What's Top of Mind in Bank Land Heading into Q2 Earnings

Dealing doomers some cold hard facts, earnings season outlooks, credit outlook, a couple dividend cut watches, the power of low expectations, and some boring small winners.

Earnings season is almost upon us.

PIMCO and others are on one side. If you believe them (and they are talking their book), then it’s failures, failures, and more failures.

An article on Bloomberg went on to say that banks will start selling loans at discounts, which may in fact be true. But banks are rarely in a fire sale situation and can restructure, extend, or modify loans at their discretion. It’s also in the regulators interest to allow this type of behavior. While I appreciate the thesis, I personally am not seeing the mass failures. Also, put this in the FWIW category, but the writeup talked about Axos as being distressed after a Hindenburg Short Report, which is comical because the 8-K rebuttal to the short seller report more or less dispelled all concerns. If you haven’t read it, I’d check it out.

The more pragmatic rational humans also known as the professionals, see a more muted bank earnings season with no major failures. And while I believe that the world of bank CRE is pretty murky & opaque, spreads are not at all distressed.

Fed Stress Test Results

On June 28th the Fed will release the results of its annual stress test. This is a major risk clearing event that most non-insiders care don’t about, but as a smaller bank or a bank investor you should.

What are these stress tests? They’re a mechanism for the Fed to pretend the end of the financial world happens and to show everyone what happens to the largest banks in the country & world. Do they die? Do they live? What happens to their earnings? What happens to their capital?

And so, they’re effectively a pre-mortem type exercise which sets the bar for what the banks can do with excess capital. A failure means you’re in the penalty box and need to hoard capital. A pass means you can at the very least continue doing what you’re doing.

Ironically this stress test is called the Dodd Frank Stress Test. Ironic because Barney Frank, champion of it, sat on the board of Signature Bank who failed despite his involvement.

