Cash Is Dead: Inside the $32 Trillion Payments Ecosystem

Meet the companies shaping the future of money: giants, challengers, and niche disruptors poised to be the biggest winners in the cashless revolution.

Many of you know me as a bank bro. Slow. Boring. Sleepy.

Profitable?

Yes.

But sleepy.

And for the most part I’ve written about banks. But that’s not all I invest in. And so I want to walk you through a space getting more of my attention. Fintech & payments.

And when you think about it, there’s a financial matrix growing beneath your feet, and most people have no idea how massive it is. Payments and fintech are no longer just "financial services." They are the infrastructure that moves the world. Every second, billions of dollars flash through digital plumbing, powering commerce across continents, from billion-dollar corporations to a kid buying candy with a tap of their phone.

Fintech & payments companies are the disruptors. They’re trying to swallow banking. They’re making in roads on disrupting lending. They’re rewriting the rules on how money moves, how businesses transact, and how consumers spend.

I’ve always been bullish on the space, owning things like NU in Brazil, SE out of Singapore, AXP here, and plenty of others.

And in a world where Trump and crew want to take back some of the financial oversight powers that agencies like the CFPB had, I think it merits all of our attention to review the landscape.

But first …

Growth Is the Only Metric That Matters

If you’re looking at fintech and payments companies and focusing on bottom line earnings, you’re missing the point. Mature banks can be judged on profitability, but payments companies? They live and die by top-line growth.

Revenue. Gross merchandise volume (GMV). Transaction growth. These are the numbers that matter.

Payments companies are network businesses. The more transactions they process, the more revenue they generate. The more merchants they onboard, the stronger their network effect. Scale leads to dominance. Dominance leads to profitability. But growth comes first.

Think of these as Amazons. The power in the company is in their ability to grow a network to monetize later.

Or for those of you value bros that are John Malone fans, think of these companies like TCI back in the day. Accruing a ton of value via amassing a huge network, but not showing bottom line profitability.

This is the lens through which you must view payments and fintech stocks.

15 Companies Leading the Future of Payments

Rather than depth, I wanted to give you all some breadth first. Think of it as a 30,000 overview. So here are some of the companies you need to know about in payments & fintech.

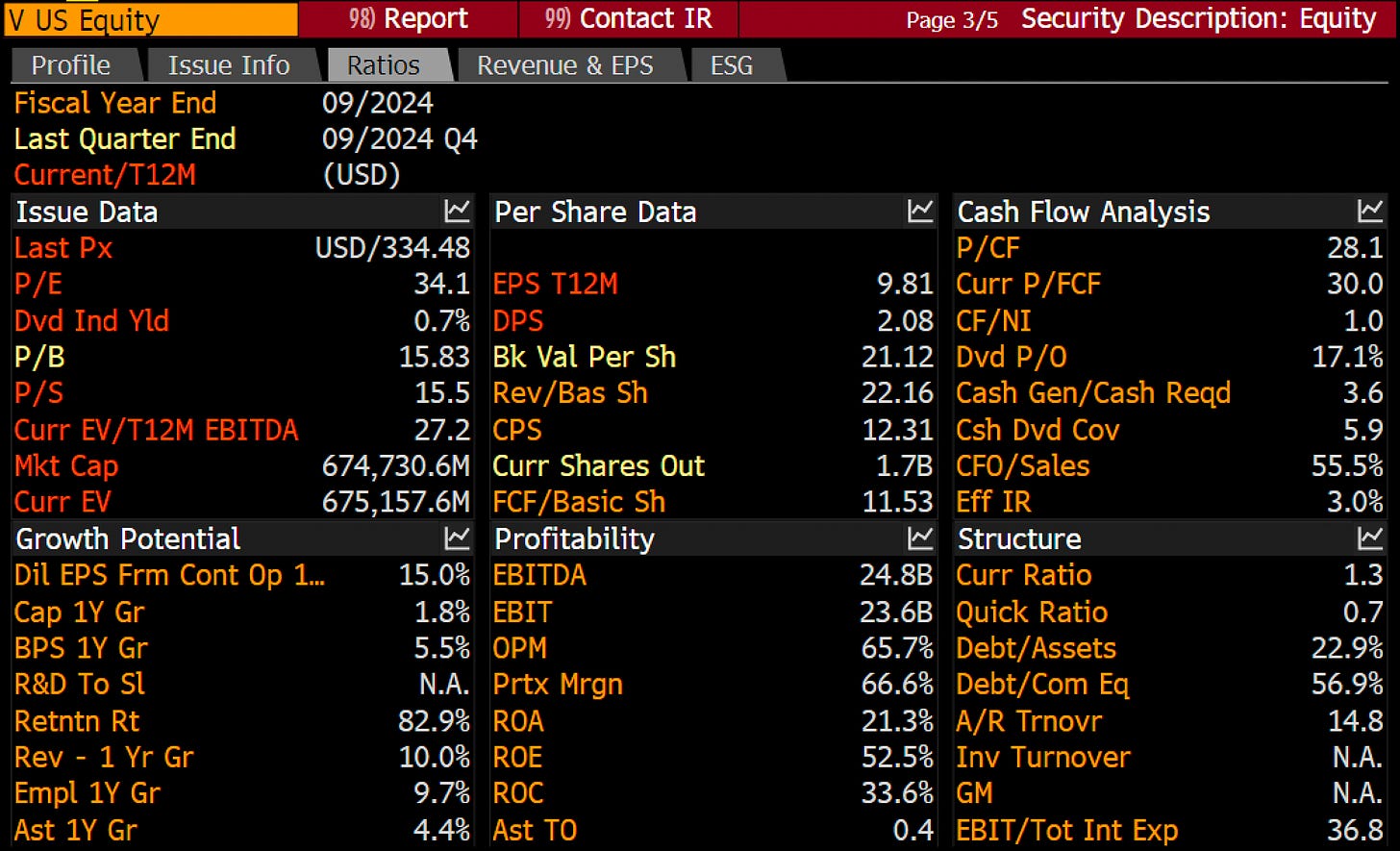

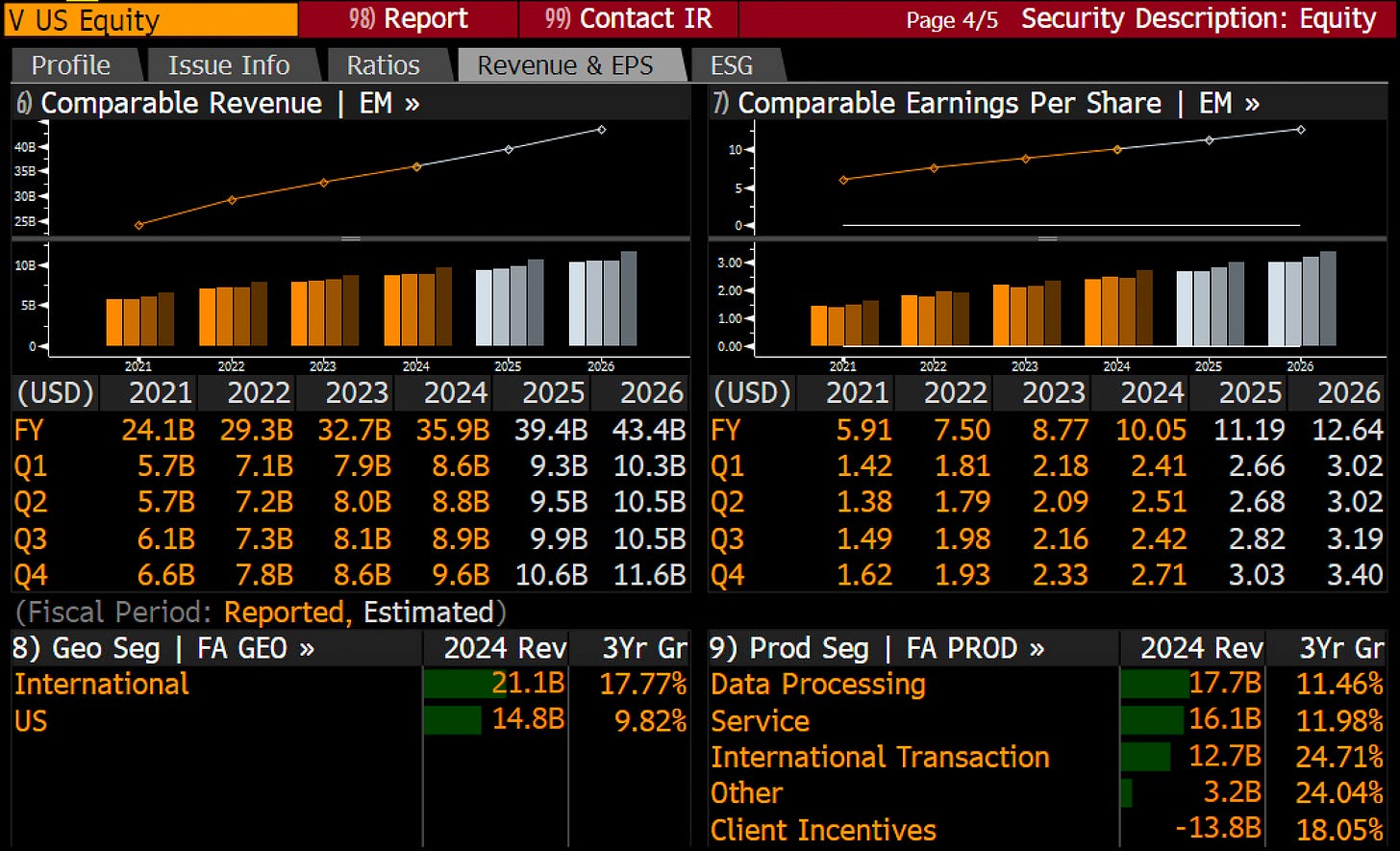

1. Visa (V) – The Indispensable Giant

The undisputed leader. Visa processed over 192 billion transactions last year, cementing itself as the backbone of global payments. Its cross-border volumes grew 12%, a strong signal of continued expansion. Plus they just announced a partnership with X to partner on their first payments platform. Up about 23% over the past year, nothing to write home about.

