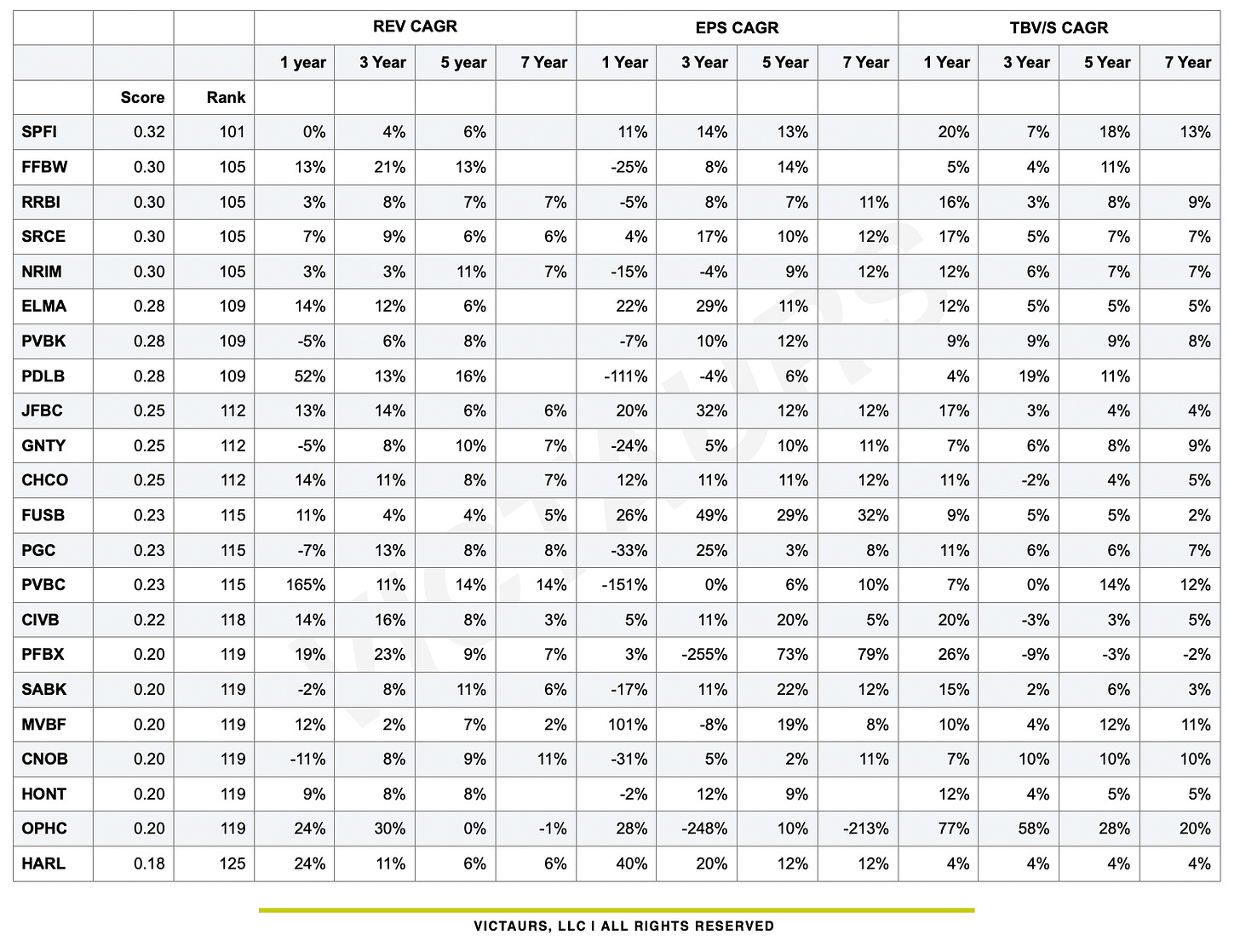

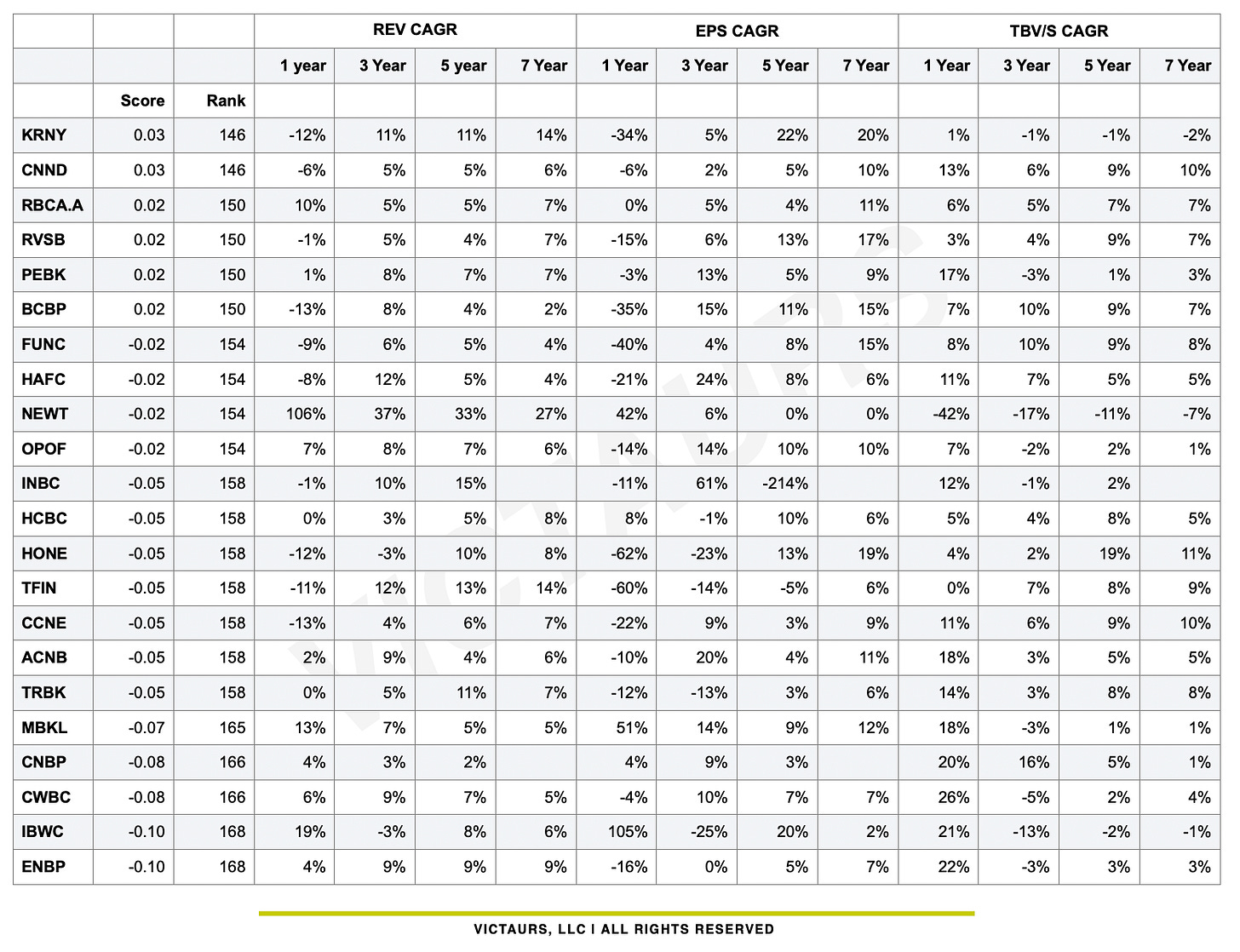

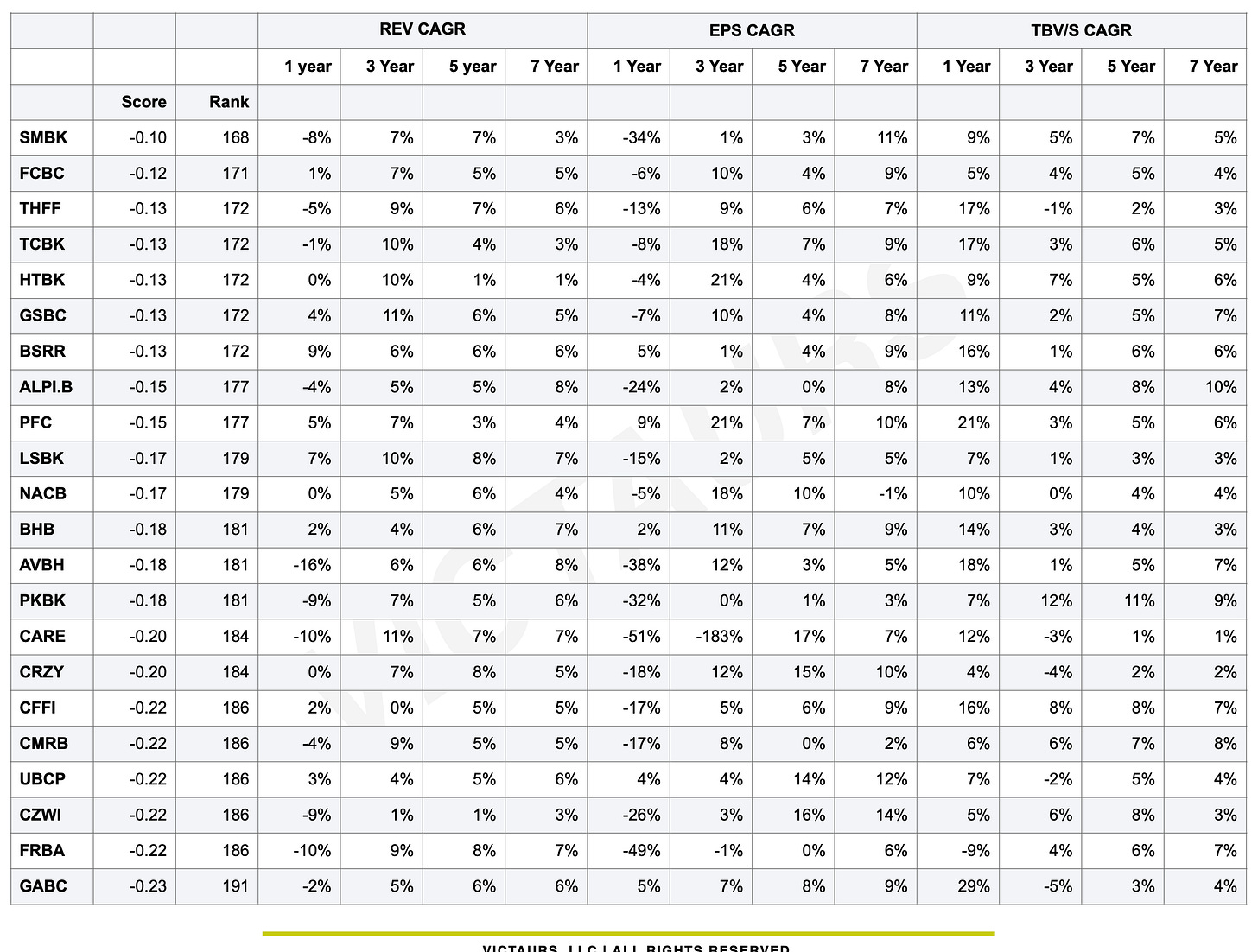

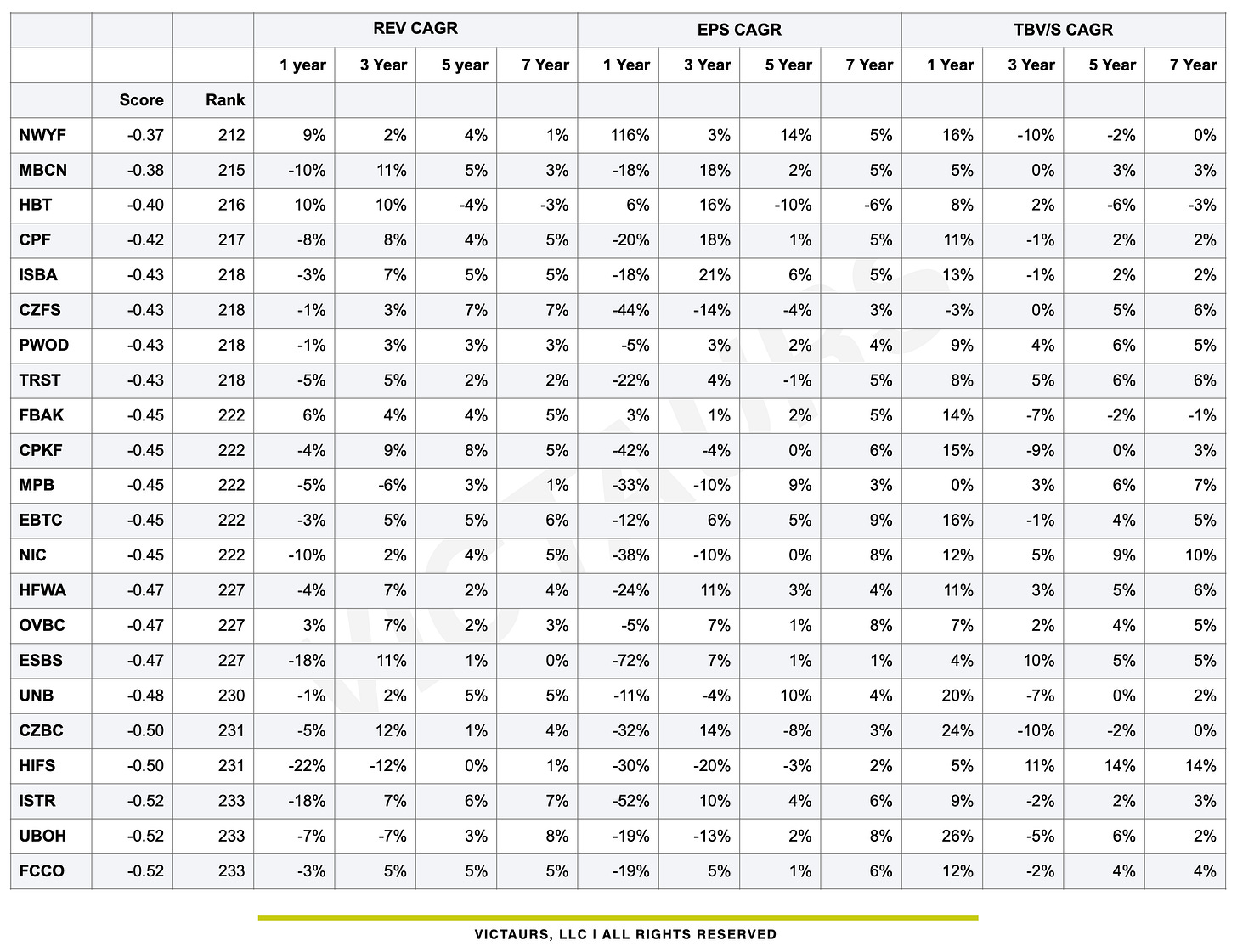

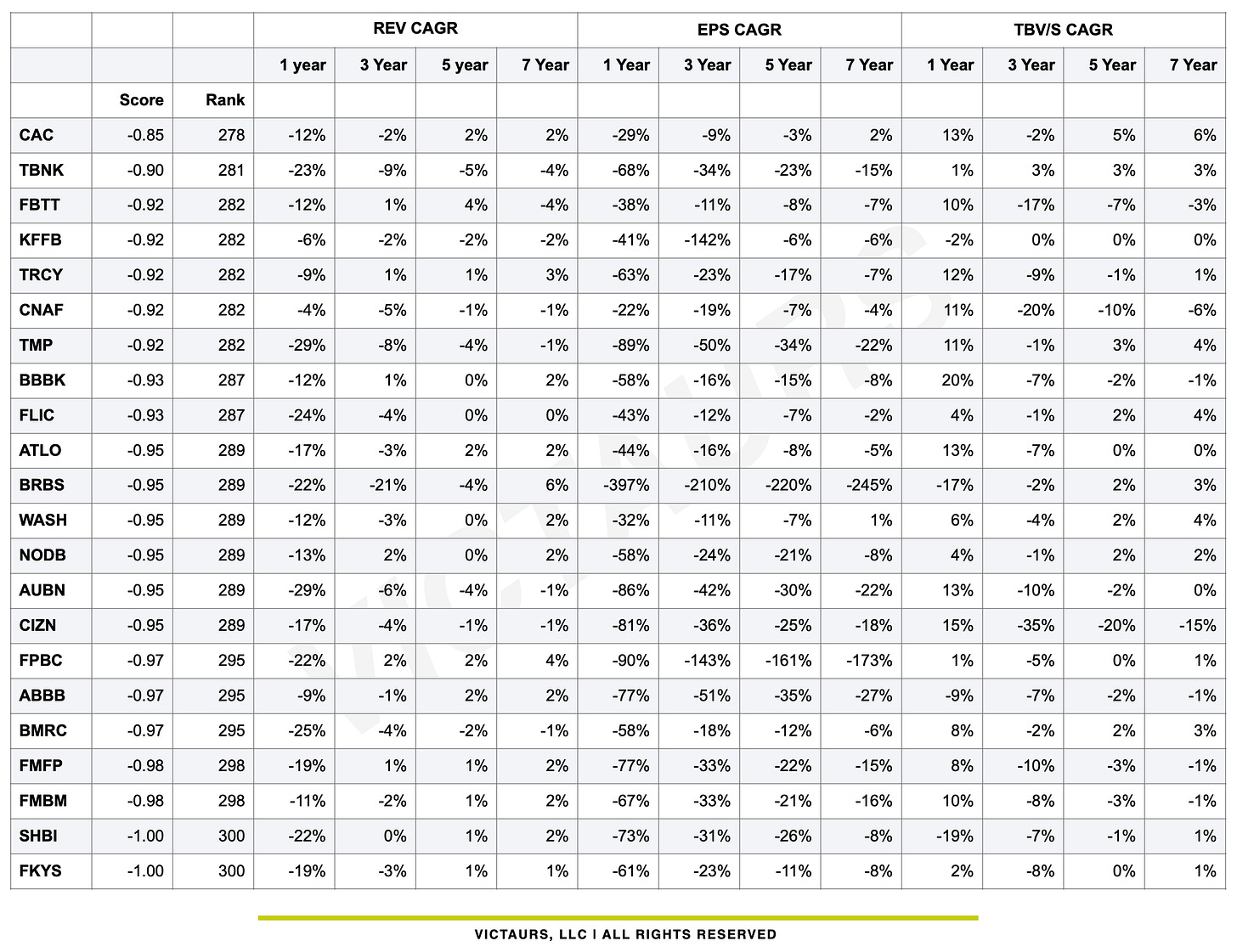

Small Banks Relative Growth Score (RGS)

Part three of four, banks under $10 billion in assets - how to find the winners that the pros don't tell you about & how to avoid the "not so good" banks.

When I started this project, I always thought that this list would be the most insightful. Finding good longs in the bank space is not easy.

We all know the numbers, something like 15 or 20 banks have outperformed the SPX over the past 5 years and banks are hated in general. They don’t generate great returns. They are like commodities. Etc. Etc. Etc.