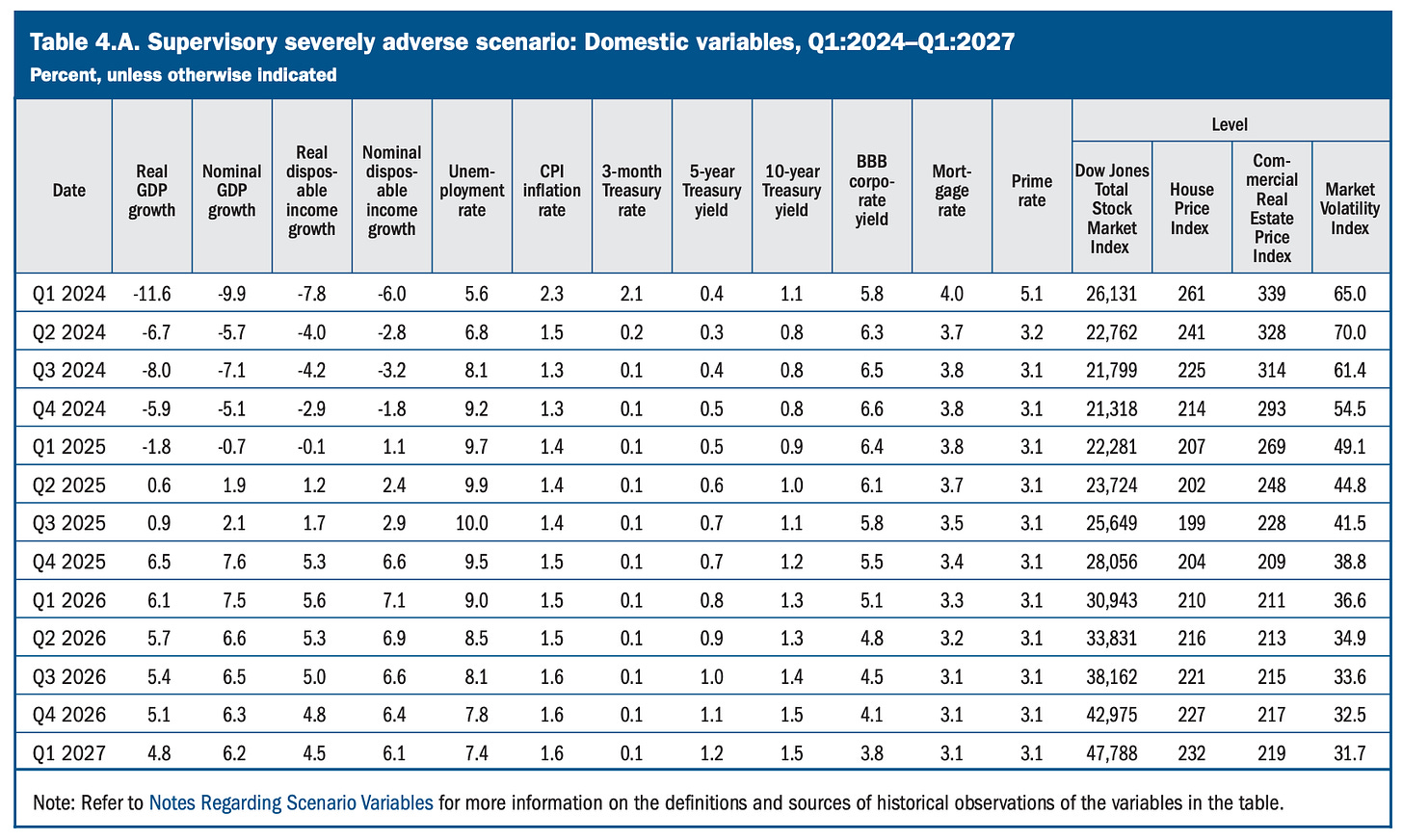

And what does this stress test involve?

CRE down 40%

Unemployment rate to 10%

GDP growth down to -12%

Disposable income growth down to -6%

And for good measure the VIX to 70, almost have to laugh at that one.

Here is the table of assumptions being used on the biggest banks in the country and below that the results.

And the big takeaway is, none of the big banks failed in this hypothetical financial asteroid heading towards Earth environment in 2023. This year’s 2024 results are being released June 28th and I expect this to be a sort of risk-clearing event. I don’t expect many if any outright failures. Banks are very well capitalized at this level and the baked in the cake assumption of 10-year rates down to 90bps does help build capital to offset losses (AOCI reversal).

Now one thing that’s interesting is that Dodd Frank was technically supposed to be applicable to all banks above $50 billion in assets subject to the Fed’s discretion on inclusion or not. This leaves the Fed with some creative liberties on who to exclude given some of those banks today are most certainly not on the strongest of footing. Below is a list of the passed banks from 2023 and below that the actual losses implied by the stress test.

When I say this is a financial asteroid, I mean it.

And that is why this is a risk-clearing event for the industry. Look at these losses. And despite that the capital of banks below that holds up.

Earnings Season Outlooks

Next up will be the guide coming out of the major research firms on big bank and bank industry earnings overall. What I’m seeing is: loan growth slowing, deposit leakage/shift slowing, credit continuing to leak higher, non-performing loans continuing to leak higher, a larger disparity between high end consumer and lower end consumer, no broad scale CRE blow ups, and maybe … just maybe people guiding to an earnings inflection coming in the horizon.

On and index level and looking back over the past 3 years banks have underperformed both large (SPX) and small (RAY) caps as the rates up move has squeezed out margin for the industry. Our forward outlook on earnings had a bigger peak relative to both the SPX & RAY but is now dealing with a larger trough.

On a forward-looking basis estimated EPS for the KRX, and the bank world should be turning a corner relative to large & small caps. Now much of this would be predicated on rate cuts, but I think September may finally be it. And as long as those rate cuts don’t come with immediate credit issues, the theory is that banks COF should decline, and we should see a well-deserved lift to our outlook.

