European Bank Momo Report: Yes They're On Fire, Are they Blanket Buys?

Running a momentum screen in the spirit of the U.S. short report and an old growth framework

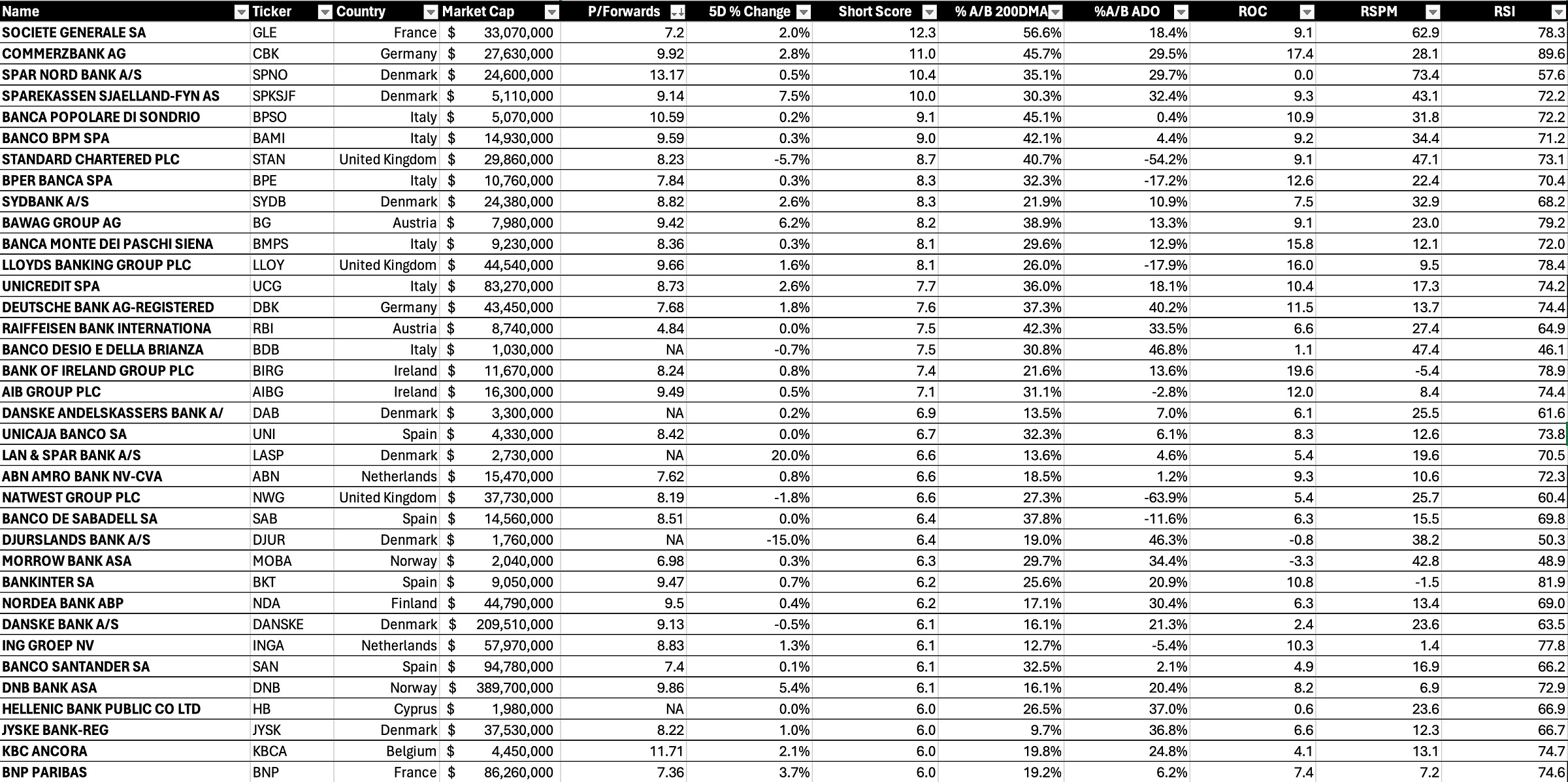

The European Bank Short Score: What You Need to Know

A day or two ago, I pointed out how U.S. banks were technically blown out in the Short Report. So, for kicks, I ran European banks through the same Short Score framework.

