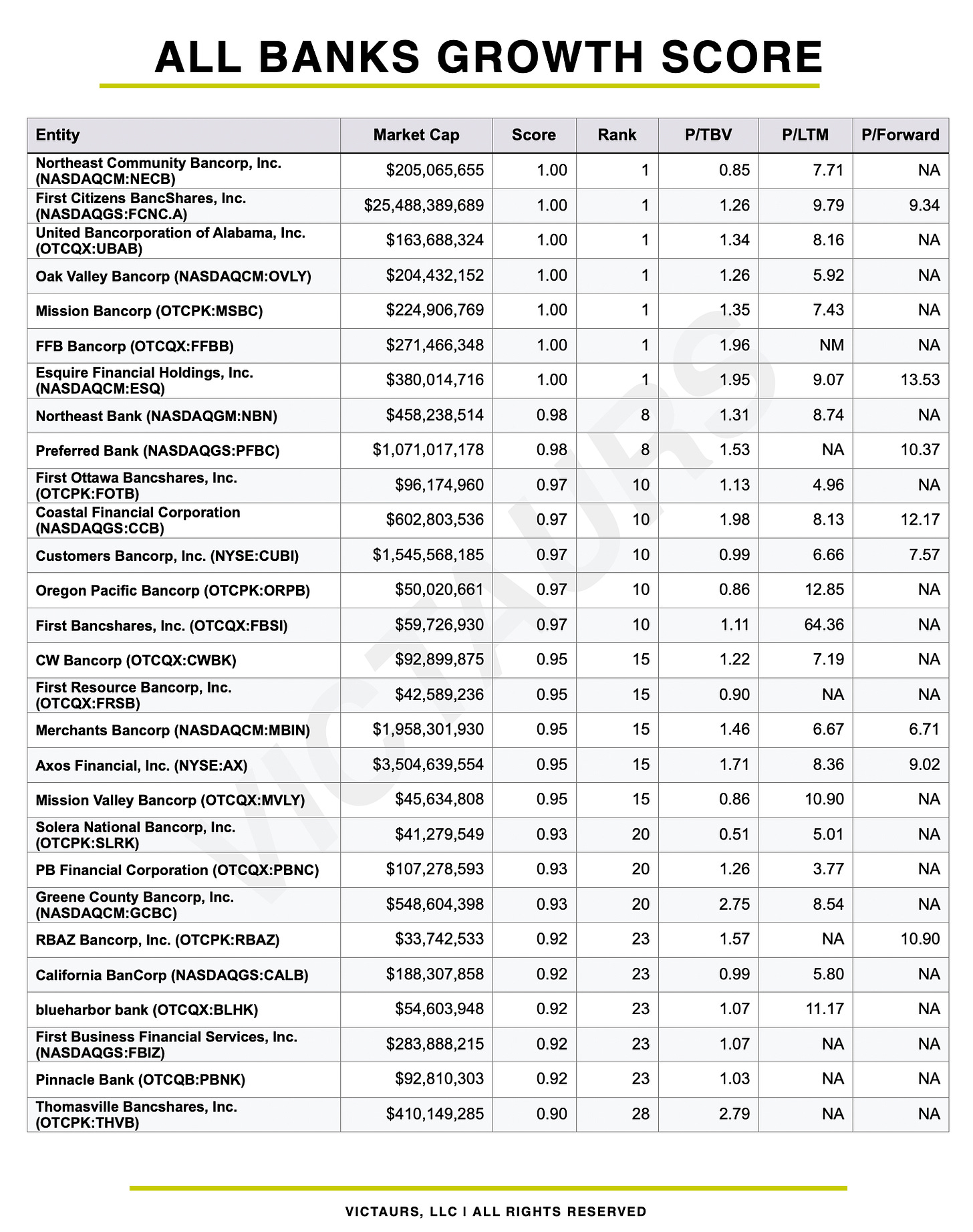

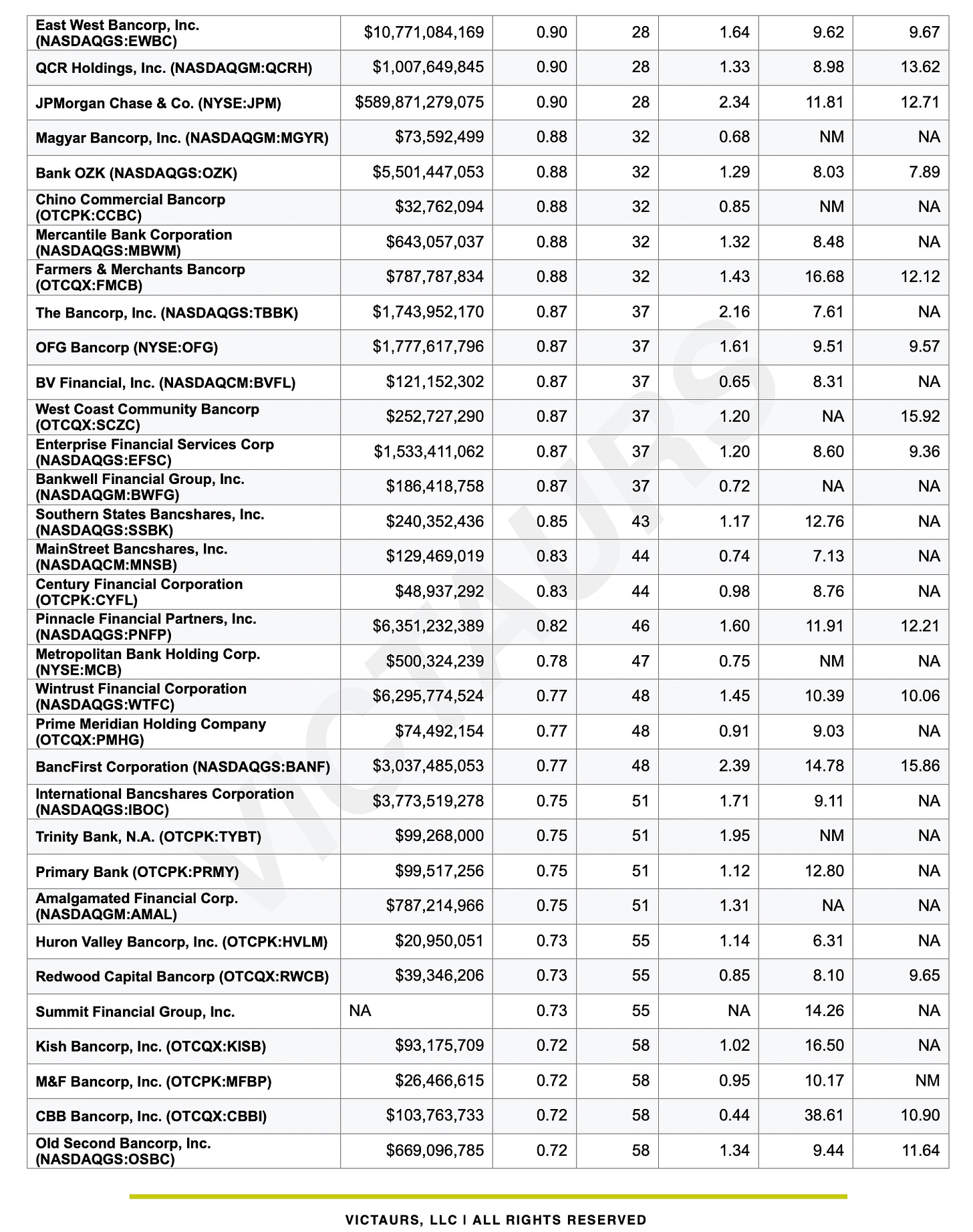

All Public Banks Relative Growth Score (RGS)

Providing you with clarity on your bank stocks ability to grow performance metrics relative to its peers. A sniff test to see what banks have had the ability to succeed in a tough environment.

The Final List

I’ll be refreshing this list annually. For me it’s the first place I go when looking at what banks to buy, what banks to sell, and who to leave alone.

Remember, the main thesis of this all is that in investing, a company’s ability to grow earnings per share, revenue per share, and TBV per share are the most important things. Following this logic would say that if you’ve been able to grow those things above and beyond your peers in the past, there’s a decent chance you can continue doing those things in the future.

A higher ranking means the bank was able to grow those metrics in the upper quartile across a 1 year, 3-year, 5-year, and 7-year horizon. A low ranking means they were in the bottom.

As a point of caution, there is some survivorship bias here but to me it doesn’t negate the analysis. The reason why there’s some survivorship bias is because a few of the highflyers recently failed; SIVB, SBNY, FRC. Be mindful of this. Also note, pricing is ever so slightly stale, but the RGS scores are current up to 2023.

I personally find the appendix to be useful as well below. Seeing the raw data on annual growth rates across the metrics is insightful. It’s also horrifying for the names on the bottom of the list.

I’d hesitate to say something like, “buy the top of the list and sell the bottom of the list” but that’s certainly where my thought process is going.

The weightings I chose attempted to consider the longer 7-year time horizon so it didn’t unfairly punish (even thought maybe it should have) a very liability sensitive bank that got crushed by rates up 500. Blending weightings on a mix of time horizons is the best way I could think of to address this. But the deeper question is, can you trust a management team that knew how liability sensitive they were and didn’t hedge or mitigate that risk in some way, shape, or form? I don’t think there’s a perfect answer here.

Another thing to remember is looking at business model risk. For example, someone like OZK has been able to grow but they are fully in on CRE and it’s a tough environment going forward for that asset class. Same would go for someone like NECB.

And a last point is to consider how a bank got to the top or the bottom of the list. Take an FCNC.A or a JPM. Haters could say they’re there because they were able to do assisted deals by the FDIC, which is true. But their ability to succeed in the past and put themselves in a position of strength doesn’t mean they won’t be able to do it again in the future.

If you see any names you want to talk about, send me an email: victaurs@substack.com

All Banks RGS

Keep reading with a 7-day free trial

Subscribe to Victaurs to keep reading this post and get 7 days of free access to the full post archives.