The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences, and the way I transact. This information is provided for general informational purposes only and should not be considered as personal advice. Your money, your outlay, your risk. This presentation does not provide investing advice in any way shape or form. You will be solely responsible for any decisions you make. If you need to seek any advice, speak to your advisers, accountants or other professionals who you may be relying on for your wealth creation journey. Please do your own due diligence.

On August 21st, with Rocket trading near local highs I said it was too expensive.

In summary I wrote: Rocket Companies (RKT) is revolutionizing the mortgage game with AI, aiming to make home loans as easy as ordering takeout. As the leader in refinancing and origination, Rocket boasts unmatched efficiency and market share gains, but with a $38 billion valuation on just $5 billion in projected revenue, the stock feels priced for perfection. The upside? Fixed costs mean explosive earnings potential if mortgage activity surges. The catch? Mortgage rates need to drop significantly to unlock that growth. At $19 a share, Rocket isn’t a bargain—but it’s a powerhouse to watch on pullbacks. Want the best in refinancing? Keep Rocket in your sights.

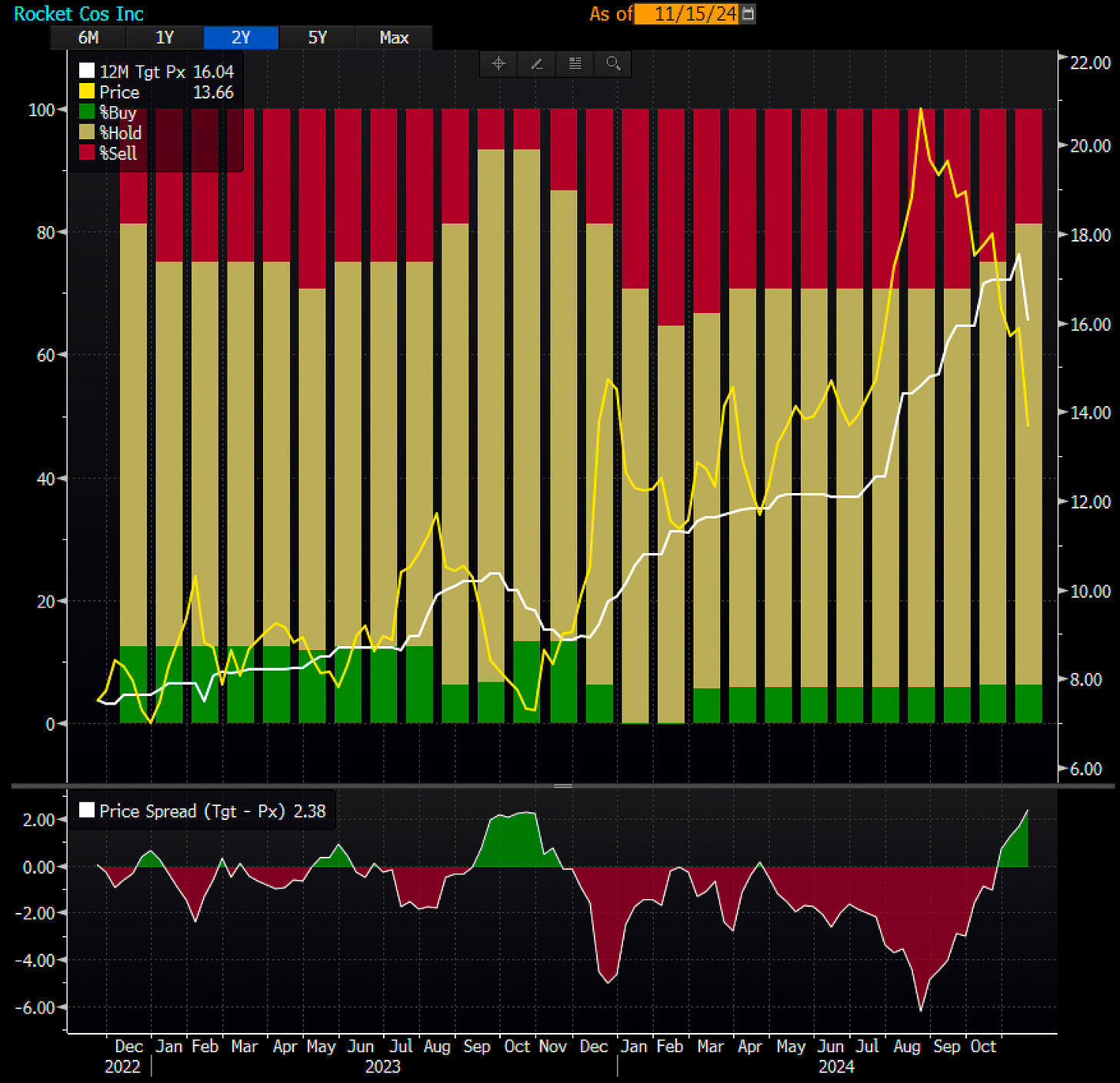

Since then with the rate rise RKT has dropped about 30%, missed earnings badly (who could’ve seen that coming), and has seen analysts catch down their price targets to reality.

