15 Questions for Banks Going into Q2 Earnings

Things I'll be looking out for that should be on your radar.

Earnings season is upon us and here are 15 questions on my mind.

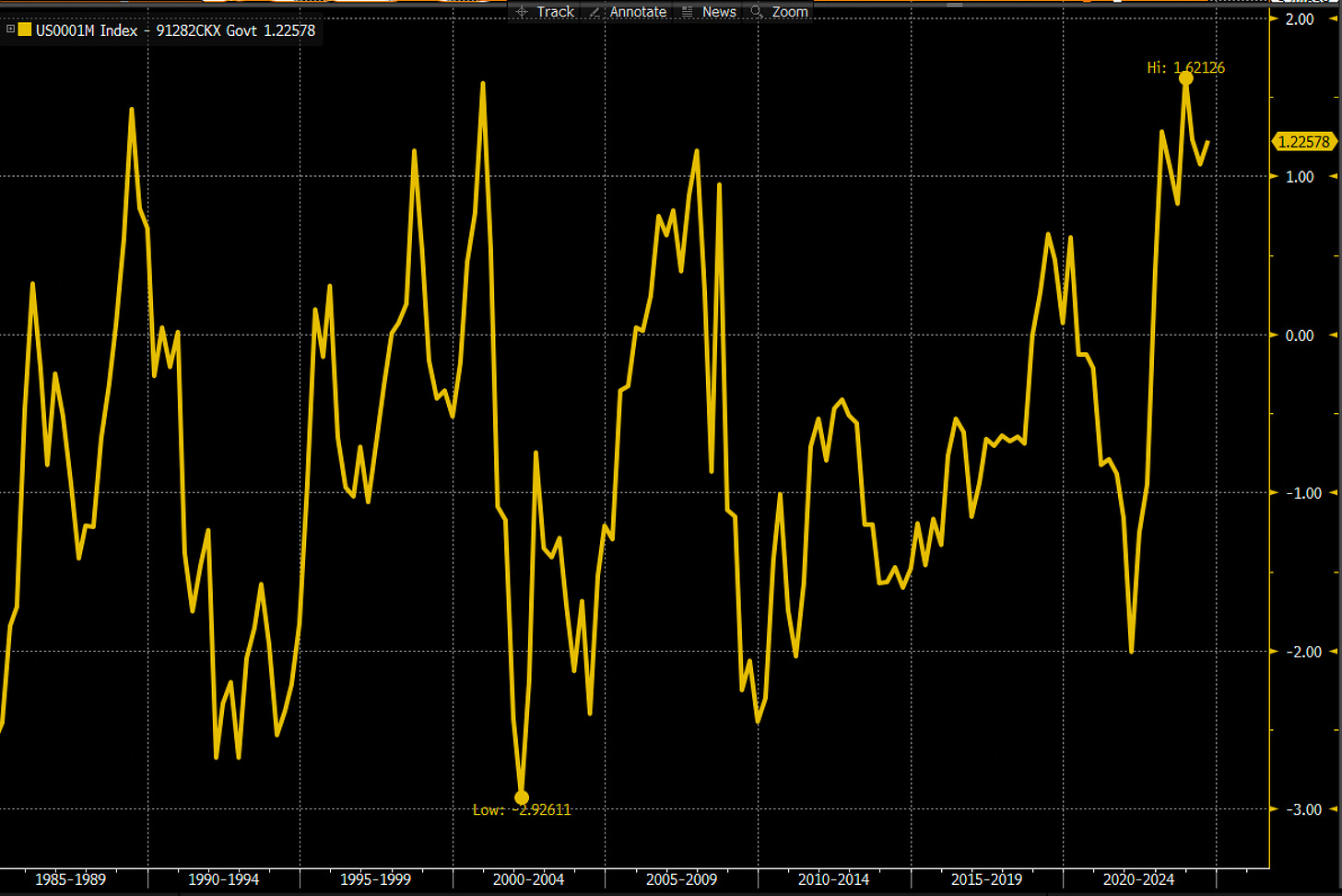

The Yield Curve

Core bank earnings depend heavily on the spread between short funding and the belly of the interest rate curve. Currently we’re inverted about 120 basis points with SOFR around 5.40 and the 5 year around 4.20. We’ve had a couple head fakes on “un-inversion” in the past couple years and I know banks everywhere are longing for 200 plus basis points of slope (without bad credit). Shoot, I think most bank management teams would take 50 basis points of slope. But the big question for the banking industry and valuations is: where does the spread between SOFR (artist formerly known as LIBOR for historical tracking) and the 5-year UST end up 12-24months out?