If you’re new here, the Short Score is a proprietary, absolute-based scoring system that evaluates a bank’s shorting potential. It blends key technical and fundamental indicators—price deviations from the 200-day moving average, rate-of-change (ROC), relative strength index (RSI), and other momentum signals like ADO (heavy short-term indicator). Each metric gets weighted, and the final score is calculated on an absolute basis, ensuring consistency across different market environments.

Higher Short Score = weak technicals/fundamentals → stronger short candidate

Lower Short Score = strong technicals/fundamentals → weaker short candidate

No region-based tweaks, no subjective adjustments—just a clean, standardized way to compare shorting opportunities across the banking sector.

Disclaimer: Euro banks are not a blanket buy. I repeat, this is not a YOLO bull call.

U.S. Banks: Danger Zone

When I ran this on U.S. banks, the numbers were screaming—scores in the 50-140 range. A contrarians dream. Dancing on the 200DMA as an index, but some names seriously damaged. They are listed and you can read it here if you missed it:

U.S. Bank Short Score

European Banks: Not Even Close

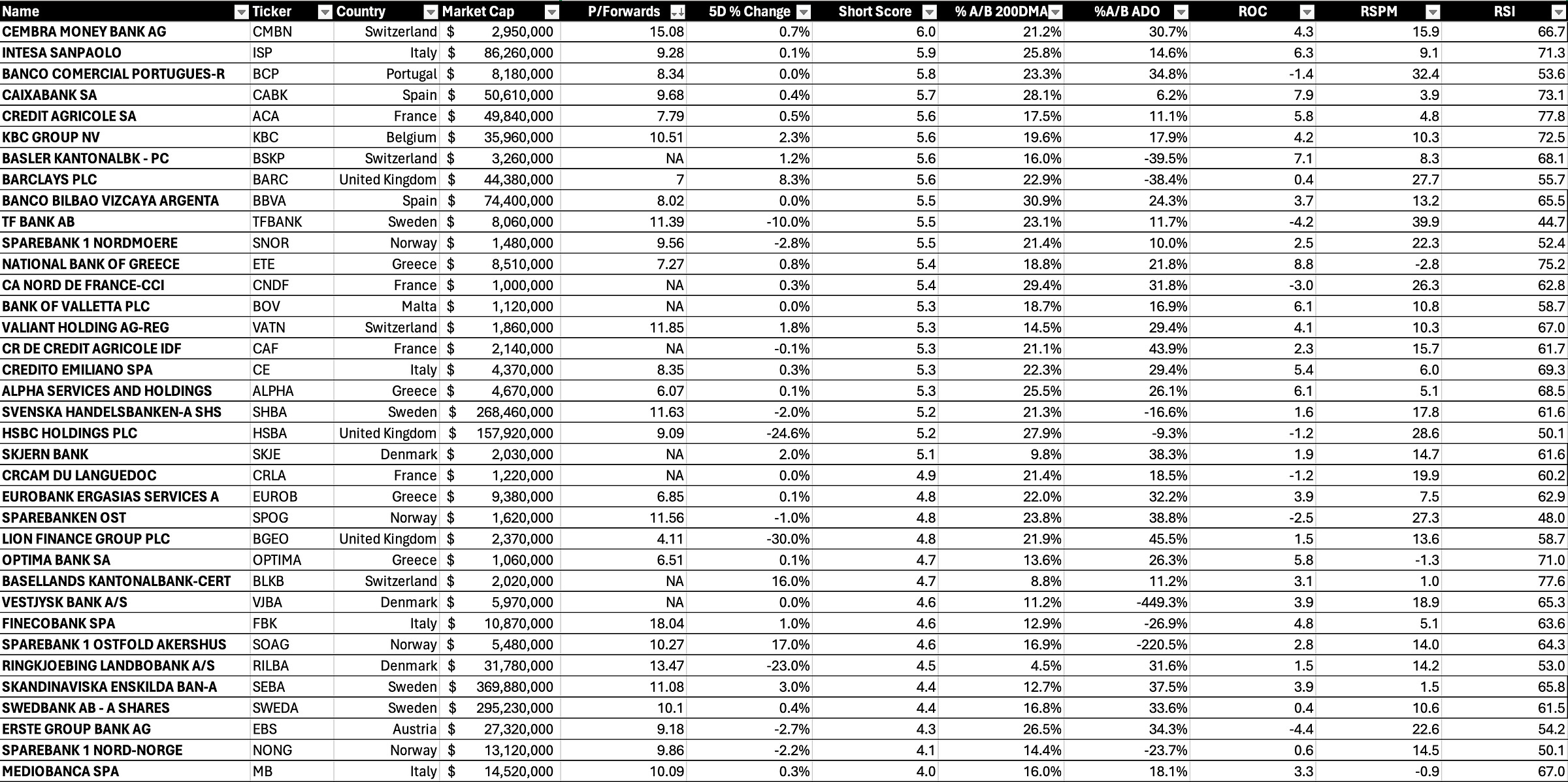

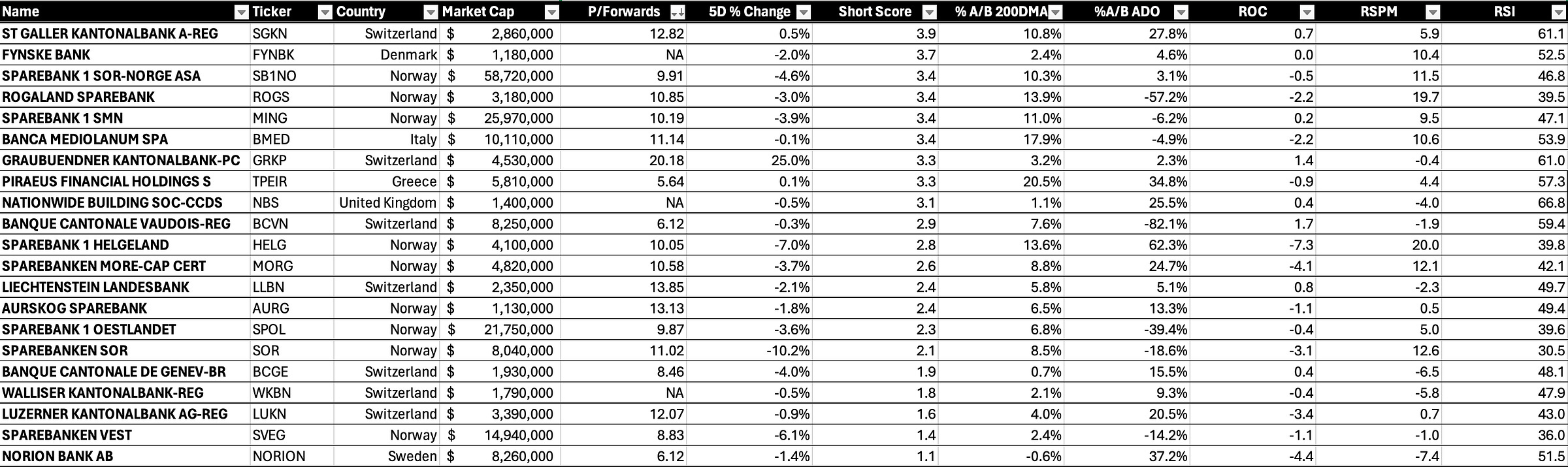

Now the European banks? 5-15 range.