But the big thing to watch for is definitely the outlook on rates. Most banks derive 70% to 90% of their net income from net interest income. I’ll say this again, most banks rely on net interest income. This is especially true of smaller community type banks that do not rely on non-interest income verticals.

A logical extreme of this is JPM, who has a very different business model than most banks, or at least a very different need for rates to work in their favor. Community banks would kill for non-interest income to make up 20% of their net income, let alone have it be where JPM’s is.

And so other than credit behaving, what’s really going to drive bank earnings is the shape of the yield curve. Inverted curve = bad. Sloped yield curve = good.

Why is that?

Because to oversimplify, banks borrow short and lend long. There’s much more nuance than this, but at the core this is fractional reserve banking and banking in general. Take people’s money, pay them a little. Lend it out to someone else, charge them a lot.

So, the big thing that would help banks is not “rates down”, but a bull steepener.

That is fancy bond person talk for, short end down (rally) and long end stay the same or rally less. Below is a graphic of the spread between 3-month bills and the 5-year UST. Historically speaking the average spread between the two is about 100 basis points.

Today that spread is -115 basis points, which has meant pain on bank margins.

With the 5-year today at 4.25%, that means for us to revert to historical we’d need short rates to come down to a 3.25% which is 225bps or 9 cuts. Not saying it couldn’t happen, just that it’s hard for me to see how that happens without something “breaking” in the economy. In that environment one would expect bank cost of funds to go down by roughly half that which would contribute to expanding margins and more net interest income.

Just to say it again, a blanket “rates down” does not necessarily help banks.

Should the longer end go down, that would be good for a few things. AOCI & CRE pricing are the major ones that would benefit from lower long-term rates. This chart below by Barclays shows what most people in the industry know. That with longer 5- year and 10-year treasury rates having gone from close to zero to 5% and now down to 4% that price declines are stabilizing. Year over year the CRE price index is not positive but is actually just going less negative. Office continues to be hated, apartment is less hated, retail is actually surprisingly hanging in there and industrial is defying all logic and actually rallying year over year.

And to drive home a larger point. Take a look below, this is the 5-year treasury and the Fed’s Commercial Real Estate Price index overlayed. I am not sure I personally will see another rally like 2021 and 2022. It was the perfect storm of monetary stimulus, fiscal stimulus, and low rates. There is always going to be a lag, but this supports my belief that lower 5-year rates will lead to slowing depreciation in the CRE market overall.

And while there was a lot of misallocated capital in 2021 and 2022 at cap rates that were pure fantasy (unless valuations kept climbing) it’s hard to for me to see problems because there isn’t a “mass refi event” or a “mass payment shock event”. These are what cause problems for people playing CRE musical chairs.

Increasing property values can gloss over some really stupid behavior, it’s true. And there will be some pain because it’s only when the interest rate tide goes out that those people will realize that underwriting to a 5% or 6% cap rate takeout isn’t guaranteed.

Unless of course you’re doing a Chick-Fil-A, which seems to defy the laws of financial physics (people love that chicken). And then you can underwrite Chick-Fil-As to 4% takeout cap rates.

Credit Deterioration Watch List

Speaking of credit, I’ll be on the lookout for tick ups in nonperforming and criticized loans. A few weeks ago, I posted the highest NPLs in SMID cap bank land. This is a list you don’t want to be on.

Of those, NEWT LOB & BY are all SBA lenders where higher rates are having a harsh impact on underlying borrowers. TFIN (which is sporting a 300% P/TBV and a ‘25 ROTCE of 8% - make that make sense) has seen the trucking industry stumble bad of late. TBBK has seen their Multi Family book deteriorate. And EGBN has seen non-owner occupied CRE tick up. CARE might be the only one where a fight between the bank and the Justice family of a Greenbriar loan may not be as bad as the number seems.

