9 Trends Mostly in Banks Both Here and Overseas

Coming up for air on a great quarter for financials, cyclicals, and banks (except in Japan)

A few trends in banks & fins both here and there.

To level set all of the below, remember that:

YTD the S&P is up about 19.7% & MRQ it was up about 5.5%

YTD the Nasdaq is up about 17.2% & MRQ it was up about 1.9%

YTD the Dow is up about 11.85% & MRQ it was up about 8.21%

YTD the Russell 2000 is up about 8.3% & MRQ it was up about 8.9%

So in general, strong returns for large caps & tech with the industrials & small caps coming on strong in the MRQ.

Trend #1 - M&A Producing Big Winners for Smaller Banks

M&A produced this quarter’s “big winners” in the Nasdaq Bank Index. The index itself was up about 12% and the big winners were VBFC, FINW, and GBNY. It’s hard to see bank M&A slowing at this point. Rates down on the 5–10-year part of the curve has done wonders for AOCI & gives bankers the comfort of paying higher premiums. I think there’s more M&A to come, but just because that’s true doesn’t mean it needs to be profitable as an investing strategy. The case in point to that is SBT, who was effectively “taken under” by Everbank. I don’t think this trend reverses, but I also don’t have the patience to sift through small & microcaps to look for dumpster fires ripe for a takeout. If I were to do that, I might look at states where the bid is elevated by friendly Credit Union regulations like Florida. I’m also personally curious who is the proud owner of Miss Homestreet when the FSUN deal closes.

I don’t see banks repeating what happened in Q4 unless the Red Sweep becomes a reality.