Technically, they’re on fire. No shorts here. If anything, these scores highlight who’s strong, well above the 200DMA, attracting big money, and riding serious momentum.

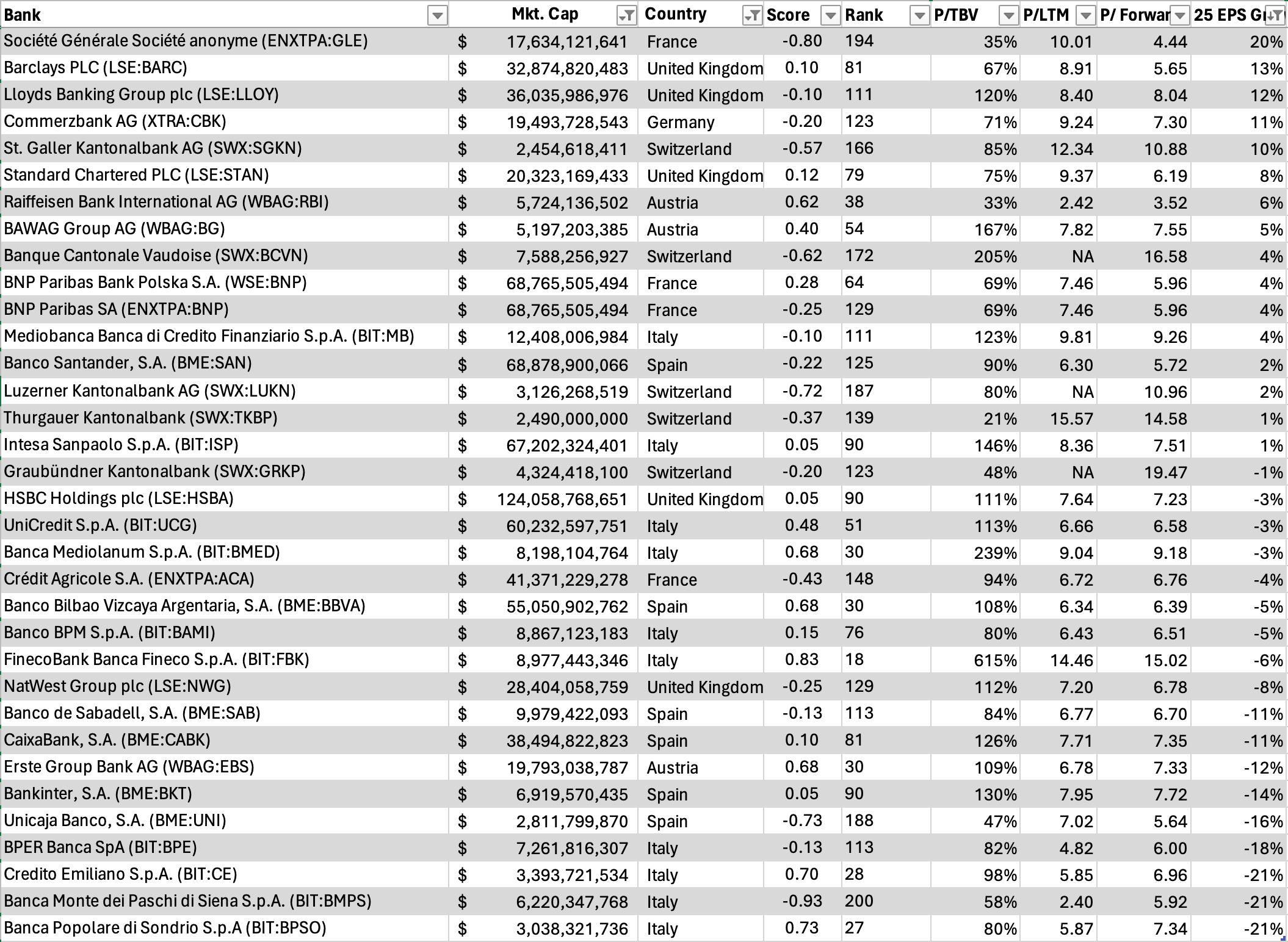

Here they are below. Remember all of these are momentum buys, but they are ranked in terms of highest score to lowest, but again, riding high above 200DMA, institutional buying, absolute and relative momentum, and high RSIs.

