rates, and the entire Mortgage Co space has rallied like crazy. Maybe getting ahead of itself, but who knows.

And If I may ask, if you like these and get value from them, spread the word. Victaurs is growing because of you all, so thank you very much.

Banks Won on the Week - Enjoy It

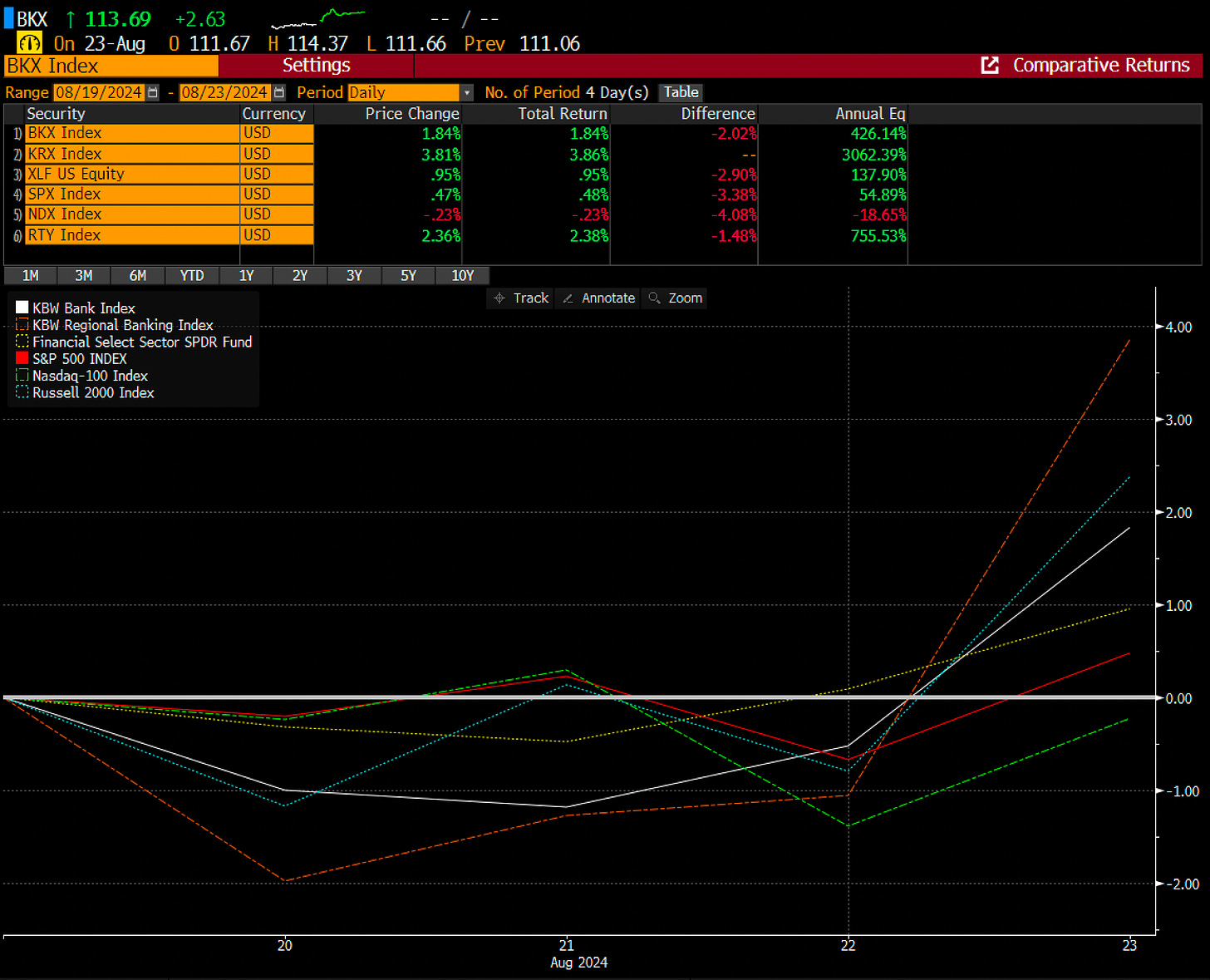

Speaking of winning. Banks won on the week, in particular regional banks. The KRX Index showed the strongest performance, gaining 3.81% over the period. This was followed by the RTY Index, which rose 2.36%. The BKX Index increased by 1.84%. The XLF US Equity saw a modest gain of 0.95%. The SPX Index had a slight increase of 0.47%. In contrast, the NDX Index was the only index to show a decline, dropping 0.23% over the 4-day period. Bulls were on parade as Jerome Powell confirmed what people had been expecting for months now, the rate cuts are coming.

Short Interest - Nothing Fundamental

More on rate cuts in a second, but speaking to Jerome’s Jackson Hole masterpiece, complete with a little humor, the bank stock world LOVED the news.

So, my question to everyone here, did that press conference change anything fundamental? Did it tell us something we didn’t already know? And if the answer to those two questions is no, then why did banks rally so hard?

I think the short answer can be found below. You’re looking at a screen of all public bank stocks scrubbing out some micro caps and orienting to highest 1 day price change first. Other than CZFS (which has some interesting ECIP news percolating) and a few other names, something should jump out to you. Many of the banks that really ripped were heavily shorted names.

And sorting the list now by most shorted banks as a % of float, the picture gets a little clearer. What we have here producing a wild one-day rally is likely more of L/S funds unwinding bets against banks/cyclicals or the “machines” reacting to a press conference where Powell said “cuts” despite it being telegraphed for months.