CBNK Q2 Performance 12.31%

CBNK YTD Performance 7.55%

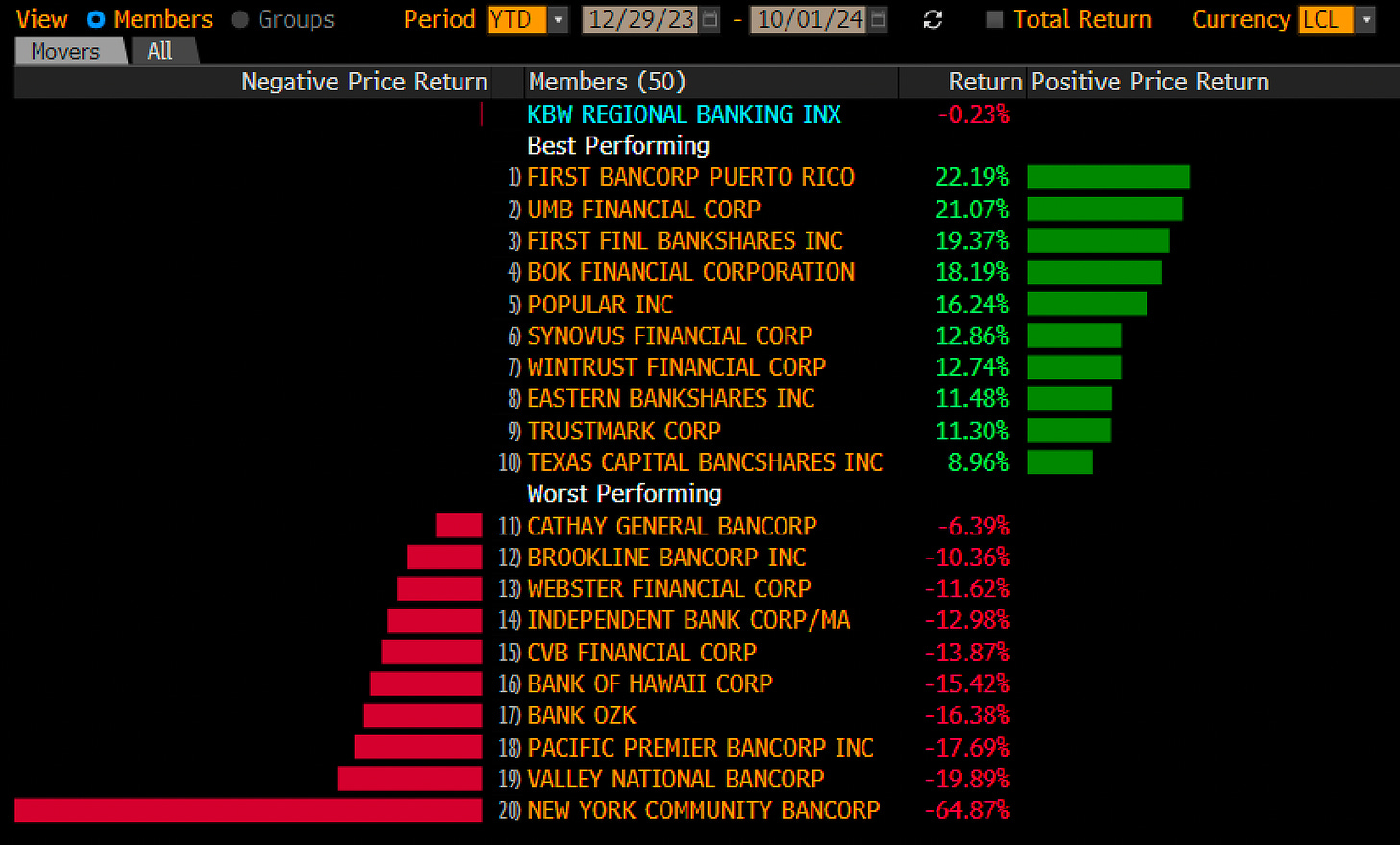

Trend #2 - A Dash for Trash in Regionals

The dash for trash (balance sheets not humans) is alive and well in the Regional Bank Index. I’ve questioned COLB but could never get myself to short it because all it took for this type of rally was exactly what happened. Rates down on the longer end and high Fed rates coming to an end. For those of you keeping track at home, on the Quarter 5-year rates came down 92 basis points from 4.42% to 3.50%. And in the process that bailed out the likes of VLY (historically really cheap), PFS (historically really really cheap), and BKU (actually a bit expensive). I personally think these type names (high CRE & high COF) are stretched here and are tough to own. Murphy’s law states that anything that can go wrong, will go wrong. This Quarter was literally everything going right for these banks. An interesting name here is CBSH who is slated to perform well but is actually fairly cheap historically speaking. Same with TRMK but they’re just kinda meh.

Same thing here, the MRQ felt great, but Regionals have come a little too far too fast for me and I could see this consolidating.

KRX MRQ Performance 14.81%

KRX YTD Performance -0.23%

Trend #3 - Large Caps Took a Relative Breather

Large caps underperformed mid/smaller caps. 9% on the Quarter and beating the S&P500 which did around 5.5% on the quarter. WAL absolutely made a mockery of all the doubters as analysts are now catching on to what I said in April., they’re ever so slightly expensive here. KEYs big equity raise & bond swap turned