Few Names I'm Watching

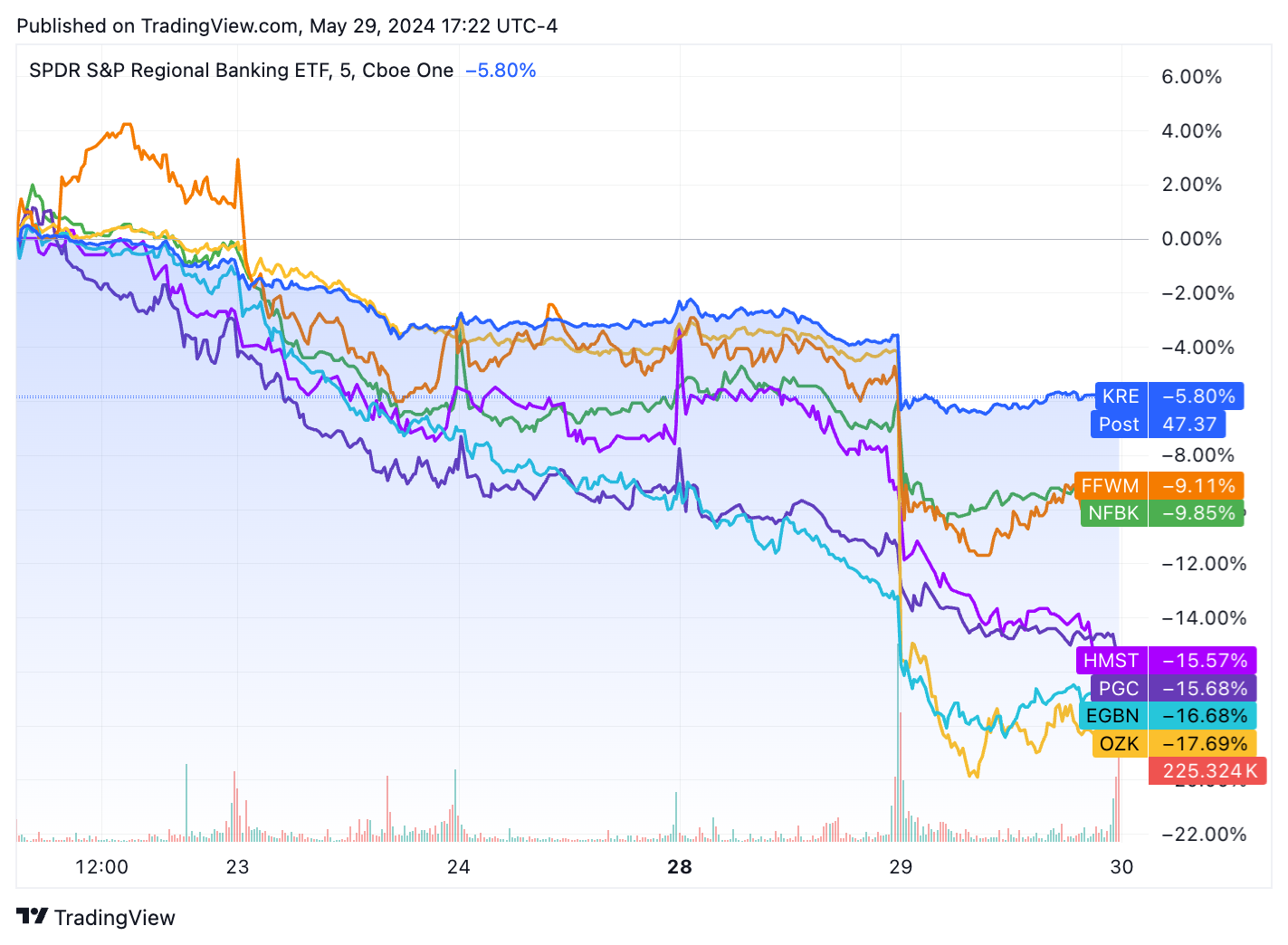

Down 580bps on the week for the index coming off a decent run up. It’s hard to see how we break out to the upside. I have maintained a light exposure to regionals since December of last year. Beneath the surface there are a few things going on that I figured I’d share.

The whole thing is trading on rates again. Long rates calmed down and now shot back higher and so we have the obligatory KRE sell off.

OZK - the fact that they haven’t come out and said anything I read as meaning a couple things. Number 1, they can’t refute the analysts point that the properties in question are seeing slower than usual uptake by tenants. Number 2, they probably don’t care and are used to this. I’m not saying I have a crystal ball, but they lend smartly. That doesn’t mean no losses, but things like this are part of the game. Now could they see increased reserves as a result of this? Sure. But they’ve also rallied 130% off the recent 2020 bottoms and has been volatile in general.

HMST - at this point I believe people are questioning whether or not this deal with FSUN gets done. If I’m FSUN, I’m absolutely thinking of ways to not do this deal at this point. A side note: it’s funny to me how commodity traders and farmers will hedge production to ensure profits but two big brain banks with all kinds of CFA investment bankers don’t think to themselves, “hey why don’t we throw an interest rate hedge on this thing in case rates go up?”