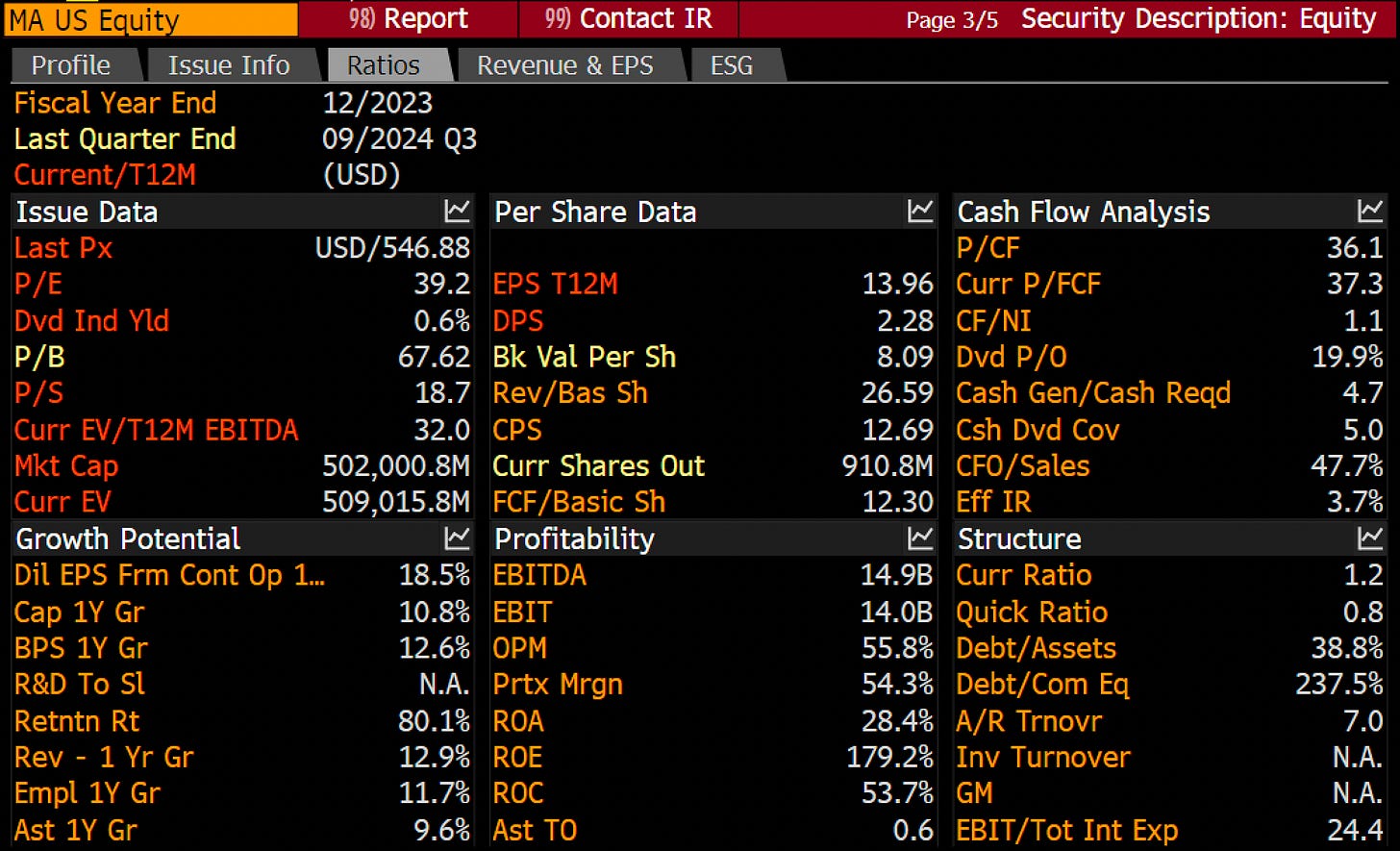

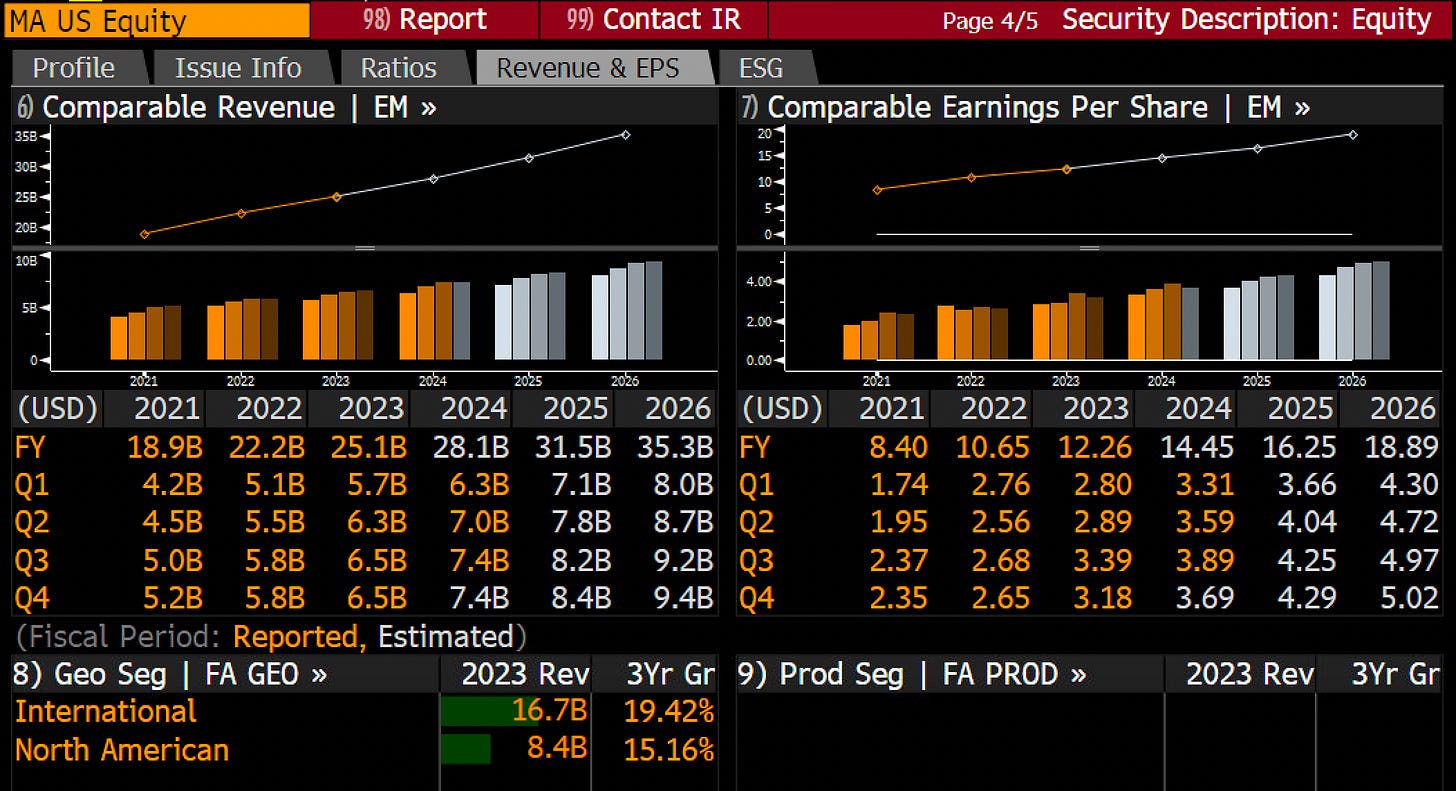

2. Mastercard (MA) – The Cross-Border King

Mastercard is growing faster than Visa, with projected 12% organic revenue growth in FY25. Its cross-border transactions surged 16%, proving its edge in high-margin, global commerce. Up about 25% over the past year MA has kind of been a SPY or QQQ surrogate return wise. Interesting international play.

