A great start to the year for bank investors. Almost everything seemed to go up. Earnings for the most part have been strong. Travis Hill as the FDIC chair (unless KBW’s Michaud gets the nod) is pretty bullish. De-regulation is bullish. M&A continues to roll on with decent pricing and market premiums at that. And most importantly for the levered beta or super cyclical investors known as bank investors, everything on the economic front seemed pretty good. Inflation is behaving, GDP is strong but not too strong, employment is in the same camp, and the consumer is still spending as evidenced by the fact that companies like Visa just upgraded U.S. guidance. Trump’s tariffs are no good for the market overall, but anything forcing domestic consumption is … drum roll please … good for domestic banks.

Surprising Euro Outperformance

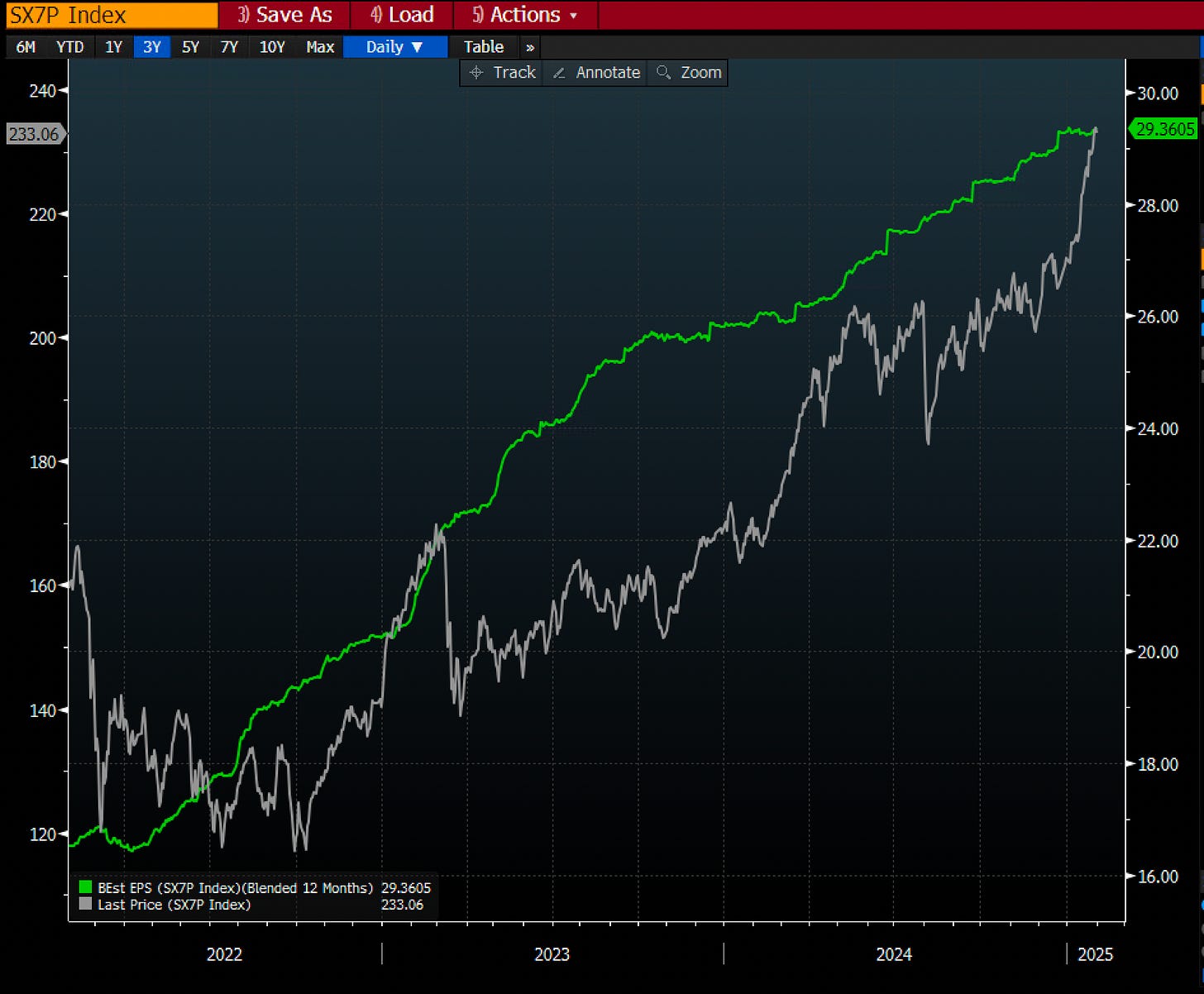

Before getting into the U.S. weeds. You’ll be interested to know some international trends. First of all Europe outpeformed the world of banks doing 8.24% in January. This edges out #2 for BKX which is the big bank index. Premium members and members of the premium chat did not miss this move. We were all over this coming into earnings and were rewarded on the timing.

What’s going on in Europe? Well broadly speaking, European banks are tremendously cheap on an aboslute and relative basis, have tons of capital, and are seeing prices re-rate higher based on the potential for higher for longer rates. In general Euro banks are very asset sensitive and so much of the fear there was that lower rates would hurt earnings going forward. I still favor the UK banks like BCAP and NWG, although GLE in France is catching my attention. This along with the inter border M&A push just makes me believe that maybe Europe won’t be as bad as everyone thinks. Earnings beats and strong guidance are happening across the pond.

January Winners in the U.S.

Flagstar beat estimates of ($0.56) doing ($0.34) and saw a big rally.

Customers continues to chug along despite constant rumors of its demise and beat estimates of $1.19 posting $1.36.

The Bancorp was a short report favorite, and beat estimates by a penny, but highlighted that sexy narratives around deteriorating sun belt Multi-Family are fun in theory, but don’t play out in practice.

Wells, JPMorgan, and Citibank all find themselves on this big winners list also. That trend shouldn’t change. All the Money Centers are the most exposed to positive catalysts going forward as well, with potentially lower capital rules giving them lots of dry powder to bump dividends, or raise buybacks.