heads and showed that investors can have short memories, but this one is historically expensive. WFC is cheap and appears to be back in the penalty box but I can’t buy them because of it. BAC is probably the most interesting name to me only because it’s rare when someone as big as Buffett nukes a large position, they’re pretty fairly valued here and a good place to “hide out”. CMA is also fairly valued and I could see myself buying them when rates inevitably bounce back higher on the long end and it cheapens. And put this in the “FWIW” bucket, but I do not expect a great quarter out of the investment banking pieces of large cap banks, ECM has been near dead and M&A in general is light.

Mixed bag here, I see some of these banks distancing themselves from the pack going forward and some staying stuck in neutral. You need EPS growth for the market to pay attention and ones like JPM won’t have it in 2025.

BKX MRQ Performance 9.53%

BKX YTD Performance 16.91%

Trend #4 - Range Bound Seeking Direction for Regionals

We’re stuck in a range with no upside catalysts expected until the election and earnings. For the “lines on a graph” people we punched through the 50DMA, and I can’t help but wonder if we tag the 100 day. The rally in July was awesome, but now we’re in digest mode. At some point it’ll be time for a tradeable DPST bounce, but for now I don’t have any conviction one way or the other. Zooming out it’s hard to see how we get substantial multiple expansion at a time when rates are only expected to be up 15% in 2025, and we’ll always have the cyclical Sword of Damocles hanging over us as we make sense of the economy.

