The Big Money Shift: Hidden Global Market Trends, Flows You Can’t Afford to Ignore, And Trump's Effect

Macro thoughts, the U.S. vs. ROW, a dive into Euro Banks, U.S. flows, ROW flows, and my thoughts on what Trump really wants (besides volatility)

Beanie Babies?

You ever think you’re onto something huge, only to realize—too late—that the world moved on? Yeah, we’ve all been there. Remember Beanie Babies? At one point, people were convinced those stuffed animals were a retirement plan. Grown adults hoarded them like gold, obsessing over rare “princess” bears and tag misprints. Then? The bubble popped. If you were still hoarding Beanie Babies in 2001 thinking they were an “investment,” well… your friends probably had some words for you. “Bro… we’re not doing those anymore.” Kinda like the Melania coin pumpers … no?

Markets work the same way. What was hot last year can make you look clueless today. And right now? A lot of investors are walking around with Beanie Baby portfolios—still clinging to yesterday’s trades, oblivious to the fact that the market has moved on.

The money is shifting. Fast. Sectors are rotating. And gasp … financials—after years in the shadows—have staged a comeback.

If you’re still showing up to the 2025 market dressed like it’s 2023, you’re about to get left behind. So unless you want to be the guy still trying to flip Beanie Babies on eBay in 2025, here are some macro trends worth paying attention to.

The U.S. Market Isn’t the Only Game in Town Anymore

For 15 years, U.S. stocks dominated, fueled by relentless tech outperformance. But now? The tide is turning. Non-U.S. markets—especially Europe & China—are waking up. If you're still operating under the assumption that the S&P 500 is the only place to be, you're playing last year’s game. A few weeks doesn’t make a year, but the world is actually fighting back and this trend could continue so long as the dollar is done strengthening.

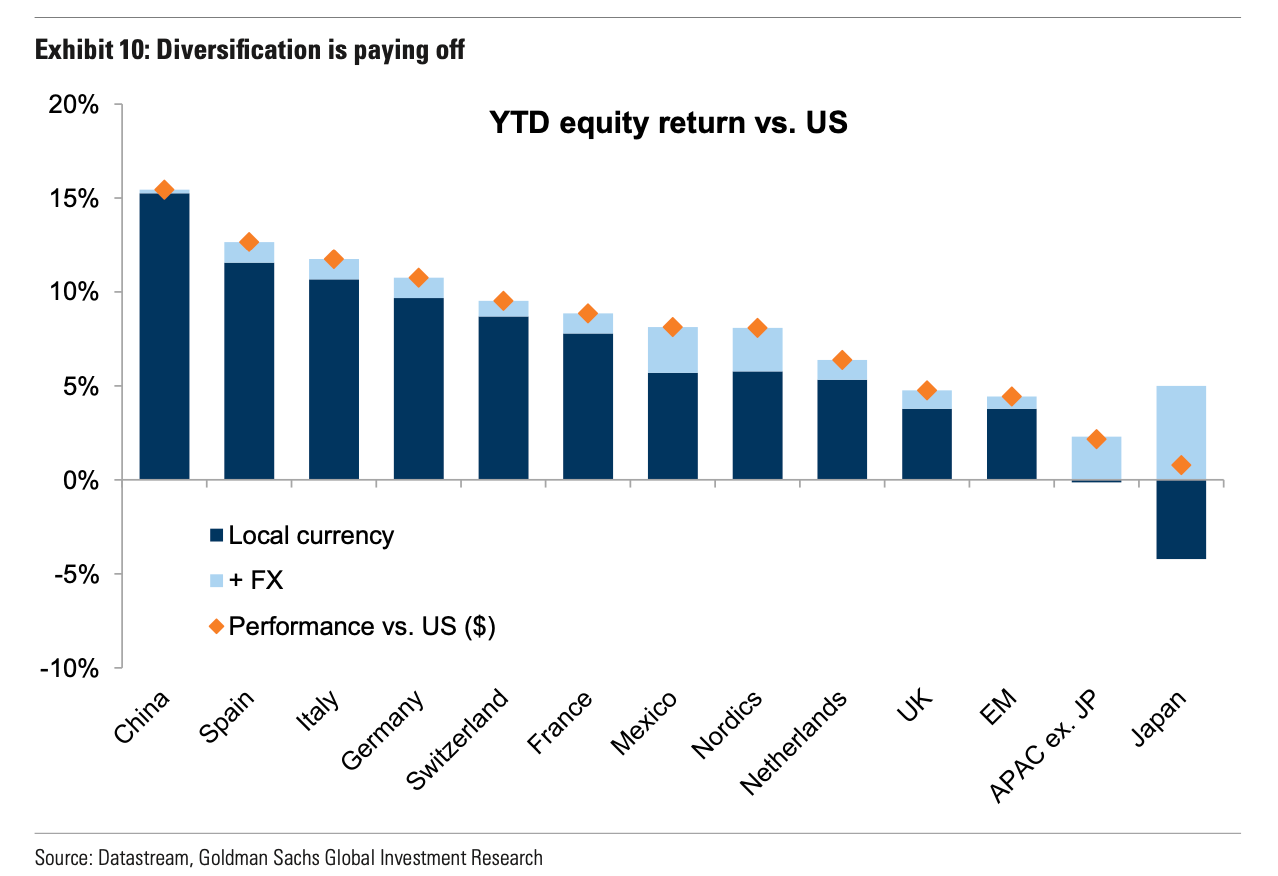

Even Goldman Sachs pointed it out below. The Rest of the World (ROW) is fighting back. China, Spain, Italy, and Germay are ripping. Which is odd considering Germany is in full recession mode.

I mentioned it eaerlier, but part of it is an unwind of a strong dollar that was long in the tooth. And I’ll comment a little on Trump’s impact on the dollar a bit later, but definitely know that he does not want a “too strong” dollar. Never has, never will.

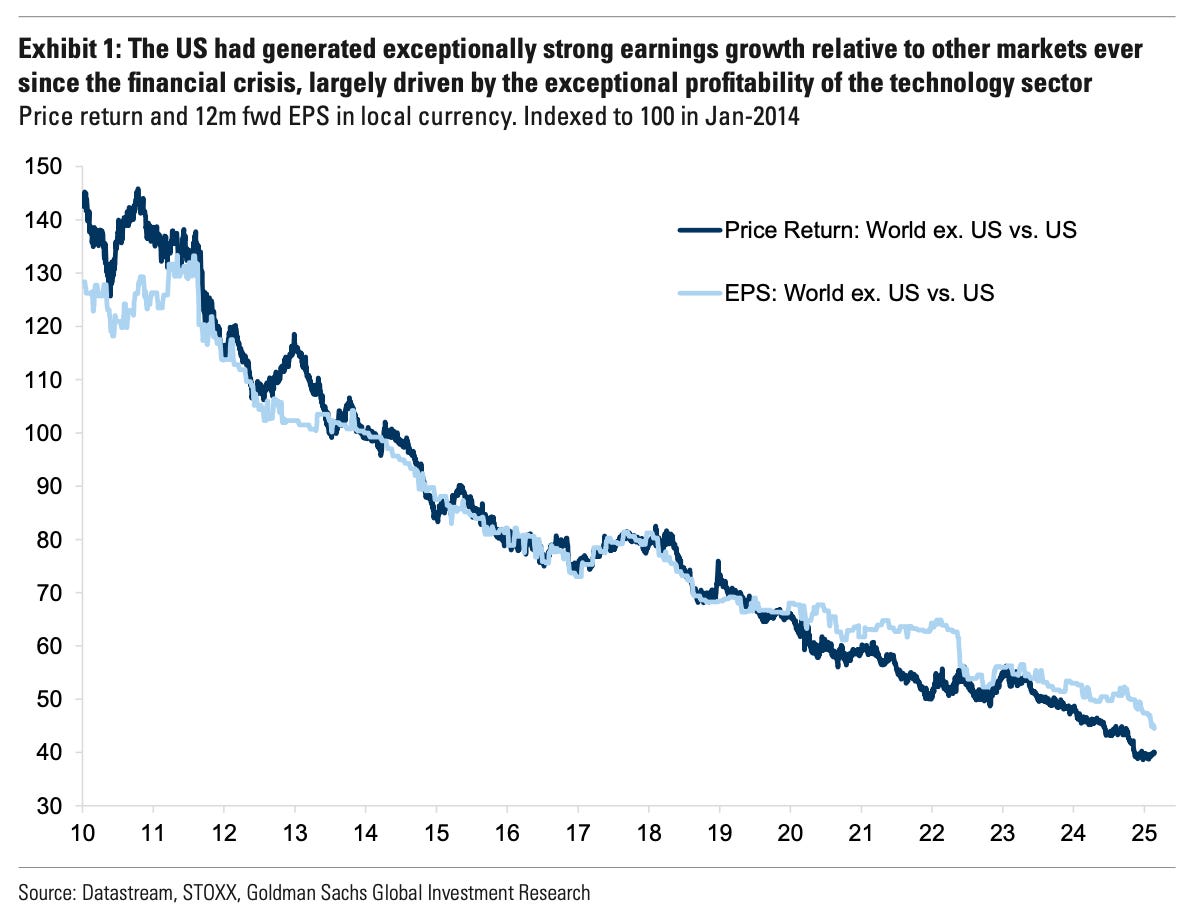

And while the ROW has bounced back, the U.S. has largely outperformed for really obvious & fundamental reasons. The U.S. has been an earnings machine. Both JPMorgan and Goldman put out different versions of the same graph saying the same damn things … earnings drive stock market values and the U.S. has outearned the ROW handily going back to 2015 or even 2010.

And with MAGA in the White House, we should expect the U.S. to keep dominating, but here’s the thing—the U.S. is expensive. And expensive markets demand perfection. And perfection is rare in the world over longer term time horizons. The vibes (if I can use my own words) are that the U.S. is going to keep crushing forever, and people are paying a premium for that assumption.

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.