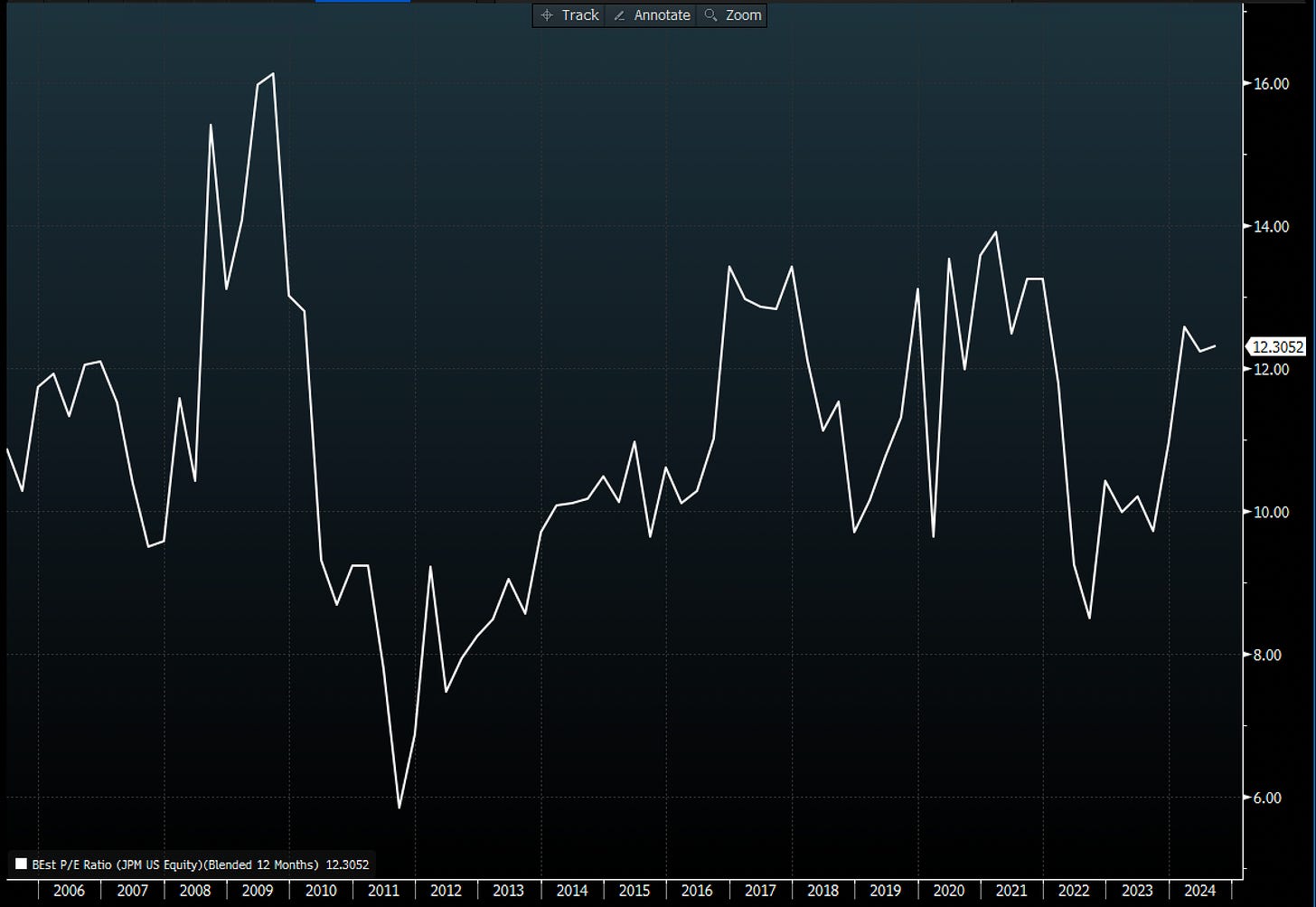

The Goliath Known as JP Morgan

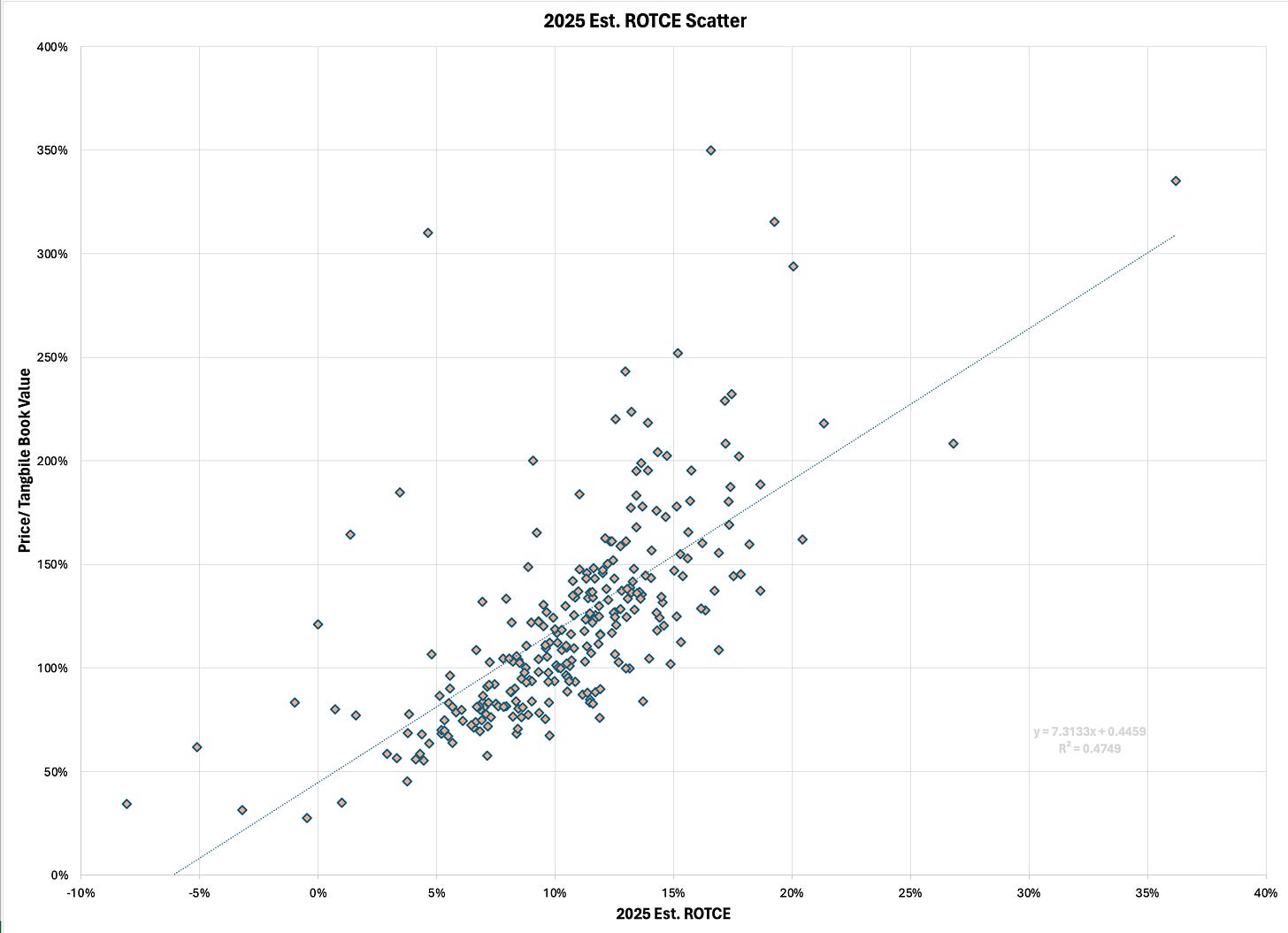

2025 estimates are flat to moderately down, Jamie Dimon just sold for the first time ever, & the bank seemingly can do no wrong. The passed the stress tests with ease, they dominate major MSA’s for deposits (I think own around 40% of greater NYC), and outspend all banks on tech & marketing by billions. And while I’d hesitate to call them a short, they’re as close as it gets to a “too good to be true” valuation. Looking back, 12x forwards is historically near the top of its range absent the GFC funkiness and some runs into the 13/14 range. My question for JPM is: How can you continue to grind higher in the face of high valuations and flat earnings outlooks?

Jane’s Magical Citibank Turnaround Tour

Recent headlines about their bank being the bank du jour for launders reminds me that no matter what they say, they’re still Citibank. They’ve largely completed the cost cutting Bora Bora, now have the sale of Banamex, and need to continue delivering on blocking and tackling banking. Their recent earnings releases have been pretty down the middle of the fairway if not boring. They are moving a battleship and so every boring quarter counts. Not for nothing people have them at mid-20% EPS growth in 2025 and the company keeps reiterating 2026 11% to 12% ROTCE goals. The key question for Citibank is: Can you keep up the string of boring on target quarters with guidance grinding higher?

Western Alliance Bank’s Near-Death Experience

Left for dead in the Silly Vally chaos (and trading down below $20 smh), Western Alliance has stabilized itself in the past 12 months. It has raised its capital levels, grown deposits, and largely been ahead of schedule on its plans to get back to growth. Most in the research community are calling for a 2H growth run albeit a moderate pace to historical levels. Projections are for $7.40 a share of 2024 earnings (currently trading at 8.4x) and for $9.15 a share of 2025 earnings (currently trading at 6.9x) and the main source of uncertainty is around credit. The Amerihome business bought in the pandemic will pay dividends if there’s ever a lower mortgage rate environment (originations and non-interest income). But for now, the question remains: Will WAL’s CRE book continue performing?