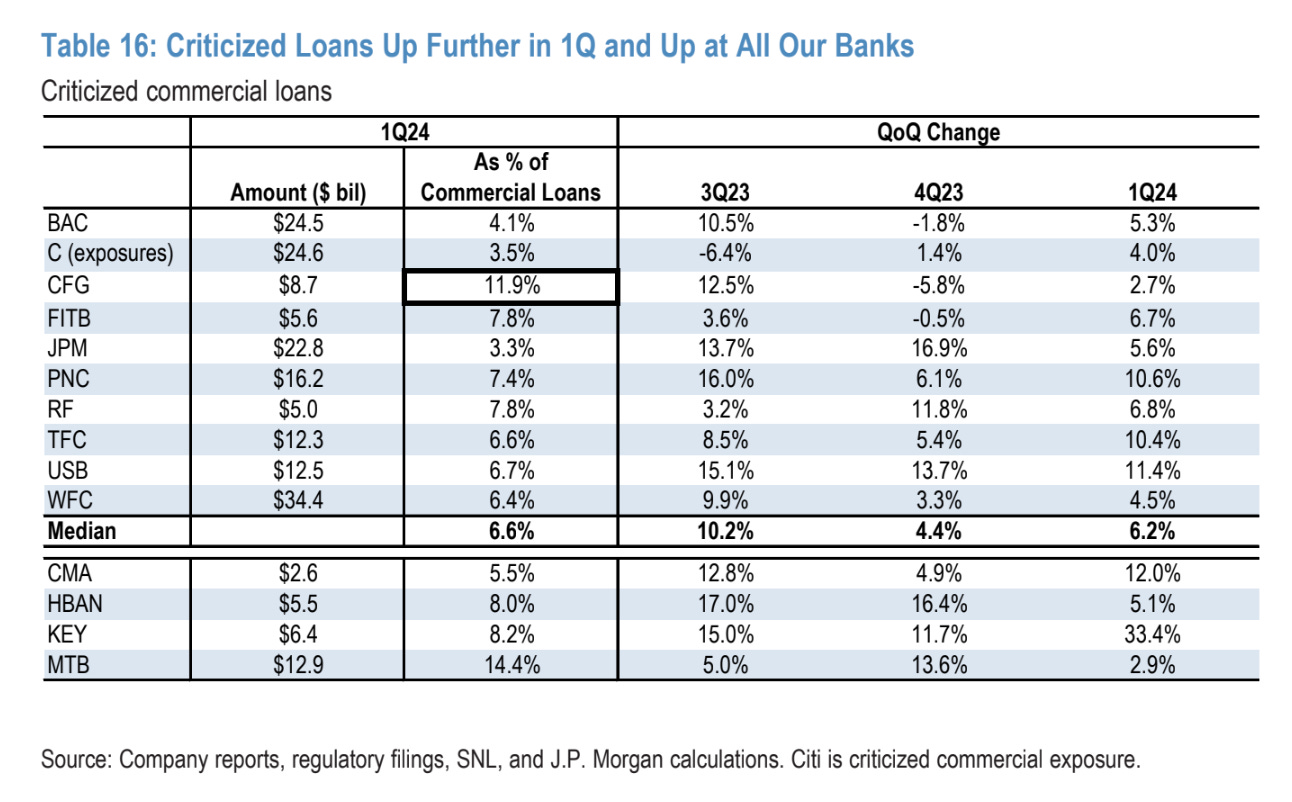

In big bank land I think you’ll want to watch Regions - RF. I recently saw that they had over 50% of their CRE book repricing in the next 24 months. And while they do a good job of sticking to Class A, I think it will be a very good read into how the CRE market in general is trending.

I’ll also be watching Citizens - CFG for a read into Office. They have about 30% of their office in Central Business Districts across California, Massachusetts, New York, and New Jersey. They also sport the highest criticized asset ratio of any of the larger banks and I’ll be curious to see how these get resolved over time. For what it’s worth, WFC and PNC also have decent amounts of CBD office if you’re trying to get a read into those markets.