We’re not fairly valued at all if the Red Sweep happens. We’re also not fairly valued if the Credit Doomers end up being right. So much of future direction depends on the broader economy, loan growth, and well remember … banks are cyclical.

KRE 1 Year Price Performance Chart

KRE 10 Year P/E Multiple

Trend #5 - Financials Continue Running Hot

Nonbank financials loved lower rates on the Quarter. Insurance continues to outperform despite lofty multiples and more public outcries about premiums. GL as much as it ran is actually still unbelievably cheap historically speaking coming off lots of bad headlines. And Private Equity also had a strong quarter as lower rates and the push back of cyclical fears lifted estimates for go forward carry. On the negative side, Banks jump out as relative losers. I think Private Equity like KKR is already silly expensive. BX is similarly expensive and is actually not far from 2021 lunacy levels on a P/E basis. Oddly enough Trust Banks like STT are actually not super expensive and despite asset sensitivity might just be okay over the long run.

In general, I think this is another too far too fast situation. I’m not short financials but their run has been fairly impressive especially sectors like Insurance. When does the headline risk of massive premium hikes begin to collide with stocks that have continued grinding higher and higher?

S&P Financials YTD Performance 19.75%

S&P Financials MRQ Performance 10.22%

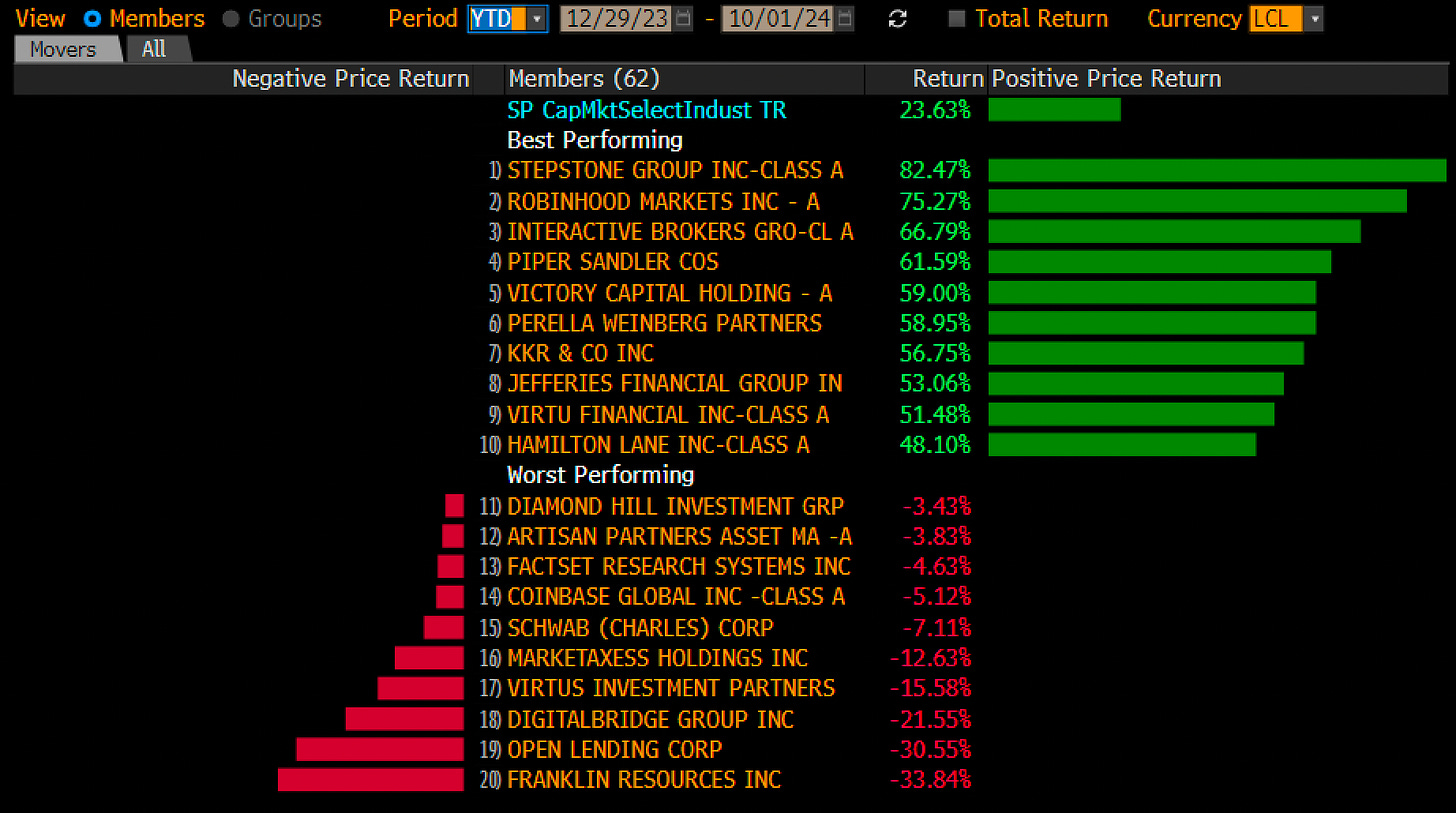

Trend #6 - US Capital Markets Dominance

Brokers, investment banks, and capital markets plays have been even more on fire. I have watched from the sidelines as companies like Piper and Jeffries have rallied over 50% this year. Both of these are down cap Investment Banks that have very well-defined niches and are enjoying recent deal prints. HOOD being up 75% is also a bit crazy, but maybe time has healed all wounds with regard to people forgetting how badly they treated their customers. I’ve only seen positive vibes for them including their gold card (backed by CCB).

I think this capital markets outperformance trend could see some air pockets ahead; everything feels like it’s priced too perfectly.