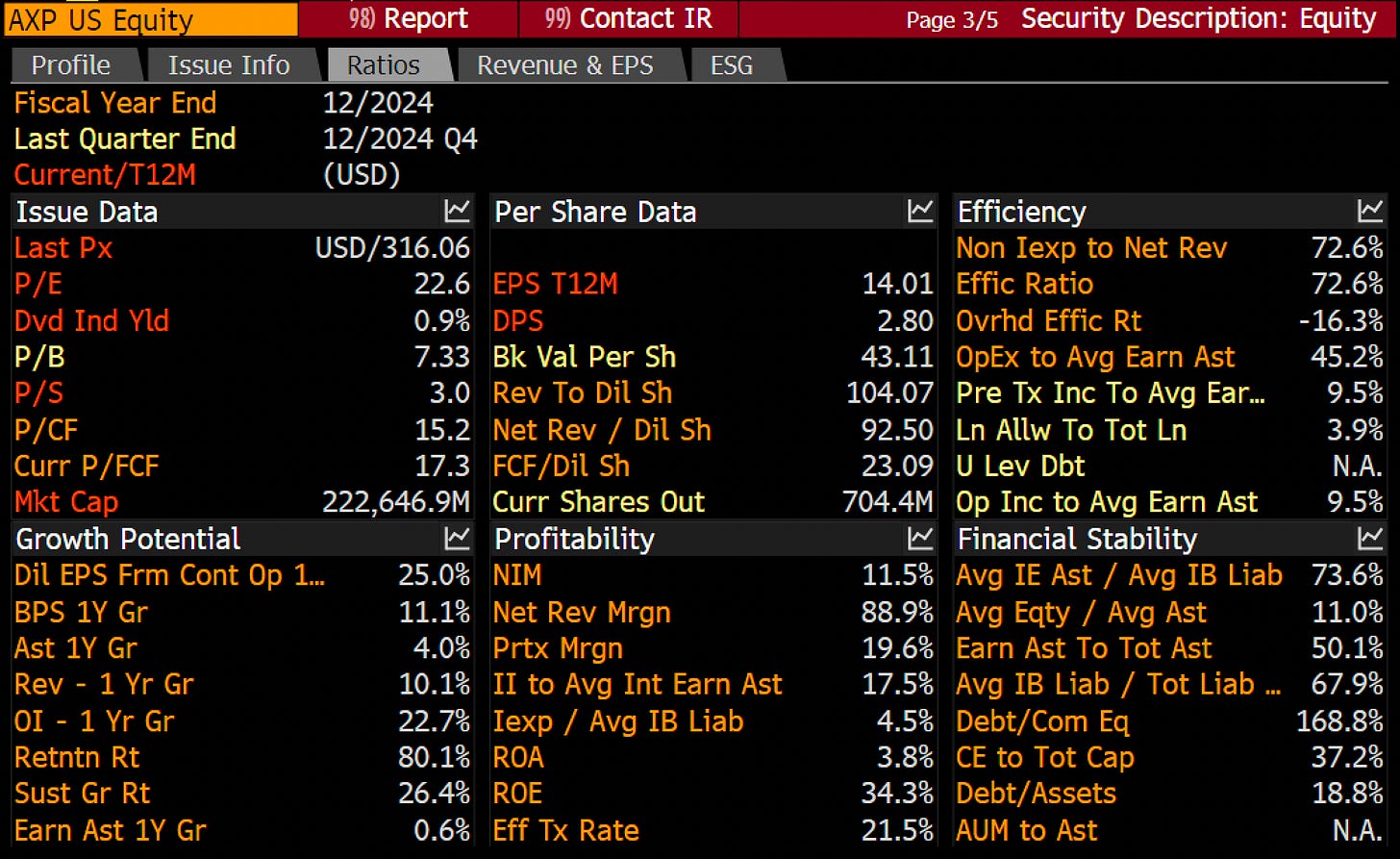

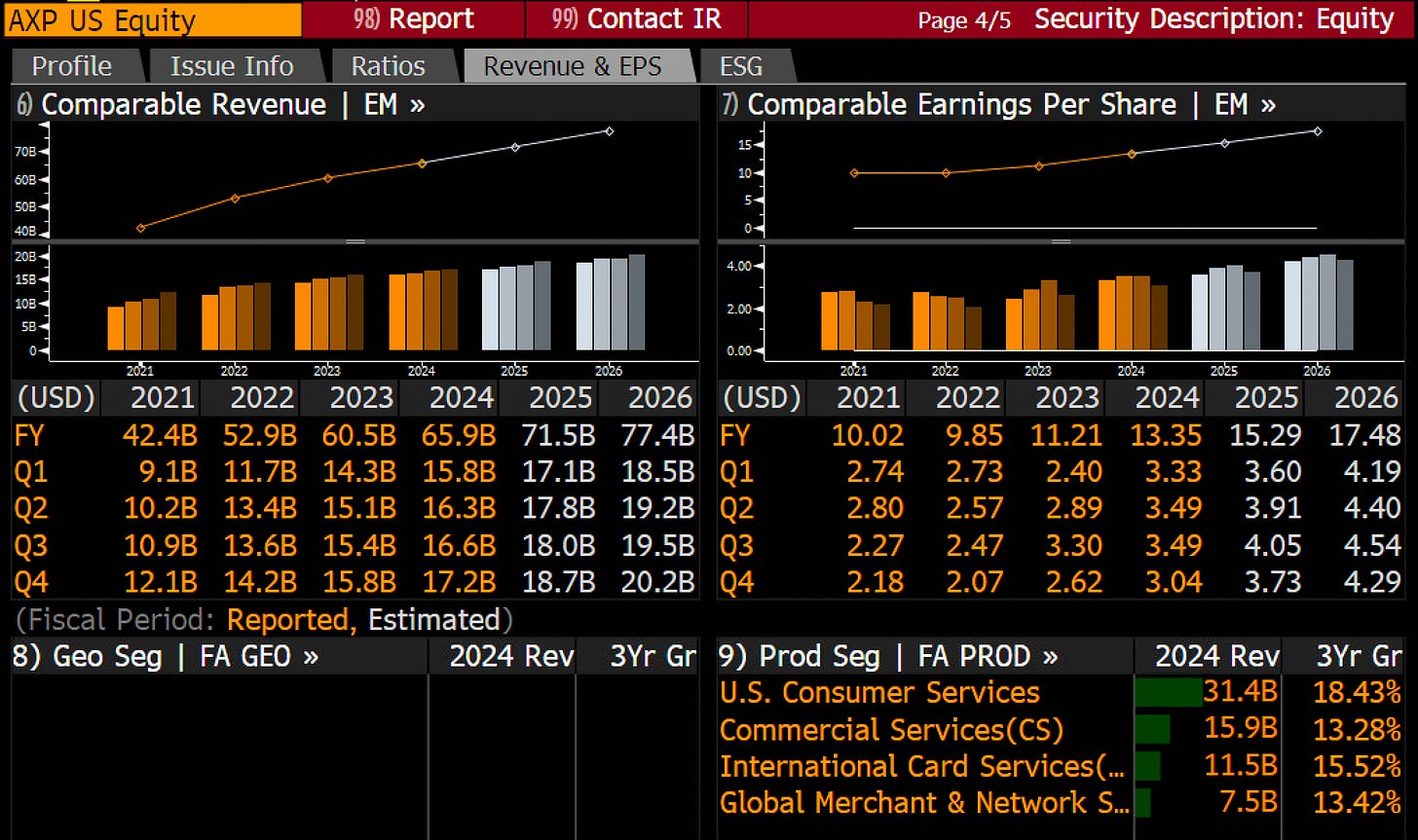

3. American Express (AXP) – The High-Spending Powerhouse

Amex isn’t for everyone, and that’s the point. Its high-end customer base is its moat. Revenue jumped 15% in FY24, fueled by a rebound in travel and luxury spending. AMEX has been pretty strong, up about 60% over the past year, haters are saying the top 25% of spenders have to stop rage spending. To be determined.