You can use this to find your favorite Euro Bank (some of you are like who is this sicko that has favorite Euro Banks), and see the momo behind it. I’ll also call how how absolutely cheap these are.

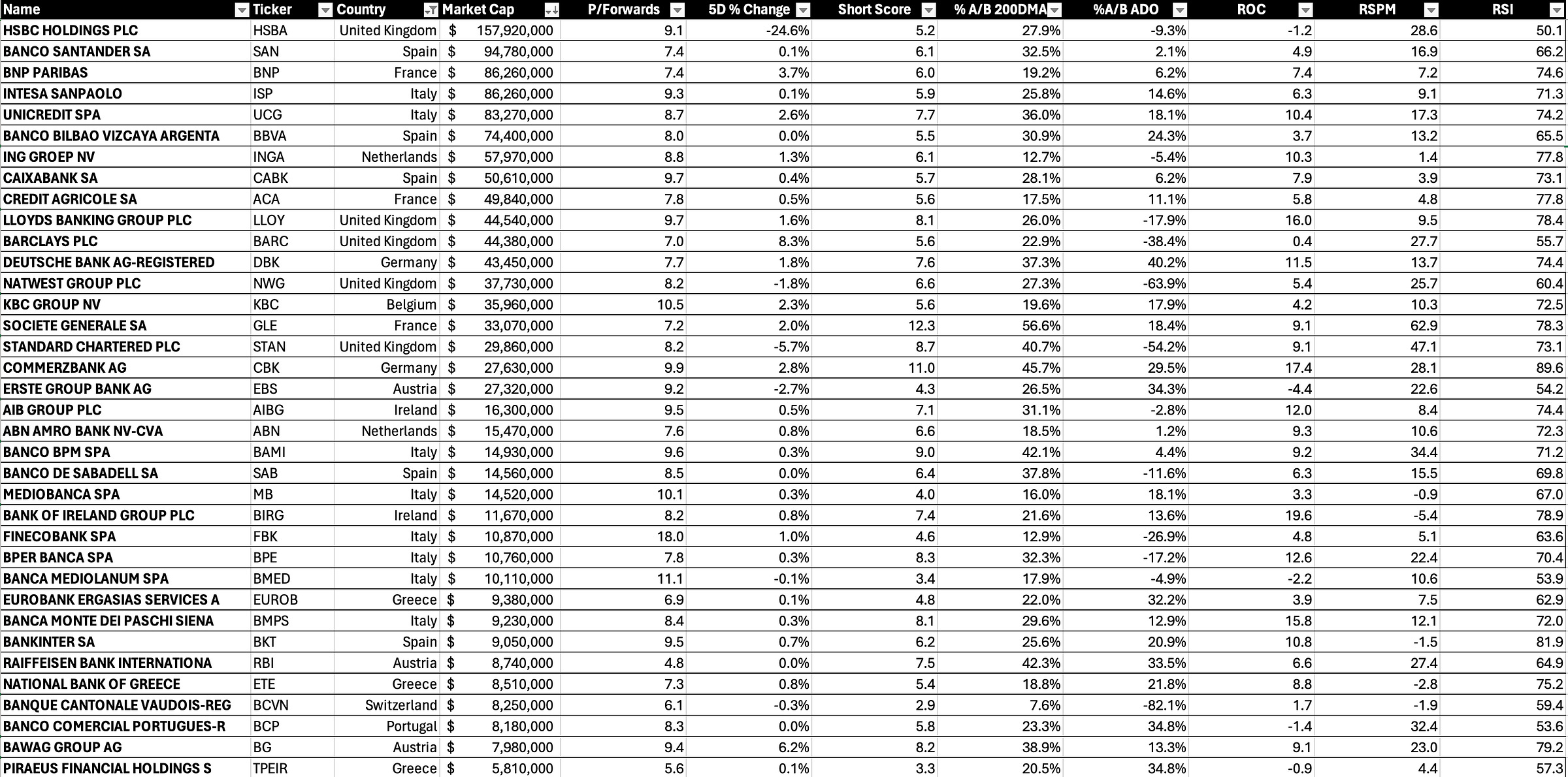

Largest Market Cap (Euro Majors - No Nordics)