Dividend Cut Watch List

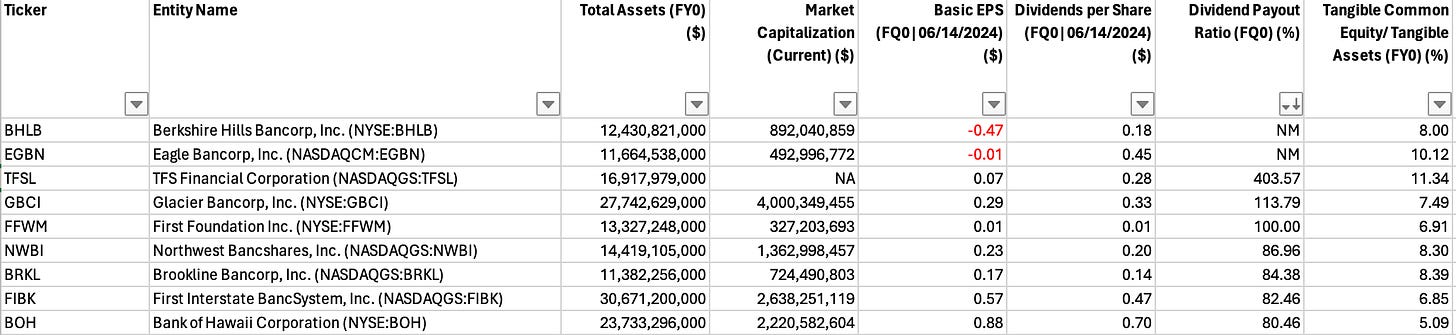

I think you could see some dividend cuts this quarter. Will be tracking some of these names below to see what management does given lower earnings, strained capital levels, and investors desire for stable dividends.

The Power of Low Expectations

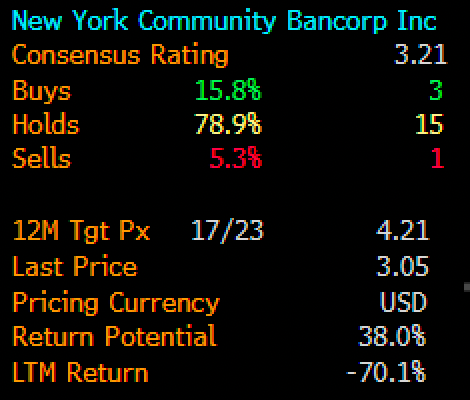

On a random note, I think at some point NYCB is a buy. I haven’t done anything yet and may not still. But there’s two things working for them. Or maybe a few things.

One is there are definitely some people that are Flagstar depositors that probably don’t even realize they bank with New York Community Bank. Hard for me to think they all of a sudden want to pull deposits.

Two, they have unbelievably low expectations, and their numbers are not that bad relative to other Category IV banks. Rates down would help them a lot given their reliance on wholesale and AOCI plus the benefit to CRE pricing. And they are working to sell off non-core assets/CRE and are doing the tried-and-true private equity strategy of stripping things down to the core studs.

Three, and most sarcastically the entire street hates them. 84% of analyst coverage has them at sell or “hold” which is really just a way of saying sell without saying it. Maybe I just love a good underdog.

Four, the people that got them into the mess got blown out and replaced with an adult in Joseph Otting (former comptroller of currency) and Trump’s buddy Mnunchin as the capital behind it. I can promise you these are serious people.

Five, the regulatory bodies do not want this thing to fail because it would look tremendously bad for them to have gifted them SBNY only to have them fail. This ironically is probably the most important reason I’ve found to buy them.

On the counter to all of this yes, there is lots of credit risk to work through.

I repeat, yes lots of credit risk to work through.

And a third time, you have to be okay with their credit risk.

Boring Small Winners

And lastly, I’ll be looking at my normal list of boring small winners.