And when you take a look at some of the names above, there is a problem for some of these people shorting banks. One problem is that a lower Fed Funds rate alleviates funding cost pressures, enhancing earnings, and easing the tension on balance sheet risk. Another problem for bank shorts is that lower mid to long term rates (as I write this 5-year USTs are at 3.69%) mean less stress on the Commercial Real Estate Market. All things equal, lower rates help valuations, alleviate some LTV issues, and help refinancings by dropping the cost of debt in the DSCR equation. Putting those two things together, banks like HIFS, NYCB, VLY, FFWM, and DCOM all feel a LOT better than they did before this press conference. And shorts in their stocks probably feel a lot worse.

Even though Jerome didn’t tell us anything novel, the confirmation of rate cuts sparked short covering & machine-based trading that were “short banks” or “short cyclicals”.

“GRate Expectations” - Always Wrong

I’m not going to get all Charles Dickens on us, but I do want to throw some cold water on the market participants looking at what the Fed puts out for Dot Plots or looking at the Fed Funds futures market and taking it as gospel. And while I’m at it, most people not spending their entire waking days in rates markets may say “rates are going down” but have no idea what they mean. There are infinite possibilities for short rates, long rates, and the timing of when or how each move. And the reality is we don’t know where rates are going much better than we know what the weather will be. We can probably do okay for a month, but anyone telling me they can predict the weather with any specificity more than a month out is lying to themselves.