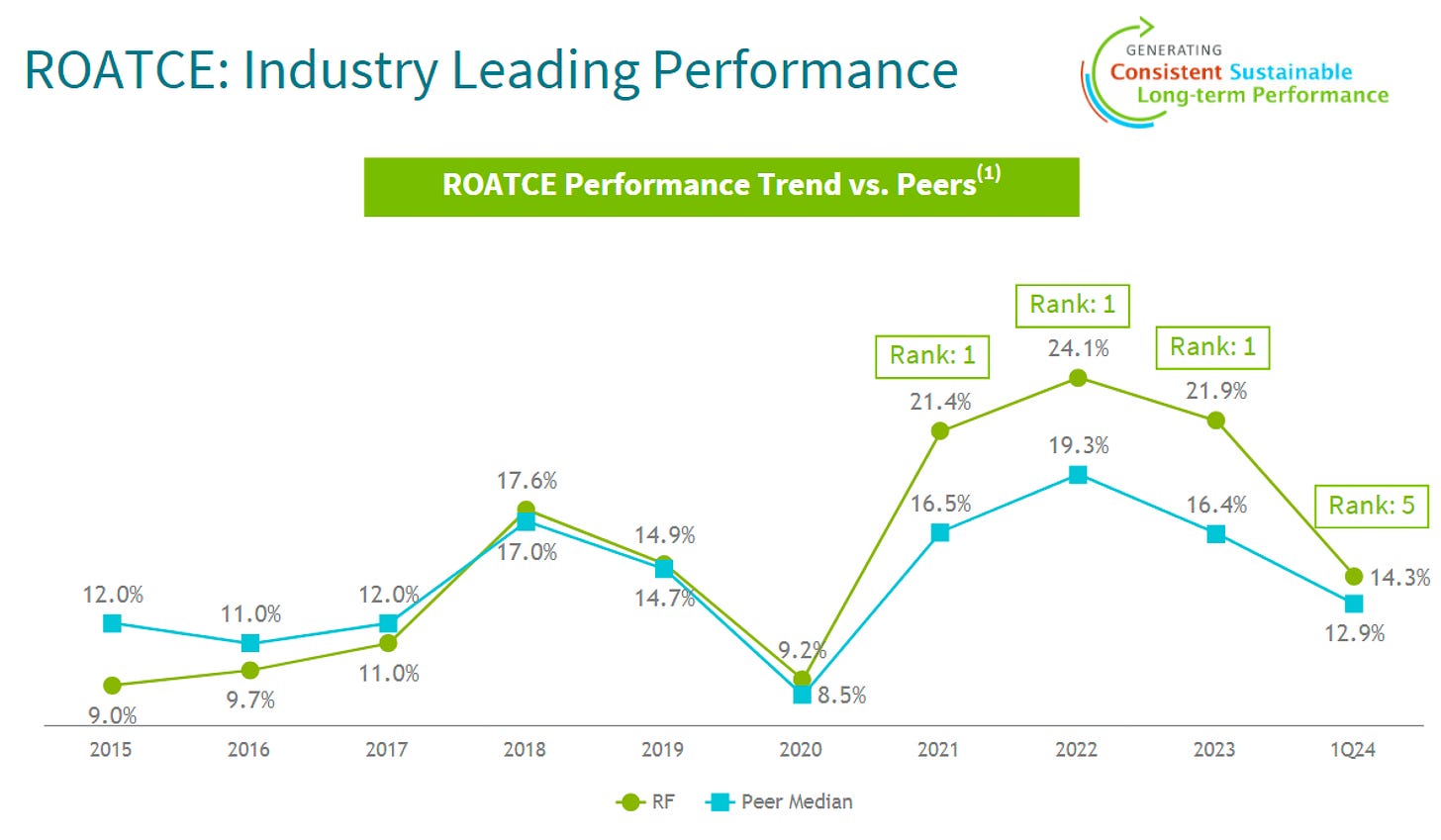

Regions Asset Sensitive Outperformance

Regions comes into the quarter moderately asset sensitive, with a credit book that has to date performed well, and a stress test passing grade. They have a top quartile level of non-interest-bearing deposits in the low 30% range and have benefitted from rates up while other balance sheets have not. However, rates down is not a great environment for them and their credit book continues to normalize. NCO guidance for them is in the 50bps range and have stated that this quarter will be the peak for charge-offs, non-performers, and classifieds. This is a bold call to me, but I respect it none the less. For me the question is: will Region’s credit, NIM, & ROTCE outperformance continue even in the face of rates heading lower?

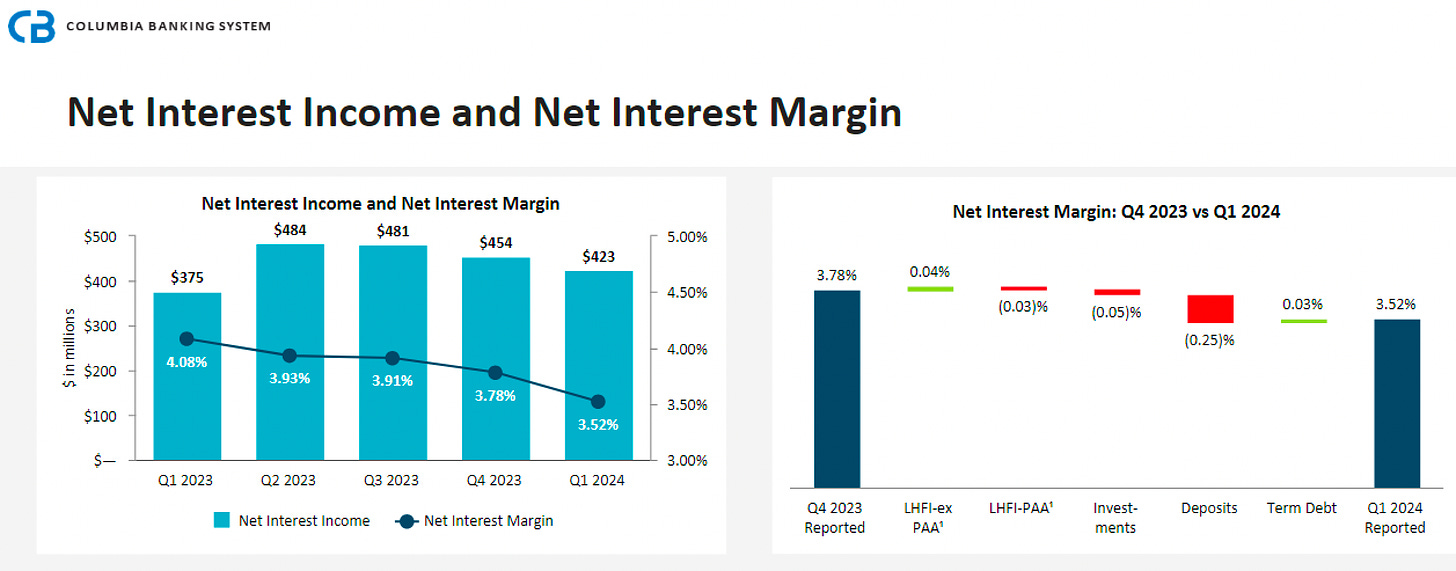

Columbia’s Pacific Northwest Crown Jewel

Digesting it’s Umpqua merger, Columbia has had challenges maintaining NIM recently. COLB pays 2.45% on deposits relative to mid 3% for most of its competition & it’s hard to go on offense while executing on a merger integration. COLB has also been losing non-interest-bearing deposits, having to replace them with higher cost funding. Loan growth has been tough to come by as well, making it harder and harder for them to outrun the deposit attrition and interest expense gains. For COLB: will the bank maintain its guide on NIM or continue surprising to the downside on the right and left sides of the balance sheet?

