Three-part series coming. First is the P/B & ROE Scatter. Second is the Relative Growth Score rankings. Third will be a few picks. Hope you all enjoy.

European banks are undervalued.

This is not an opinion. It's a fact. Why? Outdated perceptions. Regulatory fears. Political uncertainty. The “end” of a high-rate cycle? Sure, I’ll buy all of those. The real question is are they cheap for a reason?

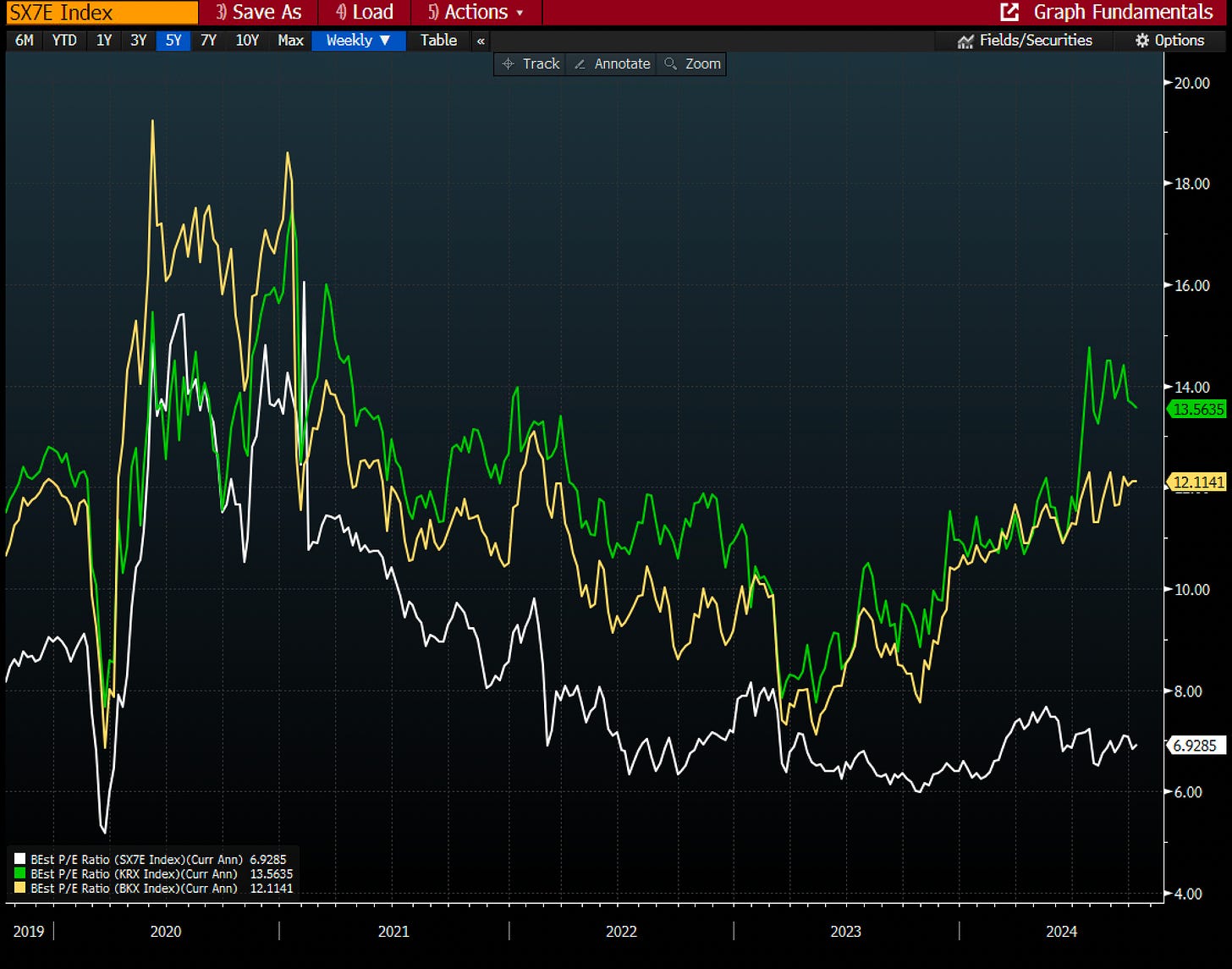

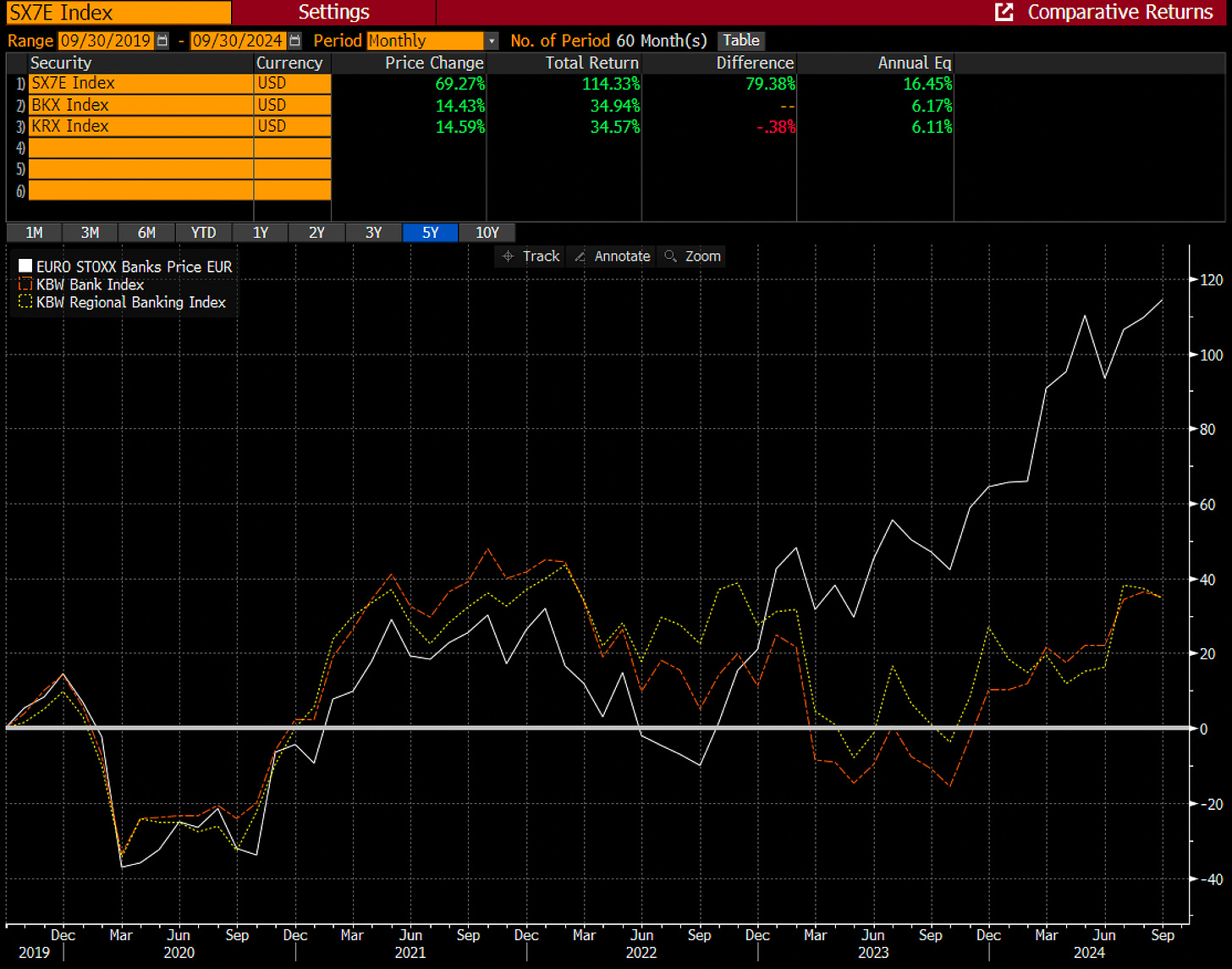

Recent Returns?

Keep in mind, in the last year, European Bank stocks have rallied around 40% on a Total Return basis, lagging Big US Banks at 56% but beating out US Regionals at 31%.

Over a 5-year period, they have actually outperformed substantially, averaging 16.45% annually in TSR for a cumulative 114% return. Not bad at all.

And over the longer term though on a 10-year period they’ve underperformed, averaging south of a 3% annualized return. Objectively bad.

So, they’ve come on strong over a 1- & 5-year horizon, but over the longer term have earned their “substandard” reputation.

And rather than give you a big, long history lesson about European banks, today is going to be a deep dive into the current landscape of European bank stocks.