Citibank, what is there to say other than stay long.

January Losers in the U.S.

Midland posted one of the worst quarters in recent history. They blew up on some consumer loan programs (non-core) and the report was a bit of a disaster.

First Foundation also missed bigly, posting ($0.17) on estimates of $0.06.

Triumph did not do as it’s namesake implied and posted $0.13 on estimates of $0.23 as it continues to navigate a very hard trucking environment (maybe one of the worst or the worst).

Washington Federal continues to hurt as higher for longer makes the acquisition of an uber liability sensitive Luther Burbank hard to manage. They didn’t miss by much, $0.54 vs. $0.65 but it’ll be hard for them going forward if rates stay up.

I kind of called this one, it’s been technically weak for a while now and posted it to the chat recently, but had no position FWIW.

Two Trends Are Your Friend

Long Big Banks - I wrote this up here, so not going to belabor the point. Just read this Big Bank Longs & also this Golden Era for Banks.

Fade Techincally Weak Banks - this isn’t splitting the atom, but without major catalysts and with earnings fading into the rearview (and despite buybacks) banks like these should continue to stay weak. On this list of “techinically weak banks” are: TFIN, LOB, HONE, WAFD, FFIC, and MSBI. For example, WAFD and MSBI charts below.

General Vibes Check from Meetings

Had the pleasure and opportunity to speak with quite a few bankers lately. What follows is some firsthand commentary about the industry, things on people’s minds, and opinions. You all know how much I love vibes investing.

Investment banks are mega bullish, Hovde or KBW even brought up “Blue Sky” type scenarios where IB revenues for the industry are at 90% of Covid … which is bonkers. Investment banks are quite obvioulsy paid to be bullish, but maybe them trading at 20-25x forwards is telling us something, or maybe they’re just eating their own cooking.

On common raises paired with bond swaps. In speaking to a few public company CFOs whom I respect, the pitch for anyone with a premium currency to do this is at frenzy level. Those humans that have NOT done these cite: permanent dilution (once a diluter always a diluter), short term artificial bumps to EPS (great for management comp plans thought), and bond pitches that may or may not create holes in the balance sheet (buying callable MBS). To be clear, common raises at a premium white wash the permanent value dilution and it’s obvious why Investment banks pitch them.