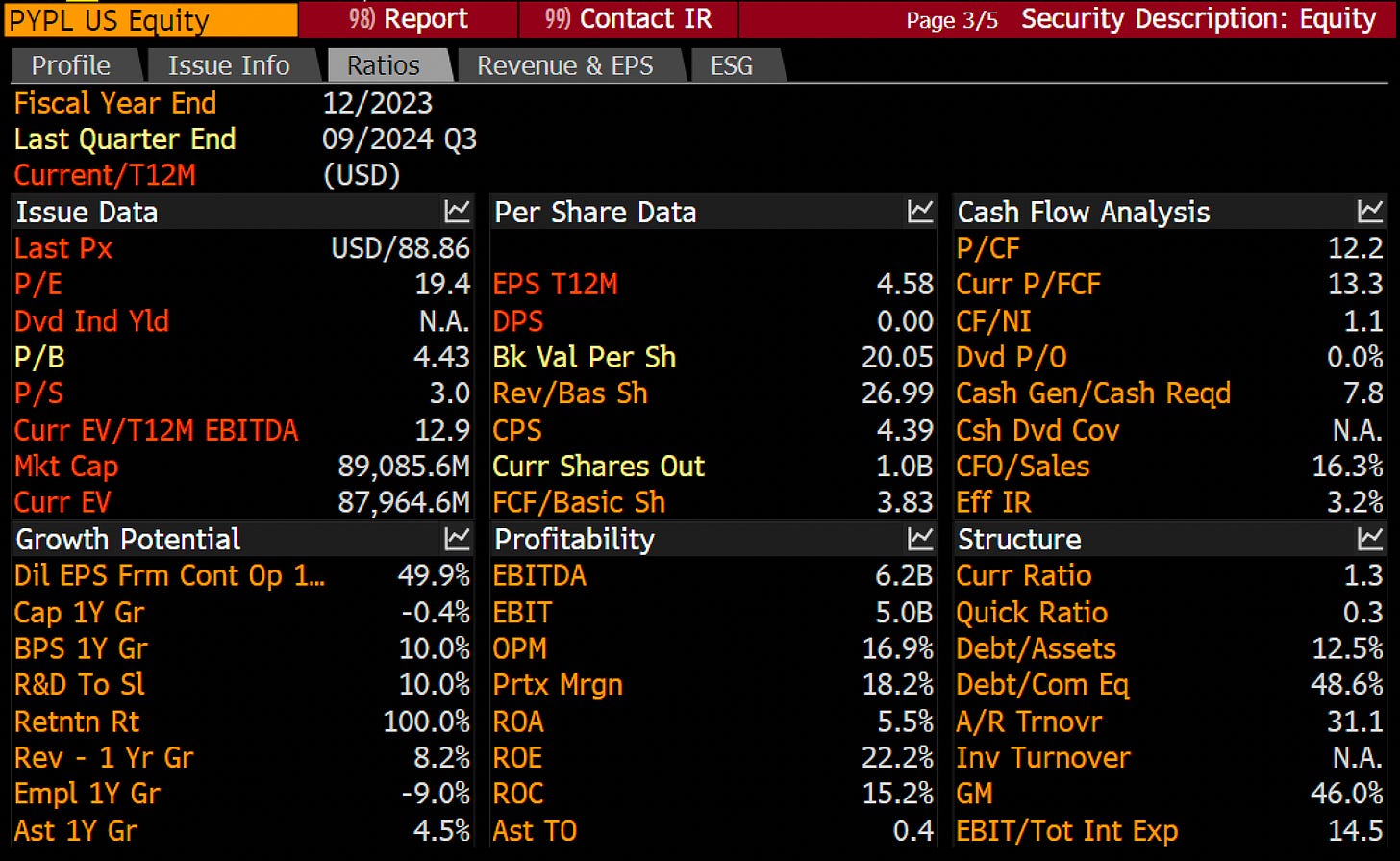

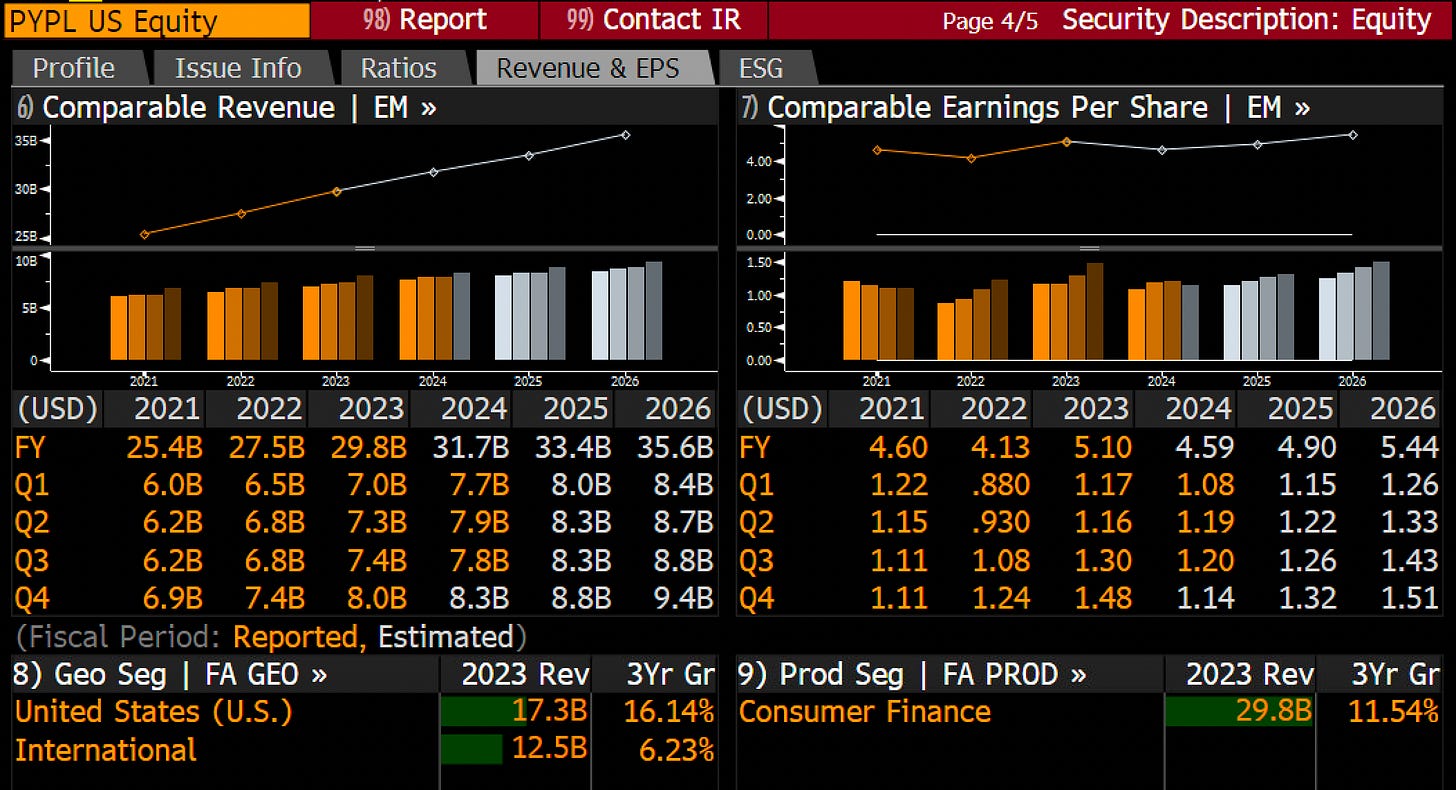

4. PayPal (PYPL) – Digital Wallet Domination

PayPal has over 430 million active accounts, making it the most widely used digital wallet in the West. Despite slowing user growth, its BNPL segment and Venmo adoption keep it a fintech powerhouse. PYPL has been an outperformer, up 40% over the past year. This one is interesting to me.