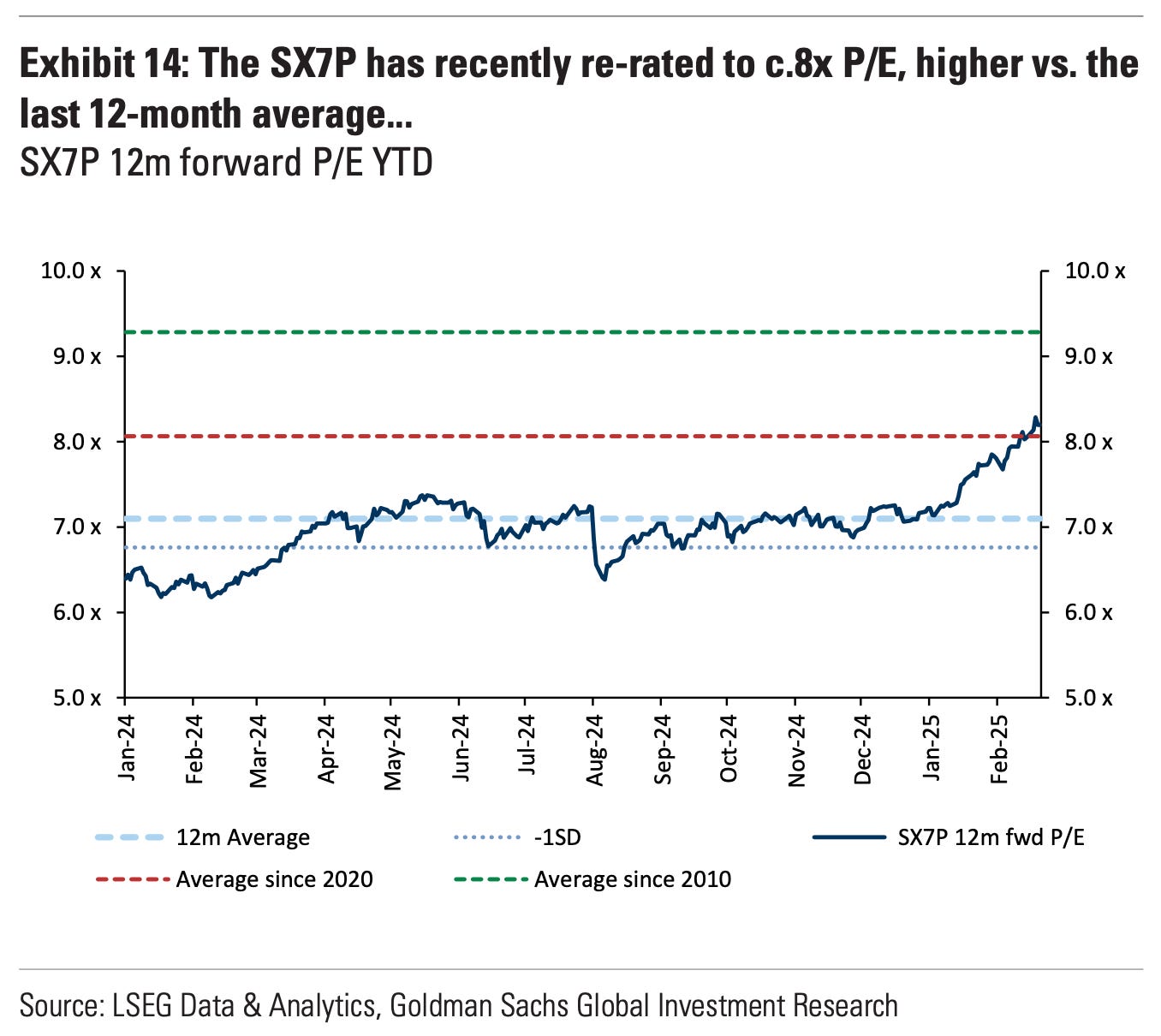

With regard to the absolute cheapness, take a look at the Euro Bank index absolute pricing, a massive multiple re-rate, but still historically cheap.

Market Cap, Growth & "Cheapness" in October?

You might be wondering, how did I see this coming? Simple—I also run a Relative Growth Score screen.

This measures growth in Revenue per Share, Earnings per Share, and TBV per Share over select time horizons. The premise? Banks that consistently grow these metrics accumulate shareholder value over the long run. Layer in valuation (how rich or cheap they are), and suddenly, you’ve got a real thesis for making money.

I ran this in October, saw what the numbers were saying, and thought:

"If 2025 EPS is anywhere close to estimates, why is no one talking about this?"

The (Almost) Clairvoyant Call

Look—I’m not psychic. But I do know when something is fundamentally cheap with strong growth (God, I sound like a value investor). The setup was there. And the performance? Massive. BARC.LN has been a favorite and was added.

I personally didn’t buy GLE.FP—but congrats to those who did. Absolute stunner of a call by Bill McGill (follow him on X).ollow Bill McGIll on X