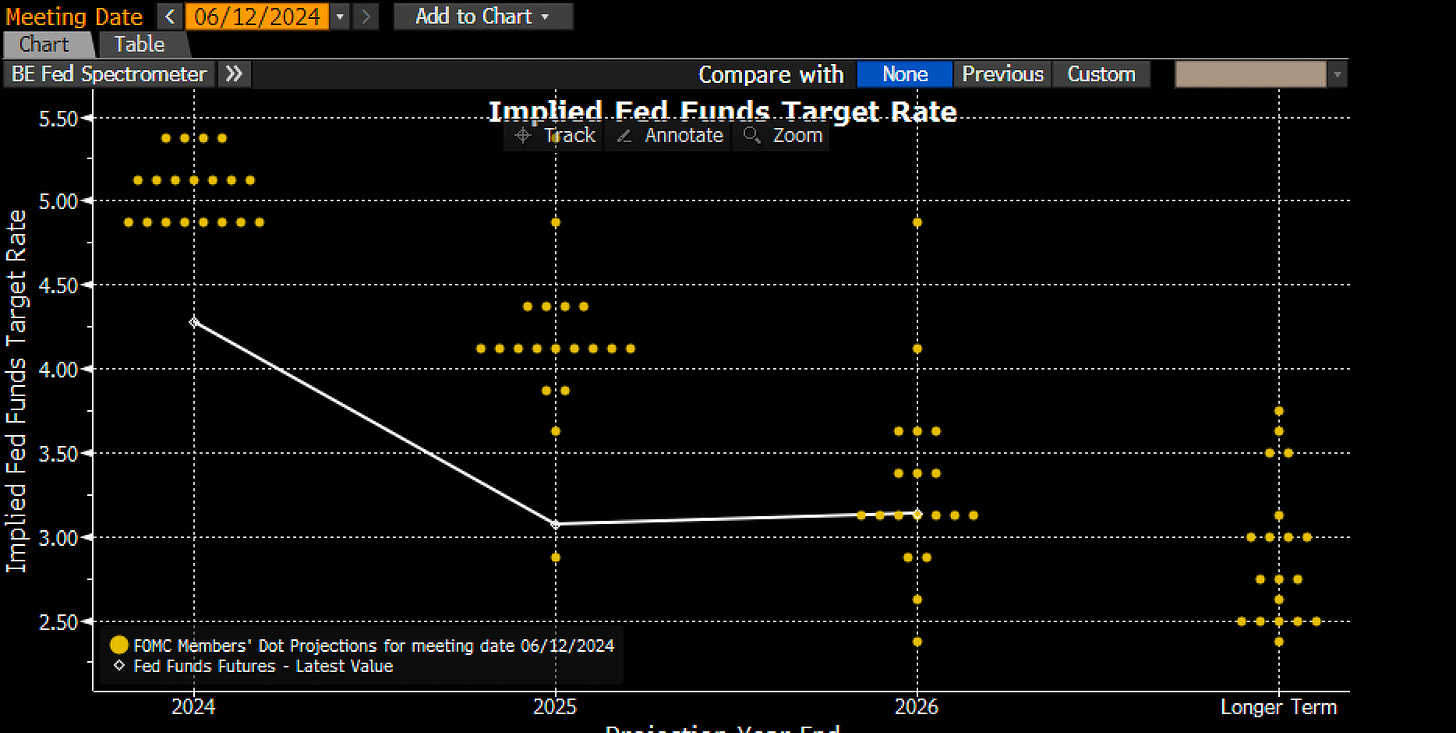

This is the current Dot Plot & Fed Funds futures market. Down 100 basis points by end of 2025 and down 200 basis points by Christmas of 2026.