Near $10 billion CEO on M&A commenting that there are no shortages of sellers, but that you might not always want the balance sheets of people knocking on your door. Pricing is tough for deals that you really want. It appears to be a buyers market, with Credit Unions taking out the $500 million-ish in asset banks that others don’t want and everyone else trying to do chunkier deals.

Travis Hill is bullish for the industry. Preaching pragmatic regulations for banks. Comments that people should not be de-banked. Would like faster and more streamlined and common sense regulations. And this is all in the face of rumors that Tom Michaud, CEO of KBW, may be coming in as the FDIC head. If true, those Blue Sky IB revenues in the FIG group may just come true.

On credit, no one is really that concerned. Or at least they wouldn’t publicly admit it if they were.

Investors are not seeing too many positive catalysts as we work through earnings. Are cautiously optimistic on the industry. Would love to see a decrease in volatility.

Buzzword of the year so far is “clean quarters”. I keep hearing people say we’re going to post “clean quarters” and sometimes the quarters they’re posting aren’t even clean to begin with. But I digress.

Earnings should continue to grind higher. Smart bankers realize and others under appreciate how much slope matters to the banking industry. And with slope re-turning both NII and NIM should begin inflecting and trending higher. This should then too contribute some positive operating leverage to the industry as a whole. We’ve made it through the worst and not we’re (knock on wood) back to business as usual.