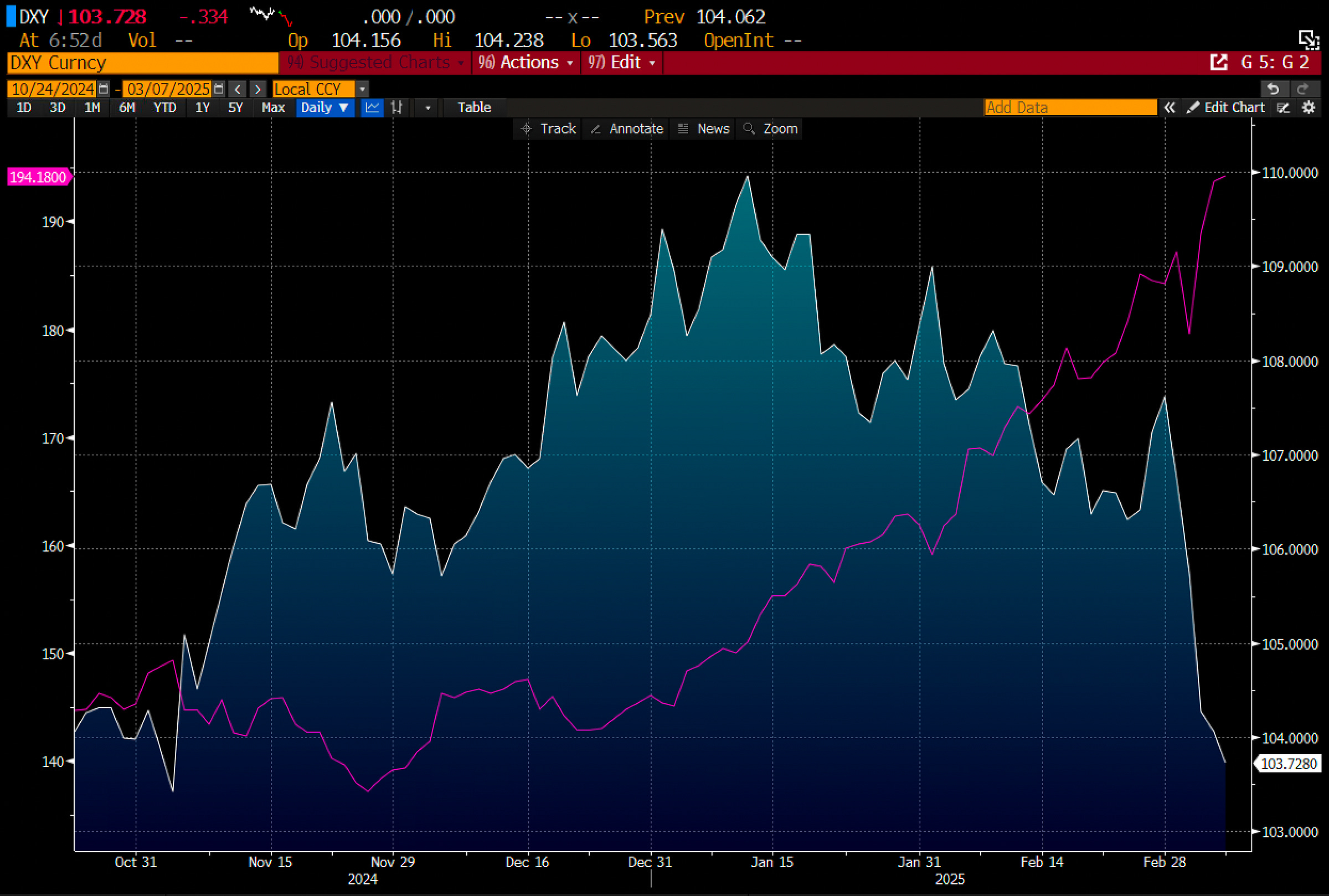

The Trump Effect & The Weak Dollar Unwind

Let’s not pretend this rally is just fundamentals. The recent run-up has been fueled by a weak dollar unwind—something I wrote about in the last two reports. Flows are shifting. Money is moving. The world is broadening out.

And yes, Trump wants lower rates and a weaker dollar—that’s not a mystery. But let’s be clear: European banks were rallying well before the dollar started breaking down.

I have zero clue what the future holds. Trust me.

I do know that there are good set ups and bad set ups. Your job (and my job) is to sift the signal from the noise and see where money is flowing, what’s cheap, and what presents a nice little future opportunity for gains.

I’d encourage everyone to brush up on this one:

The Takeaway

U.S. banks? Overextended. Technicals stretched. Short Scores flashing red. If you’re long, be careful. If you’re short, the setups are there.

European banks? Absolute strength. Low Short Scores. Heavy momentum. Big money is here, and the tape confirms it—these are not short candidates.

Big picture? This rally wasn’t built on fluff. Fundamentals kicked it off. The weak dollar just threw fuel on an already burning fire. Smart money saw it early.

Not a blanket buy. Disclaimer again, not a blanket buy. Think for yourself. But look at what the numbers are telling you.

The Lesson

Markets reward those who think independently, focus on signals, and act before the crowd catches on. The biggest moves don’t start with headlines—they start with fundamentals, momentum shifts, and liquidity rotation. By the time everyone’s talking about it, the real money has already been made.

Most investors chase narratives. They react instead of anticipate. But the best trades? They come from understanding what actually moves stocks—earnings growth, valuation dislocations, technical strength, and institutional flows. Not opinions. Not noise. Just data.

That’s why process beats prediction. Having a repeatable framework—one that cuts through emotions and hype—is how you build an edge. Spot the patterns, follow the numbers, and when the market shows its hand, have the conviction to act.

Because at the end of the day, the market doesn’t reward hesitation. It rewards preparation.

The best is ahead,

Victaurs