SPISMCT Index YTD Performance 23.6%

SPISMCT Index MRQ Performance 13.95%

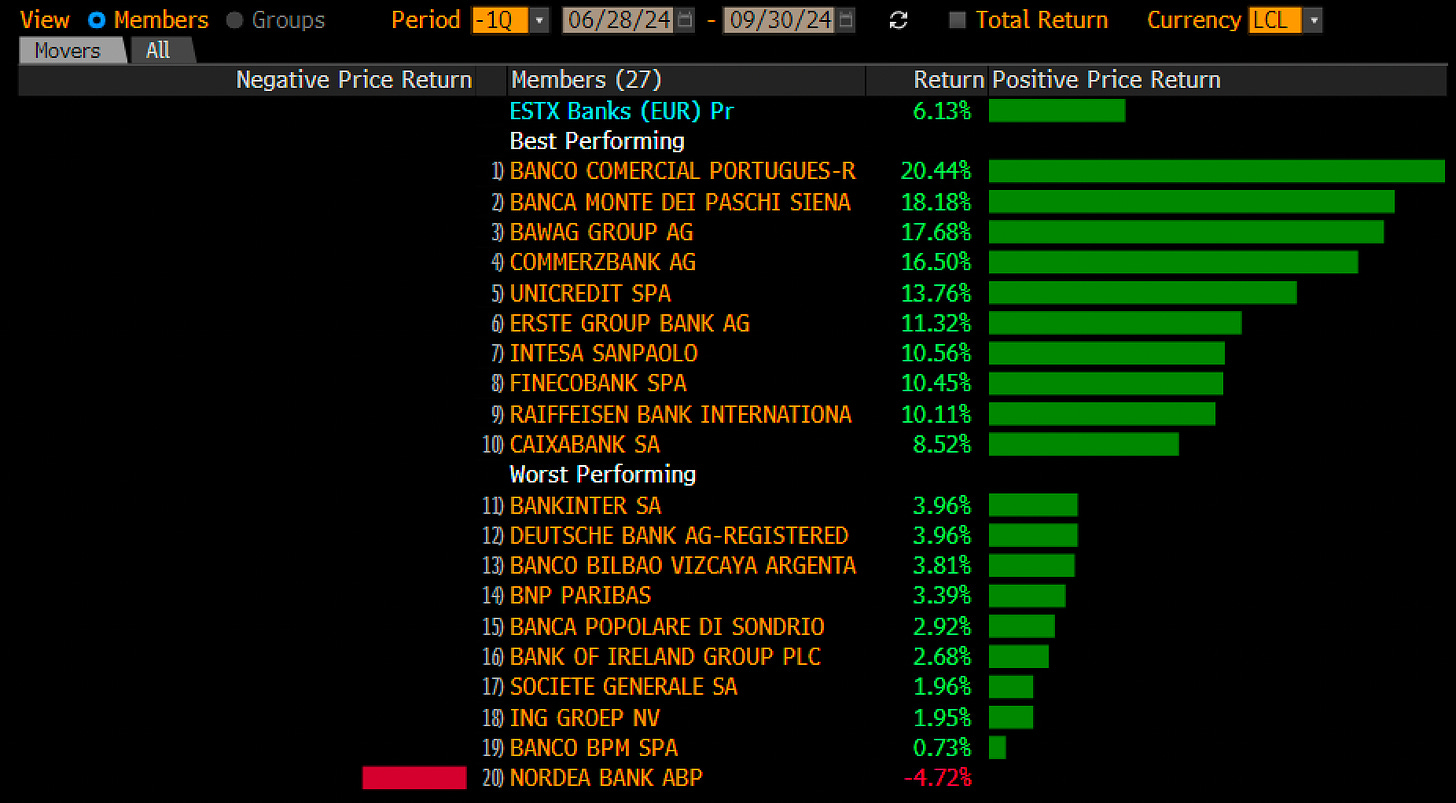

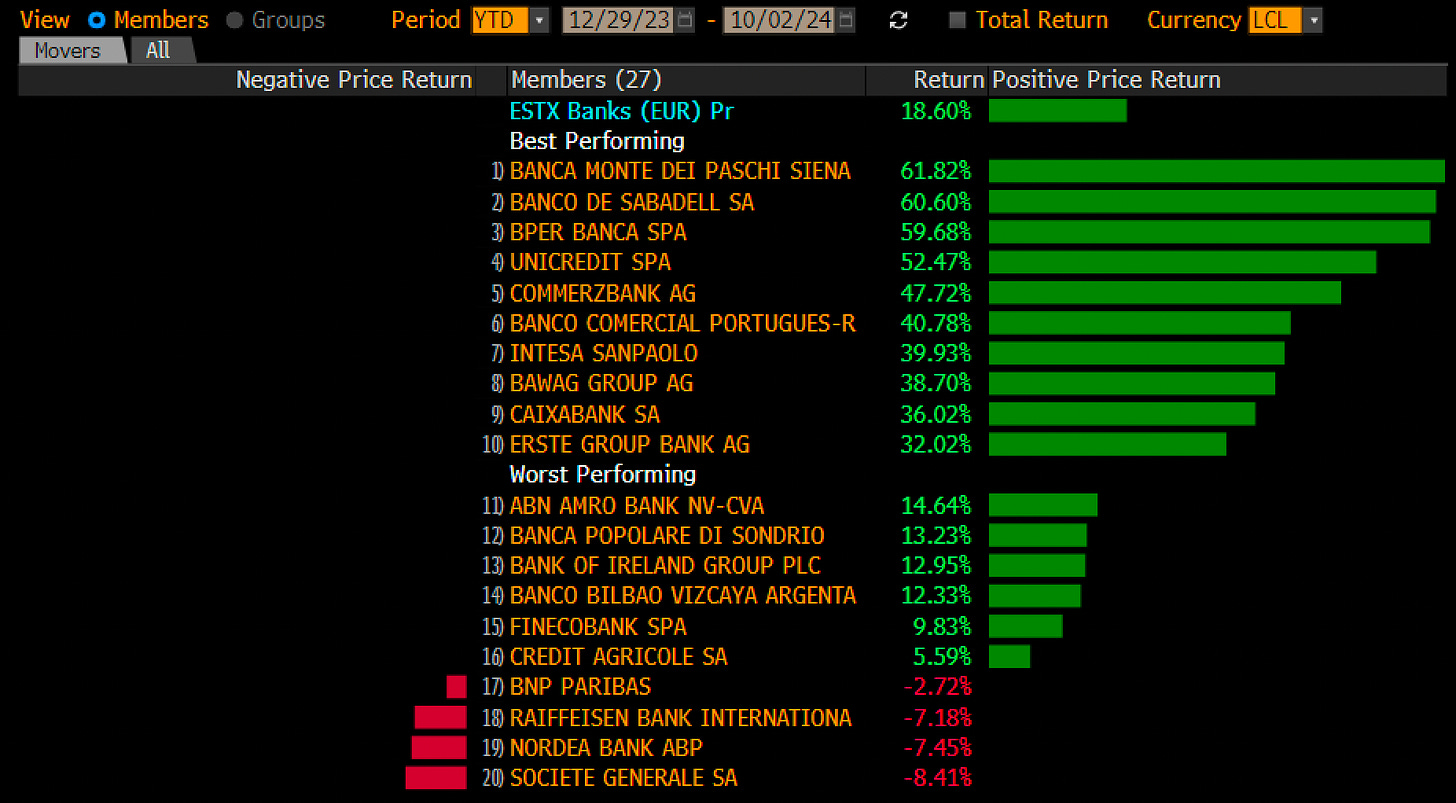

Trend #7 - European Banks Slowed Their Ascent

We all know European banks are asset sensitive, but this quarter to me felt like an approach towards the inevitability of European bank underperformance coming down the pike. They lagged US Regionals severely, but I am not buying the fact that they are all going to be terrible and I’m going to prove this to you all going forward. Be on the lookout for a Relative Growth Score and Scatter on European Banks in the weeks to come. I think it should be fairly obvious that banks with special moats and a track record of growing earnings will be a focus. I also will be looking into the French banks. And lastly, as a trend you do want to look at those with higher percentages of non-interest income.

This one is in the, all good things must come to an end trend. But that being said, I will find a few winners going forward.

SX7E MRQ Performance 6.13%

SX7E YTD Performance 18.60%

Trend #8 - UK Banks Also at Cruising Altitude

Similar to Europe’s bank trends, I do see UK banks overall continuing the slowdown in relative performance. To those of you that followed on BCS and NWG, have yourself a beer. What a heck of a run. The UK economy is absolutely slowing, and I hate to jinx this, but it is actually holding in there from a GDP and PMI standpoint especially relative to the rest of Europe. I can’t help but wonder if investing in “the least dirty shirt” across the pond is smart, but if I were forced to be in banks in the Greater Europe area, I would continue to favor the UK. BCS to me is still cheap and should post a decent IBanking quarter. NWG continues to be a holding of mine although it may be pare back time overall.

The cruising altitude, approaching descent trend is going to continue. I think they’re broadly going to be better than most European banks.