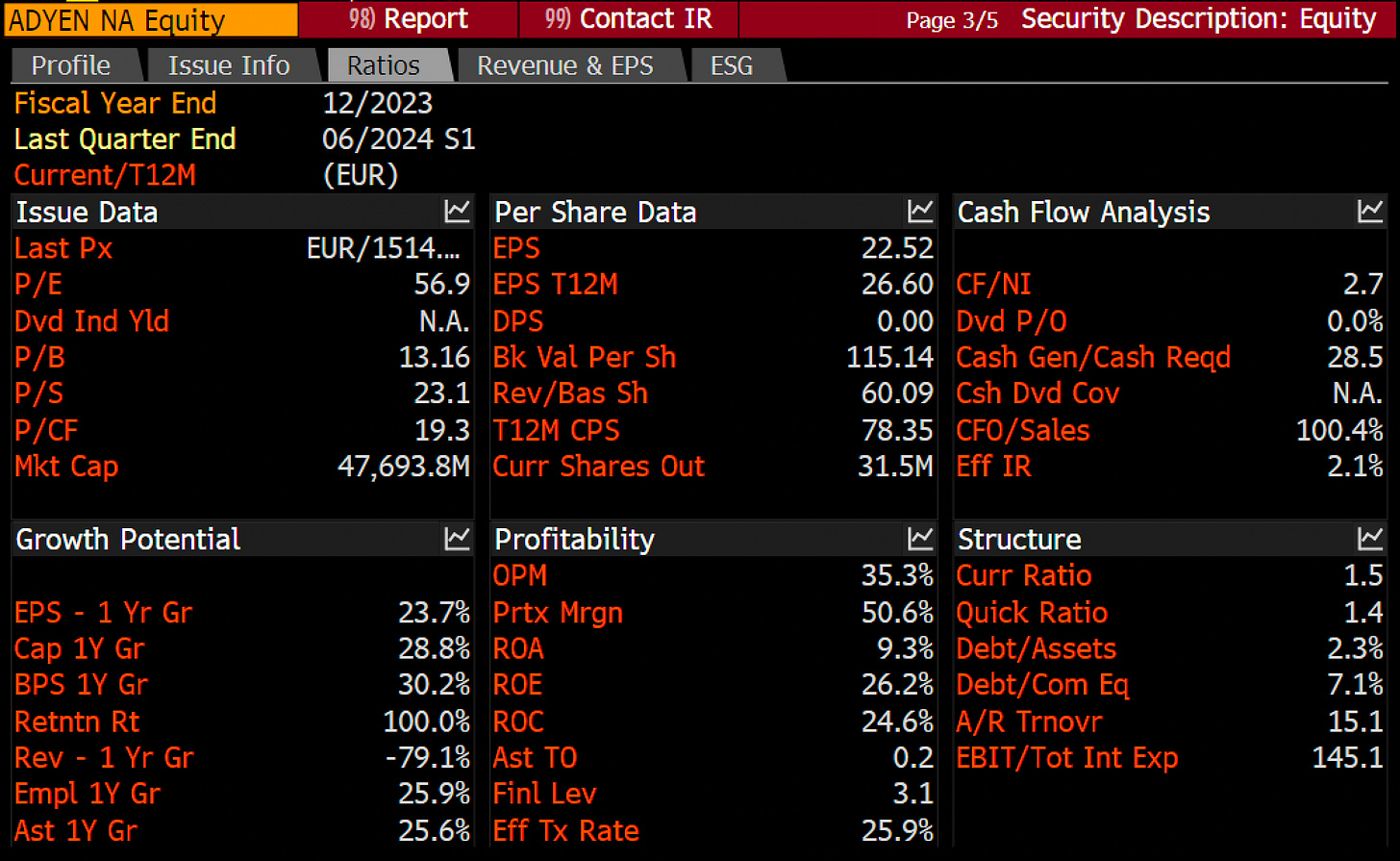

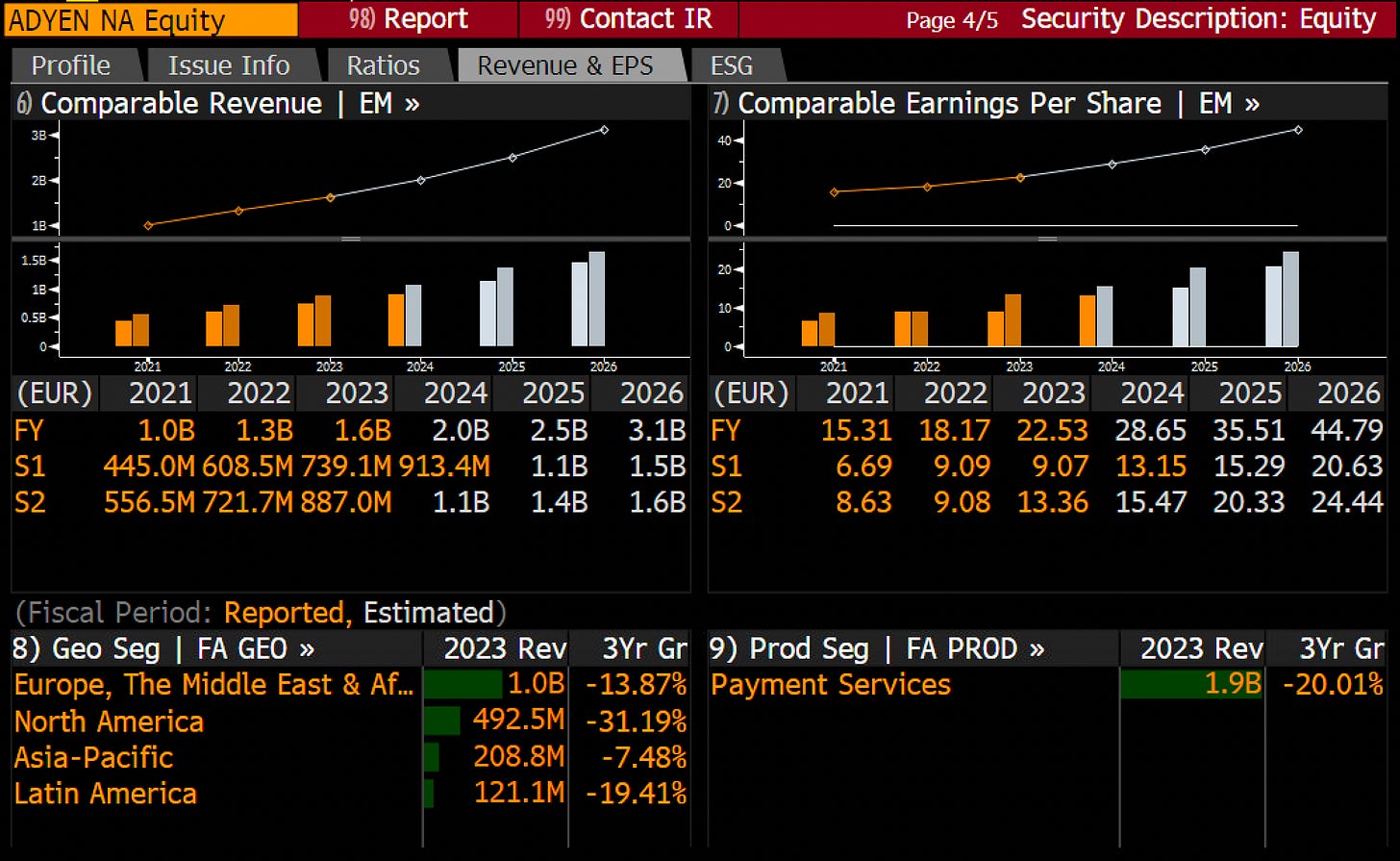

5. Adyen (ADYEN.NA) – The Enterprise Payments Machine

Merchants love Adyen. Companies like Spotify, Uber, and Microsoft trust it for seamless, global transactions. Revenue is growing at a 25% CAGR, with EBITDA margins projected to exceed 50% by 2026. Adyen is another more or less performing in line with the space over the past year, up just shy of 30%.