Everyone’s Favorite Punching Bag in NYCB

New York Community, what is there to say other than this bank has the lowest expectations of any bank I know of. Left for dead, given recent price action it appears people are beginning to realize that anything other than a complete disaster in earnings is actually a positive. The adults are in the room with Otting and crew, and people are realizing that Mnunchin gives them a sneaky Trump trade impact. All eyes will be on credit and deposit migration (did the SBNY teams that left take all their deposit customers?) The question for NYCB is: will the adults in the room give NYCB investors their first taste of reliable guidance and results?

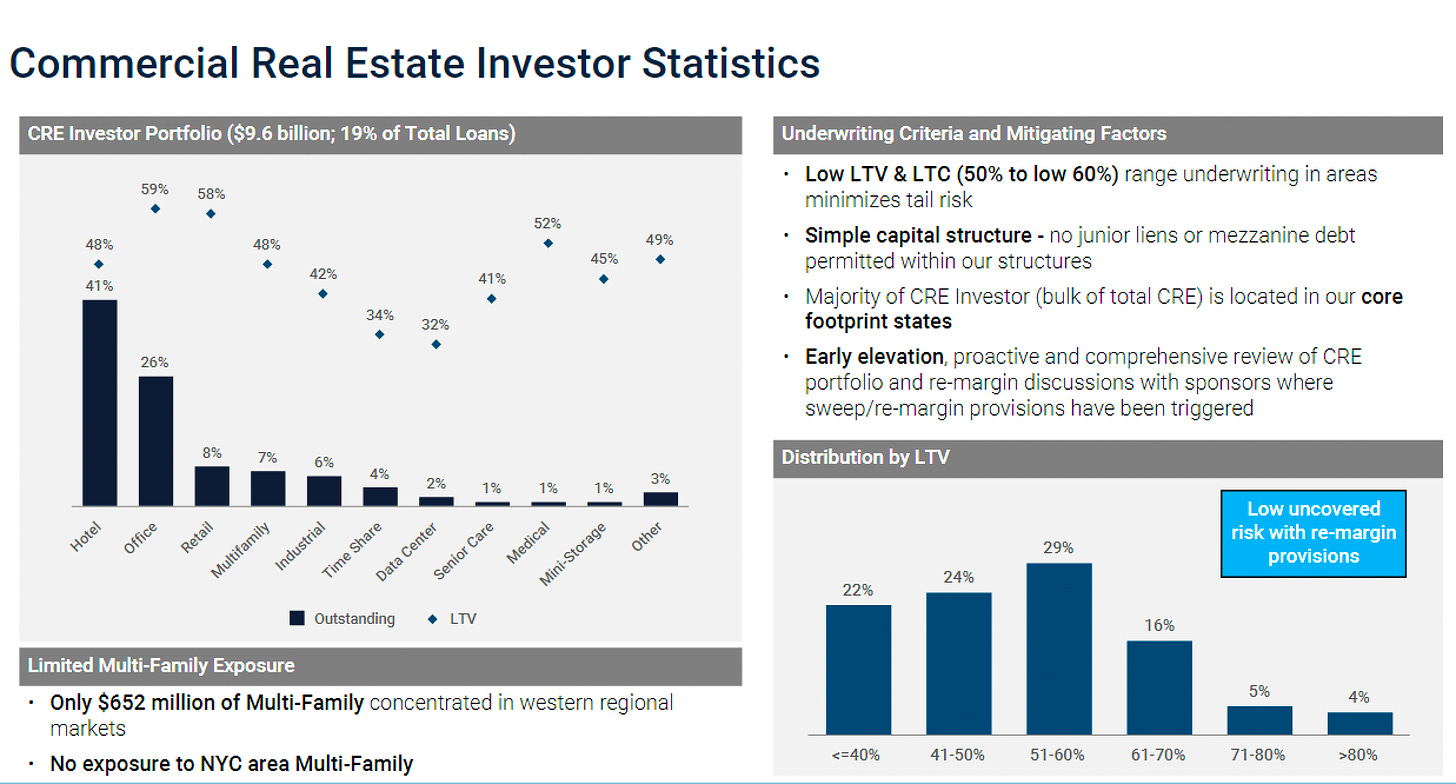

Nothing To Fear but CRE Itself With MTB

M&T comes into the quarter historically cheap on a forward earnings basis. Like surprisingly cheap at just under 10x forwards. They’re capable balance sheet operators, strategic thinkers, and have a culture of great capital allocation. In the words of Denny Green, “their risks are what we thought they were”. CRE & Office in particular. Those have been behaving so far and the bank put out a mid-quarter update highlighting that criticized loans, non-performers, and charge-offs are all stable. They also highlighted that their loan refi wall is fairly spread out over time. And as long as that trend continues the bank is cheap. For MTB the question is simple: will CRE & Office credit continue to behave?