But this list in particular is a means to find the compounders in small cap land that win, but that few know about. I say few, because for the most part you’d never really hear about these, but rest assured some astute investors own these names.

Sifting through this will find you small winners.

A few things:

#1 it’s not 100% complete. It’s a reality that you’ll be looking for a ticker or two and it won’t be on here. Some hadn’t filed when I pulled. Some were missing data. Or some didn’t have a long enough track record to make it onto this screen. If you see one you want to see, let me know for the future. The data on multiples & pricing is also a couple weeks old.

#2 it is a phenomenal list of that has some banks that should be loved. They’re compounders of returns and compounders of fundamental growth. But like Rodney Dangerfield, they can’t get no respect.

#3 it is a huge shout out to the small bank performers that don’t get the spotlight, but probably should. Size matters in banking, but hopefully this screen calls out some great performing C-suites that fly under the radar.

My goal in all of this was to find the banks that have track records of producing above average results over a long period of time. It is my belief that those banks will be the ones that have a good chance of producing superior returns into the future.

Simple, but true in the long run. Grow earnings per share, grow revenue per share, and grow tangible book value per share and you’ll typically have success. This holds true for a large data set, but definitionally will not hold true for every single growth bank. Dimon makes a valid point about this with his “don’t do anything stupid” quote.

The Biggest Benefits of Using This

Find cheap names that have superior ability to grow fundamentals & buy ‘em

Learn who has not grown earnings over a long time period & avoid ‘em

The Biggest Risks of Using This

An otherwise “good” bank may have made a mistake like go too long into a rates up environment which would hurt their growth score

An otherwise “good” bank may have too much forward-looking risk like CRE which could make them look good now, but not in the future

Long or Short?

As far as going long or short, it would be drastically oversimplified to say, “buy the growers and fade the non-growers” because current conditions matter. So does current pricing. As I look through this list, I see some names that are “cheap for a reason” or at least for today’s reasons for example take these two:

NECB - yes, the business model has definitely worked, but will it work in this new world?