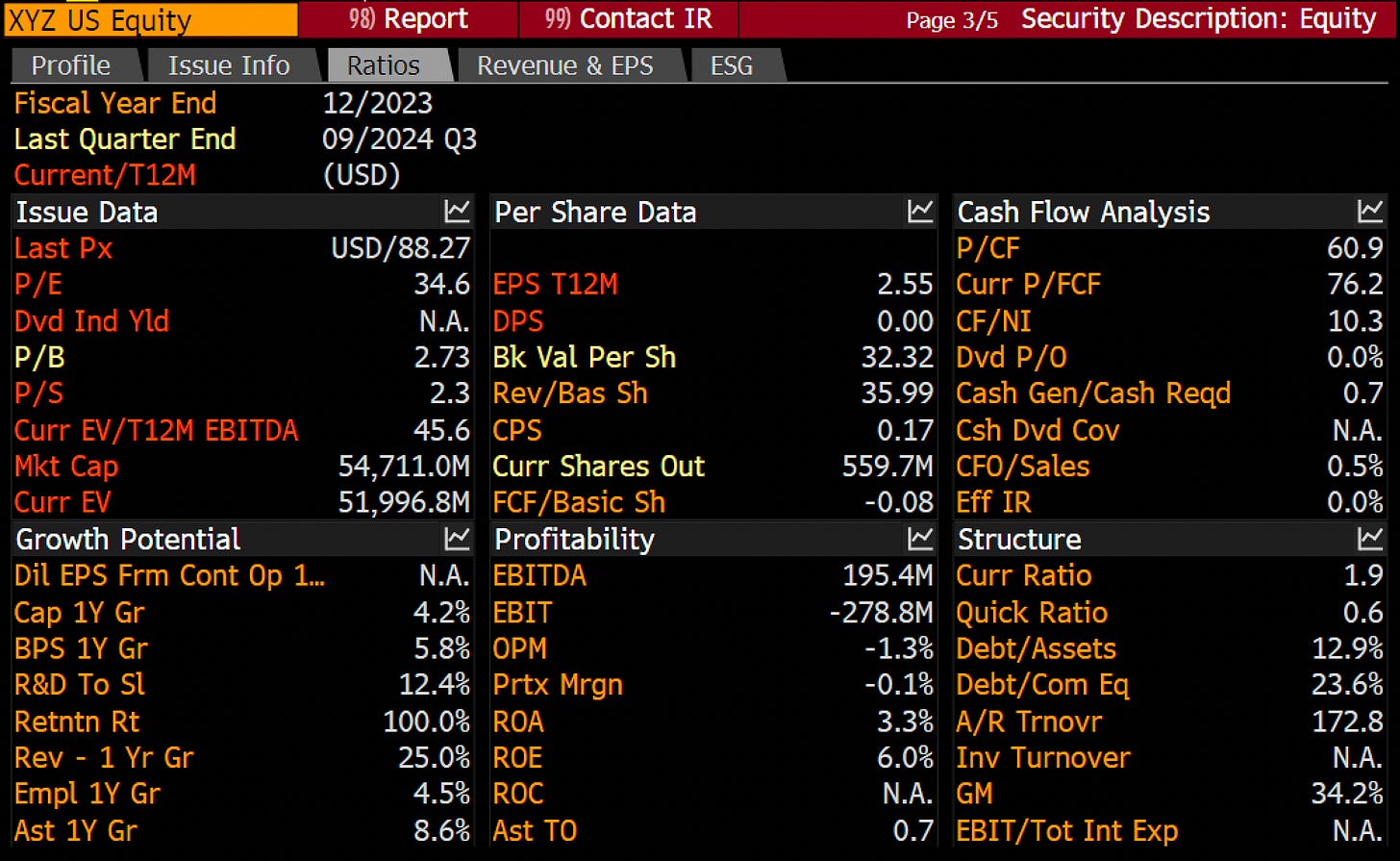

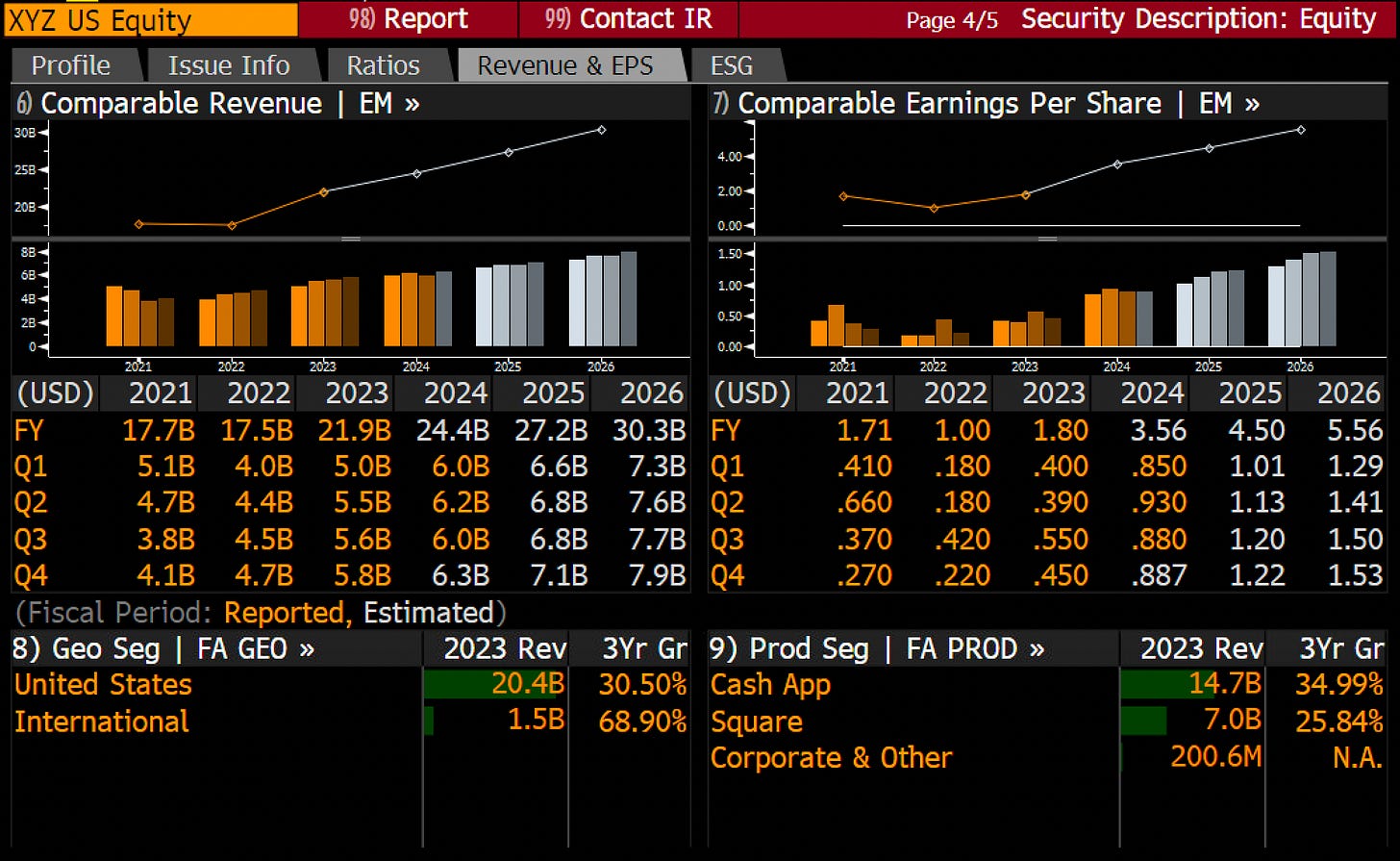

6. Block (XYZ) – The Financial Super App

Square built a business serving SMBs, but Cash App is the real growth engine now. It’s evolving into a financial super app, integrating payments, banking, and crypto. Revenue is projected to grow 15% annually. Block has been basically the same as owning QQQ and some of the majors over the past 12 months, sitting right at 29%.

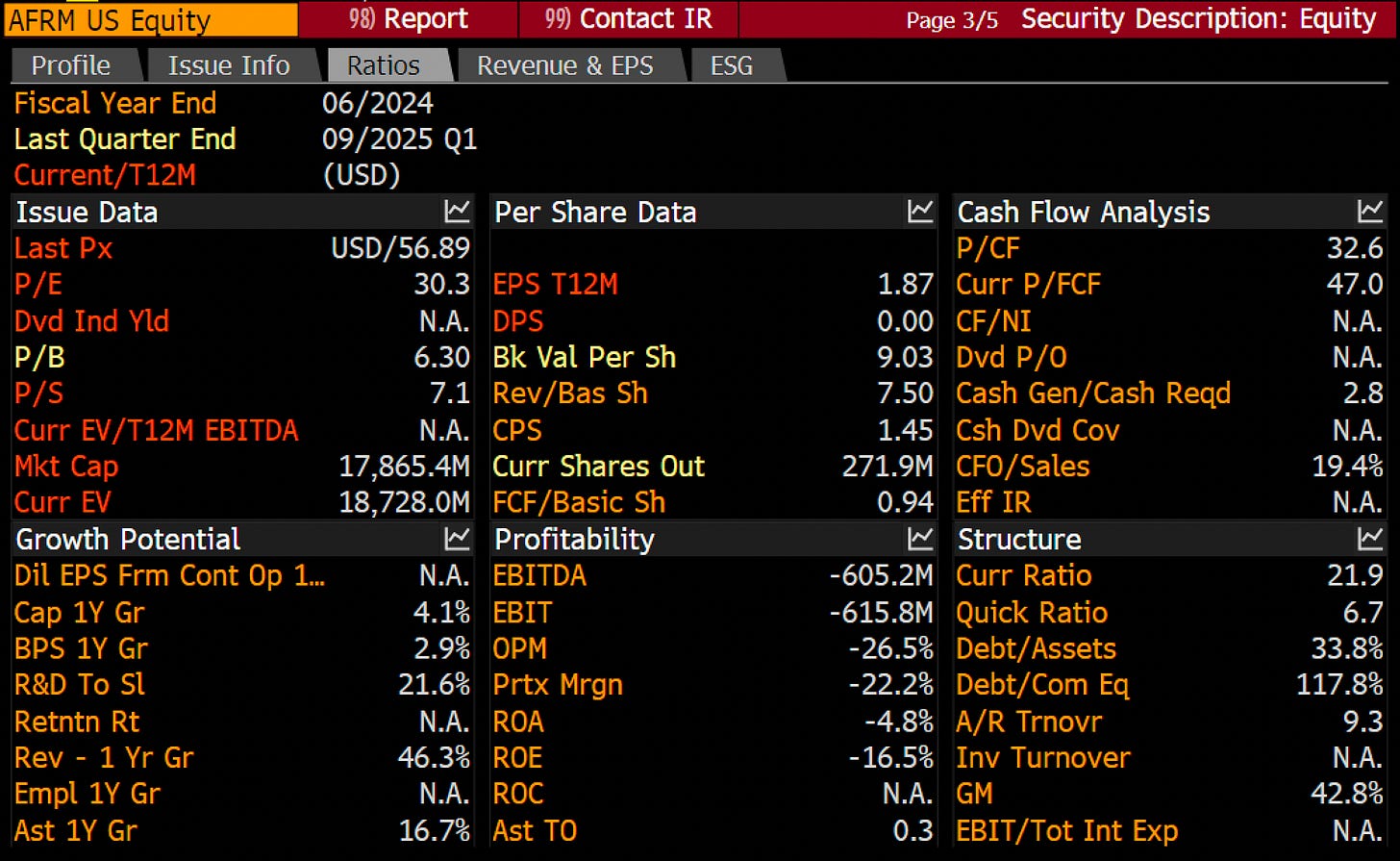

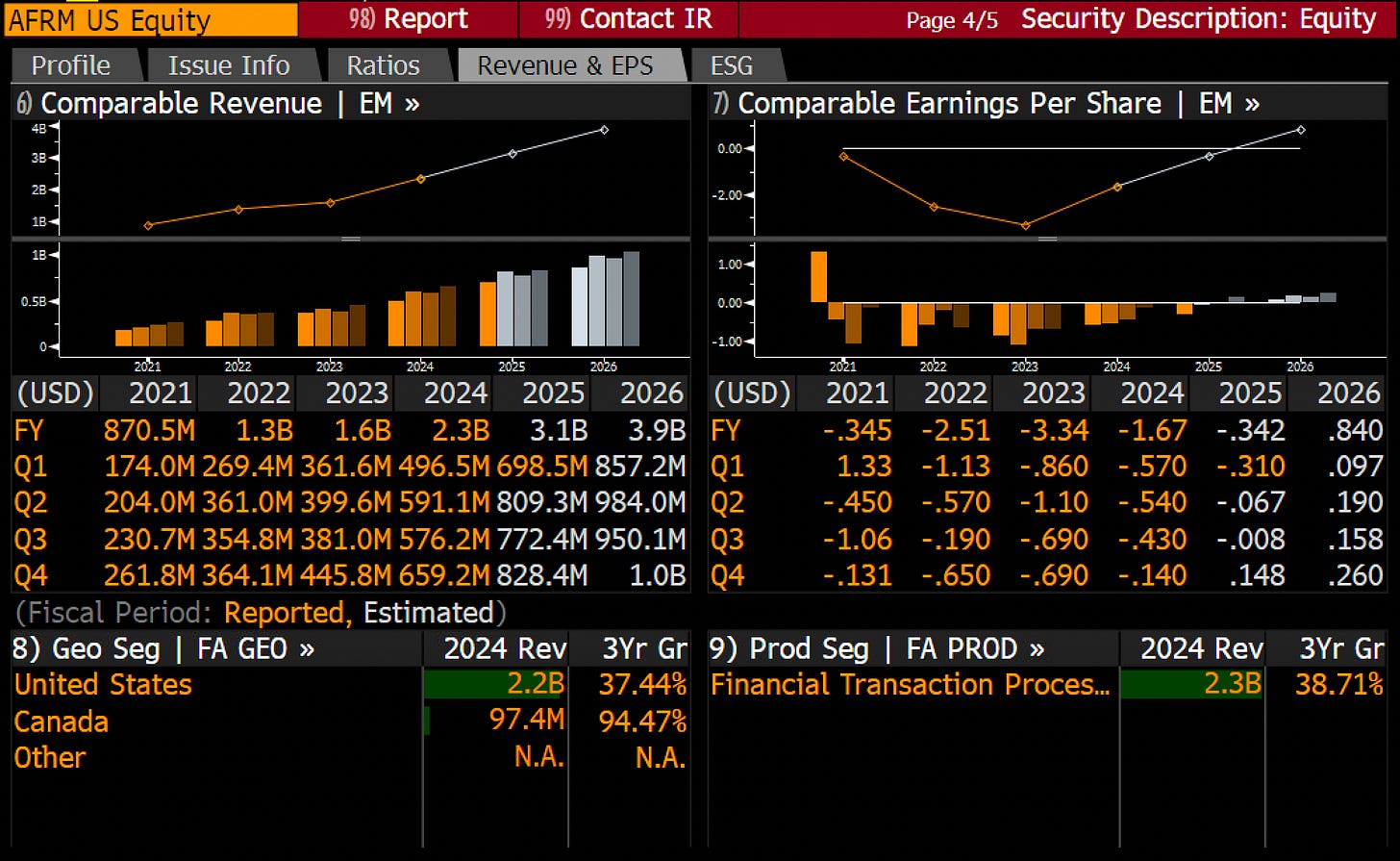

7. Affirm (AFRM) – The BNPL Pioneer

Buy Now, Pay Later is booming and Affirm leads the pack. With 30% GMV growth expected in FY25, it’s expanding through partnerships with Amazon and Shopify. Over the past year AFRM has been strong, but it sold off a bit recently in the end of 2024. Up about 32%, BNPL is always nerve wracking due to its cyclicality, but there is a tidal wive of people choosing BNPL over traditional means.