A Cult-ish NIM for Hingham Insitute for Savings

A cult stock favorite of some very outspoken fans; Hingham continues to fight through a liability sensitive balance sheet and rates up 500 basis points. They are uber levered to CRE and have one of the lowest (if not the) NIMs in all of banking (as well as one of the lowest expense bases). All pro eyes will be on the NIM this quarter and also how many gains they take on their equities portfolio to wash over the poor core banking numbers. As long as credit stays in check, and they have equity gains to sell they can continue posting decent earnings (even if they’re what could be called “non-core”). So, the question for HIFS is: what will NIM be and how many non-core gains will it take to show good results this quarter?

The DC Swamp Lender Eagle Bank

Somehow EGBN did not cut their dividend this quarter in the face of poor operating performance. They are uber concentrated in the DC area and to my knowledge there are no buyers wanting to jump in as a white knight (like in the case of HMST and FFWM). The most important thing for EGBN is credit performance. Thin NIMs can be fought off, but thin NIMs with bad credit kill. In 2022 they went from pristine credit to 2% NPAs in 2023, a number that has been elevated since Q1 of 2024. My gut tells me that they must feel at least “okay” with it given their maintaining of the dividend. For EGBN: How are credit migration trends in your loan book for in the Northern VA & DC area?

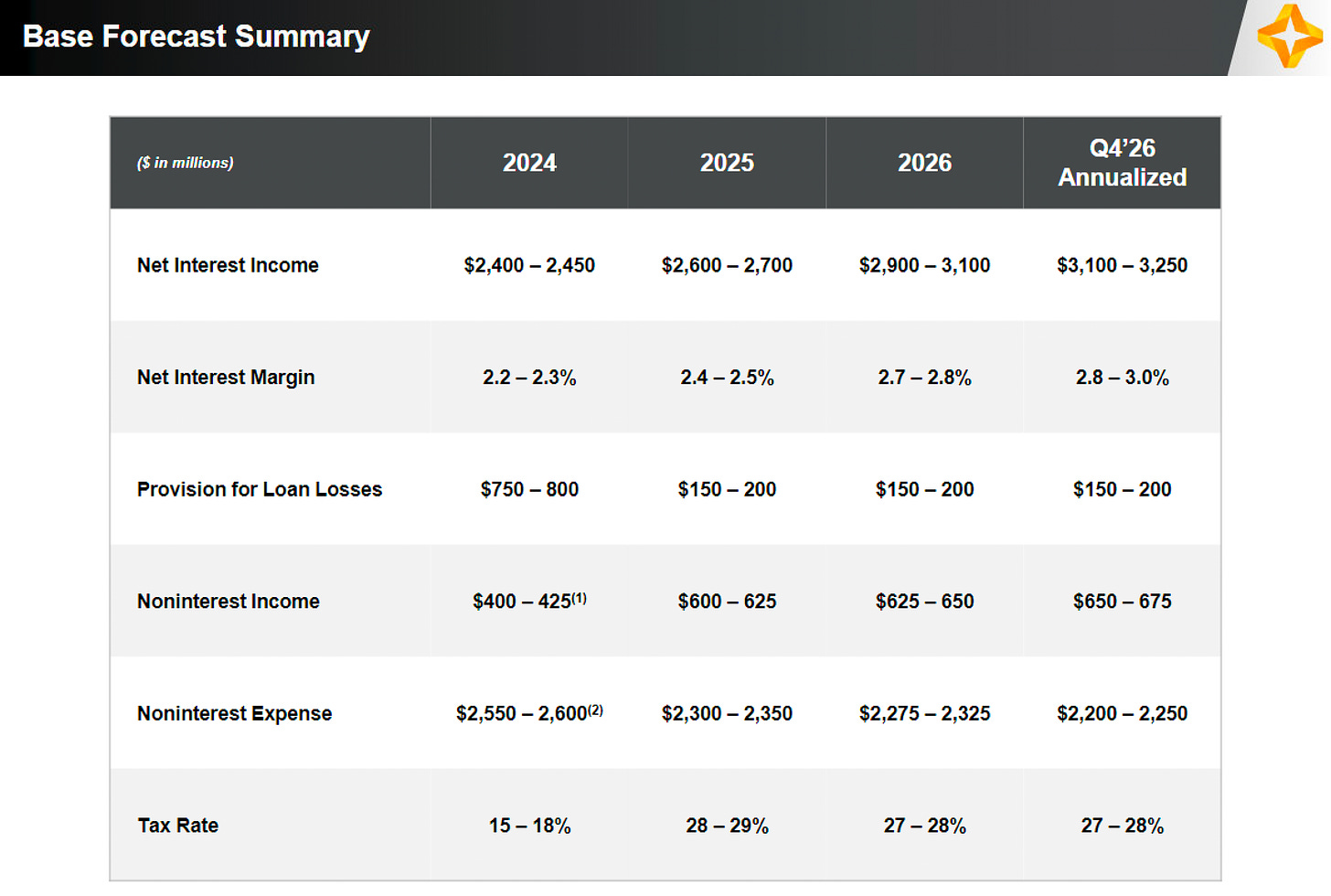

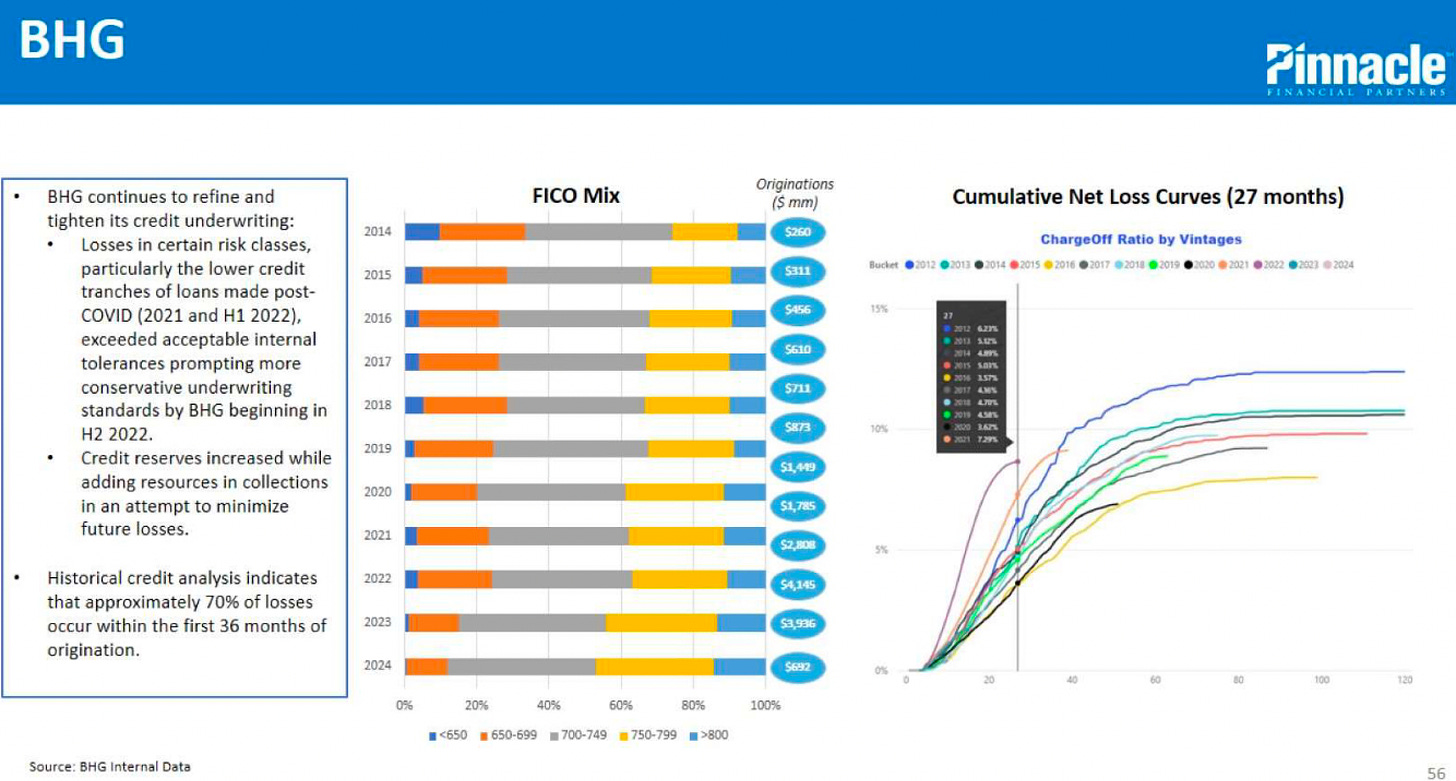

Pinnacle Financial Group’s SE Growth Machine

