Riding the Investment Bank Rollercoaster: How to Spot Winners, Dodge Losers, and Profit from the Madness

Plus the top 5 lessons for allocating your capital to the Investment Bank sector

Investing in pure-play investment banks (Ibanks) is like riding shotgun in a Ferrari driven by a caffeinated teenager—thrilling on the way up, terrifying on the way down, and profitable only if your macro timing skills are flawless. To do this, you need to have a sense for what investment banks do, how they trade, when they win, and when they lose. Not to pat myself on the back, but yours truly nailed the 2024 in rally in Ibanks perfectly. With the world seemingly asleep at the switch on a lethargic econmy, depressed capital market activity and light M&A activity I went long.

From early Q1 to the election Goldman Sachs jumped 35%, Evercore soared 55%, and Piper Sandler rocketed 65% and that was before the group surged another 50-60% after Trump’s election win. Visions of 2021 Ibanking revenue booms filled investors heads with everyone.

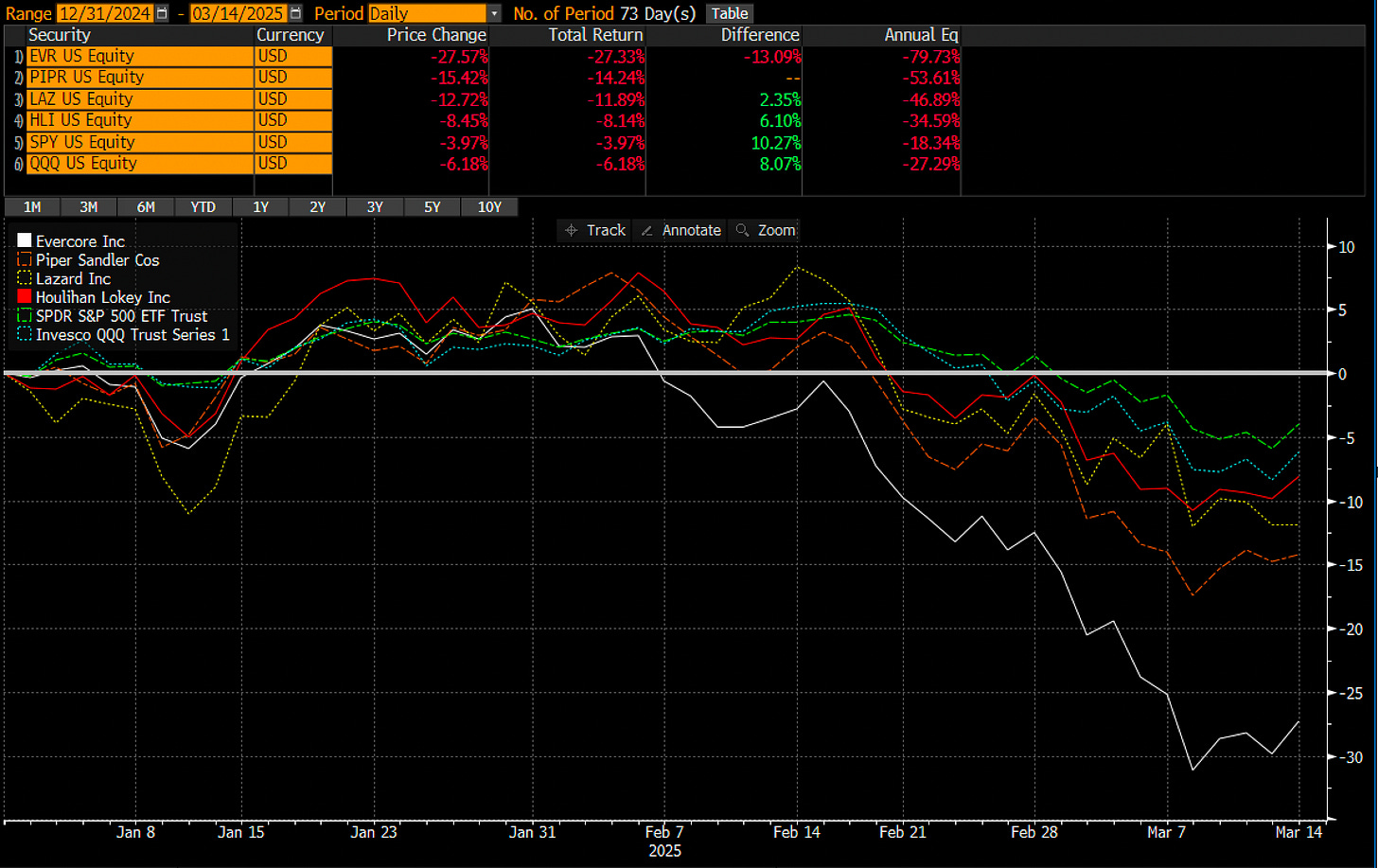

But in January something happened; tariffs sparked uncertainty, freezing deals, crushing confidence, and sending valuations plummeting. Multiples contracted as everyone realized, no deals means no tendies for Ibanks. Perception swung and the names got whacked. (Yes not to gloat and I didn’t write it up fully but I did catch a decent amount of the short side with PIPR and EVR).

And just now a recent Goldman report cited that expectations for completed US M&A growth in 2025 have plunged from +25% to just +7% due to weaker economic growth forecasts and diminished CEO confidence. Tariff uncertainty further threatens a potential contraction in completed M&A deals. This backdrop leaves investment banks vulnerable, especially given current historically elevated valuations. When economic optimism fades, these stocks quickly fall out of favor. In investment banking, timing isn't just everything—it's the only thing because investment banks are uber-cyclical.

Investment Banking 101: Quick Primer

Investment banks make money through three primary channels, each reacting differently to economic cycles and stock market conditions. Mergers & acquisitions (M&A), which involves advising on corporate deals, is the most cyclical, booming when CEO confidence is high and economic growth is strong but stalling when uncertainty creeps in. A strong stock market also fuels M&A because companies often use their stock as currency for acquisitions—when valuations are high, buyers can pay more with fewer shares, driving deal volume. Equity capital markets (ECM), focused on IPOs and stock offerings, thrives in bull markets when valuations are high and investor appetite is strong but dries up when volatility spikes. Debt capital markets (DCM), which involves issuing corporate bonds and raising debt, is the most resilient of the three, as companies still seek financing even during slowdowns—though extreme uncertainty can still freeze activity. Understanding how these segments move with market conditions and stock valuations is crucial for timing investment bank trades effectively.

Valuation Alert: High Multiples Spell Risk

Even after the recent shakeout, investment bank stocks are still expensive. On a forward P/E basis, the sector is sitting in the 77th percentile of historical valuations, rich by any standard. And if earnings disappoint and sentiment takes another hit, multiples could stretch into the 85th percentile, historically where things start looking frothy and unsustainable. (h/t Goldman Sachs).

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.