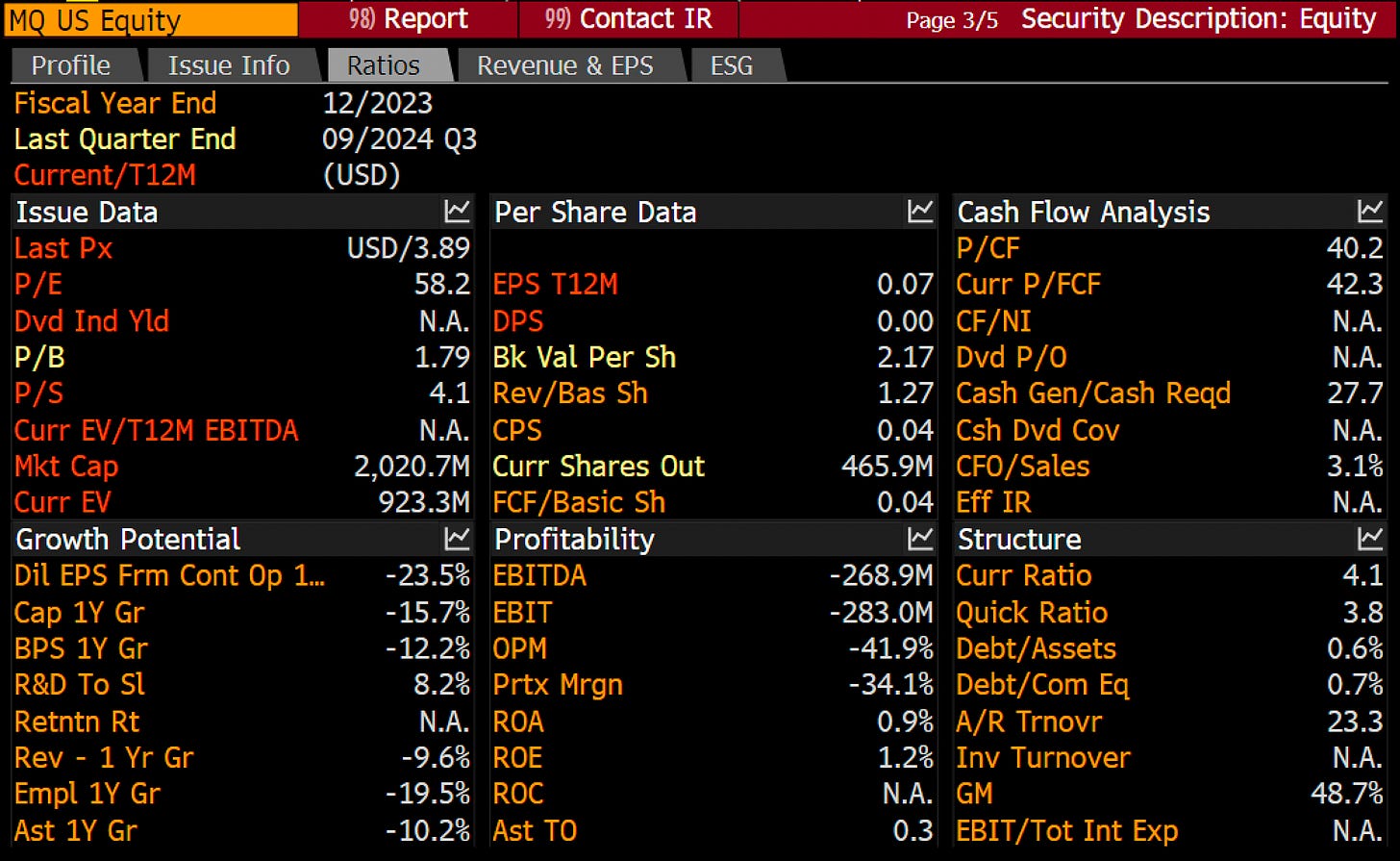

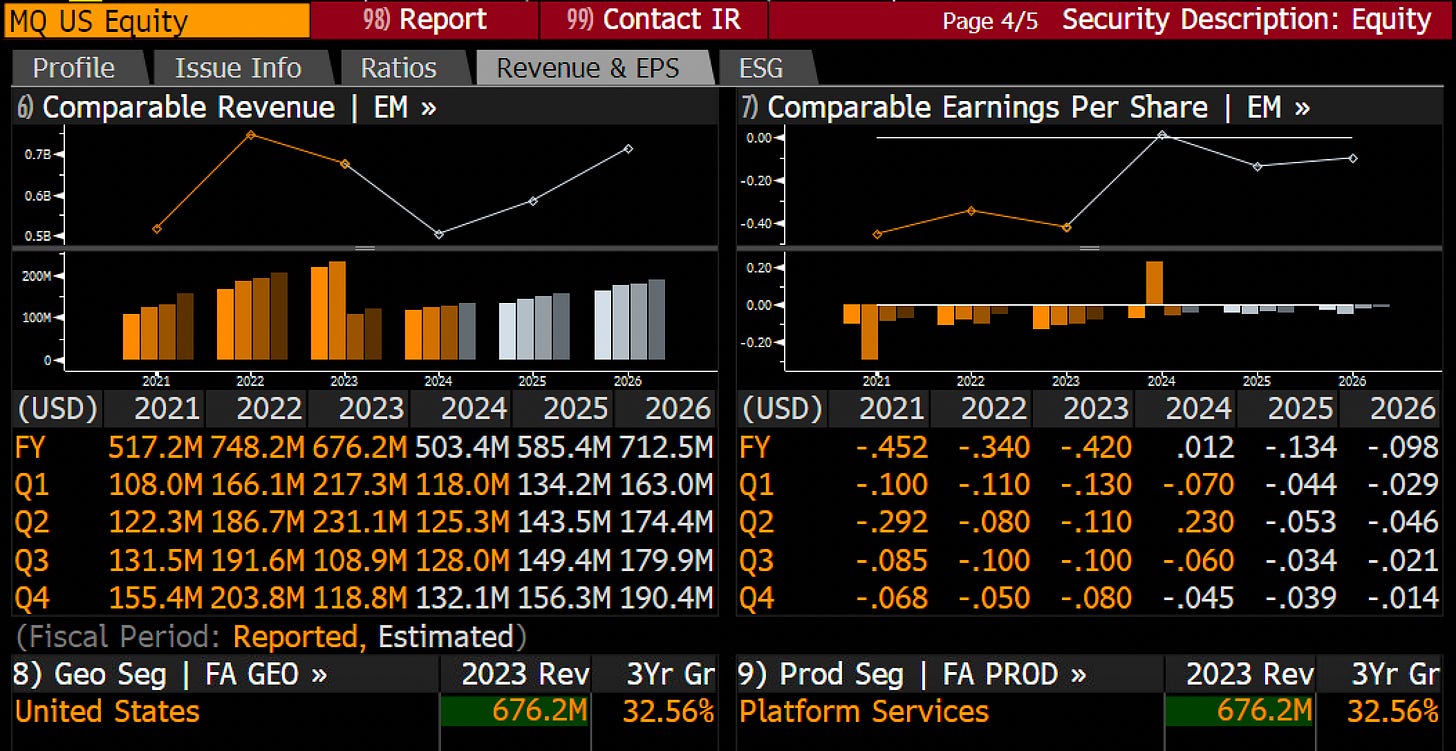

8. Marqeta (MQ) – The Embedded Finance Backbone

Every time you use a DoorDash or Square card, Marqeta is in the background. The leader in modern card issuing, with revenue growing 20-25% annually. MQ has actually been a pretty big underperformer over the last year. Has lagged other major payments players and QQQ as well. Down about 40% over the past 12 months, I’d like to learn more about this one.