Historically a growth bank, Pinnacle has over the longer term outperformed KRX but has traded more in line with the index of late. Their 2024 guide was for an industry leading high single digit to low double digit growth (i.e. new markets of Jacksonville & Atlanta) and continued strong credit performance on core banking. They run a tight ship, focus on shareholder value, and put out one of the more detailed and thorough earnings releases in the business. An interesting piece of their bank is their non-interest income generator Bankers Healthcare Group. This is PNFPs irresistible mouse trap for selling other banks loans at big premiums which has been a strong business (although not without some legal questions) and it will be interesting to see how this credit business line performs in the face of high rates. For PNFP: are you able to maintain top tier credit performance while growing into new markets?

Triumph For Trucking

One day (I’m serious) I believe Triumph is going to show us why their thesis about betting on the trucking market is a good idea: that their niche will lead to future returns into the distant future. But today it is an unproven bet on the future. I don’t have a dog in the fight other than the fact that I appreciate when people have a conviction and try to make it become a reality. But that makes for bumps and bruises from the haters or traditional “bank investor” types. Trucking too has been in the doldrums which can’t be good for the overall business model. For TFIN the biggest question is: what milestones are you hitting in the face of underperforming EBITDA targets to convince us that a 5% ROTCE is worth north of 300% of TBV?

