There are three main things going on in bank stocks right now. I’m supportive of banks here, but not all in by any stretch of the imagination. Call it a solid 6/10. A few things jumped out at me as we worked through this quarter’s earnings releases.

Boring is good: earnings broadly speaking were really, really boring. Overall banks beat on down projections and there were very few fireworks on credit (almost none in CRE oddly & more C&I mentions than anything). The margin bears took it squarely on the chin, since the 2nd derivative of deposit costs is slowing and barely anyone’s deposit shift caught them by surprise. In order for bank stocks to go higher this has to continue. If you’re long, hope for boring, pray for boring. I know that’s kind of sad, but it’s true.

Earnings growth is closer: given the world hasn’t melted down, depositors aren’t playing “bank run” on their phones anymore, and balance sheets have been fortified the narrative can ever so slightly shift back to growth. Growth in earnings for the industry comes when NIM stops compressing and loan growth plus asset yield repricing is able to outrun funding costs (and credit behaves). For most that’s an end of 2024 thing and for a few it’s going to be here sooner.

Fear is fading away: Friday FRBK was shut down and my sense is no one is going to care. FULT picks up lots of deposits for a song and more importantly the FDIC gets to resolve a zombie bank without contagion panic. The thing about it is, there are probably more banks that are dead men walking or as Harvey Updyke said about Toomer’s Trees, “they’re not dead yet, but they will die”. But that’s okay because it’s been telegraphed and the market kind of yawned at it.

Where Are We?

I listened to too a few calls this quarter, and I can’t say I was looking for anything in particular, but more an overall tone to the calls. Here’s what I took away:

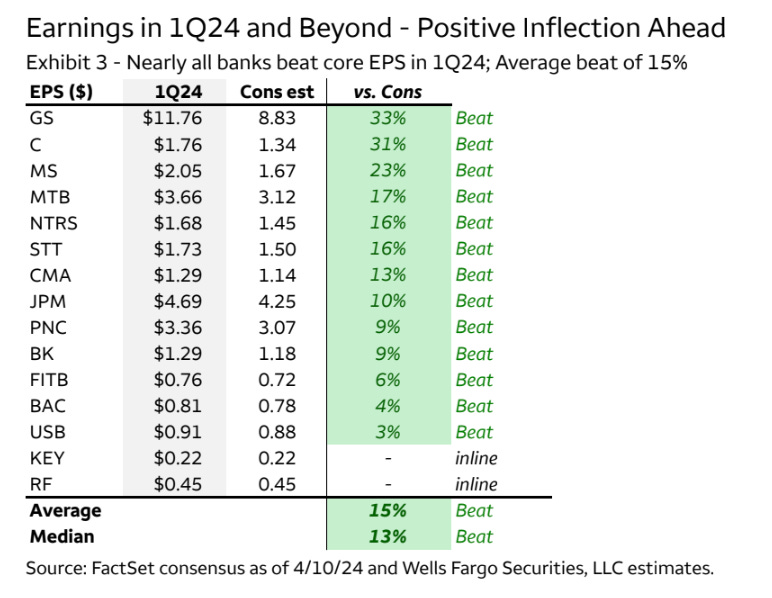

First of all, big banks all beat. Now haters will say expectations were beat down (which they were), but this is not indicative of a banking market in turmoil. Now remember these were all beat down estimates and declines from previous quarters, but the key takeaway is, less bad is good. Everything pretty much behaved.

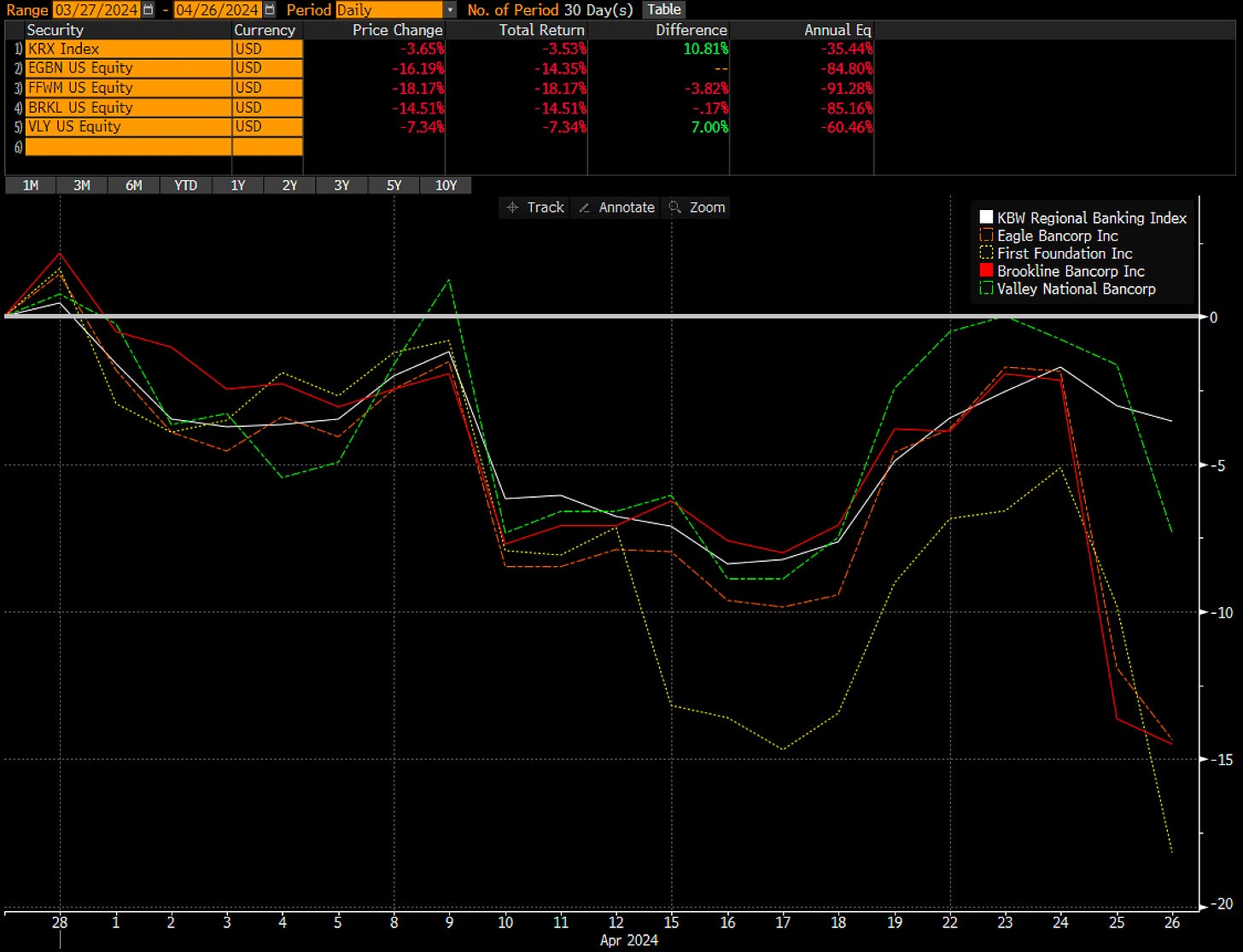

In the regional & small bank space it was mostly a mixed bag but mostly positive. But here’s where the positives are. Most of the results were fairly straightforward or put differently nothing was really surprising. Banks like FFWM, EGBN, BRKL, and VLY all got roughed up because the business model of being a heavily lent out, liability sensitive balance sheet, operating in a time where everyone is afraid of CRE doesn’t exactly work today. Their earnings all reflected this, and price action post earnings followed. As always, earnings today and people’s perceptions of earnings tomorrow drive prices. These banks are playing a game of poker where they’re on a rates down river draw. When rates rally you feel like a genius owning them. When rates sell off, well not so much.

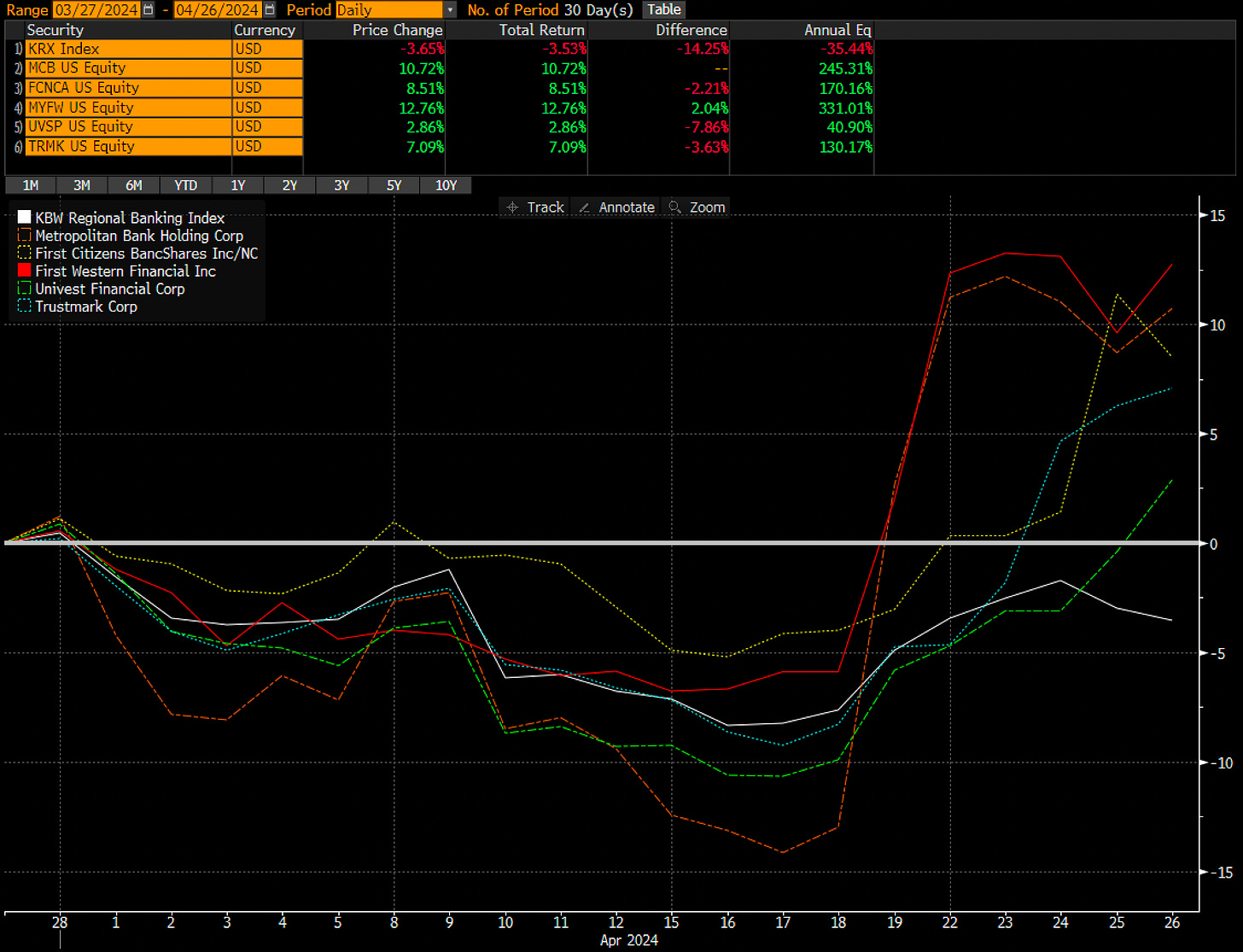

On the positive side, MCB showed that they could raise deposits, TRMK beat and announced yet another big insurance sale for the industry, MYFW rallied on some bad loan resolution updates, FCNCA reminded us that they are an absolute beast always and forever, and UVSP out of Souderton, PA put up really strong results. It’s hard to put an exact finger on the factor driving outperformance, but strong results are being rewarded. I didn’t put it on here, but CASH had a nice report scoring one for the BaaS guys. If you have any names you like be sure to hit me up, always looking for underrepresented names.

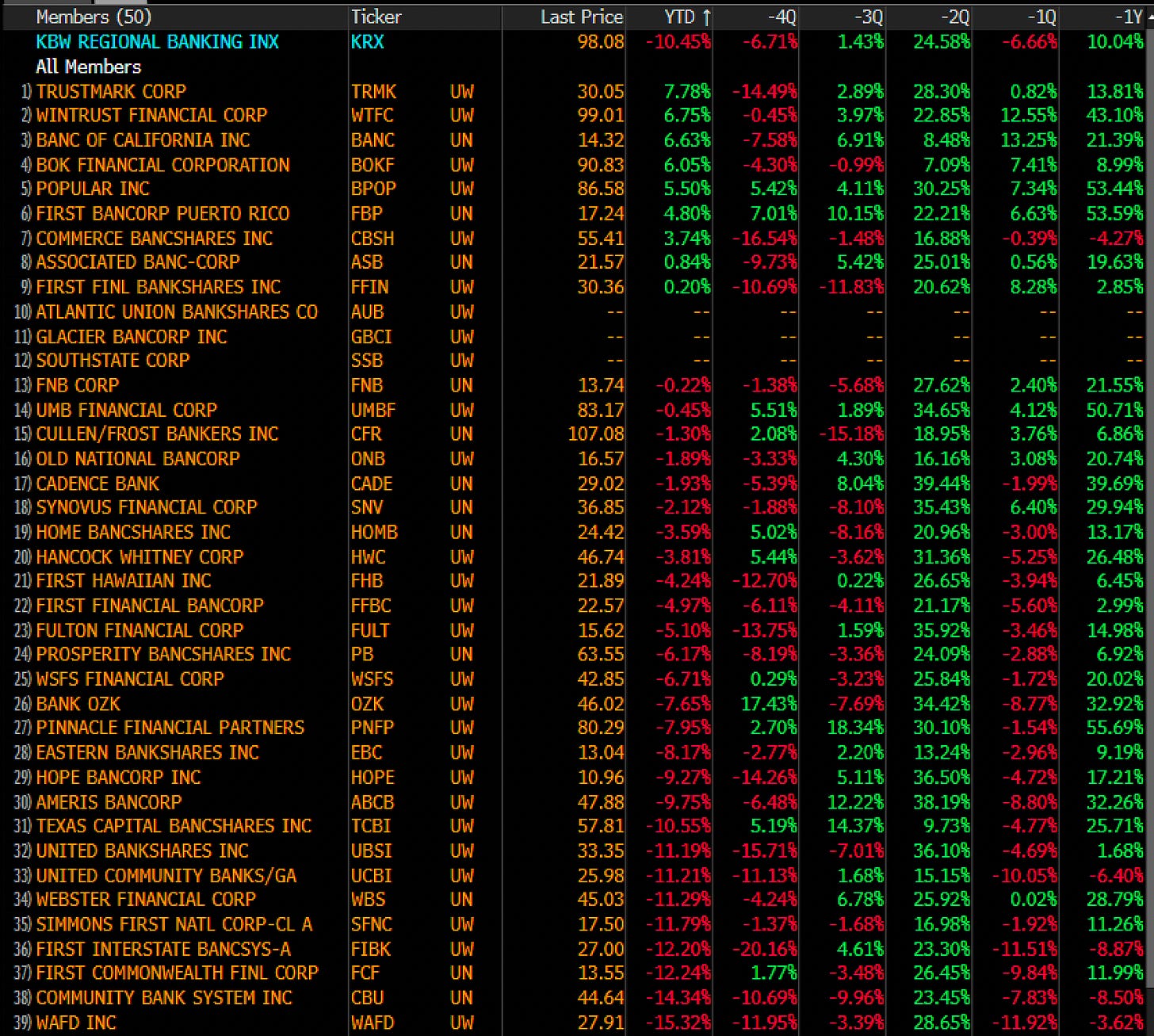

Year to date it’s been tough with the index down 10% and best in breed down a lot. Biggest losers first and then biggest winners below for regionals. It’s definitely tough out there in regional land, and while there’s a few I like it’s not a place I’m overweight at all. It just feels kind of like basic to quote the milennials.

Where Do We Go?

I don’t have a crystal ball, but I think longer term we muddle around for a bit on an index level before seeing some Q3 outperformance relative to the rest of the investing world. If pressed my bias is slightly to the upside. Some banks will outperform (you know how I feel about WAL & C). But the bank bull narrative goes something like this.

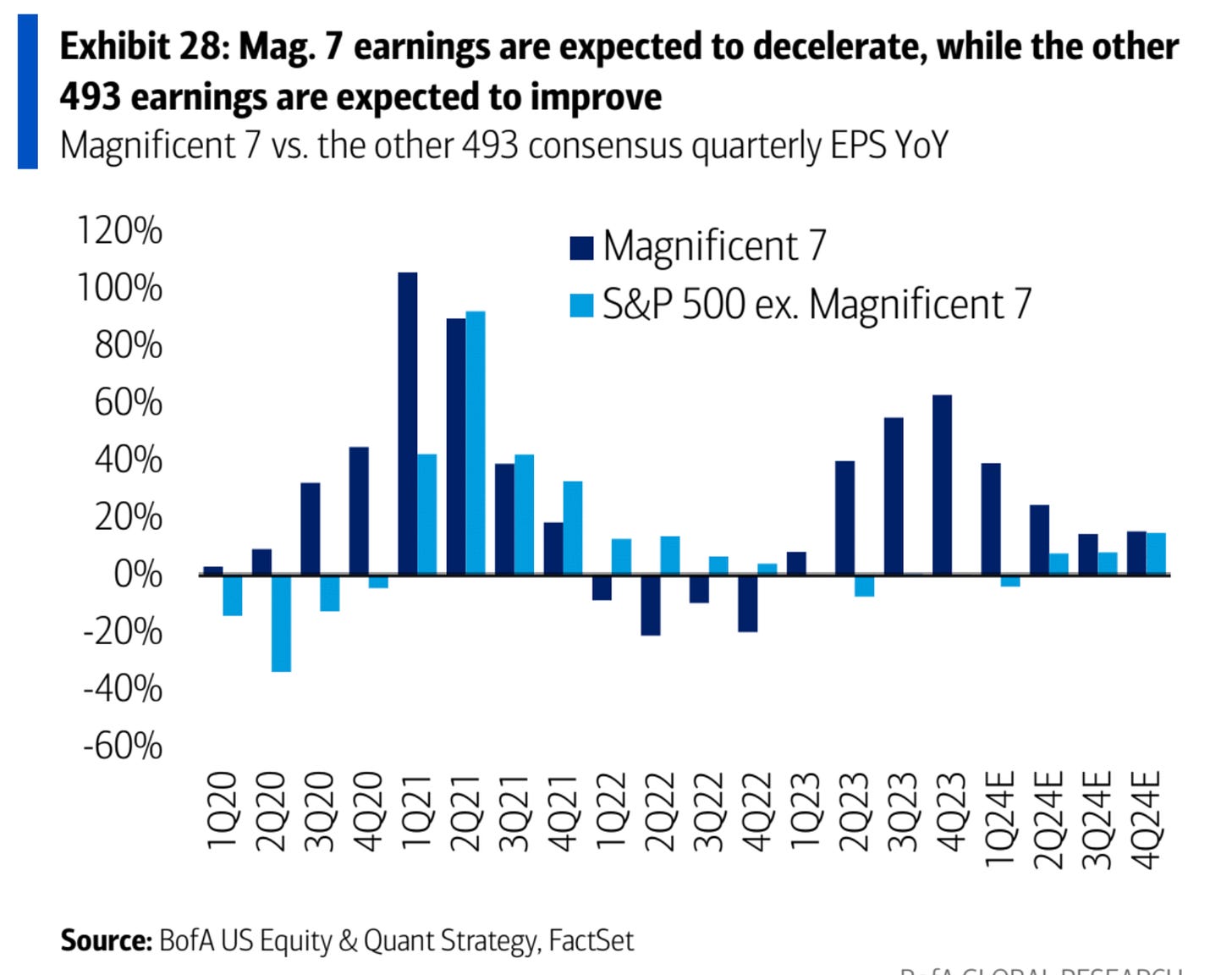

If the broader economy stays strong, credit continues to behave (albeit normalize), and liquidity scares continue chilling there exists a scenario where bank earnings in general are growing come Q4 and into 2025 while the rest of the investing world is decelerating. Everyone knows what the MAG7 did, but the luster has worn off a couple of those and the recent EPS growth is coming down. So, you have a potential world where banks here coming of a fairly valued starting point see earnings growth while some other people aren’t. That’s it. That’s the bull case down the road. For generalists to return that kind of has to happen.