F3BANK MRQ Performance 2.38%

F3BANK YTD Performance 16.8%

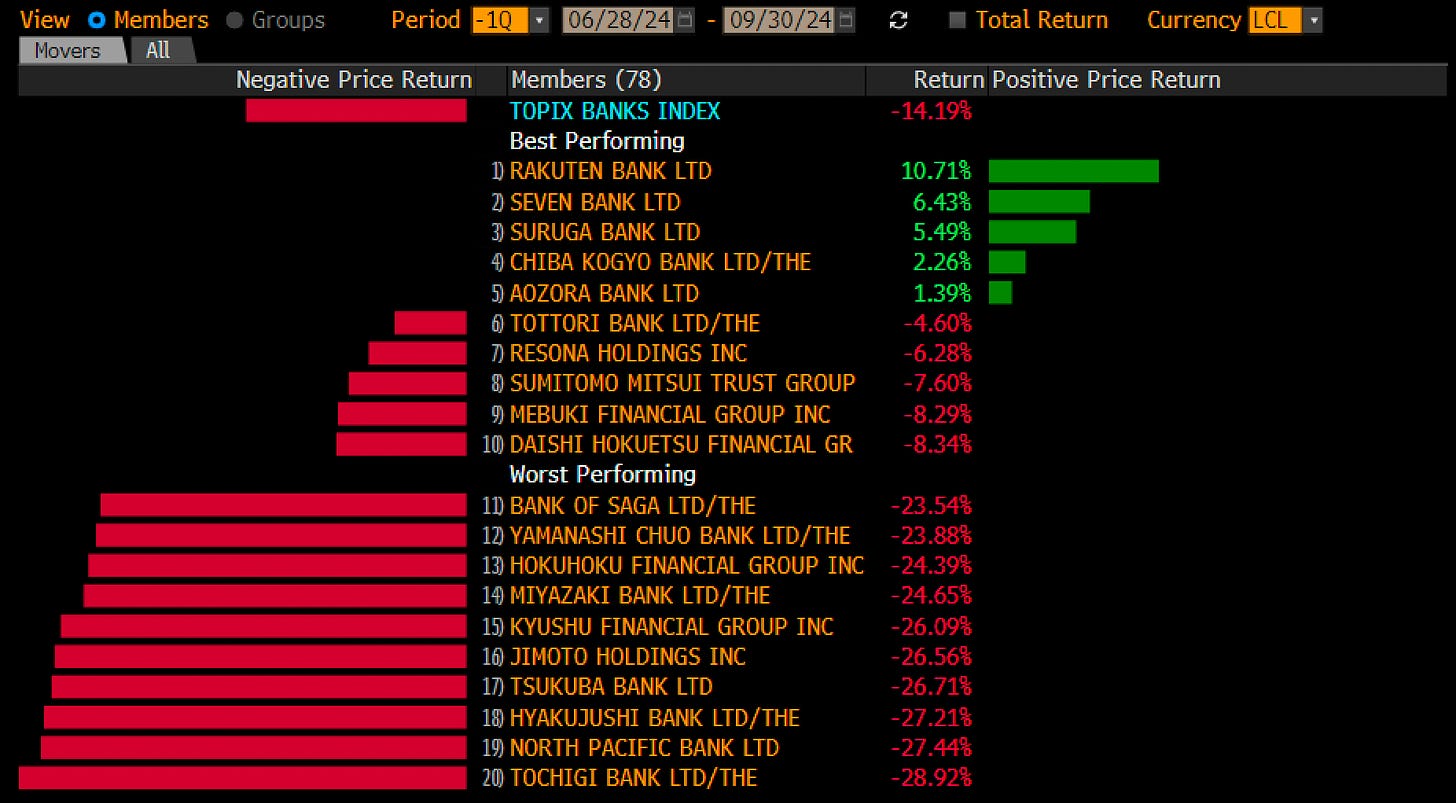

Trend #9 - Japanese Banks Hitting Air Pockets

With China easing and them having run up quite a bit over the course of the year the setup gets more challenging. There was the whole carry trade unwind that did some damage to market confidence. Both of these things are on the market’s mind and on my mind. I know you’re supposed to buy things when they go down, but I can’t help but think that money flows out of Japanese banks in favor of China. People love easing & the PBOC and Xi are in an easing mode. If you rode these banks up, congrats but I wouldn’t own them going forward.

Fundamentally I think the money has been made here and that there’s too much uncertainty and better opportunities elsewhere to keep riding Japanese Banks.

TPNBNK MRQ Performance -14.19%

TPNBNK YTD Performance 19.75%

Trend #10 - China Banks {COMING SOON}

Chewing through some numbers to produce the ROTCE Scatter & Relative Growth Score Rankings. I philosophically go back and forth on whether or not this is worth the time given the run up. But in the end the journey of doing the work always helps me. I’ll be sure to share it when it’s ready. Might do something similar for Latin American Banks. In general, I think that the weaker dollar is going to do wonders for emerging economies on top of the added benefit of China doing more stimulus.

Hope you enjoyed the quick run around the world of banks & fins both here and overseas. More to come soon. Jesse Livermore said it best about trends. Stay poised & stay patient friends.

The best is ahead,

Victaurs