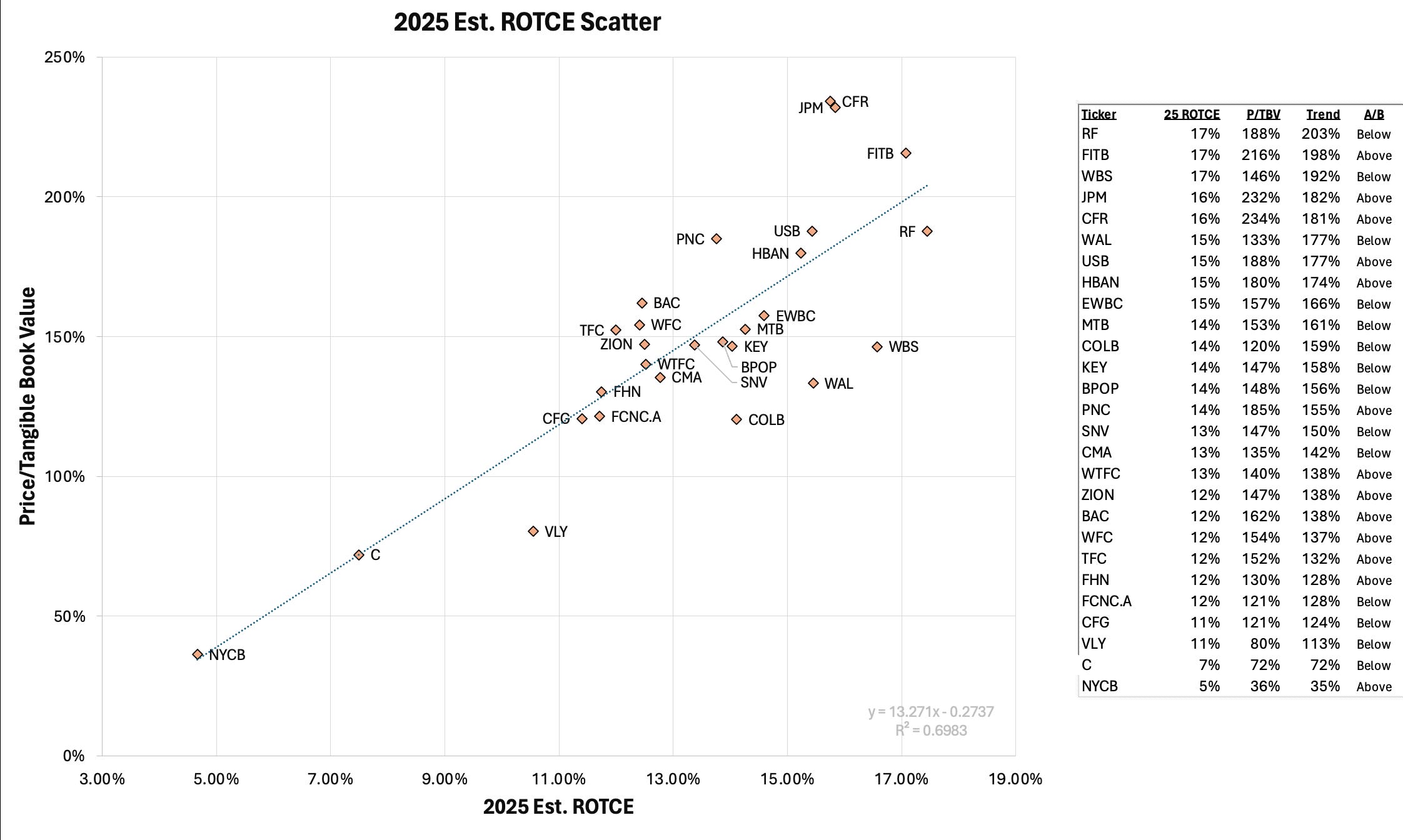

One of the most popular investment bank graphics is this one. P/TBV vs. Next Years ROTCE.

Why?

You can quickly tell if your bank stock is rich or cheap relative to others.

Both relative to others and relative to its earnings power next year.

There are many reasons why a bank may be trending above or below the regression line (remember correlation is not causation).

Below the line: They may have a lot of CRE. They may have a high Loan to Deposit ratio. They may have a high Cost of Funds. Etc.

Above the line: They may have been generating high returns for a long time. They may have a high percentage of retail holders. They may have specialty “non-bank” business lines”. Etc.

The power in this graphic then is to help you observe & orient yourself to “what is a certain ROTCE worth”.

Valuation wise, this data was pulled a week ago and the 2025 estimates for EPS, TBVPS, and subsequently ROTCE are as of June 1.

I did not add back AOCI as some people like to do, so use your brain when interpreting the richness or cheapness. In some cases, artificially high ROTCEs and P/TBV may be because of outsized bond marks.

Big Bank ‘25 ROTCE vs. Valuation Scatter

I have positions to the long side in C and WAL for very different reasons. But absent those I do think JPM is expensive although I can’t bring myself to short the GOAT. WTFC appears fairly valued but screened really well in my Relative Growth Score from past posts, so I’ll be looking at that one here soon. HBAN was ever so slightly expensive until they guided down and got whacked. CFR is another odd one for me, very asset sensitive and a big premium valuation but with the returns to back it up. There’s also never been a recession in Texas (since the big one at least). VLY is one I’m having a hard time touching even though it optically looks cheap. I guess if I had to sum up my thoughts it’d be that people are rushing into winners and over paying for quality in large bank land.

Regional Bank ‘25 ROTCE vs. Valuation Scatter

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.