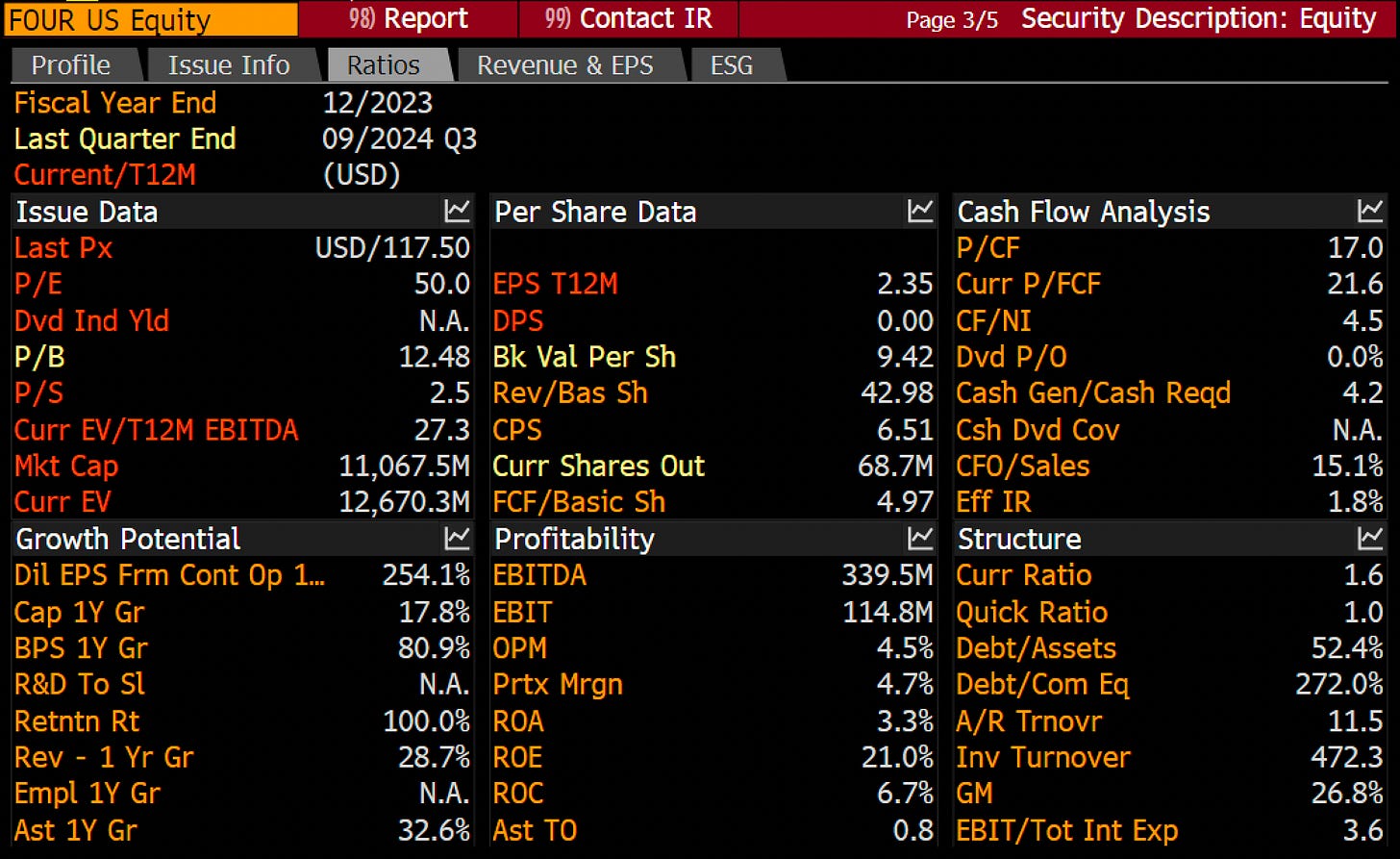

9. Shift4 Payments (FOUR) – The Hospitality & Sports Leader

If you’ve paid at a stadium or restaurant, you’ve probably used Shift4. Revenue is growing 15-18% annually, fueled by expansion in entertainment and travel verticals. FOUR has outperformed QQQ over the past 12 months and also some of the major players like V, MA, and lagging only AXP. 51% is really good and I’m looking into this one more.

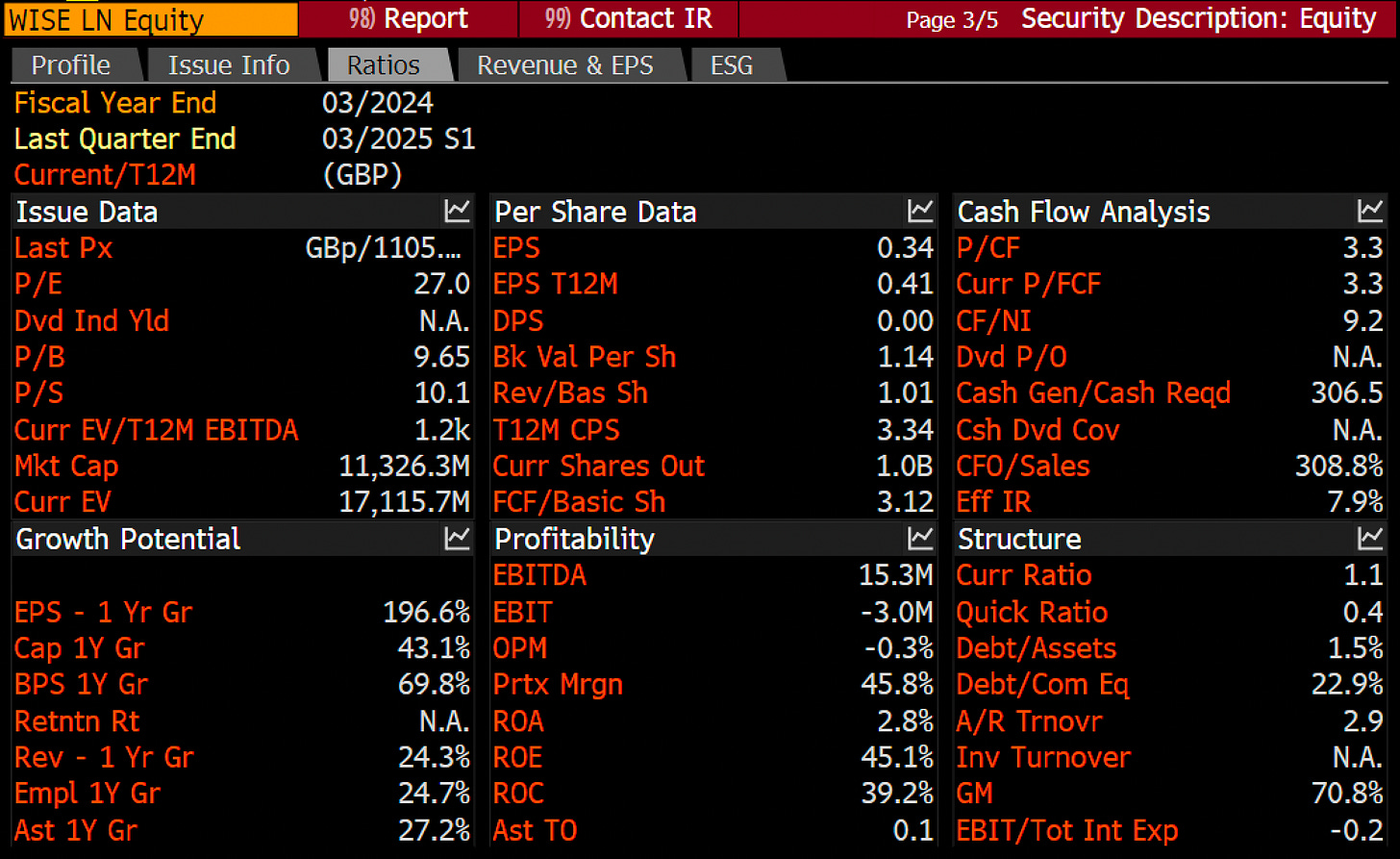

10. Wise (WISE.LN) – The Cross-Border Disruptor

International transfers shouldn’t be slow and expensive. Wise is making them cheap, fast, and transparent. Its transaction volume is growing 25% annually, and it’s expanding across Europe and Asia. Wise has some momentum on its side, lagging the major players over the past 12 months at 34%, with some strong moves coming the past 6 months though.

11. Apple (AAPL) – Payments as an Ecosystem Lock-In

Apple Pay and Apple Pay Later are quietly taking over payments. They don’t need to be the biggest—they just need to keep people inside the Apple ecosystem. And they are. Different beast than the others, but letting you know they care about the space.

12. Google (GOOGL) – The Emerging Market Giant

Google Pay may not dominate in the U.S., but in India and Southeast Asia, it’s massive. Its market penetration is growing faster than most Western fintechs, proving the power of scale. Same story as AAPL.

13. Ripple (XRP) – Blockchain’s Answer to SWIFT

Ripple’s vision? Replace SWIFT with a blockchain-based cross-border payments network. It’s making inroads, though regulatory battles continue. There’s some Trump team ties too. But remember there are no pricing multiples with coins …

14. Stripe (Private) – The Startup Favorite

Every startup, SaaS company, and new-age merchant wants Stripe’s API-driven payments. It’s the silent enabler of millions of businesses worldwide.

15. Klarna (Private) – The Global BNPL Titan

Affirm owns BNPL in the U.S., but Klarna is a global force. Expanding aggressively across Europe, Australia, and Asia, it’s reshaping consumer credit. IPO for them should be coming and will be interested to look deeper into the financials and business.

The Bottom Line: Payments Are Eating Finance

The payments and fintech revolution is coming whether we want to admit it or not. Every business needs to accept payments. Every consumer needs to make payments. This isn’t optional. It’s the backbone of commerce.

If you’re interested in banks, you better know the space. If you’re a bank, same story.

You have to know your competition.

To that extent, it’s best to know the space rather than ignore it.

I’ll be diving into a few of these over the coming weeks.

Stay tuned.

Until next time,

Victaurs