Now one way that happens faster is if there’s a rates down & un-inversion of the curve. In that scenario, COF pain would go away, NIM would expand, & you’d see some positive operating leverage. All of that would be a big EPS tailwind for the banking sector that would cause outperformance relative to the SPX. Not to mention all that AOCI accretion that would flow into TBV, increasing capital and allowing banks to buyback more of their shares. Shout out to the OG AOCI bears that said SCHW and BAC would fail. We miss you.

Remember, in the long run the banks that outperform are the ones that have growing top line, growing bottom line, and growing TBV/s all while managing to not do something stupid. This is more or less the most obvious statement in the world & I wish people would tattoo it on their foreheads. Once you understand this investing gets ever so slightly easier.

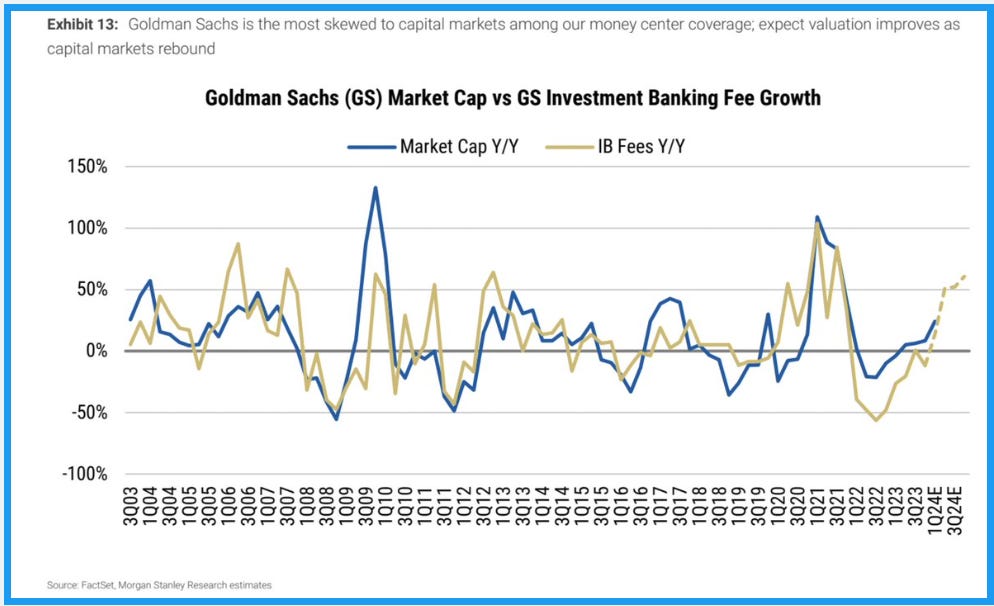

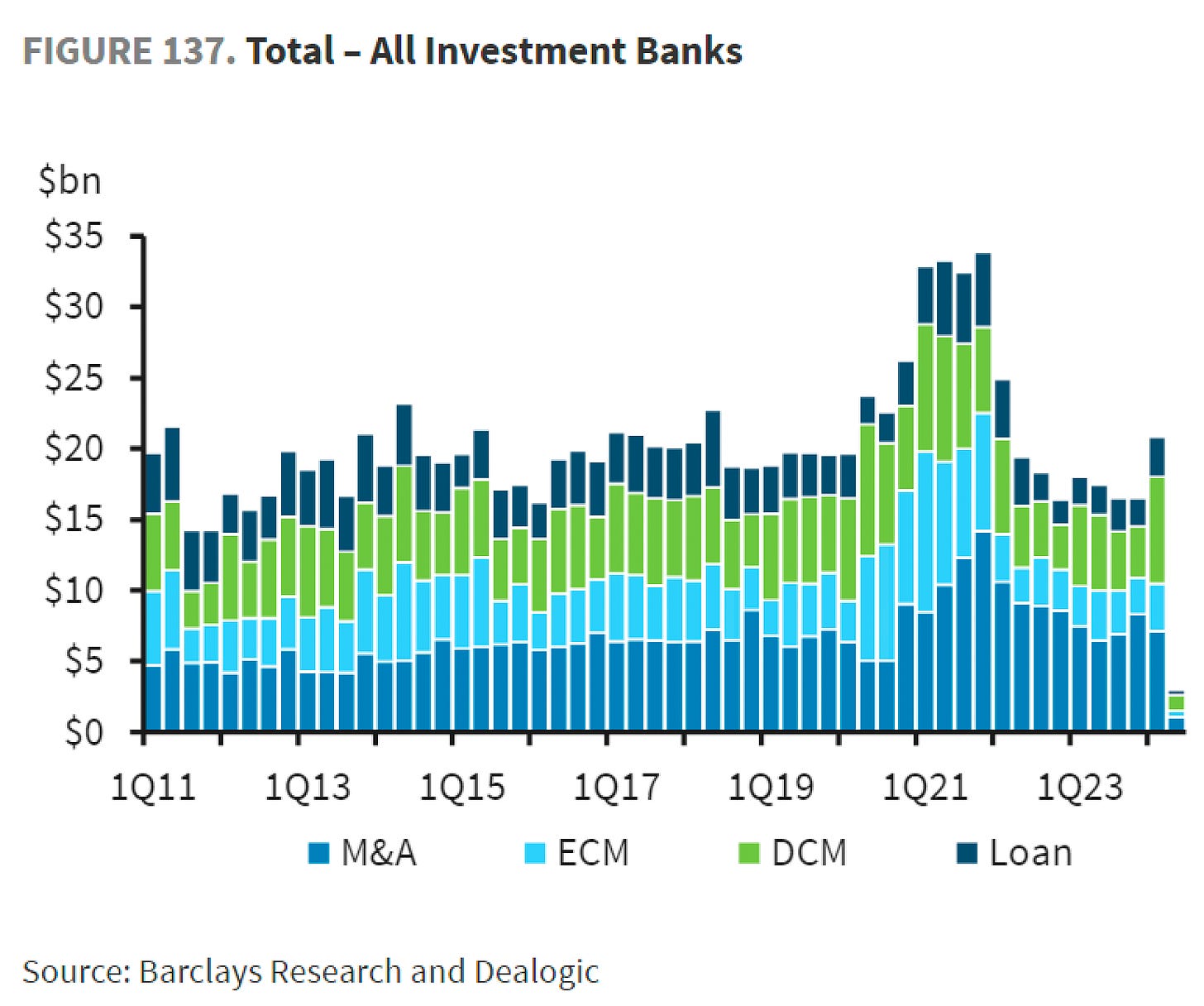

To this point, one area I’m focusing is on capital markets banks like GS. Should the world not blow up (something I have no control over) then a lower volatility world where rates are more stable should mean the capital markets windows open back up. This should mean tailwinds for all three of the metrics above and beyond normal guidance. I know it’s a bit of a macro call, but that’s my gut right now. Feels like going into an election the powers that be want a healthy and functioning capital markets ecosystem & GS benefits from that. There is pent up demand by companies wishing to do an IPO, raise equity, refinance debt, do M&A, and generally get back to business as usual. IB fees then should see some tailwinds for all the big banks, and I’m not calling for a return to 2021, but marginal outperformance should help.

Closing Thoughts:

The way to outperform in banks is by looking at who is able to grow top line, bottom line, & TBV/s in excess of the industry over time.

For all banks, boring earnings and time passing are the main way this happens. The other big way this happens is if there is a rates down which helps on many fronts.

Regional banks are going to have a hard time doing the above without some big rates down, even though there are a couple winners out there.

Bigger banks are positioned to take advantage of the current rate environment and banks like GS are able to ride a potential capital markets wave.

Sometimes it’s obvious and unless you know rates are going down it’s hard to own liability sensitive CRE names versus others.

I don’t love the set up in banks here as much as I do across the pond in Europe, largely due to the return/valuation profile. Send me a DM on X if you want to chat.

Make sure to follow me on X: Aurelius On X

And if you like this make sure to pass it around. At some point I’m going to paywall, but that day is not today friends.

Until next time,

Aurelius