And then on September 18th, with the Fed about to cut 50 bps I presented an alternative play in the mortgage space, Mr. Cooper.

In summary I wrote: Mr. Cooper (COOP) is the underdog of mortgage servicers, quietly dominating with $1.56 trillion in loans and a balanced approach to steady servicing income and origination growth. Unlike pricey competitors, COOP thrives on stable interest rates, efficient hedging, and a massive Flagstar acquisition that boosted scale and earnings power. With EPS projected to grow 28% in 2025 and 15% in 2026, COOP offers a compelling mix of undervaluation, operational excellence, and shareholder-friendly buybacks. Trading at just ~8x forward earnings, it’s a smart bet for a mortgage market poised to rebound—but you’ll want to grab it in the high 80s to low 90s.

Despite long rates rising COOP has held in due to its MSR book and structurally different rate bias.

Rocket Companies (RKT) is a direct beneficiary of rallies in 10-year bond yields because lower bond yields drive down mortgage rates, which expand the mortgage basis and create new opportunities for refinancing and origination. As rates fall, Rocket’s gain-on-sale margins improve, boosting profitability from originating and selling loans. Additionally, their large servicing portfolio benefits from increased servicing revenue tied to higher outstanding balances and fewer prepayments, stabilizing cash flow. With fixed costs, Rocket's earnings power accelerates in a lower-rate environment, making the stock an effective way to play a bond yield rally with a clear tie to mortgage market dynamics.

Mr. Cooper (COOP) doesn’t rally as much as Rocket (RKT) when rates fall because COOP’s business is more heavily weighted toward mortgage servicing, which faces headwinds in a falling rate environment. Higher rates reduce prepayments and extend the life of its servicing portfolio, stabilizing revenue but limiting opportunities for the lucrative refinancing activity that drives Rocket’s earnings growth. COOP’s servicing income is steady but less sensitive to rate-driven market volatility, while Rocket, with its focus on refi & origination, benefits disproportionately from higher gain-on-sale margins and expanded refinancing activity when mortgage rates fall. COOP's balanced model makes it less reactive to rate changes but more resilient overall.

The pair of long COOP and short RKT has worked really well. Giving you a way to short RKT with a lower net exposure. Plus 36% is pretty good to me.

At this point, with yields having already climbed significantly, I wouldn’t remain short on Rocket (RKT) unless you firmly believe rates will rise materially from here. The market likely overreacted to the downside for Rocket, pricing in overly pessimistic scenarios for its future returns. While rising rates initially squeezed refinancing volumes, Rocket has shown resilience through market share gains, strong gain-on-sale margins, and efficient AI-driven operations. If rates stabilize or even drift lower, Rocket stands to benefit disproportionately, as its fixed-cost structure amplifies earnings growth in a more favorable mortgage environment. At current levels, it seems the worst-case scenario is already baked in, making a short position increasingly risky.

What I do know is that RKT at this point is a great way to play changes in rates. Below is RKT vs. TLT. Rates down/bonds rally means RKT gives you extra kick to the move. From May 15th of this year to September 18th TLT rallied about 10% while Rocket rallied about 40%. And down below, from June of 2023 to October of 2023 TLT dropped about 18% and RKT gave up about 50%.

If you followed along on the short side of RKT congrats. I would take it off here unless you’re perfectly convicted that rates are going up. Analysts often serve as a contrarian indicator for Rocket (RKT) because their forward-looking projections tend to overly rely on backward-looking trends, missing key inflection points in the mortgage market. When mortgage rates rise sharply, analysts typically downgrade Rocket, extrapolating poor origination volumes and declining refinancing activity into the future. However, these same analysts often underestimate Rocket’s operational leverage, its ability to capture market share, and the potential for rate-driven refinancing surges when rates stabilize or decline. Conversely, when Rocket performs well in a low-rate environment, analysts often turn bullish just as refinancing volumes are peaking, leading to overly optimistic projections. This backward-looking bias frequently causes analysts to miss pivotal shifts in the mortgage cycle, making their consensus a useful contrarian signal for investors. The fact that they’re downgrading makes me think we’re closer to a bottom than a top.

For what it’s worth, I still own COOP at 2.5% of portfolio. I am looking at entry points for RKT. This last quarter was terrible. At a $27 billion market cap it’s expensive to last quarter annualized revenue, but not to projected 2025 even if it comes down.

If you have questions premium subs can always send me a message and I’ll respond. I appreciate all of you and your support. Let’s find another winner.

Until next time,

Victaurs

PS - you can find both premium articles here: