I know everyone is about to log into their account and try to hedge or panic sell (not me). But in a world of tarrifs blowing up markets can we take a minute to celebrate?

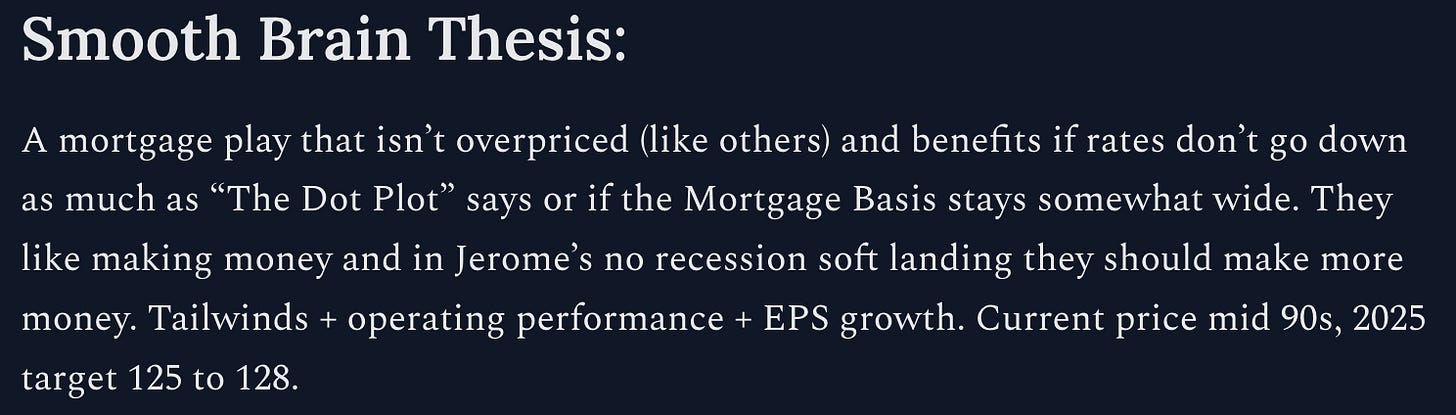

Back in September, I shared a straightforward "smooth brain" thesis about a lesser-known mortgage player called Mr. Cooper (COOP). For those paying attention, the price at the time was about $93 bucks. Today, with the recent Rocket (RKT) buyout offer, it's trading right around $125. A nice little ~30% return in a few months—not bad, huh?

Wins like this are exactly why I maintain the blog at a premium level, instead of a few bucks a month. Quality ideas consistently deliver premium outcomes. I’m in the top 10% of posts by activity on the platform too. And while we won’t bat .1000, we will win.

But back to the article at hand. Remember now that true success isn’t just about outcomes; it’s about mastering the process. Bill Walsh famously embodied this mindset by focusing relentlessly on preparation. Walsh transformed the once-terrible 49ers into a legendary dynasty, believing that victories were simply the inevitable result of excellence in every detail, from precise game plans to even how players dressed for practice (yes, we're talkin' 'bout practice AI!).

Walsh coined the "Standard of Performance," emphasizing continuous improvement, meticulous attention to detail, and relentless consistency. This principle didn’t just dominate football, it became foundational for businesses and organizations everywhere. His coaching tree is unmatched, producing legends like Mike Holmgren, Andy Reid, Mike Shanahan, Jon Gruden, Tony Dungy, and George Seifert.

Impressive, right?

And because we’re celebrating, here are three absolute Bill Walsh bangers I live by:

“Concentrate on what will produce results rather than on the results, the process rather than the prize.”

“Champions behave like champions before they’re champions.”

“There’s no guarantee, no ultimate formula for success; however, we have a guaranteed formula for failure, and that’s trying to please everyone.”

Whenever I land a big win, I celebrate briefly, then immediately do a post-mortem to keep the growth going. If you want to dive deeper, check out the original piece below:

Lesson #1: Trust the Vibes (But Verify)

Great investing blends numbers with intuition. My initial analysis pointed clearly to Mr. Cooper’s strengths: a robust business model, strong leadership under CEO Jay Bray, and proven resilience through varying economic conditions. My gut or the "vibes", matched the evidence perfectly. And when the vibes were there I did the work. Because even though I joke, behind every great vibes investment is real work.

So ask yourself why an investment feels right. For COOP, the confidence came from recognizing their disciplined growth strategy and operational standards, qualities that stood out clearly when examining their past acquisitions and steady profitability. They said they would grow the book through acquisitions (like FLGs) and then they did it. When management words match the actions (without excuses) you start to feel the good vibes.

The lesson: trust your intuition when it aligns closely with concrete evidence. Your gut feeling isn’t random; it's your subconscious synthesizing experience and knowledge into actionable insights.

Lesson #2: Prepare for Luck (Luck Favors the Prepared)

I originally set a legitimate price target of $125 to $128 based on strong current run rate EPS and some thought about future growth. This was inclusive of all moving parts of the business and the passage of time (plus some slack). And I was prepared to hold this for a while because of point #1 and because of the fundamentals of the business. But then … the unexpected buyout by Rocket Companies (RKT) at $130 exceeded my target. Some might call this luck, but luck doesn't happen in isolation, it emerges from thorough preparation.

Investing successfully means strategically positioning yourself for good fortune. COOP’s consistent profitability, prudent hedging against interest rate volatility, and strategic acquisitions positioned them perfectly for unexpected upside. I didn’t 100% know that they wouldn’t mess things up, but the numbers told me without a major recession and rates flat, we were good.

The lesson: preparation doesn't guarantee luck, but it ensures you're in the right place at the right time when opportunities arise. Good things happen when you put in the work.

Lesson #3: Simplify, Simplify, Simplify (Complexity is Your Enemy)

Complexity often creates unnecessary risk. My thesis for COOP was intentionally straightforward: it was a stable mortgage servicer, profitable in moderate interest-rate environments, and strategically hedged against volatility. In the original analysis, I said simply: “They like making money, and in Jerome’s no-recession soft landing, they should make more money.” Clear and direct. Almost idiot proof.

Occam’s razor says “given a competing set of hypotheses, the one with the fewest number of variables is typically the most correct”. Or put another way, “the simplest explanation wins”. And that’s because in life lots of stuff goes wrong. So you want fewer moving parts. And this COOP call was just that. Few moving parts.

The lesson: simplicity allows clarity in uncertain times. If you can’t explain your investment thesis succinctly, you’re likely overthinking or misunderstanding critical aspects. Aim for clarity and simplicity, this approach reduces noise and helps you hold your position confidently through market volatility.

Bonus Lesson:

It’s popular to invest in fintechs, or MAG7, or meme coins. But that’s not my thing. I know fins. I know them well. So you think a mortgage servicer is boring? Who cares. Gains are gains. So the bonus lesson is really do what you know, do what you love, and who cares what everyone else says.

Applying These Lessons Forward

Every investment decision, whether successful or not, teaches invaluable lessons. COOP reinforced that strong intuition backed by disciplined analysis, preparedness for unexpected opportunities, and ruthless simplicity consistently lead to great outcomes.

But one successful trade isn't the end goal, it's consistently applying these principles across future investments.

A few highlights for you all to remind you of the process. Recently I wrote up HOOD. I highly reccomend you check that one out. And the European bank one is also a very simple hypothesis but one that I think will work. And lastly, it was posted in a premium member chat, but the short EVR on inflated IB revenue expectations was also a beauty. Trust. The. Process.

Robinhood (HOOD): Highlighted compelling upside factors, already delivering strong results. Feels like the vibes are good here, macro notwithstanding. HOOD Writeup

European Banks: Nuanced yet simple analyses continuing to produce profitable outcomes. They’re on fire. I’m riding until a trend change occurs (and have been for over a year). Euro Bank Momentum Run

Evercore Short: A bold, profitable call from our paid subscriber notes.

I also wrote up what I see coming for US Banks this quarter here: US Bank Crystal Ball

So yes, you can tell I’m living my inner Bill Walsh and focusing on process and standards of excellence over flash. And by the way over the past month, our Substack surged in popularity and briefly securing the #1 trending spot in finance. That momentum isn't accidental, it's built on clear thinking, disciplined processes, and actionable insights that deliver real results.

Join Our Growing Community

If you're reading this, you understand investing is an ongoing journey of learning and refinement. Our community thrives because we focus relentlessly on the quality of our processes and analysis. We dissect each win, learn from it, and replicate that success systematically.

We're not perfect, but we're continually improving, and we'd love for you to join us. Premium memberships are worth it.

Want in? You already know the next step.

The best is still ahead,

Victaurs

PS - I recently had a military service member reach out to me and ask if I offered discounts. And I didn’t. But I didn’t have a good reason for doing this, it was just no one had asked. So going forward I’m happy to do so to any and all future armed forces & military service members. I am grateful and thankful for what you do for our beautiful country, and this small token of my appreciation is the least I can do. DM me for details.