Before Getting Started - Broader European Thoughts

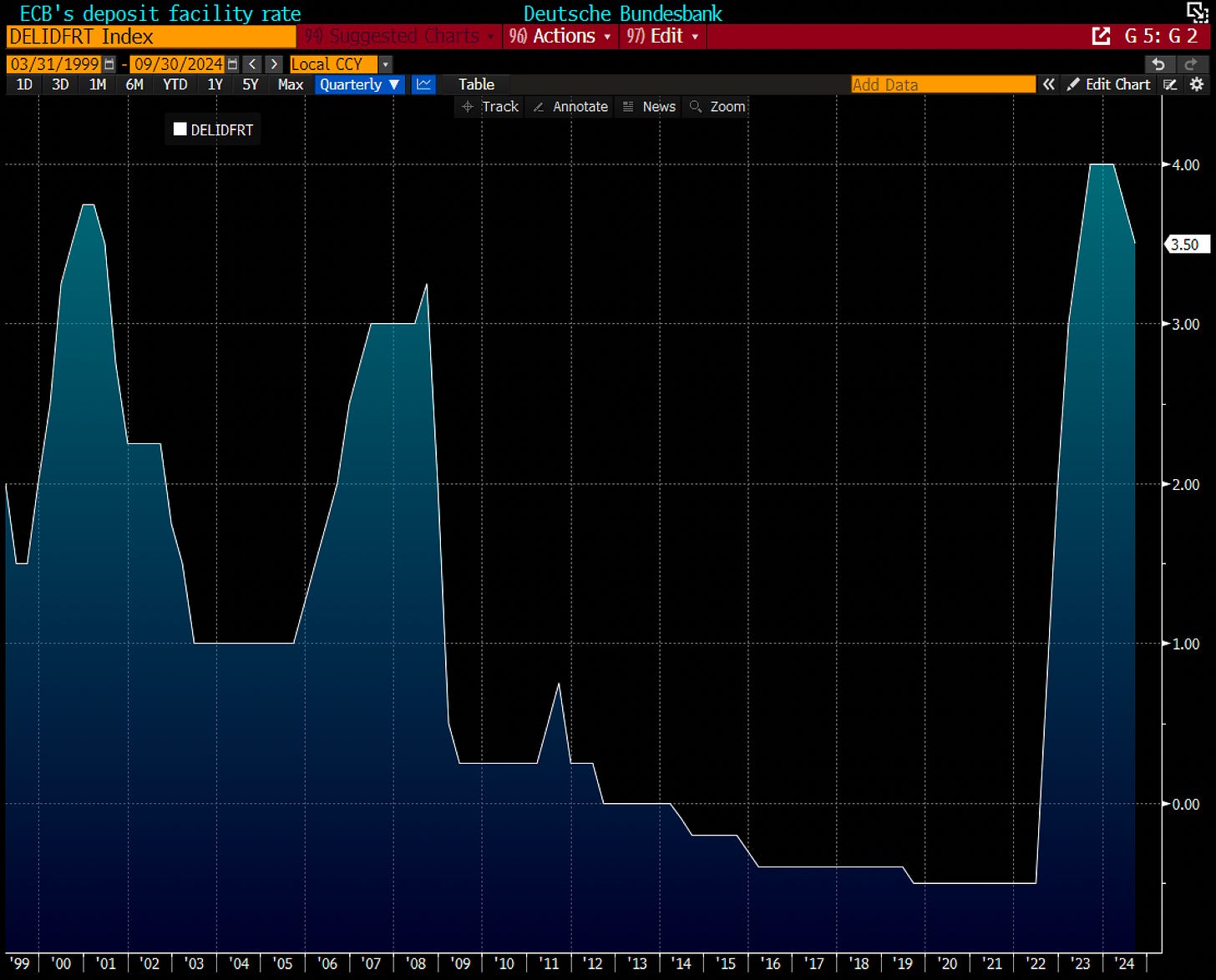

What goes up, must come down.

When interest rates are low, many European banks struggle to make money. This is because these banks are set up to benefit more when rates are higher - a situation called being "asset sensitive." Imagine a seesaw: when rates go down, the banks' profits tend to go down too. However, there's good news on the horizon. The recent increase in interest rates has been like a helping hand, pushing up the profits for many of these banks. It's as if someone finally sat on the other end of the seesaw, bringing things back into balance and giving European banks a much-needed boost to their bottom line.

Regulations hurt.

European banks operate under a regulatory regime that's notably more stringent than in the United States. In the aftermath of the 2008 financial crisis, European regulators implemented a series of reforms that went beyond global standards. They imposed higher capital requirements, with many European banks now required to maintain capital ratios well above their U.S. peers. The European Central Bank's stress tests are often considered more rigorous, pushing banks to hold additional capital buffers. Moreover, Europe's fragmented banking market, with different rules across countries, adds layers of complexity and cost. Restrictions on banker bonuses and more aggressive enforcement of anti-money laundering rules further tighten the screws. This regulatory burden, while aimed at stability, has squeezed profitability and made it more challenging for European banks to compete globally with their American counterparts.

Where to focus?

In the complex landscape of European banking, discerning investors can find significant opportunities by focusing on key performance indicators. The twin pillars of Earnings Per Share (EPS) growth and Tangible Book Value Per Share (TBVPS) growth serve as crucial metrics for identifying banks poised for success. These indicators provide insight into a bank's profitability and intrinsic value, respectively. The upcoming Relative Growth Score (RGS) promises to add another layer of analytical power, offering a comparative measure of a bank's growth potential. However, raw growth figures alone don't tell the whole story. The art of successful investing in this sector lies in understanding fair valuations - distinguishing between fairly priced stocks and those trading at a discount or premium. This post aims to equip readers with this critical knowledge, offering a panoramic view of the European banking sector. By examining future return prospects and current valuations, we'll navigate the intricacies of this market, helping you identify undervalued gems and avoid overpriced pitfalls. Our goal is to transform the often-opaque world of European banking into a landscape of clear investment opportunities.

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.