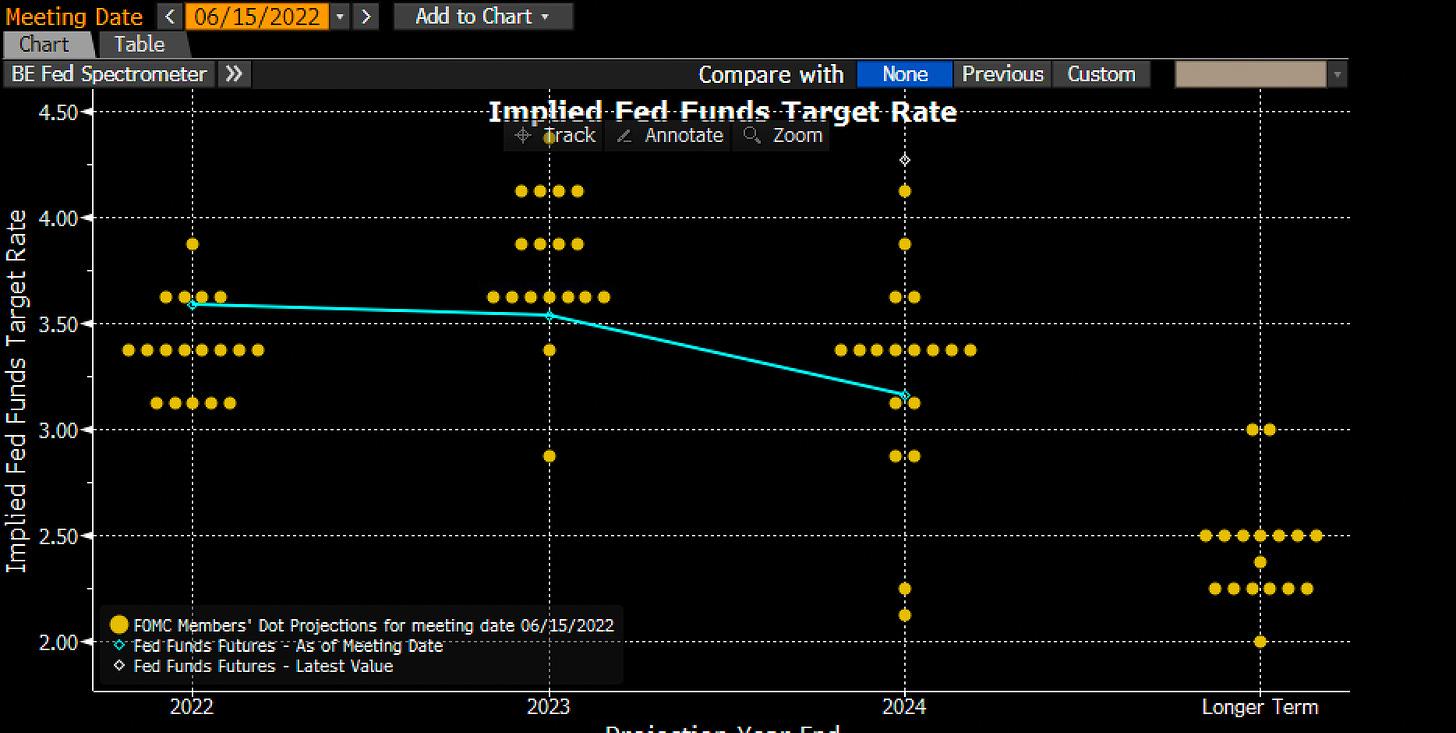

Here is where it gets fun. This is the same Dot Plot & Fed Funds futures market bets for June of 2022. For those of you that have forgotten June of 2022, inflation had peaked at 9% and the 5 Year UST was at 3.59% (just a shade lower than were we are today). And here was the Dot Plot back then. They had 2024 Fed Funds at a 3.50% and we are most certainly not at a 3.50% Fed Funds. And the Fed Funds futures market was at a 3.25%. Piling on their “longer term” rate outlook which would’ve included 2025 at the time was 2.50%.

The Fed is regularly wrong.

The Fed Funds futures market is regularly wrong.

And it will likely be wrong again. Please sear this in your brain. And don’t base investing decisions based on what you think might happen to interest rates. Look at the underlying Company, its cash flows, and how durable they are.

Seasonality Turns - Tread Carefully

Speaking of being wrong, this is a fun one to look back at. Below is a 10 year look back at KRX by monthly return, or seasonality. A few things jump out to me.

July the past two years has been absolutely phenomenal. And those two great years have pulled up the 10-year average performance in the month into a historically great year.

March of late has been nothing short of Madness. The COVID & ‘23 Regional Banking crisis sell offs were catastrophic. And those two pulled down the average 10 year returns for March considerably.

August is historically a weak month although we are fighting back this year.

October and November are historically pretty good months for Regional Banks and all banks really. A historical average return of just under 10% for those months was actually pretty surprising for me.