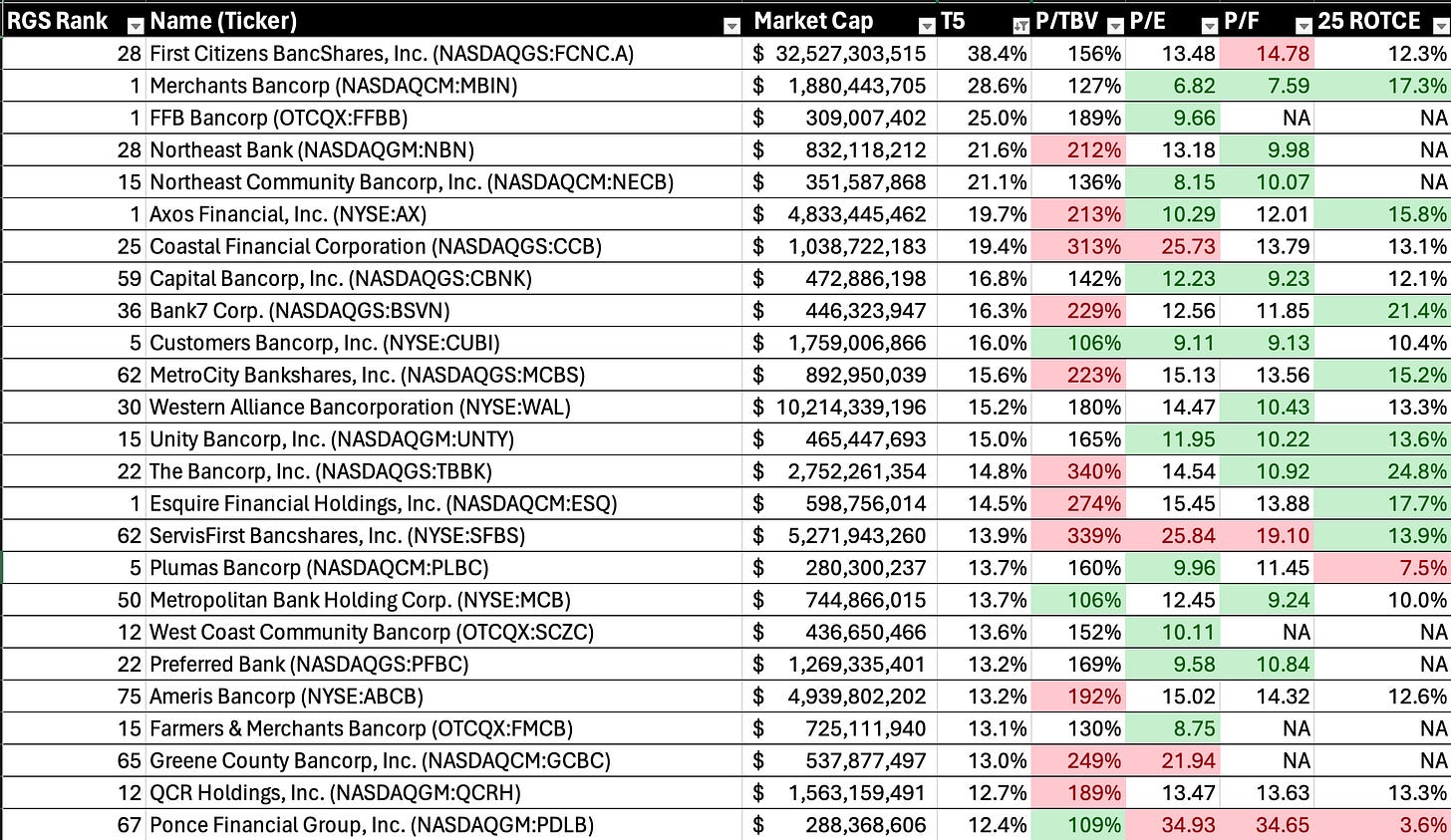

TBV Growth Always Plays

Longer term subscribers will know that a big focus in bank investing is to find companies that compound earnings and TBV. If your accounting is right, then your TBV should be the truest view in to core bank value. And we all know how earnings drive share prices. It should be no surprise then that the banks that have track records of growing TBV tend to be the ones that outperform (over the long run). Now of course you can (and some do) blow themselves up, which is what makes banks tough to invest in but for the most part finding compounders plays.

I’ll be updating the Growth Score rankings for the bank universe in the coming 4-6 weeks and dropping them out sporadically. I may just post to chat, but they will be for the premium community only. Thought is to start with U.S. banks north of $10 billion in assets and do Europe & maybe Japan too. You can catch up on recent analysis here TBV Growers and can see the top compounders of TBV over the past 5 years (T5 column) here.

Revisiting Western Alliance

And a last word on Western Alliance. I may be getting back in. You can find the past write up in the archives. The snapshot on their earnings is here.

Strong Q4 2024 results, with EPS up 46.6% year-over-year to $1.95 and tangible book value per share increasing 11.9% to $52.27. Net revenue grew 22.9% to $838.4 million, and pre-provision net revenue rose 12% quarter-over-quarter. Loan growth was steady at 6.7% year-over-year, driven by commercial and industrial lending, while deposits increased 19.9% year-over-year to $66.3 billion despite a seasonal decline of $1.7 billion. This always happens around this time because of the nature of their mortgage & escrow deposits. Net interest margin compressed by 13 basis points to 3.48% due to lower asset yields, though deposit costs improved by 27 basis points. The big fly in the ointment was that credit quality showed some deterioration, with non-performing assets rising to 0.65% of total assets and charge-offs increasing, leading to a $60 million provision for credit losses. Capital remains strong, with a CET1 ratio of 11.3%, supporting the bank’s forecast for continued earnings growth, margin expansion, and an expected high-teens return on tangible common equity by year-end 2025. Management felt confident on the conference call citing deposit stability and credit risk management but acknowledged ongoing commercial real estate challenges.

Lastly on Capital Stack

The preferred market appears to be back. Nothing like perpetual FIXED rate Tier 1 capital at 6.5%. When you compare that to permanent dilution via a common raise this is a cheap form of capital.

I’m not saying JPMorgan is the end all be all, but when they’re doing something like this you probably want to pay attention and see if you too can do it.

In coming weeks I plan to do the Growth Score updates, continue delving into Fintech and payments (if you didn’t read the FOUR write up, you should), and continue trying to simplify complex financials, produce winners, and have some fun while doing it. I appreciate you all.

The best is ahead,

Victaurs