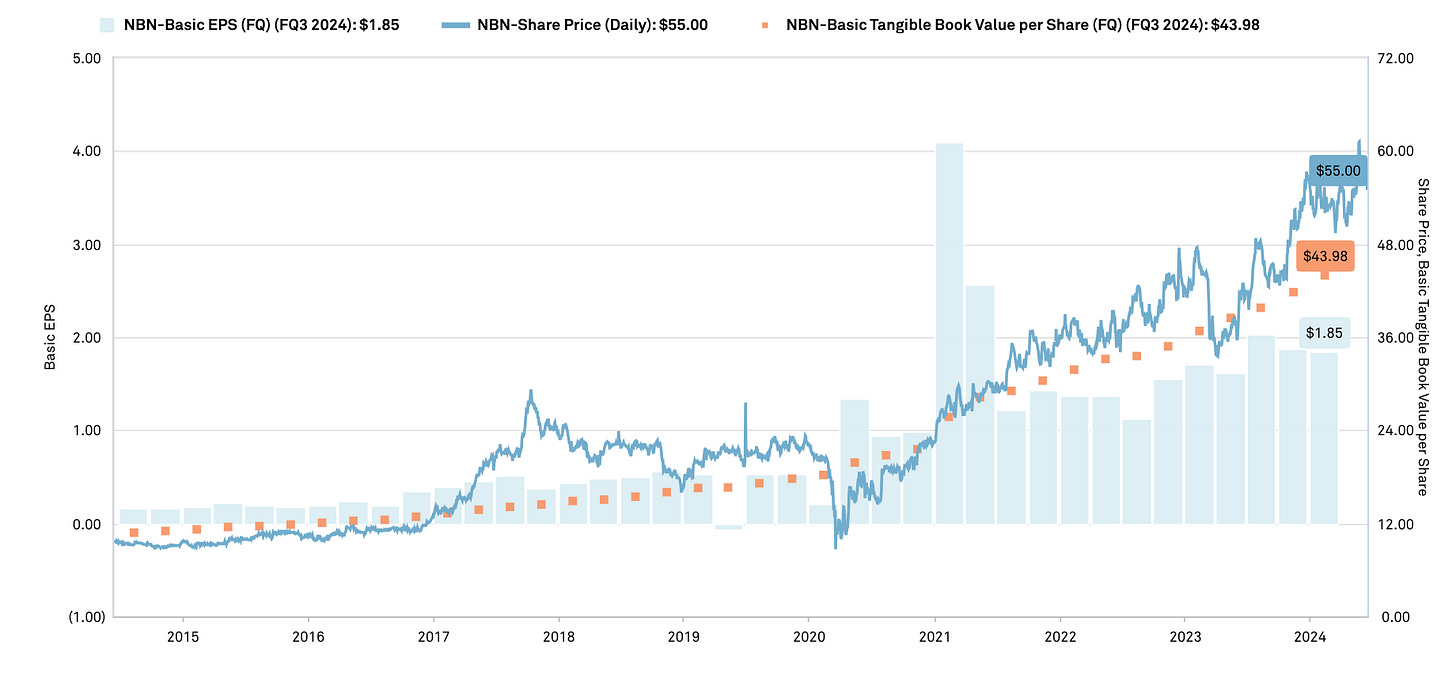

Say what you want about these people now and the risks they have (I deliberately picked trigger worthy names like TBBK and NECB), but there are small banks out there that do nothing but compound earnings & book value and win relative to the index. NBN is a good example of a bank that most people would say is "not core” since they literally do wholesale lending & purchases of distressed pools. Haters will say they’ll never achieve a premium multiple (currently trade at 121% of TBV and something like 7x earnings. But who cares if you keep compounding earnings per share and book value per share.

On my list that I track there are some much better names without any of the “hair” that these names have. But look at these returns …

The thing is most bank investors don’t know about banks like this. Boring. Small. Winners. I’ll be publishing that list on Wednesday. Some of the names are absolute champions. You should check it out.

Gratitude

More to come soon including the RGS for small banks and RGS for all banks. Then some ROTCE vs. P/TBV stuff. And then hopefully back to some good old fashioned stock picking.

I appreciate you all. Keep striving. Keep winning.

The best is ahead,

Victaurs