September is a bad month for banks. And this data above doesn’t even include the September from the Great Financial Crisis. Those in the markets back then remember:

September 7, 2008 - Fannie Mae and Freddie Mac placed into conservatorship

September 15, 2008 - Lehman Brothers bankruptcy

September 15, 2008 - Merrill Lynch acquisition by Bank of America

September 16, 2008 - AIG $85 billion bailout

September 16, 2008 - Reserve Primary Fund "breaks the buck"

September 25, 2008 - Washington Mutual (WaMu) failure

September 29, 2008 - Wachovia crisis and acquisition

And then history buffs would note some other historical September volatility:

September 18, 1873 - Jay Cooke & Company failure, triggering the Panic of 1873

September 19, 1984 - Completion of government bailout plan for Continental Illinois National Bank and Trust Company

September 1, 1989 - Resolution Trust Corporation (RTC) takes control of 11 failed savings and loan associations

September 19, 1991 - Southeast Bank, N.A. failure (Miami, Florida, USA)

September 23, 1998 - Long-Term Capital Management (LTCM) Crisis bailout arranged

Who knows why this is the case, but September brings more volatility. Think about it, there’s a lot of fiscal year end rebalancing for mutual funds, some caution ahead of Q3 earnings, corporate fiscal year end activities/planning, deep memories of historical market volatility, a self-reinforcing loop on “the September effect”, the start Seasonal Affective Disorder (it gets colder & less sunny), a shift from vacation mindset to work mindset, dealing with kids back at school, and the anticipation of Holiday season spending. It may sound whacky, but we’re all irrational creatures. And we’re all impacted by things we don’t notice. At any rate, it never hurts to be mentally prepared for potential volatility. Here’s the same graphic for the SPX.

What Always Wins - Great Companies

In the realm of bank investing, a golden rule echoes Warren Buffett's wisdom: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." I think some street research is saying some version of “buy the junker names” because they will mean revert more than the high-quality companies. Maybe this is true in the short run. But I’m more of a Buffett fan and his principle guides us to focus on banks that consistently grow revenue per share, earnings per share, and tangible book value (TBV) per share over time. This is what drives Total Shareholder Return and what banks should focus on growing.

And as I look at the market today a couple things are jumping out at me:

Fundamentally the outlook for bank earnings is better today going forward than it has been in at least 2 years. Earnings should grow. Capital buffers are large. Credit fears haven’t materialized.

More and more people are “believing” that a recession is not imminent and that cyclicals (like banks) are still good to own.

Large and mega cap banks have performed really well as investors have favored liquidity. Down into the SMID caps those banks have underperformed and carry lower valuations, at least on a P/TBV basis.

I think there is some alpha to be had in buying SMID cap banks that have not gotten much love yet, but that do have solid fundamentals and ROTCE profiles. If you’re interested in seeing who those banks are, your list is here. It is worth every penny to upgrade to paid for this list alone. I’ll be updating this as well as the ROTCE Scatter this week to reflect current market pricing.

Parting Thoughts - Enjoy the Ride

The Oracle of Omaha's guidance to "buy into a company because you want to own it, not because you want the stock to go up" aligns perfectly with the strategy of identifying banks that consistently improve their per-share metrics in excess of the “average”. These institutions, often overlooked, may offer substantial upside as they grow, and the SMID cap valuation divergence is giving smart bank investors the chance to produce outsized returns. But success in this approach requires patience and emotional stability, as Buffett notes, "The stock market is a device for transferring money from the impatient to the patient." I like to remember this, especially when the markets of late have felt like a spasm of violent up and down moves. Stay patient. Focus on the long term. Win over time.

As potential fall volatility rears its head, I hope you all stay cool in the markets, I hope you enjoy time with your family & friends, I hope you get outside once in a while, and I ask that you remember that our time on Earth is not infinite. It’s up to us to make the most of it while we’re here. Have a great week and a great finish to the year and remember to enjoy the ride.

“Life is not a journey to be rushed, but a journey to be savored.” - Seneca

The Best is Ahead,

Victaurs