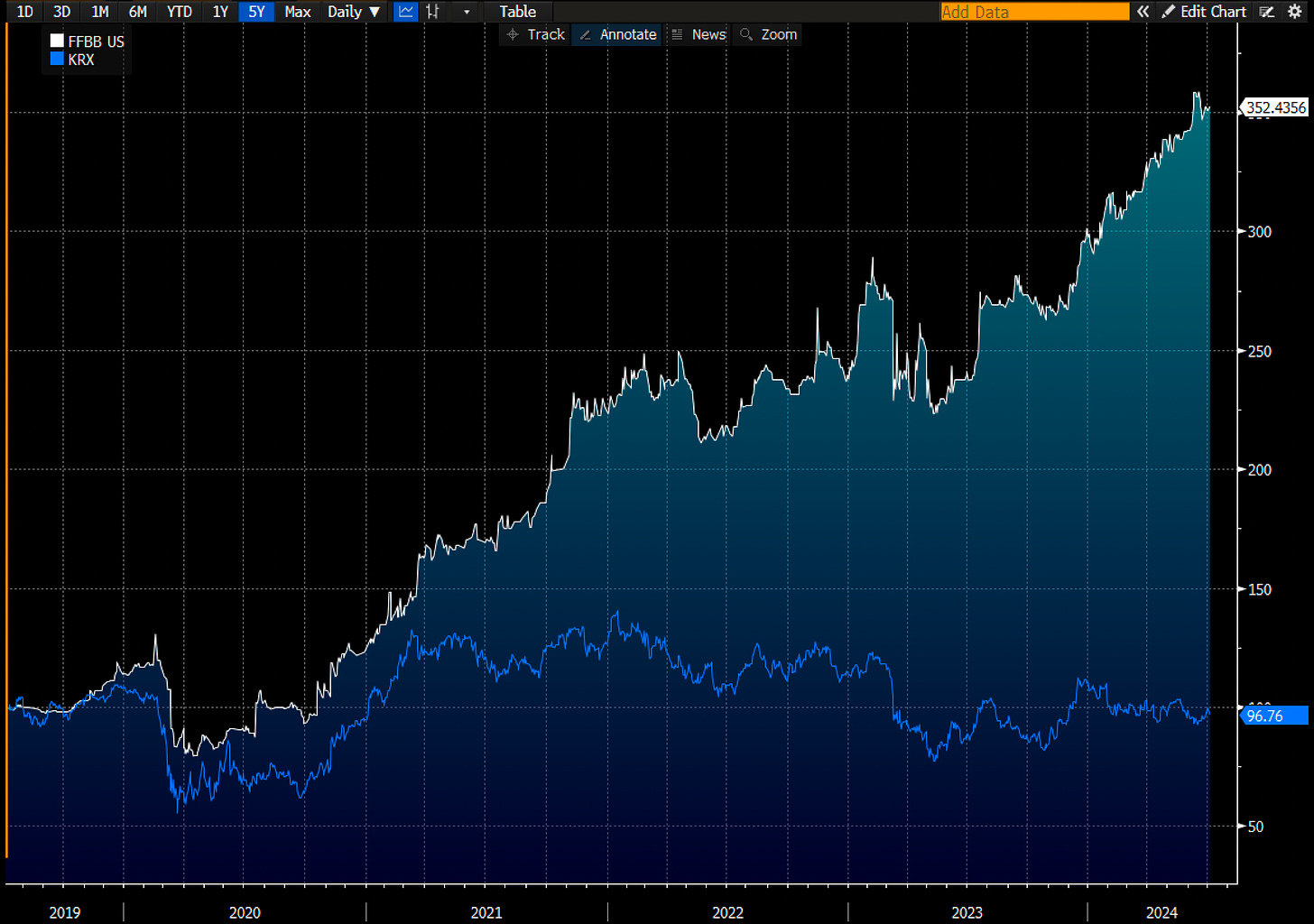

FFB Bank & The Steve Miller Band

Most of you haven’t heard of this bank, but you should (FFBB). CEOs name is Steve Miller and because they say AI isn’t good at anything, here’s proof it does. They do everything a good bank should do: deliver for their communities, keep shareholders at the top of mind, and pump out solid operating performance. The question for FFBB is: can you continue flying like an eagle?

Sung to “Fly Like an Eagle”

I want to bank like Steve Miller

Into the future, oh, what a thriller

where the numbers flow and the profits soar

FFB Bank’s the place I’ll explore

Take may deposits, make ‘em grow

Steve’s at the helm, he sure does know

How to navigate these financial seas

With FFB Bank, we’re riding the breeze

Bank like an eagle, soaring high

Steve’s the captain, reaching for the sky

Interest rates rising, loans getting sweet

FFB Bank’s the rhythm, can’t be beat.

The Biggest Losers YTD

Wrapping things up, none of these banks inspire confidence right now. Call it a business model mismatch with a macroenvironment that has produced rates up 500 basis points, declines in CRE property values, and fears about refinancings. Some of these will no doubt be winners, but the risk/reward is skewed absent some clarity on interest rates and the ability of the CRE market to absorb refinancings. The main question to the losers list is: other than rates down and a benign credit environment, what else are you doing to inspire confidence in shareholders?

The Biggest Winners YTD

Some of these are M&A targets (MCBC, HMST, HTLF) but the biggest winners of the Russell 3000 Bank Index span a variety of business models. FCNCA (scooping failed banks) and CASH (Fintech/BaaS excellence) are two banks that always seem to find their way onto the “best of banks” list and I would imagine they continue performing well into the future. Winners tend to win after all. DAVE has been trading down with the Evolve data breach but had been on a torrid run until then. With the SPY up around 17% you even have some banks that have outperformed the broader markets. The question for the YTD winners is: how are you keeping focused & disciplined while the times are good ensuring that you make it onto the 2024 year-end winners list?

Be sure to subscribe. Hit me up on X Aurelius. Hoping you have a prosperous 2H of the Year.

The Best Is Ahead,

Vicaturs