EGBN - easy to pick on for high CRE, relatively poor asset quality, thin margins, & high COF but at this point absent a bank run it’s hard to see how this isn’t cheap at 45% of TBV. The selling in this name has been fairly incessant. What is the bull case for a bank that no one really wants, that doesn’t perform well, and that has spotty credit already?

PGC - they’re kind of like EGBN’s little brother because the balance sheet feels the same. Less cheap at 69% of TBV, and again what is the bull case here?

FFWM - much worst from a concentration standpoint, but better from an NPL standpoint than the others. 34% of TBV they’re one of the cheapest in bank land. I feel like trying to bottom tick them, but I can’t get myself to do it. If I wanted duration, I’d just buy TLT.

NFBK - all of the same problems as the rest and sporting a 58% of TBV valuation. They must also be in some hedge funds short basket. I don’t know how you long them for anything other than a trade. They’re in jail with any deterioration in credit and higher reserves penalizing them even more.

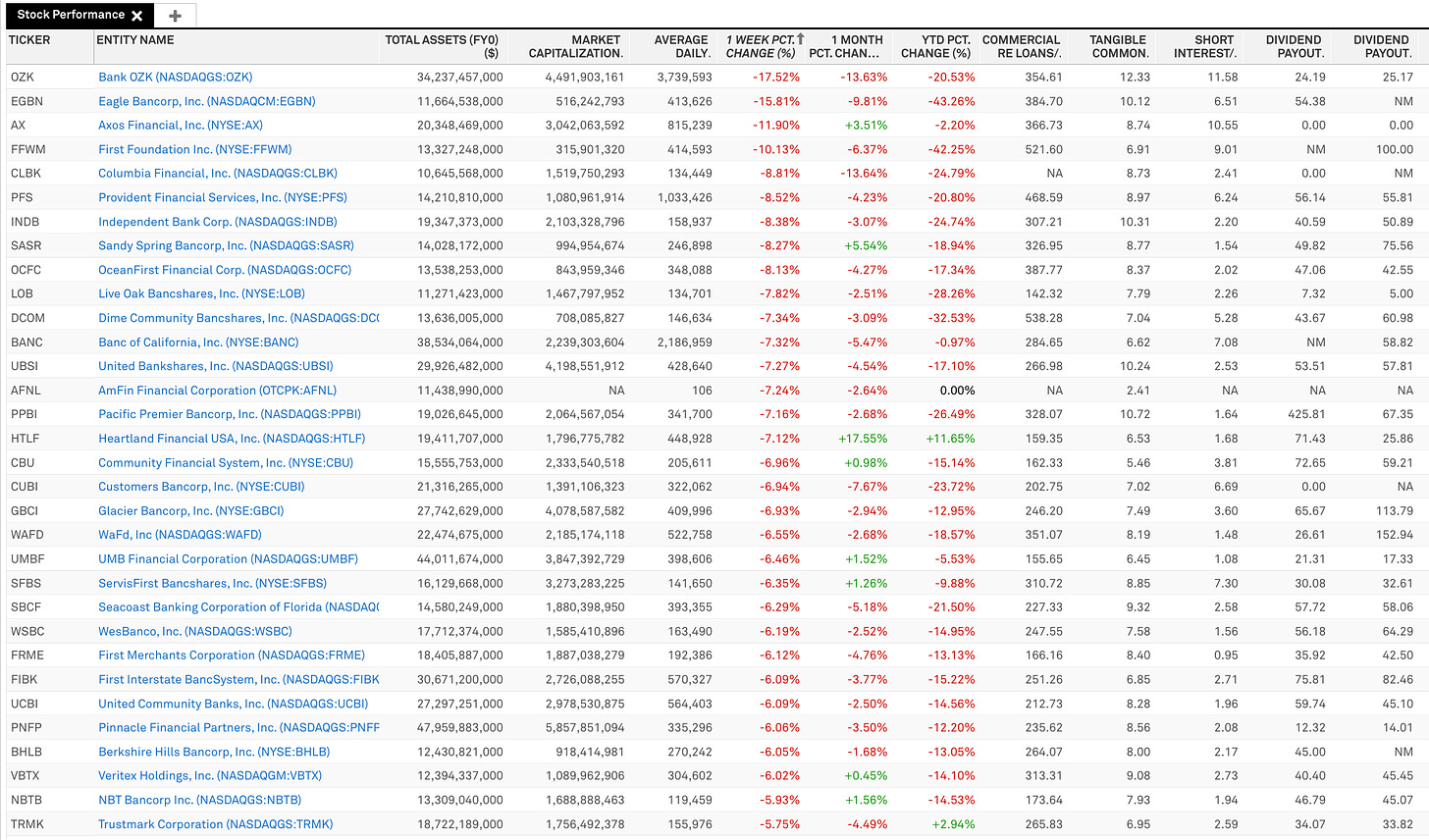

Worst On the Week

In regional land here’s the rest of the worst performers for the week.

Rather than spend a bunch of time looking for shorts I’ll be releasing my fundamental screen list. It is a way for you to orient to the entire universe of bank stocks and see who has performed the best from a revenue, EPS, and TBV/S standpoint. I find it a much better use of time to sift through good companies that may be on sale than bottom tick a trading range for a bad company. I know you all will enjoy it.

Gratefully,

Aurelius