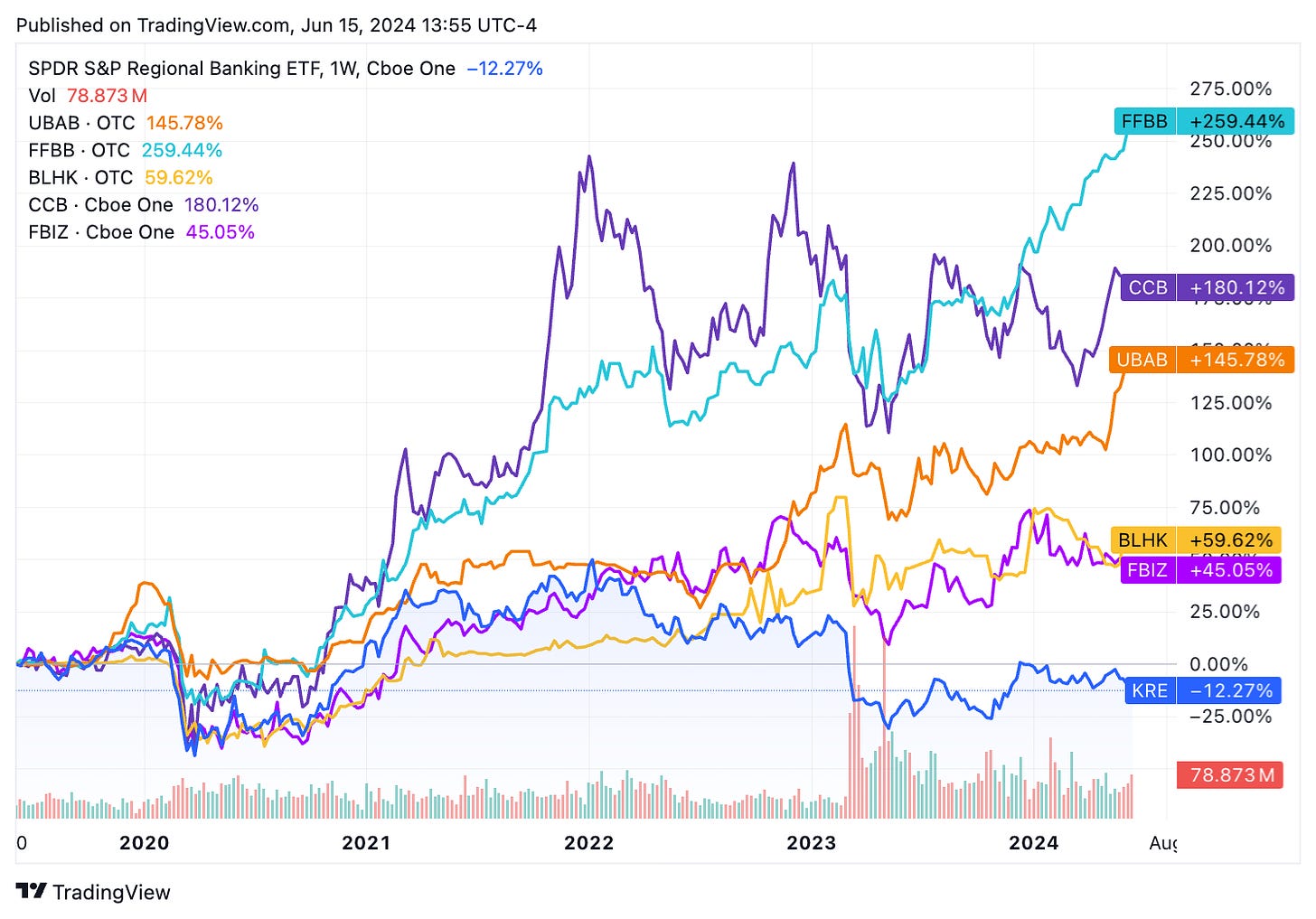

FFBB - expensive to book, but cheap to earnings and even more so when you think about the track record SM has delivered on.

Remember that what the Relative Growth Score does is tell you over the past 7 years or so who has done the best job growing key metrics relative to their peers. The scores are aggregated based on whether or not a bank has performed in the upper quartile or lower quartiles on RPS, EPS, TBVPS.

In general, small banks are trading cheaper to larger liquid names, so this is a great place to build positions and ride the wave with great teams that will grow top line, bottom line, and book value over time.

One Final Point

Almost all of the banks on the first page have produced superior returns relative to the KRX index over the past 5 to 10 years. And while it is likely that some will stumble, it is also likely that most will continue outperforming their counterparts.

A handful of these names have absolutely trounced the index over the past 5 years.

My belief it objects in motion tend to stay in motion.

But before buying I’d definitely poke around and try to get a feel for governance, board/insider ownership, and how the CEO thinks about capital allocation. All these things matter.

Enjoy the list.

Appendix

The best is ahead.

Victaurs